Hello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of SPX Index published in members area of the website. As our members know, SPX has shown incomplete bearish sequences in the cycle from the February 19th peak. The price structure indicated further weakness. In the following text, we will provide a more detailed explanation of the Elliott Wave forecast.

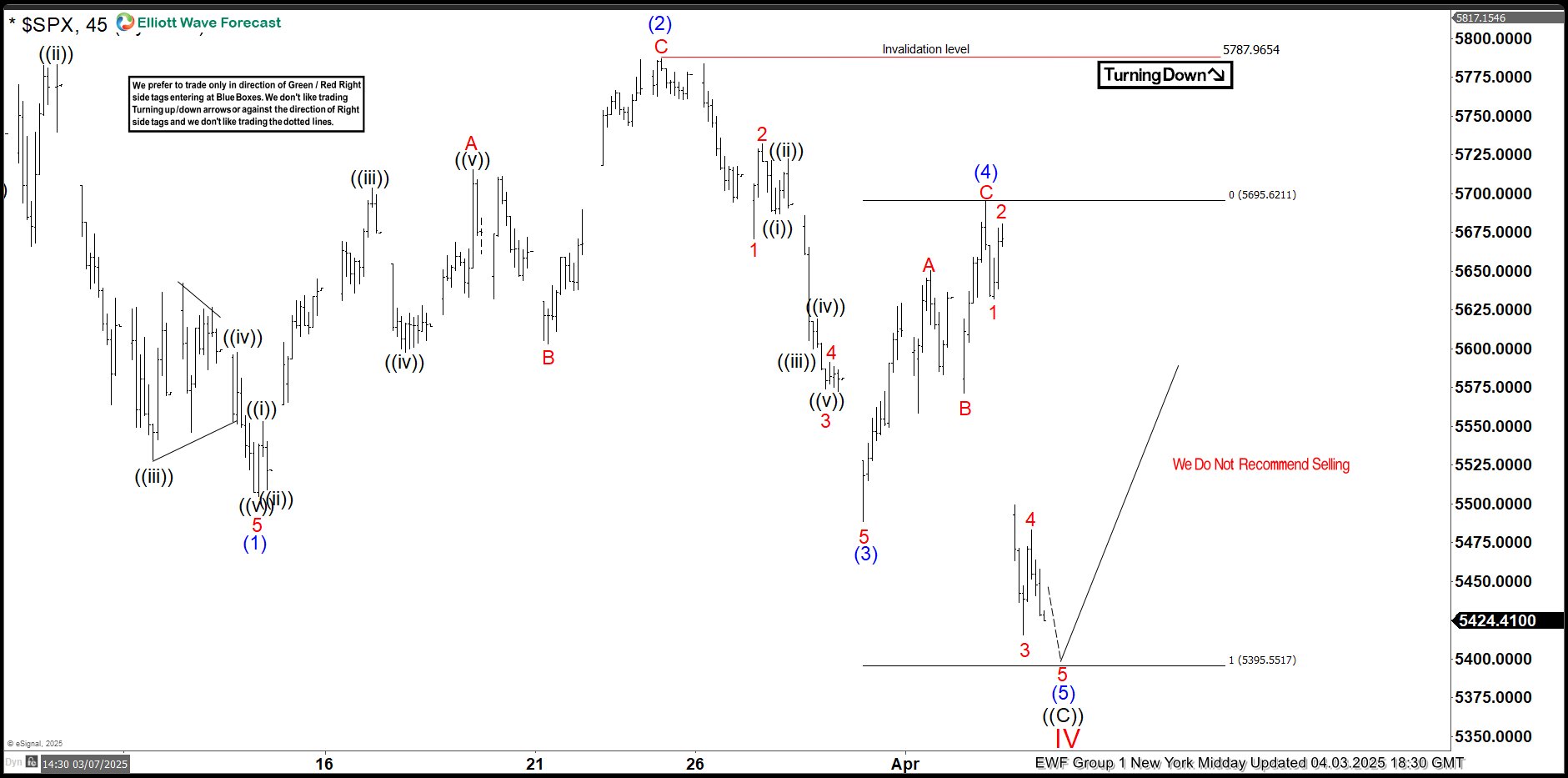

SPX 1-Hour Asia Chart Analysis: April 3, 2025

Current Elliott Wave analysis suggests that SPX has completed a three-wave recovery against the 5787.96 high, marked as wave (4) blue. As long as the price remains below the 5694 level, we consider wave (4) blue to be complete and expect continued downside in SPX towards new lows.

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

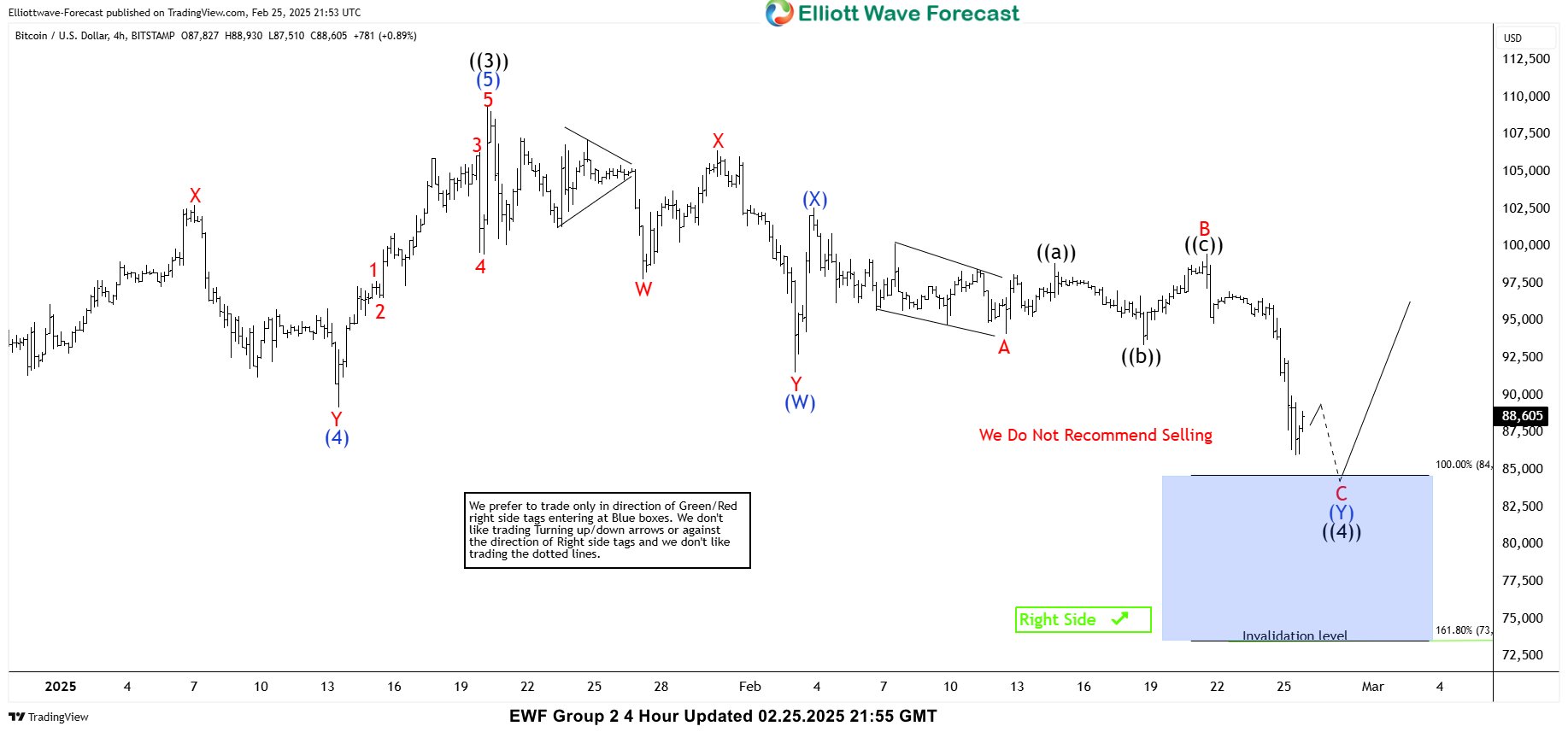

SPX 1-Hour New York Midday Chart Update: April 3, 2025

The price remained below the 5694 level, and as expected, the decline occurred. The price broke to new lows, confirming that wave (5) is in progress. We are now looking for further short-term weakness, with the next target around the 5395.55 area.

Remember, the market is dynamic, and the presented view may have changed in the meantime. For the most recent charts and target levels, please refer to the membership area of the site. The best instruments to trade are those with incomplete bullish or bearish swing sequences. We put them in Sequence Report and best among them are presented in the Live Trading Room

Reminder for members: Our chat rooms in the membership area are available 24 hours a day, providing expert insights on market trends and Elliott Wave analysis. Don’t hesitate to reach out with any questions about the market, Elliott Wave patterns, or technical analysis. We’re here to help.