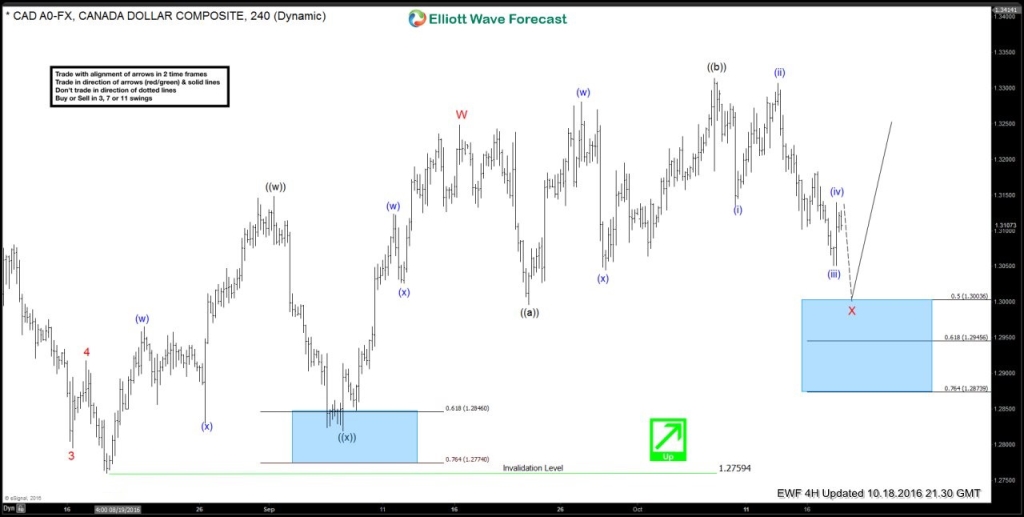

In this technical blog we are going to take a look at USDCAD October 18th 2016, 4 hour chart. In which pair was showing incomplete Elliott wave bullish sequence from May 3rd 2016 lows (1.2460) showing higher highs & higher lows. Hence, the strategy was to buy the dips in sequence of 3, 7 or 11 swings for further upside in the pair against August 18 low (1.2759) for potential upside target at 1.35-1.3675 area. Thus the 4 hour chart from October 18th suggest that pair was correcting the cycle from August lows in wave X in red pullback as irregular correction, which mainly known as Flat 3,3,5 structure.

USDCAD October 18th 2016, 4 hour chart:

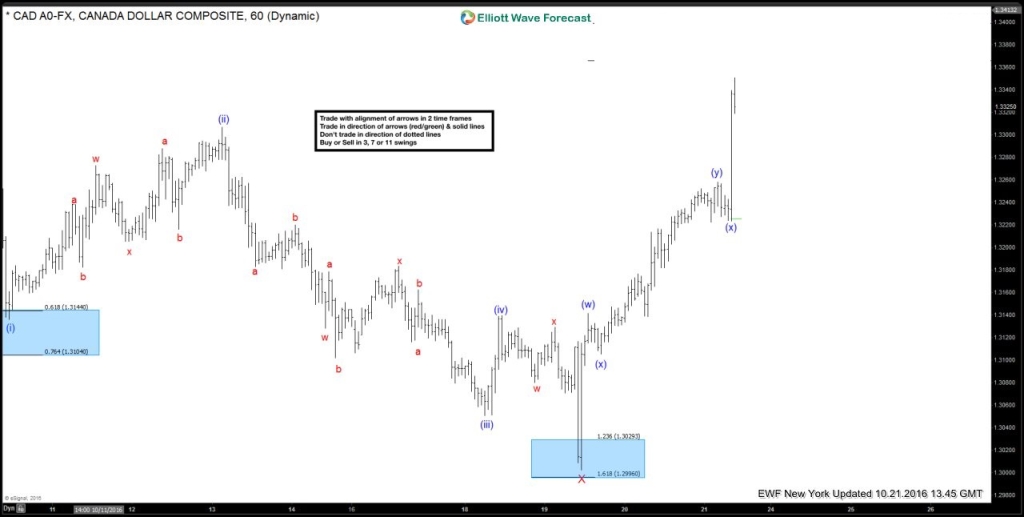

$USDCAD October 19th 2016, 1 hour NY updated chart: Preferred Elliott wave count was suggesting while the pivot from 1.3307 wave (ii) connector’s peak stays intact pair should be looking for another marginal push lower towards inverse 1.236-1.618% extension area (1.3028-1.2995) to complete the 5 waves sequence from October 7th peak (1.3312) before it find buyer’s for 1.35-1.3675 area potentially or for 3 swing bounce at least to correct the cycle from the peak.

$USDCAD October 21st 2016, 1 hour NY updated chart: suggesting the market gave us the push lower towards (1.3028-1.2995) area as expected & formed the new low at (1.3005) within X pullback. Since then Market gave us the reaction higher as expected & it broke to new highs above October 7th peak (1.3312) currently sitting at (1.3331) thus allowed our members to create a risk free position.

Keep in mind that market is dynamic and the view could change in mean time. Success in trading requires proper risk/money management, so does understanding of Elliott Wave theory, Cycle and Correlation analysis. We have developed a very responsive trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy and allows you to make position Risk Free, shortly after taking it by protecting your portfolio. If you want to learn all about it and become a professional Trader, sign up now and get Try free 14 day trial.

You will get access to Professional Elliott Wave analysis in 4 different time frames, Daily Elliott Wave Setup Videos ,Live Trading Room and 2 live Analysis Session done by our Expert Analysts every day, 24 hour chat room support, market overview, weekly technical videos and much more. If you are not member yet, use this opportunity and Sign up for free Trial.

Back