Let’s start by getting one thing straight: trading is not easy. There are so many pitfalls and traps that people create for themselves, even before they look at a chart. That’s right; most traders are setup to fail before even considering the validity of their system, or their style of trading. This is mainly because, as humans, we are emotional creatures that are constantly being forced to make decision about money, relationships, food, our jobs, and even as simple as the clothing we put on in the morning. We often let our lowest levels of thought, those that drive our animal instincts, to do the choosing for us. This creates a crack in the foundation of our decision making process, where we fail to apply sound logical thinking and rational thought. Instead we often times rely on the most basic survival instinct: fight or flight response. This is the single biggest reason a trader fails.

I want to now share with you a “thought experiment” that has been argued over by the world’s brightest minds for nearly a century. This exercise is meant to give you a new understanding and perspective on how and why any particular outcome comes to be. It’s a core principle in the field of Quantum Mechanics (a field of advanced sub atomic physics), but don’t be scared, it’s a simple analogy that can be applied to trading almost perfectly.

This thought experiment was created by Erwin Schrodinger (and helped by the Copenhagen Institute, with the likes of Albert Einstein) in 1935. While Schrodinger liked to use a cat in a box in his storyline, Einstein preferred a less sinister analogy of dice being tossed. The important part however, is the idea of predicting, or not predicting, the outcome of any event.

Schrodinger writes:

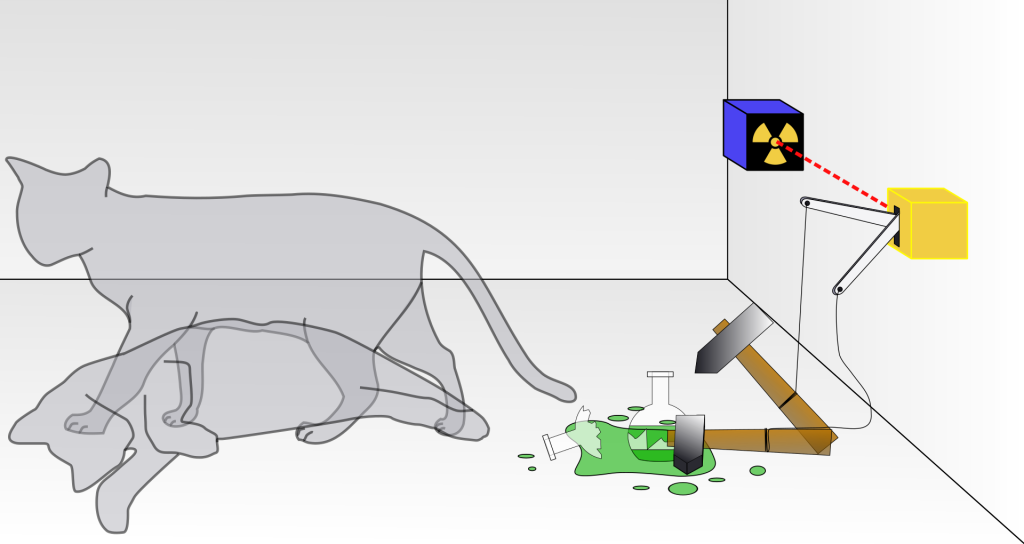

“One can even set up quite ridiculous cases. A cat is penned up in a steel chamber, along with the following device (which must be secured against direct interference by the cat): in a Geiger counter, there is a tiny bit of radioactive substance, so small, that perhaps in the course of the hour one of the atoms decays, but also, with equal probability, perhaps none; if it happens, the counter tube discharges and through a relay releases a hammer that shatters a small flask of hydrocyanic acid. If one has left this entire system to itself for an hour, one would say that the cat still lives, if no atom has decayed. The first atomic decay would have poisoned it. The psi-function of the entire system would express this by having in it the living and dead cat (pardon the expression) mixed or smeared out in equal parts. It is typical of these cases that an indeterminacy originally restricted to the atomic domain becomes transformed into macroscopic indeterminacy, which can then be resolved by direct observation. That prevents us from so naively accepting as valid a “blurred model” for representing reality. In itself, it would not embody anything unclear or contradictory. There is a difference between a shaky or out-of-focus photograph and a snapshot of clouds and fog banks.”

The fictional machine inside the box, with the cat

If that was a bit Greek to you, don’t worry. The basic idea is that there is a cat in a box. In that box, is also a device that has the ability to kill the cat. After a purely randomly generated time interval, that device may trigger, with a 50/50 chance, and that will kill the cat. So, is the cat dead or alive?

At any particular moment, we do not know the outcome and more importantly, the health of the cat. We cannot see for certain until the box has been opened if the cat is dead or alive, and therefore, are unable to make a definitive prediction before opening the box. Is everything we know for certain only known because we have observed it, or can event occur and be definitive without being seen? The cat has a 50/50 chance of being alive or dead. Before we open the box, the cat exists in an indeterminate state (called quantum superstition). The possibility that the cat is alive, and the possibility that it is dead, are exactly the same. An outcome must exist, but we are unable to determine which outcome happened, at any time before the box is opened.

Imagine the cat is in a movie, where a plot twist can change the ending dramatically.

You may have also heard this paradox described as a tree falling in the woods. If no one is around to see and hear the tree fall, did it make a sound? It doesn’t matter the analogy you make, it’s all the same principle: you cannot know for certain the outcome of an event, until it happens. For many years, the likes of Einstein and Schrodinger debated this paradox. It presented a huge problem for their scientific models, and in many ways, it present a huge problems for traders as well.

The solution to overcoming, what really is a paradox of self-fulfilling prophecies, is to begin to understand that, while nothing is known for certain we are able to determine varying degrees of the potential outcome occurring. In other words: we can promote a probability that the cat is dead or alive, that the tree has fallen, and for a trader: the probability of success or failure.

Every trade we take is effectively a bet on the outcome of an event. I don’t mean a literal event like news, central bank interventions, or other things people use to describe why a market moved. I mean the very movement of a market, up or down. If you are long, you only make money when the market rises. If you are short, you only make money when the market falls. Therefore, a trader needs to stop thinking about the market as if its rise or fall is certain, but rather, what is the probability of either outcome.

This way of thinking objectively about the market, can remove the blinders we sometimes create for ourselves. By properly vetting all outcomes (market moving higher or lower), and determining which side has the greatest probability for success, you will find yourself being on the right side of the trade more often than not. After all, you will never know for certain until the trade is over if you have won or lost, so why do we let ourselves believe anything else before it’s over?

Of course, this is only first mental roadblock a trader must overcome. It is the foundation to build a sound and valid strategy for trading on top of, and any structure without a sound foundation, is doomed to collapse.

So I will leave you with this simple question: is the market going up, or is it going down?