Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

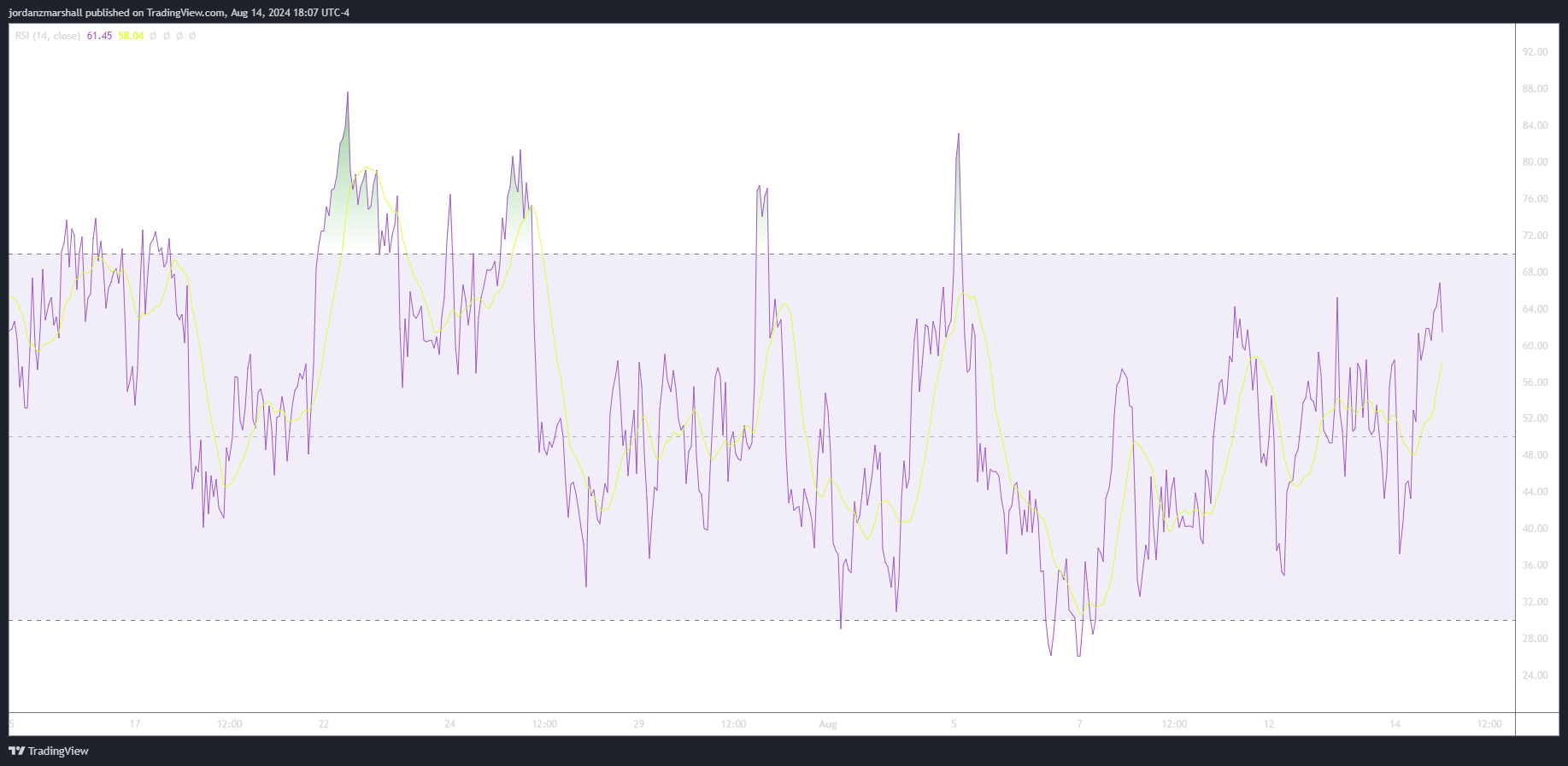

Using RSI to Identify Elliott Waves – Elliott Wave Basics

Read MoreIf you’re new to Elliott Wave, you may be asking: How do I tell if a wave is over when there’s so much price movement? One tool, in addition to trendlines, is to use Relative Strength Index (RSI). Relative Strength Index The relative strength index (RSI) is a momentum indicator used in technical analysis. RSI measures the […]

-

Trendline Basics – A Critical Market Tool

Read MoreWhy trendlines? One thing I’ve found through my past years as a trader and market analyst is the importance of using a trendline. These simple tools can really help make or break your trading, and often signal a larger move to come. I’ve met traders who ONLY use trendlines, and they have made massive profits […]

-

Gold (XAUUSD) Has Gained More Than 45% Since Our 2022 Buy

Read MoreIn this technical article we’re going to take a quick look at the weekly Elliott Wave charts of GOLD (XAUUSD ) commodity , published in members area of the website. As many of our members are aware, we’ve seen significant gains in GOLD over the past few years. Since September 2022, we’ve maintained long positions […]

-

Short term SPY Price Prediction for the Days Ahead.

Read MoreRSI and Trendlines – SPY S&P500 shifted to new highs today, but how long will the trend last? As we can see, with price making new highs, RSI has made lower-highs. A possible sign of a impending short-term top. On this chart as well, I’ve drawn two trend lines to capture the recent upward movement […]

-

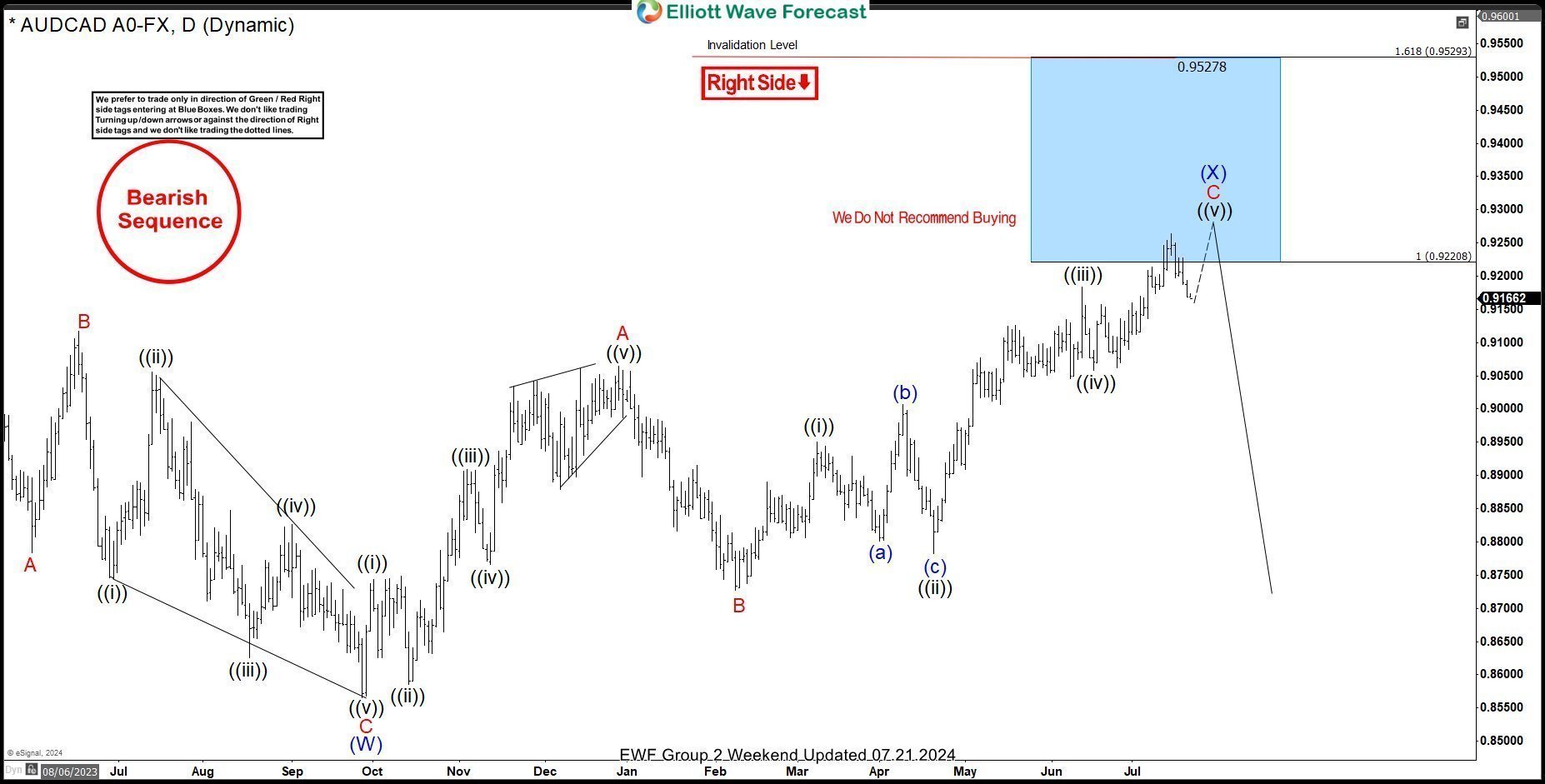

AUDCAD Selling the Rallies at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of AUDCAD published in members area of the website. As our members know the pair has been showing incomplete sequences in the cycle from the February 2021 peak. Recently AUDCAD has given us the recovery that […]

-

Is Elliott Wave Subjective or Objective, how do we combat its’ Subjective Nature?

Read MoreElliott Wave Subjective Nature The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, offers a framework for predicting market movements. Elliott Wave is based on repetitive wave patterns that nest inside of each other. While it has its merits, the subjective nature of the theory makes the use of additional indicators a […]