Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

FTSE Selling The Rallies At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of FTSE published in members area of the website. As our members know, FTSE is giving us pull back, correcting the cycle from the March low. The price structure from the June 8th peak is incomplete at the […]

-

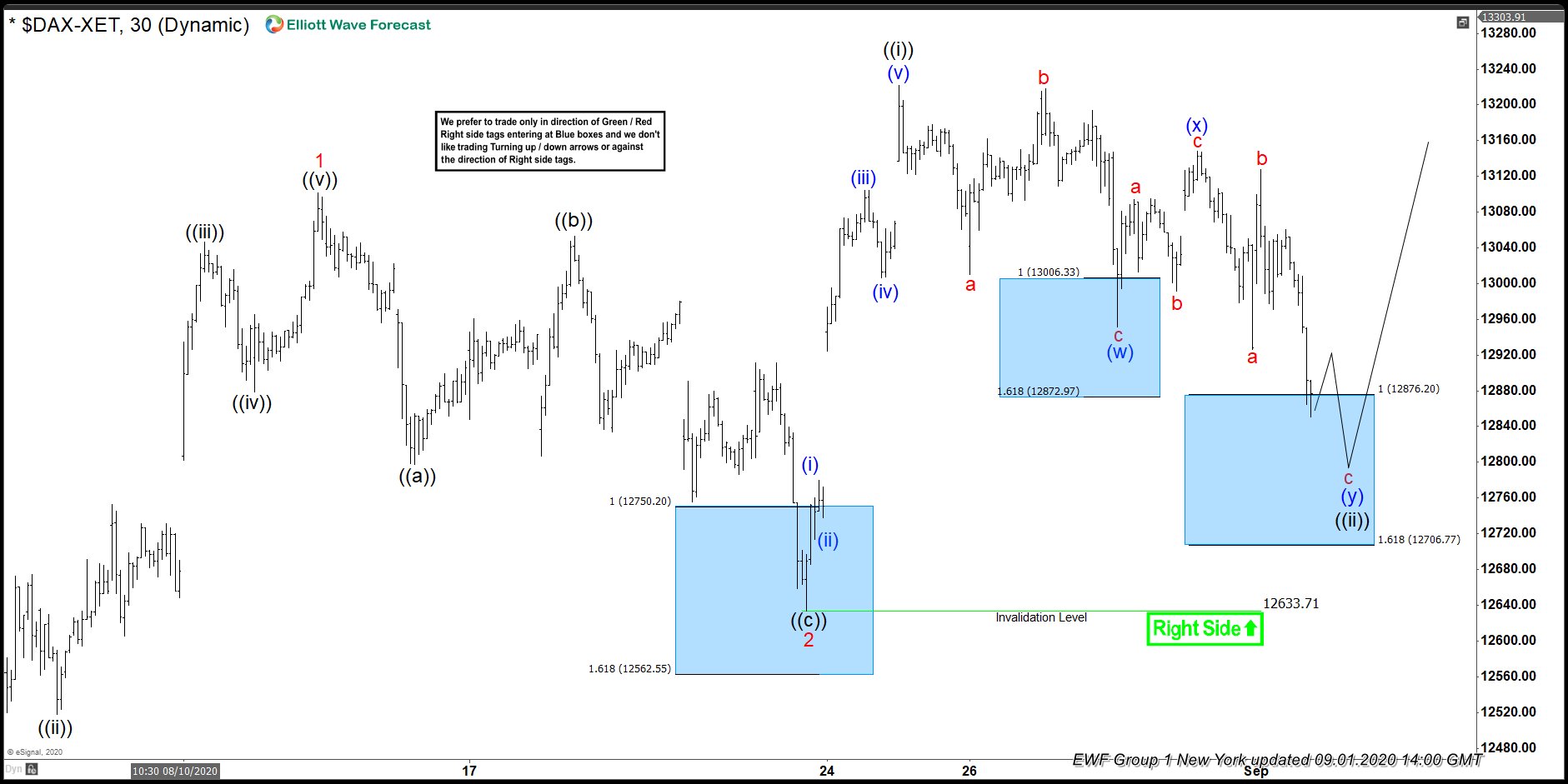

DAX Keep Finding Buyers in 3,7,11 Swings

Read MoreHello fellow traders. DAX is one of the instruments that has been giving us a lot of good trades recently. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX, published in members area of the website. As our members know, we’ve been calling rally in DAX […]

-

$ADM : Agriculture Stock Archer-Daniels-Midland Has a Huge Potential

Read MoreArcher-Daniels-Midland company, commonly known as ADM, is a multinational food processing and commodities trading corporation. Founded 1902, headquartered in Chicago and traded under the ticker $ADM at NYSE, it is a component of the S&P500 index. First of all, ADM is engaged in corn and oilseeds processing. In general, the products are oils and meals […]

-

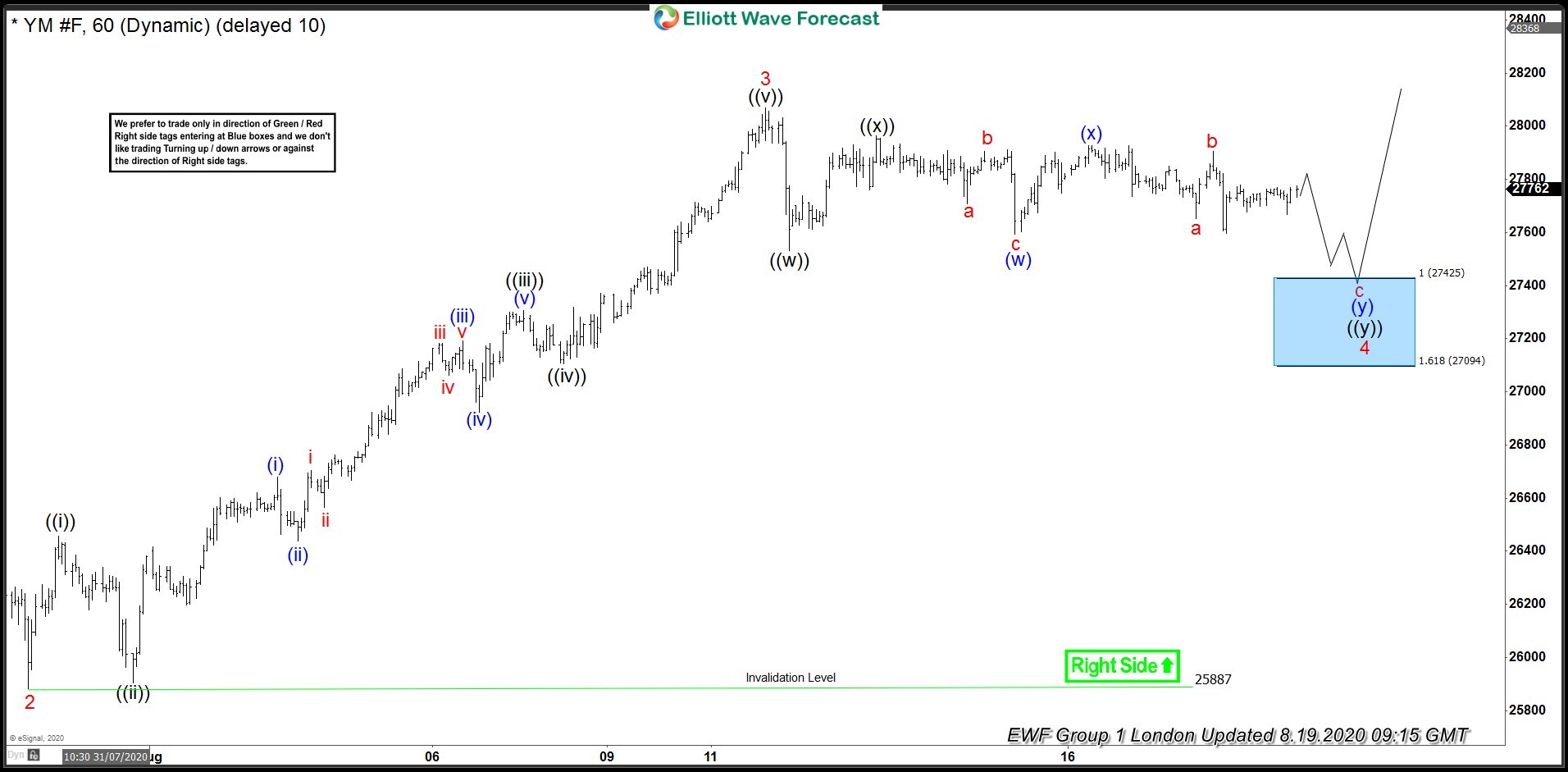

INDU Buying The Dips At Blue Box Area In August

Read MoreHello fellow traders. Another instrument that we have been trading lately is INDU. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $INDU , published in members area of the website. As our members know, INDU is showing higher high sequences in the cycle from the March […]

-

XLV Forecasting The Rally & Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XLV , published in members area of the website. As our members know, XLV is another instrument that we have been trading lately. The price is showing Impulsive sequences in the cycle from the March […]

-

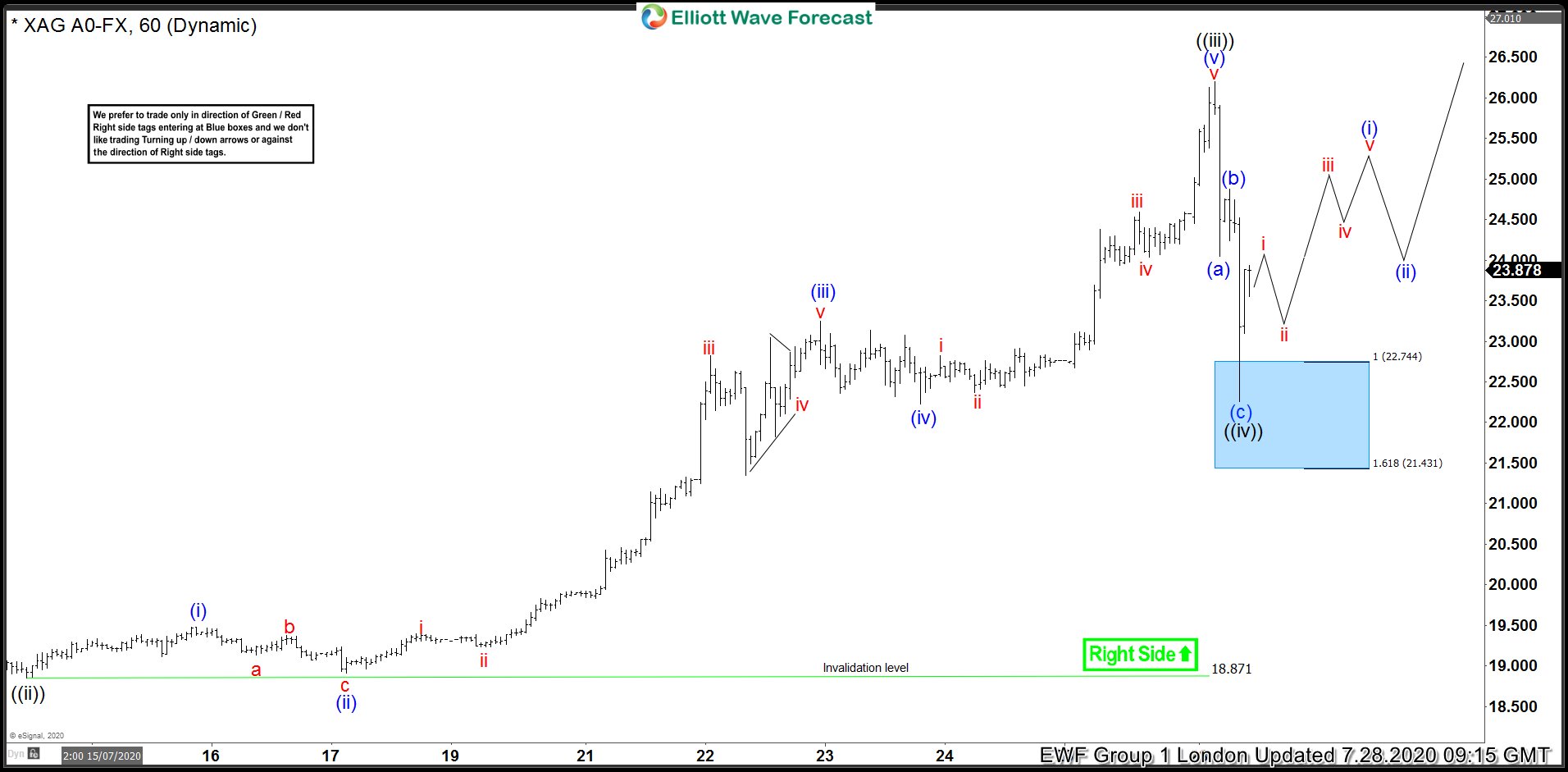

Silver ( $XAGUSD ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. Another instrument that we have been trading lately is SILVER ( $XAGUSD ) . In this technical blog we’re going to take a quick look at the Elliott Wave charts of SILVER, published in members area of the website. As our members know, SILVER is showing Impulsive sequences in the cycle from […]