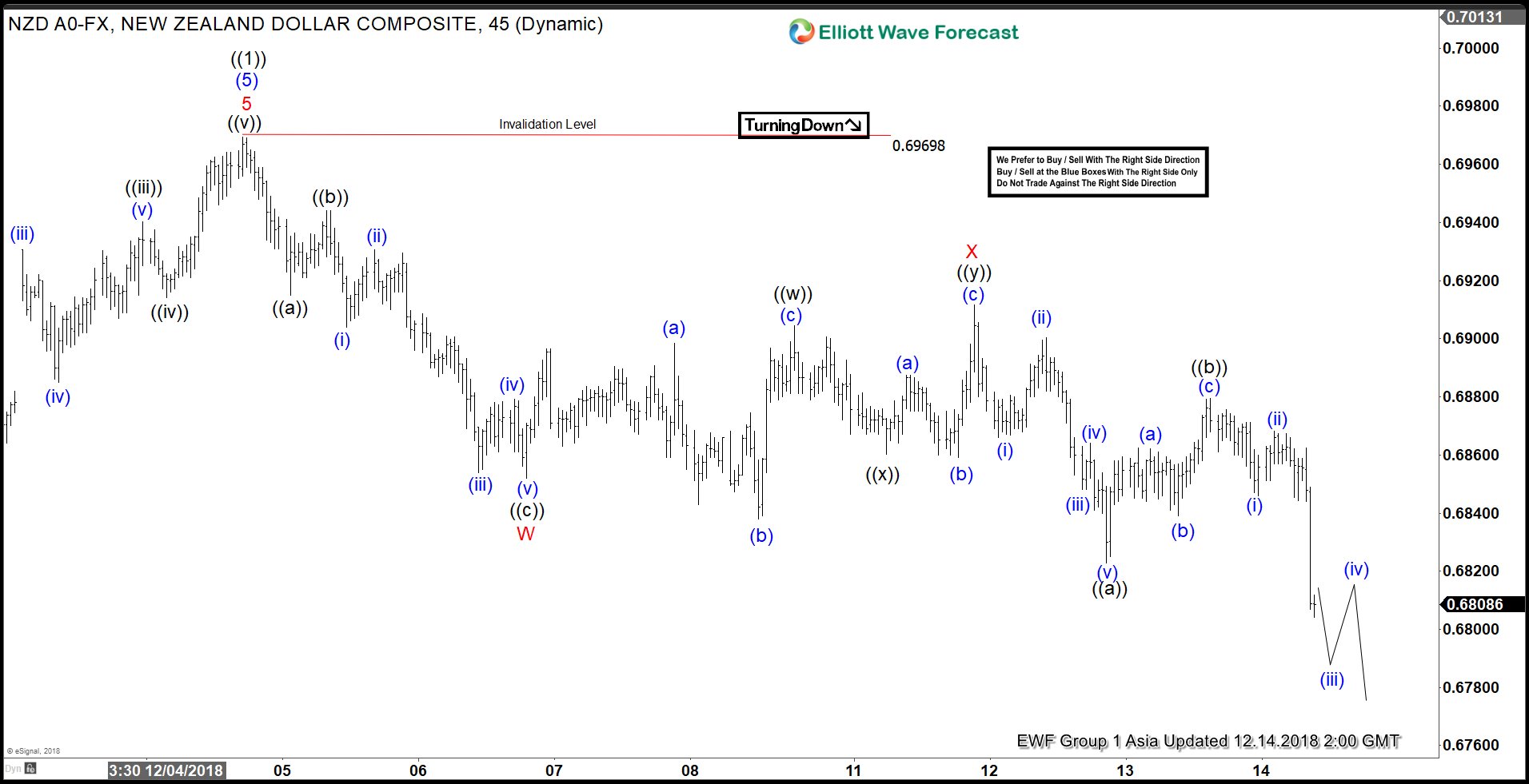

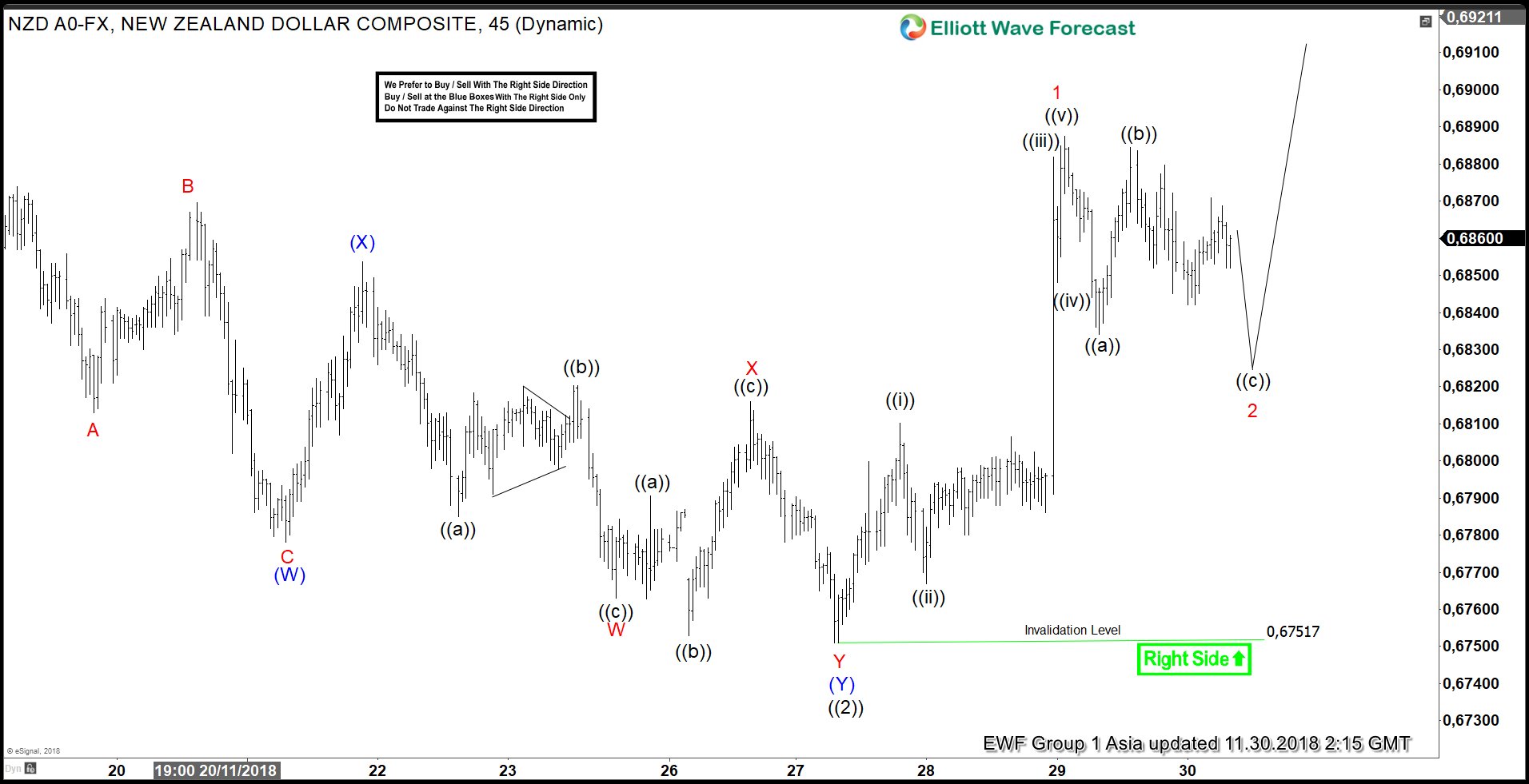

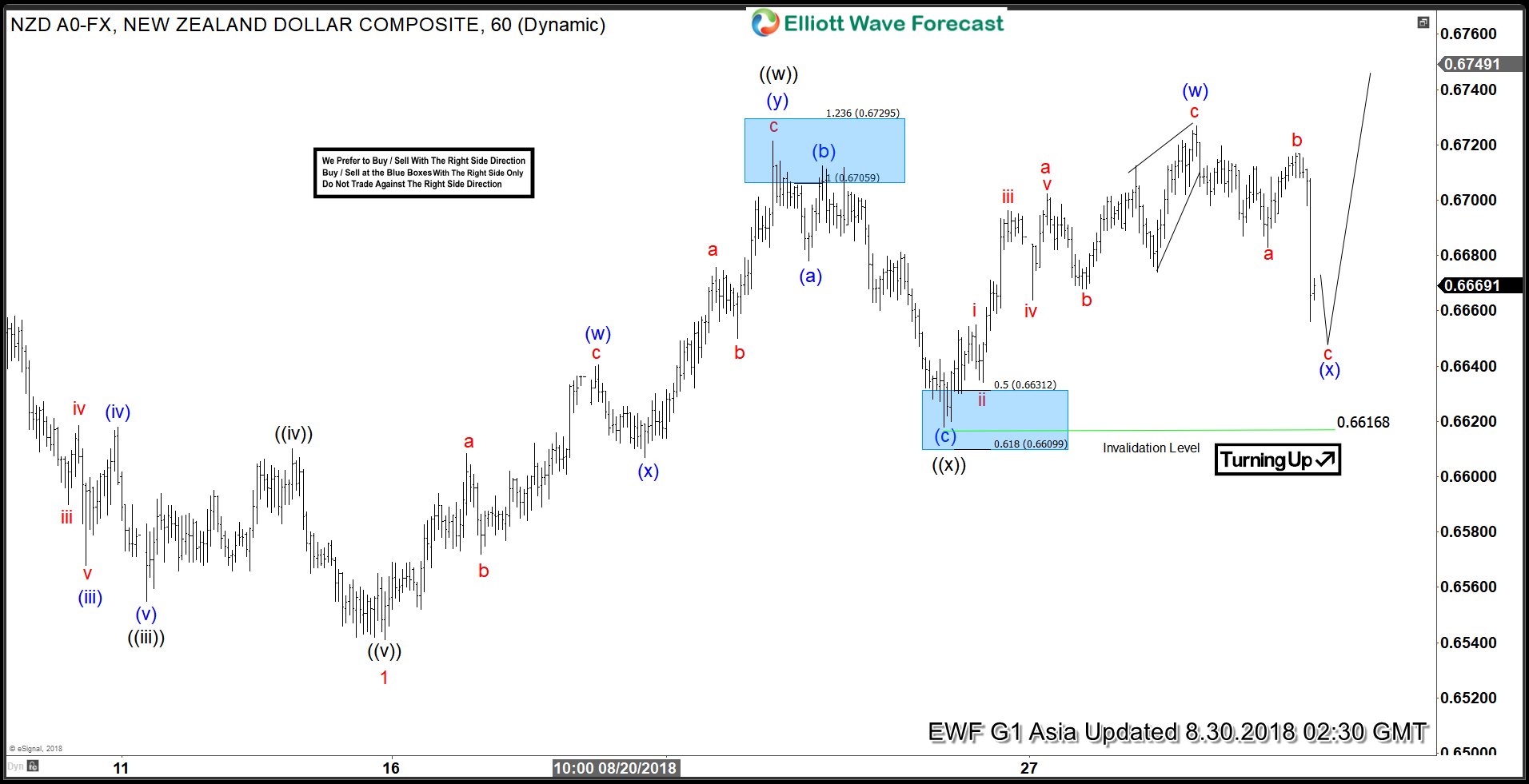

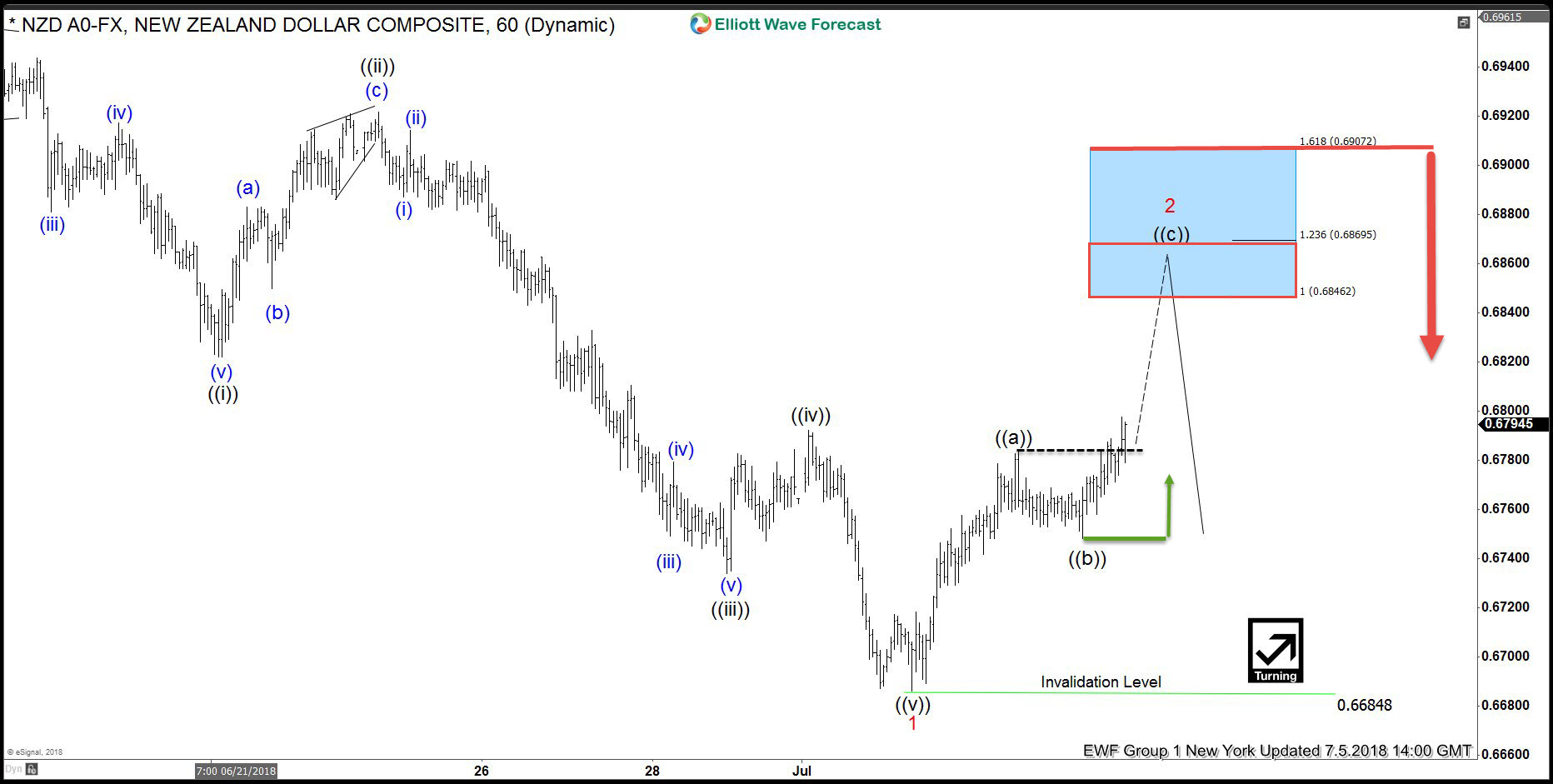

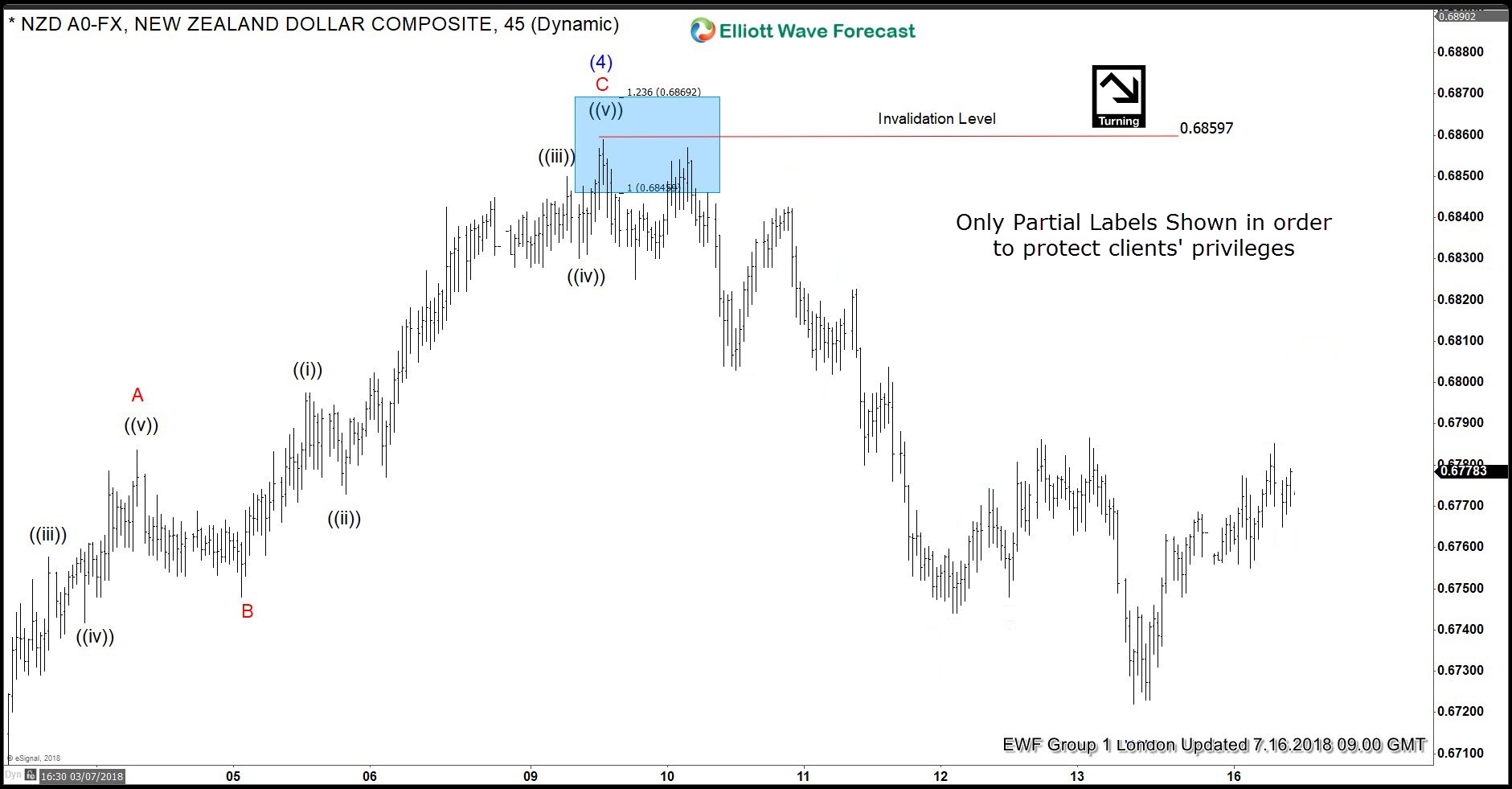

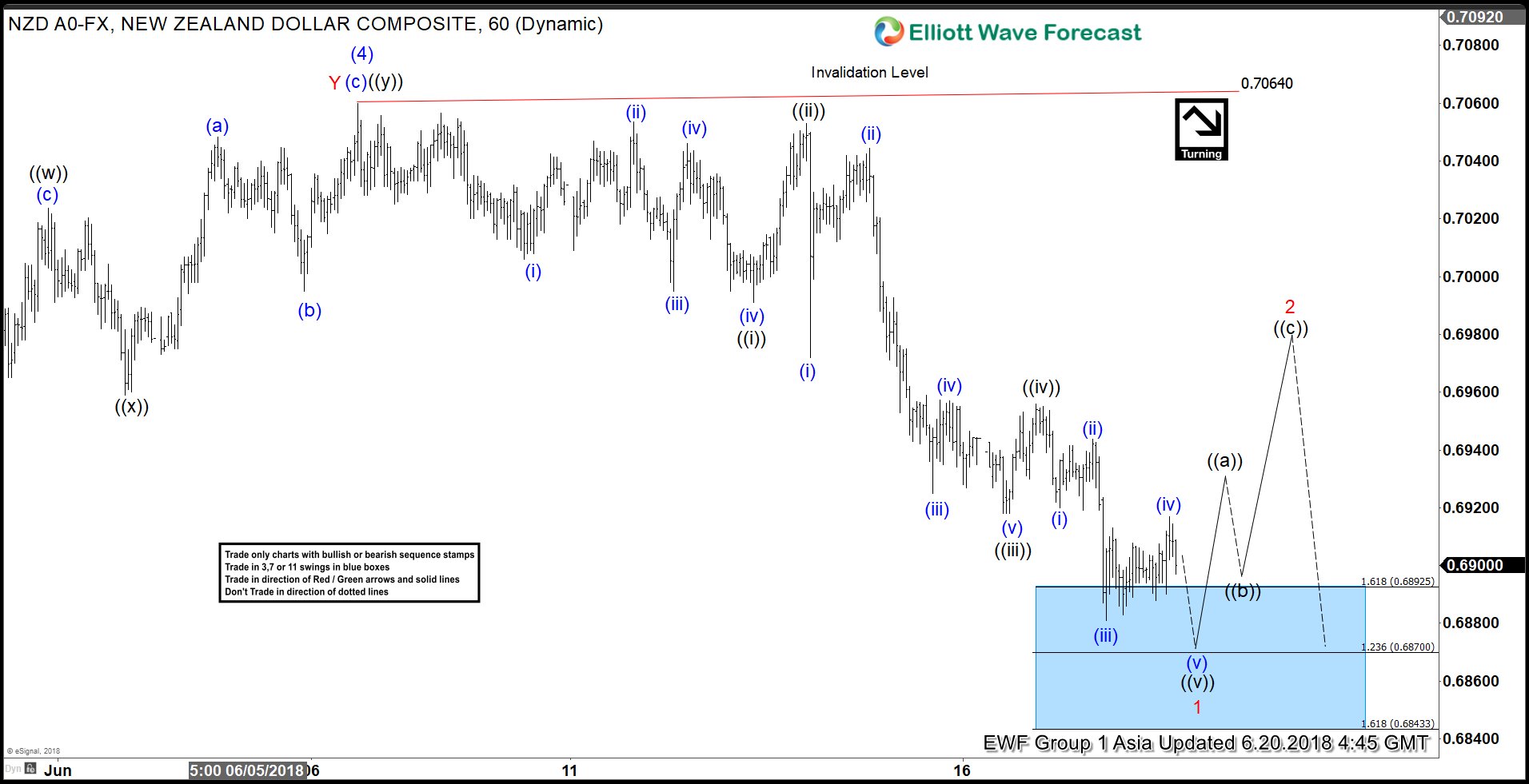

Short Term Elliott Wave view suggests that cycle from Oct 8 low (0.642) has ended at 0.697 high as Primary wave ((1)). Pair is now in the process of correcting the rally from Oct 8 low in 3, 7, or 11 swing within Primary wave ((2)). Decline from 0.6968 is unfolding as a double three Elliott Wave structure where Minor wave W ended at 0.6852 and Minor wave X ended at 0.6911.

Internal of Minor wave W unfolded as a zigzag Elliott Wave structure where Minute wave ((a)) of W ended at 0.6915, Minute wave ((b)) of W ended at 0.6944, and Minute wave ((c)) of W ended at 0.6852. Up from there, Minor wave X of ((2)) ended at 0.691 as a double three Elliott Wave structure where Minute wave ((w)) of X ended at 0.6904, Minute wave ((x)) of X ended at 0.686, and Minute wave ((y)) of X ended at 0.6911. Minor wave Y is now in progress lower as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 0.6822 and Minute wave ((b)) ended at 0.6879. Short term, while rally fails below 0.6968, expect pair to extend lower

NZDUSD 1 Hour Elliott Wave Chart