Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

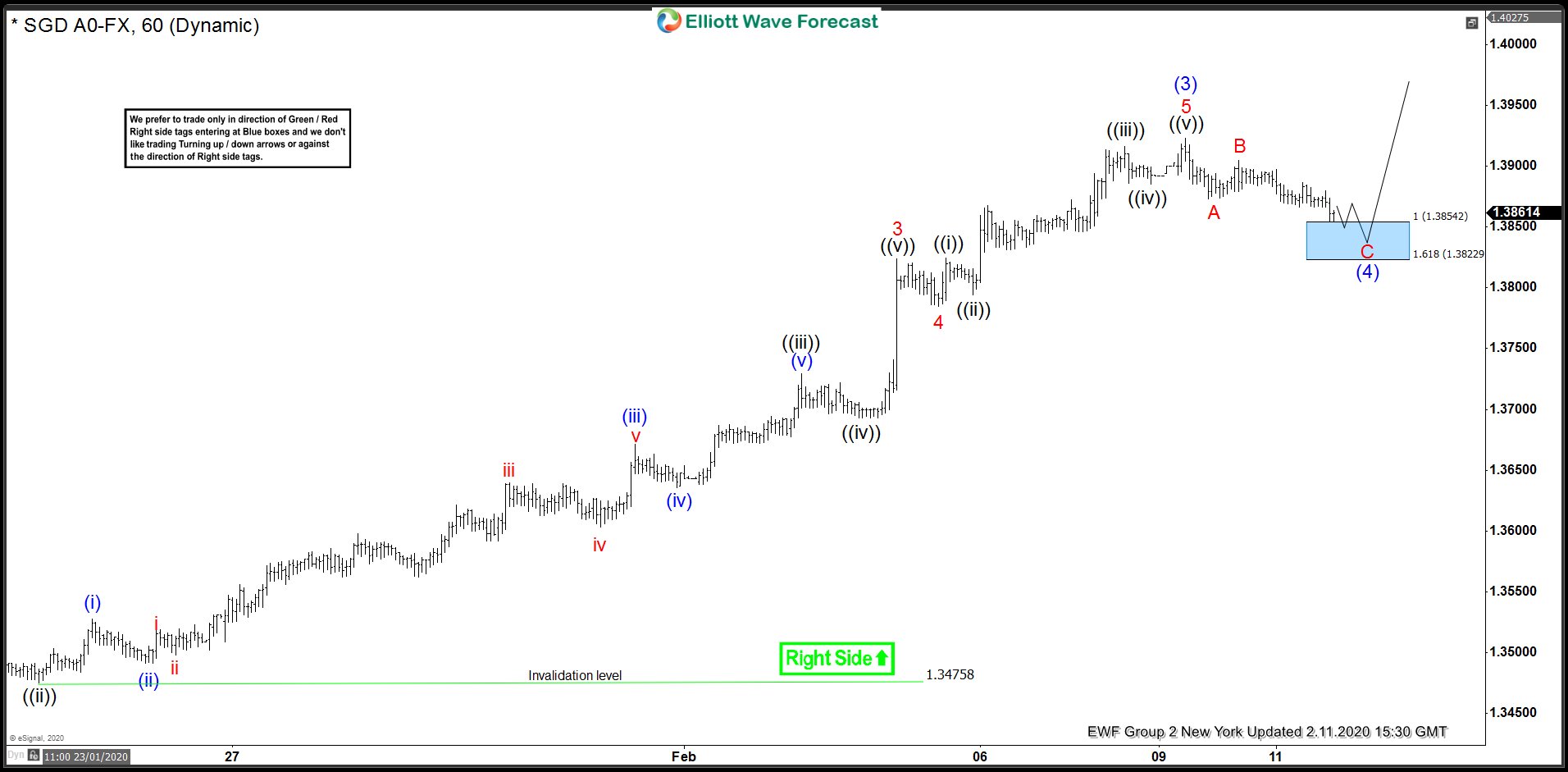

USDSGD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. USDSGD is another forex pair that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDSGD , published in members area of the website. As our members know, USDSGD is showing bullish impulsive sequences in the cycle from […]

-

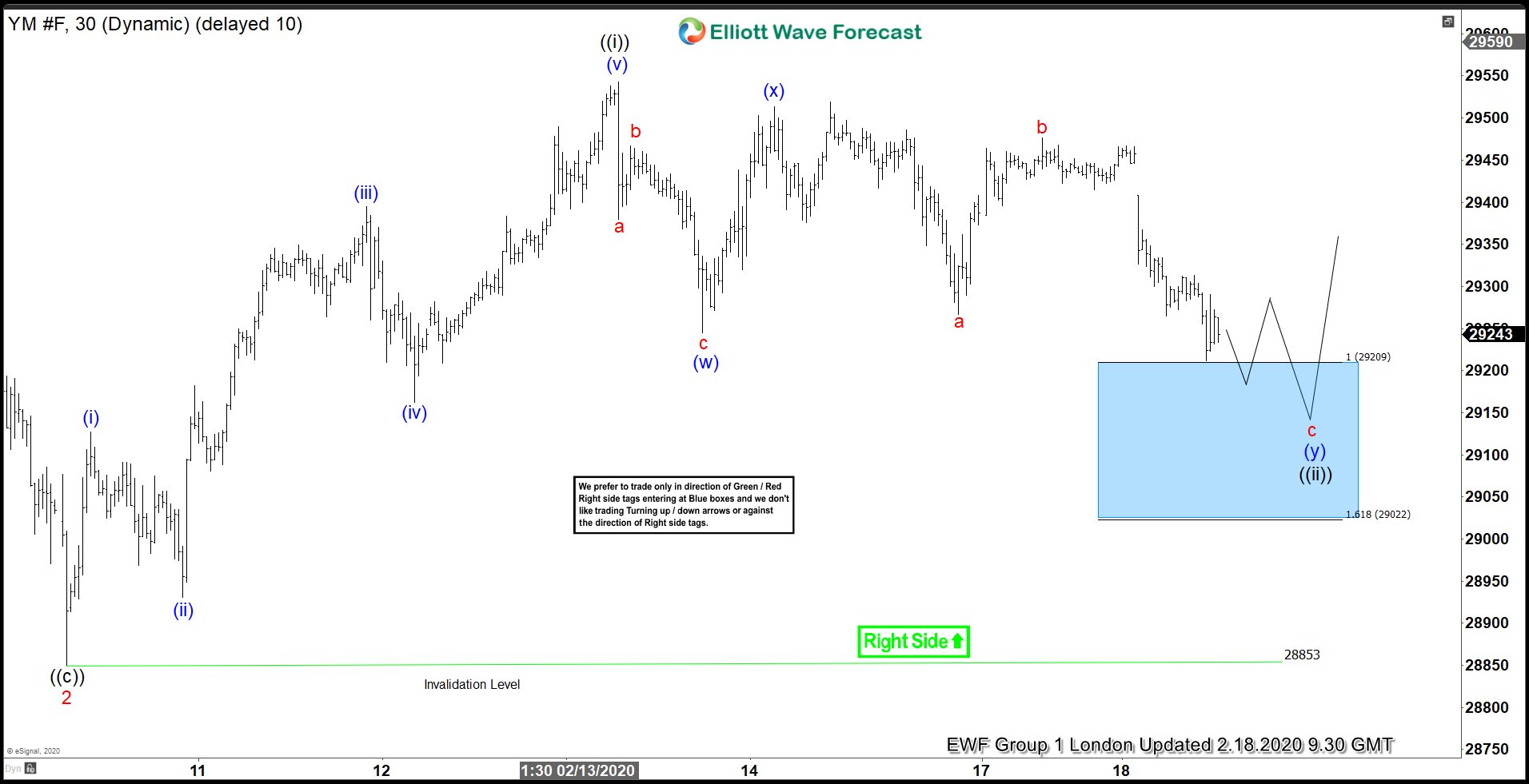

INDU Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. INDU is another instrument that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of INDU, published in members area of the website. As our members know, INDU is showing higher high sequences in the cycle from the December […]

-

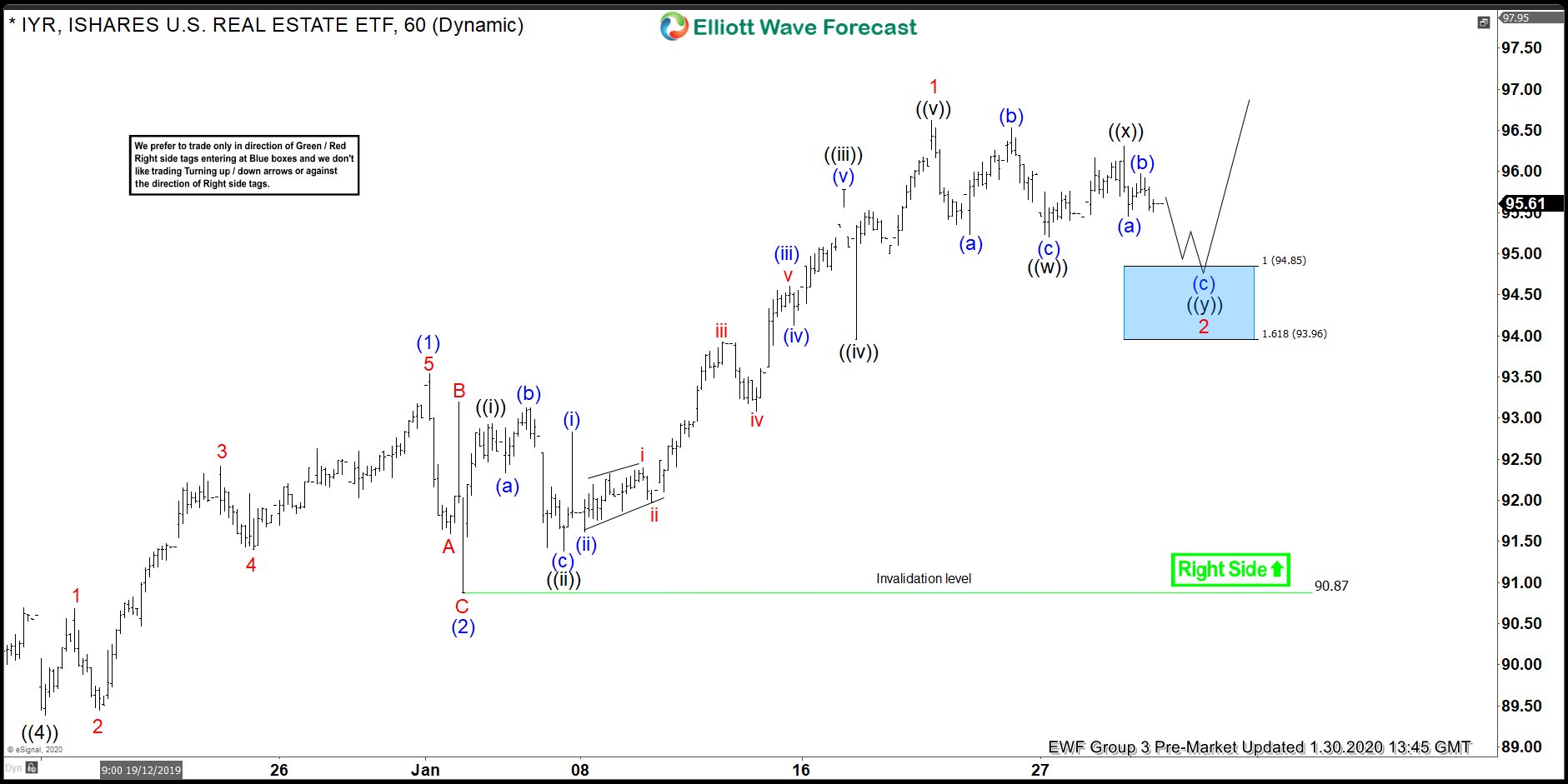

IYR Forecasting The Rally & Buying The Dips At The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of IYR published in members area of the Elliottwave-Forecast . As our members know, IYR is showing incomplete bullish sequences within higher time frames cycle. Break of 10/22 peak made ETF bullish against the 89.39 low […]

-

NIKKEI ( $NKD_F ) Forecasting The Rally & Buying The Dips In The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in members area of the Elliottwave-Forecast . As our members know, NIKKEI has recently gave us pull back against the 19841 low. Pull back made 3 waves , when the price reached Blue […]

-

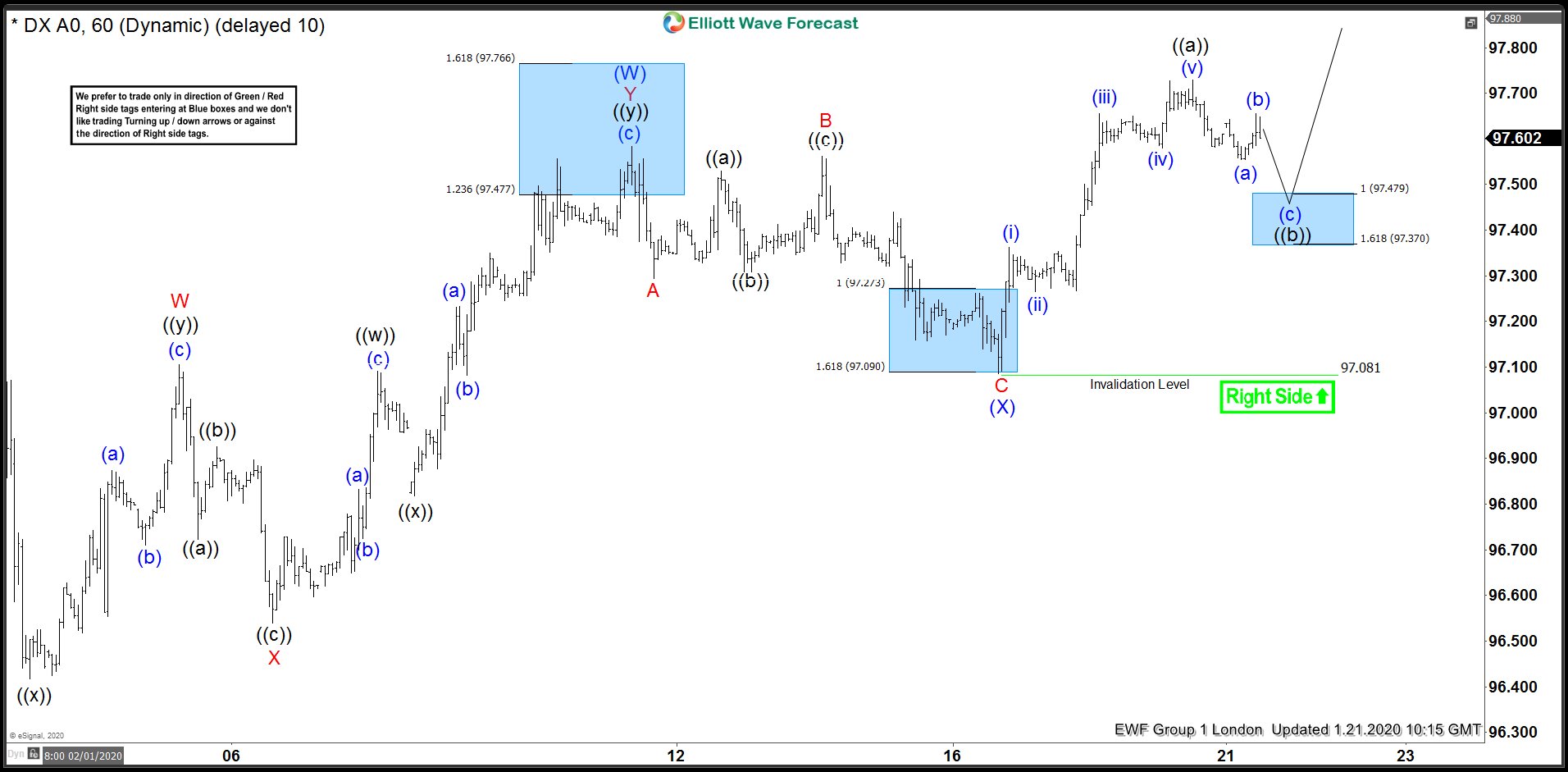

USDX Forecasting The Rally And Buying The Dips In The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDX, published in members area of the website. As our members know USDX has incomplete bullish sequences in the cycle from the December 31. low. Consequently, we advised members to avoid selling it and keep on buying the […]

-

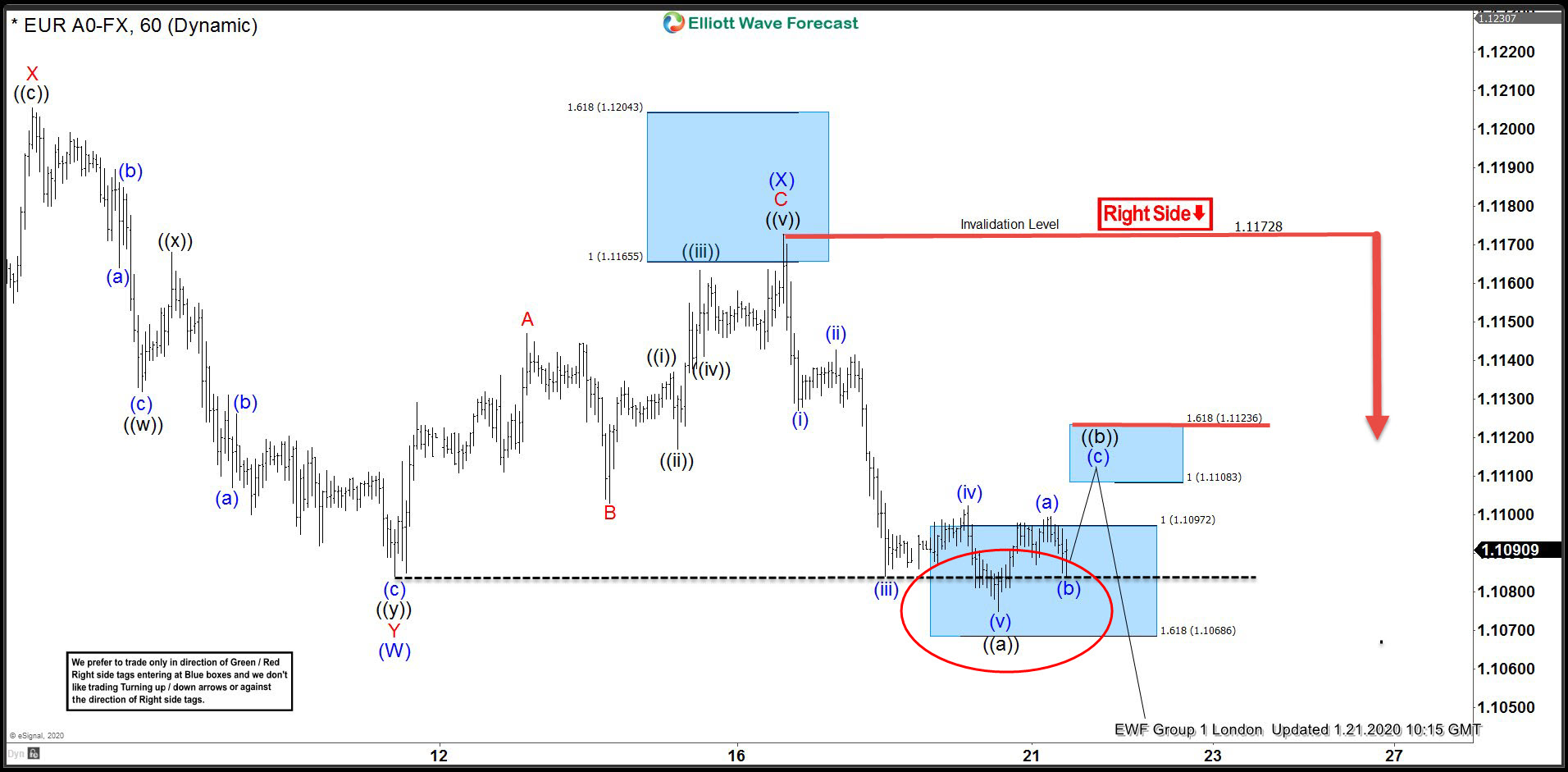

EURUSD Found Intraday Sellers Against The 1.1172 High

Read MoreHello fellow traders. Another instrument that we have been trading lately is EURUSD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD, published in members area of the website. EURUSD has incomplete bearish sequences in the cycle from the 12/31 peak. The pair is ideally targeting […]