Elliott wave Theory is a great tool for traders when the traders understand that it is only a tool to help them anticipate a big move. The dream of traders using Elliott wave is always to see the Market rallying in their direction and the Plan becoming a reality. The Market moves in sequences which is either Impulsive or Corrective. Impulsive waves move in a sequence of 5, 9, 13 while corrective waves move in a sequence of 3, 7, 11.

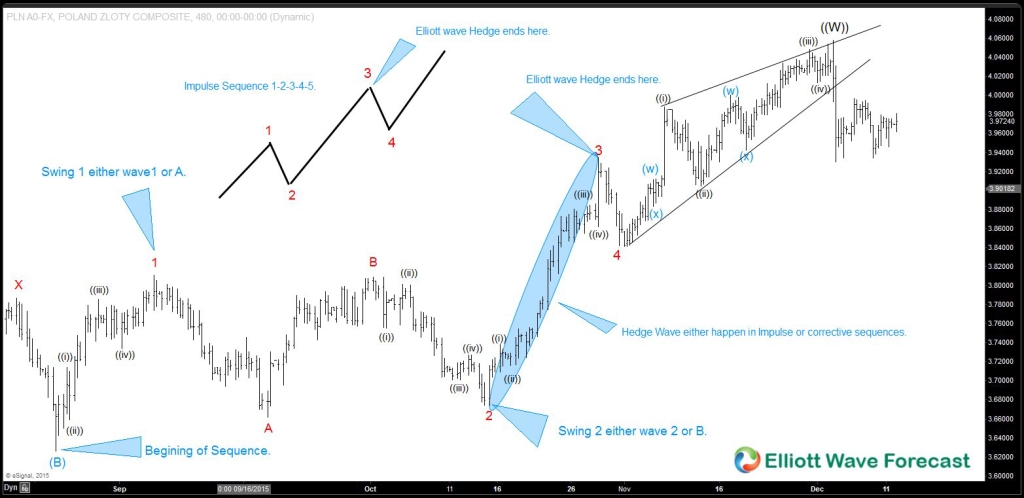

The fact is that in today’s Forex market, the sequences are more Corrective than Impulsive, and it’s almost impossible to see a perfect 5 waves move in the era of High-Frequency Trading. Today, it’s more common to see 5 waves sequence in Indices and Commodities instead. However, in reality it doesn’t matter whether market moves in impulsive or corrective sequence when traders understand that both impulsive and corrective sequences share similarities until the third swing. The only difference between the two is that in impulsive sequence, there is an extension in swing 4 and swing 5.

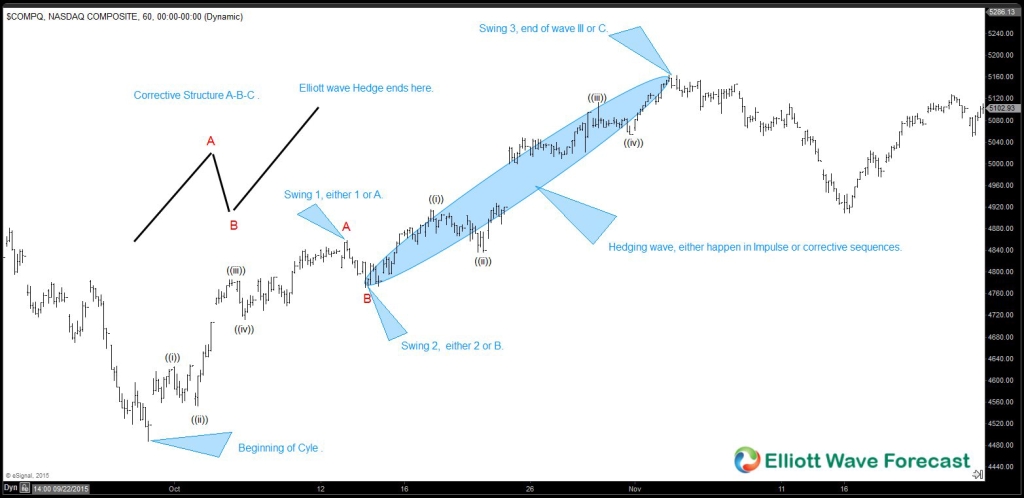

At Elliott wave Forecast, we understand the limitations of the Elliott wave Theory and we use the technique with the practical view towards trading. We use the Theory to trade what we call the Elliott wave Hedging to allow us catch either a wave 3 or wave C. Wave 3 or C should travel most of the time at least towards 1.00 %-1.618% the distance of wave A or wave 1.

Understanding different time frame cycles and how they relate with one another, combined with the knowledge of Elliott wave sequence and Elliott Wave Hedging will allow traders to catch the powerful wave III or C. Traders with this information can use it to identify wave II or B, which has the same sequence, within the higher time frame cycles. Once wave II or B is identified, traders can then forecast the inflection area in which Market will turn in favor of the trend, thus allowing traders to anticipate and catch wave III or C.

Back