Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

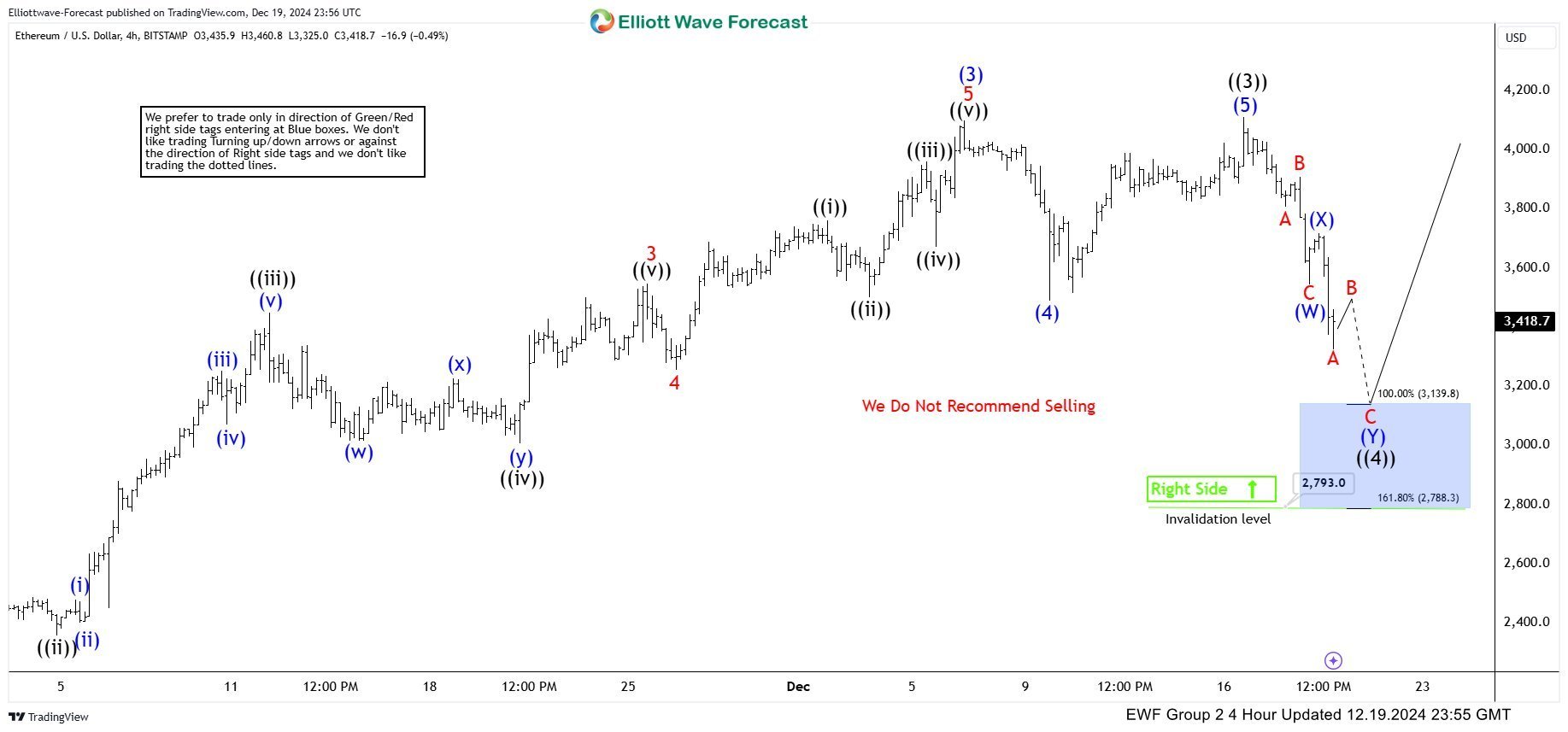

Ethereum ETHUSD Buying The Dips After Elliott Wave Double Three

Read MoreHello traders ! In this article we’re going to take a quick look at the Elliott Wave charts of Ethereum ETHUSD published in members area of the website. As our members know ETHUSD has given us nice bullish trading setup recently. We got a pull back that has ended at the Blue Box zone,our buying […]

-

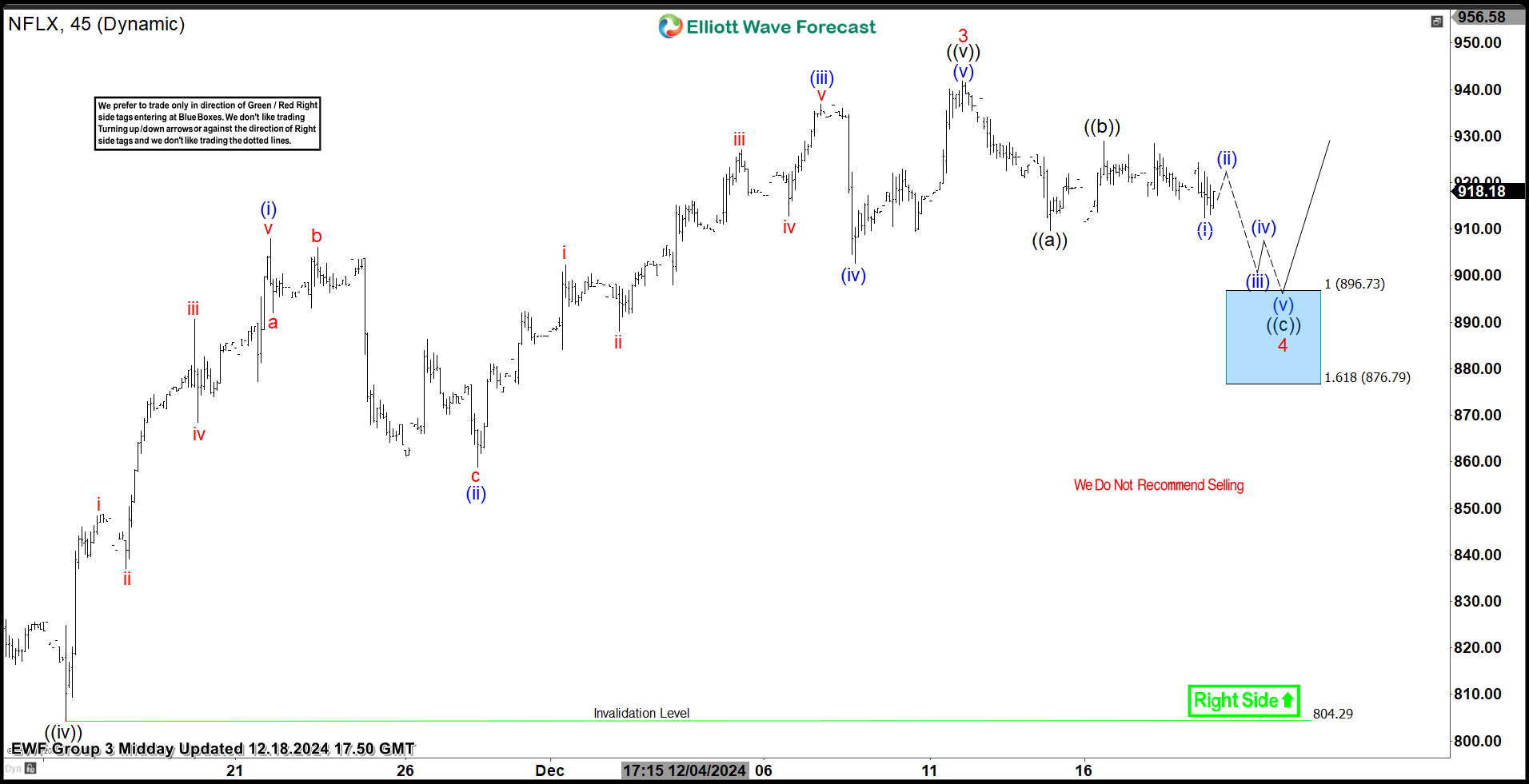

Netflix Stock (NFLX) Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Netflix (NFLX) Stock published in members area of the website. Our members are aware of the numerous positive trading setups we’ve had recently. One of them is NFLX, which made a pullback that concluded right […]

-

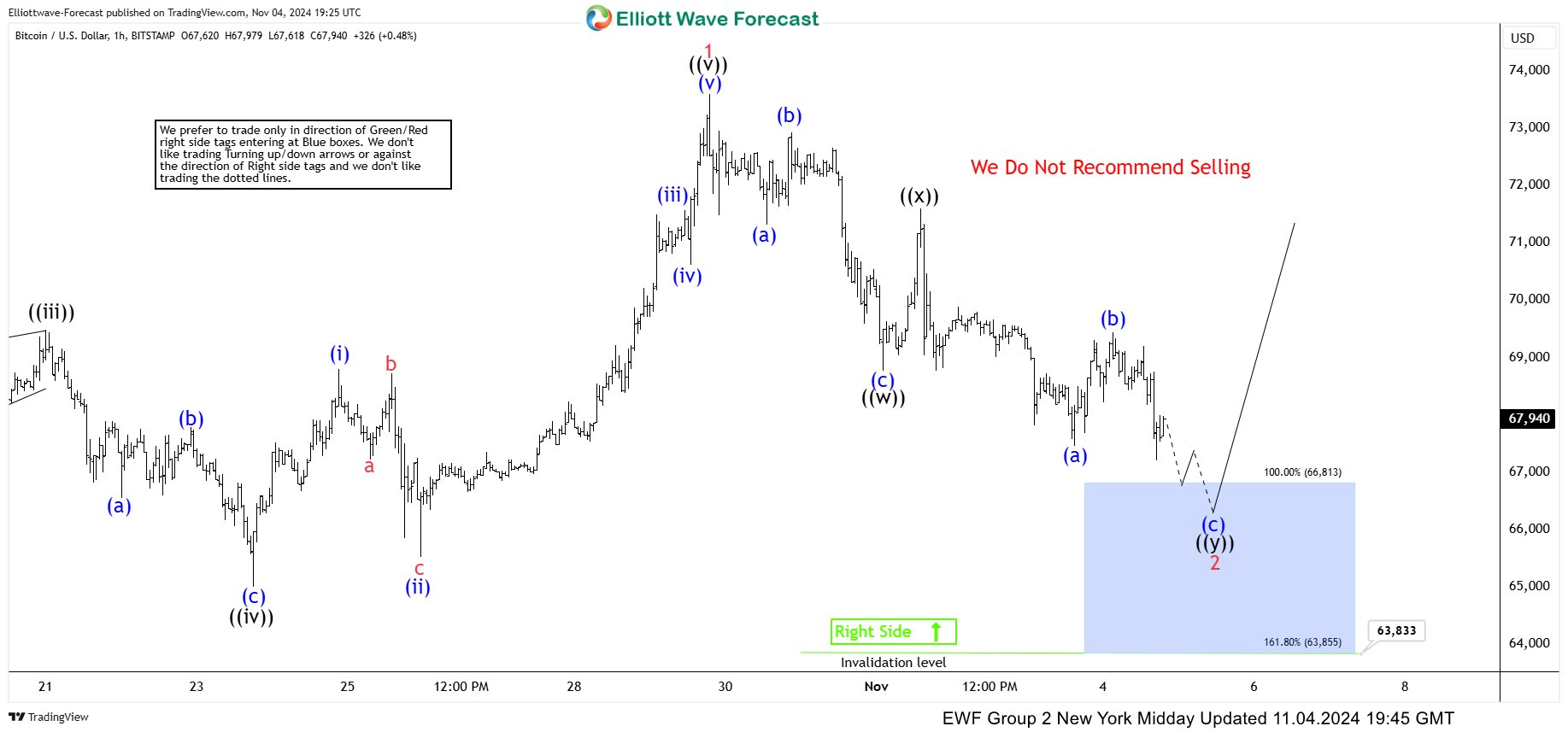

Bitcoin BTCUSD gained 50% from our buying zone – here’s how we did it

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD published in members area of the website. As our members know BTCUSD is showing impulsive bullish sequences in the cycle from the 52598 low , that are calling for a further strength. Recently we got a pull […]

-

NASDAQ Futures (NQ_F) Forecasting the Rally From the Equal Legs Zone

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of NASDAQ Futures (NQ_F) published in members area of the website. Our members know NQ_F is showing impulsive bullish sequences and we are favoring the long side. In this discussion, we’ll break down the Elliott Wave […]

-

Silver (XAGUSD) Buying the Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Silver (XAGUSD ) commodity , published in members area of the website. As our members know, Silver has recently given us correction against the September 6th low. The commodity reached our target zone and completed correction right at […]

-

GBPCAD Elliott Wave Buying the Dips at the Blue Box

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of GBPCAD Forex Pair , published in members area of the website. As our members know, GBPCAD has recently given us correction against the 1.76877 low. The pair reached our target zone and completed correction right at the Equal […]