Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

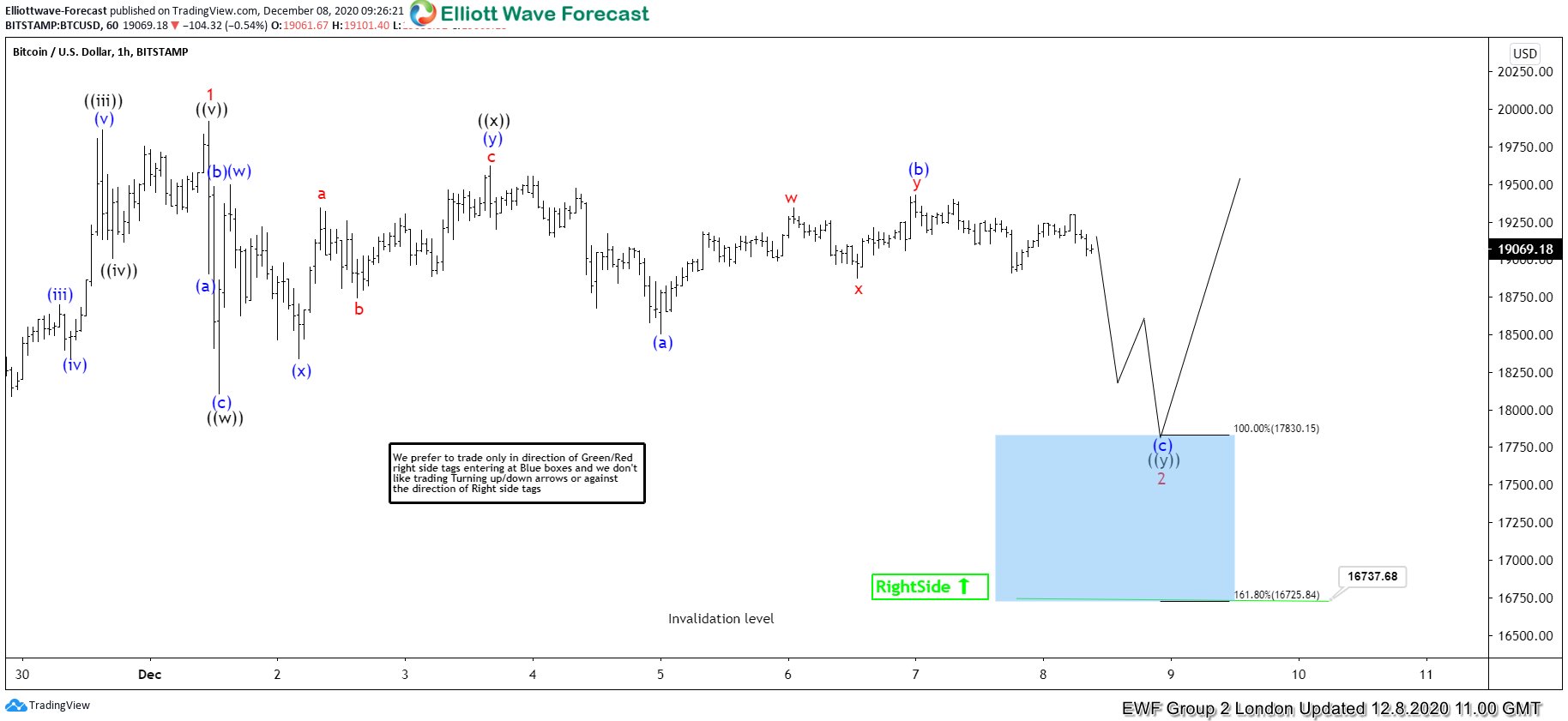

Bitcoin ( BTCUSD ) Buying The Dips At The Blue Box Area

Read MoreAnother instrument that we have been trading lately is Bitcoin ( $BTCUSD ) cryptocurrency from Group 2. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BTCUSD, published in members area of the website. As our members know, BTCUSD has been showing incomplete impulsive sequences from the […]

-

Top 21 Best Day Trading Stocks in 2024

Read MoreDay trading is a skill that has made fortune for many well-known traders from Jesse Livermore to Steven Cohn. The names mentioned were the best day traders of all time and proved to the world that trading is not speculation but a highly calculative and strategic business. In this blog, you will find well known […]

-

$EURUSD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD , published in members area of the website. EURUSD is another Forex pair that we have been trading lately. The price is showing impulsive sequences in the cycle from the November 1.1598 low.

-

Top 13 Best Forex Brokers for Trading in 2024

Read MoreWith an average daily turnover of over $5 trillion, the Forex market is exponentially growing and gaining popularity adding millions of new users each day. Therefore, it becomes essential for you to choose a trusted and reliable forex broker as markets are already subjected to risk, however it’s beneficial to have peace of mind knowing […]

-

Tesla ( TSLA ) Elliott Wave Buying The Dips In A Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Wheat Future TESLA, published in members area of the website. As our members know, TESLA is another instrument that we have been trading lately. The stock is showing impulsive sequences in the cycle from the October low (379.67) […]

-

OIL ( $CL_F ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL, published in members area of the website. As our members know, OIL is another instrument that we have been trading lately. The price is showing bullish sequences in the cycle from the April 21st […]