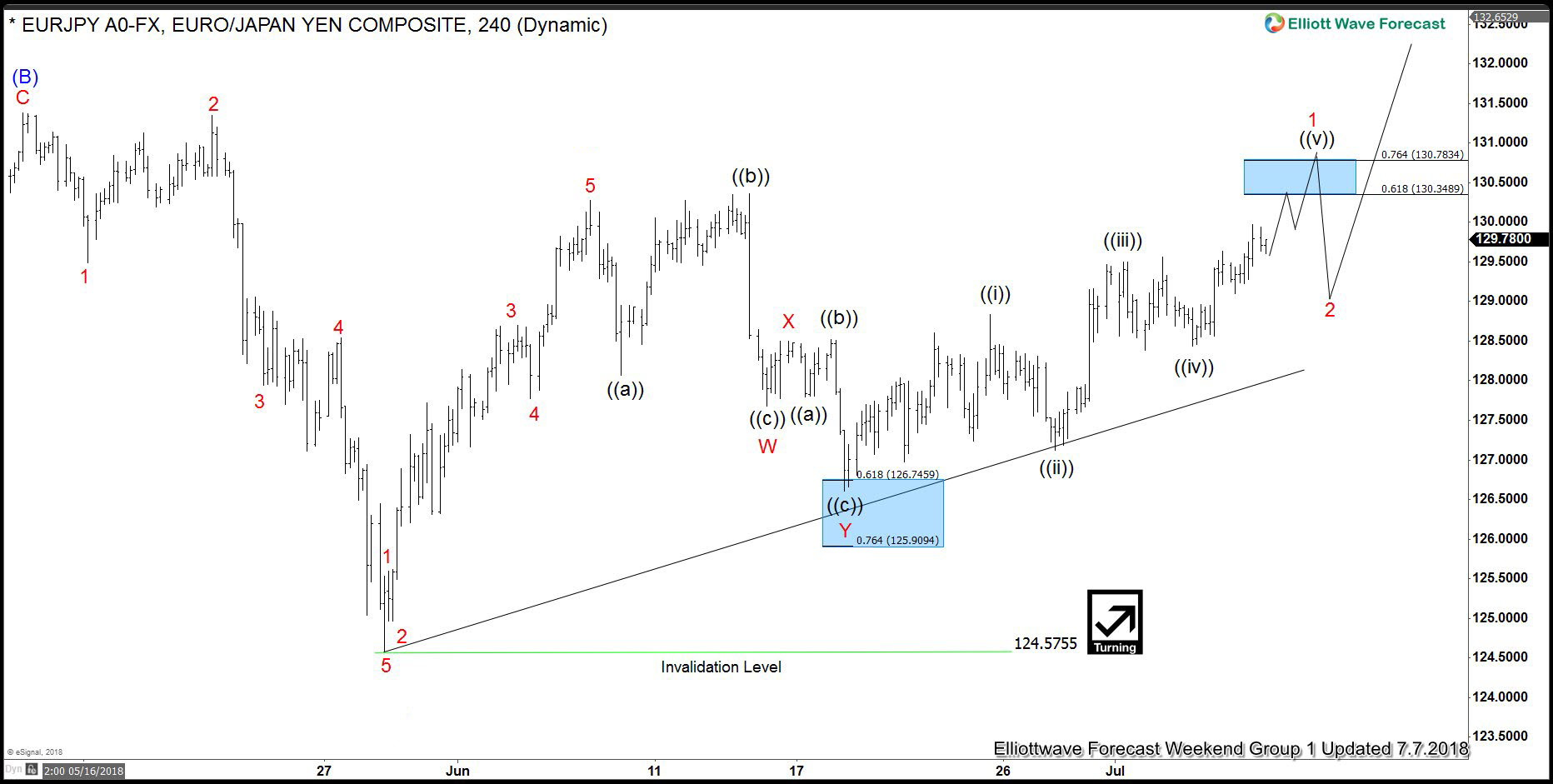

EURJPY LONG/BUY Trade Update 9.23.2018

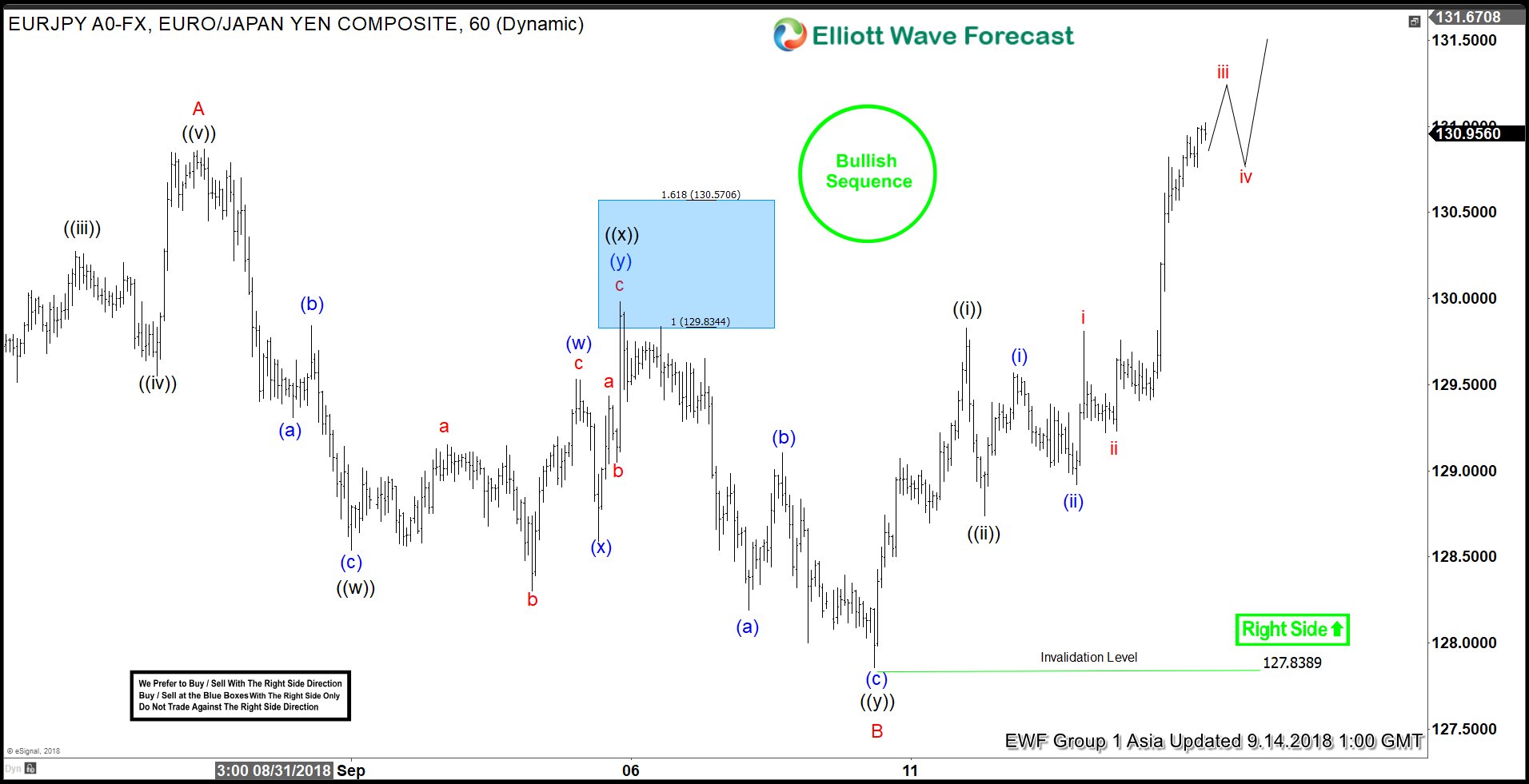

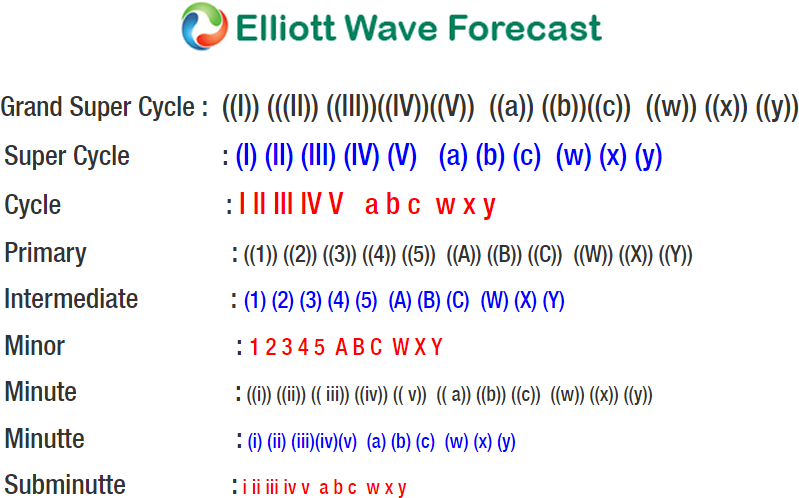

On September 21/2018 I posted on Twitter, @AidanFX , the EURJPY trade setup to look for LONGS/BUYS on the break above two bullish market patterns that was forming. Since September 21/2018 the pair broke above the bullish market patterns and has extended over 300 pips to the upside. The charts below will show how any trader could have caught the EURJPY move higher by trading market pattern breakouts. Traders only need to watch for these patterns to happen and execute the trade when the breakout occurs. Market patterns are Channels, Triangles, Wedges, Head and Shoulders pattern, Cup and Handle pattern, Flags, Pennants, Harmonic Patterns, Elliott Wave Patterns. These patterns form in every market and in every time frame. Each pattern has precise entries and defined stops. Market pattern breakouts can also be used with a simple 50 moving average plotted on the chart on any time frame. Only take the buy breakout if price is above the moving average and only take the sell breakout if price is below the moving average.

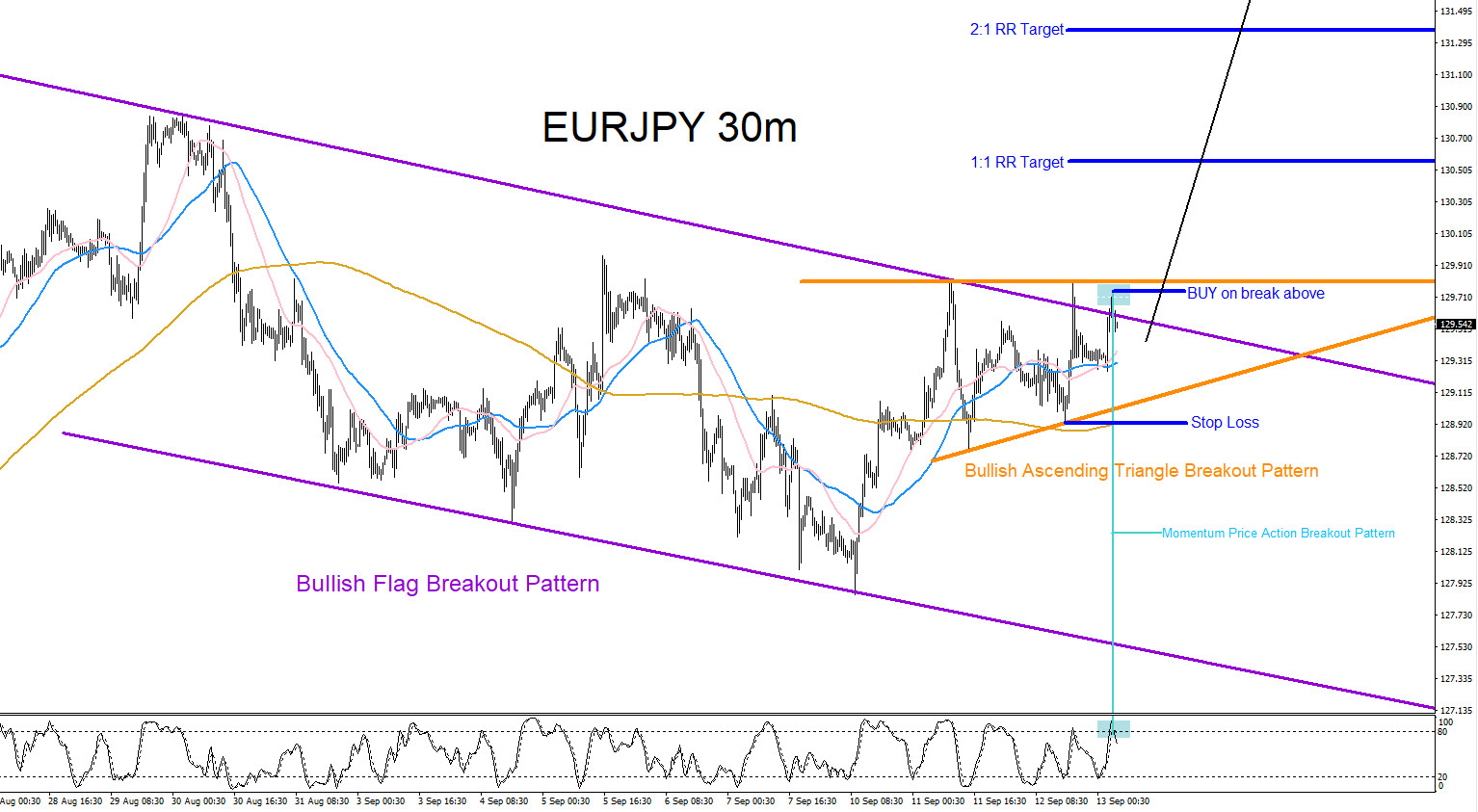

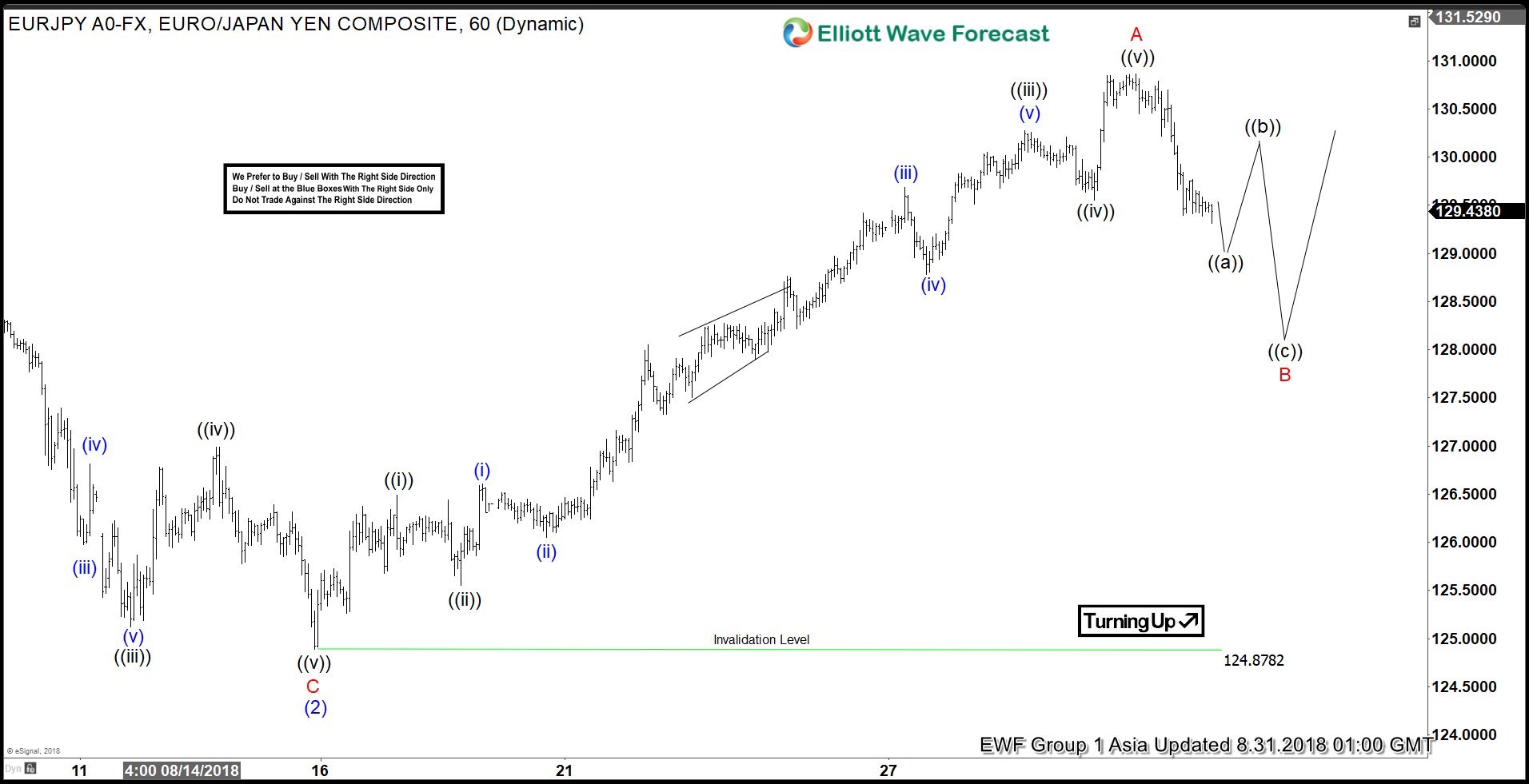

EURJPY 30 Minute Chart 9.12.2018

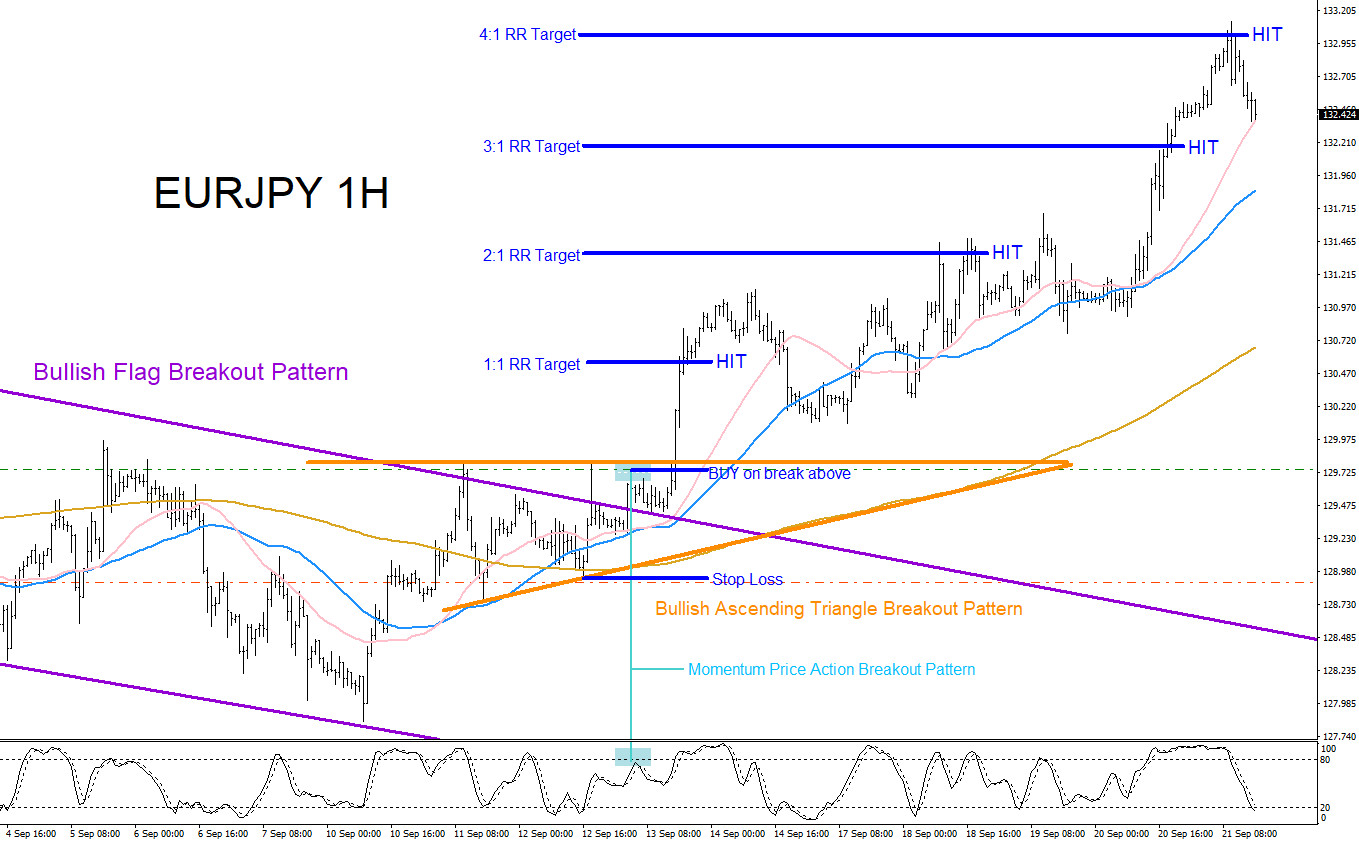

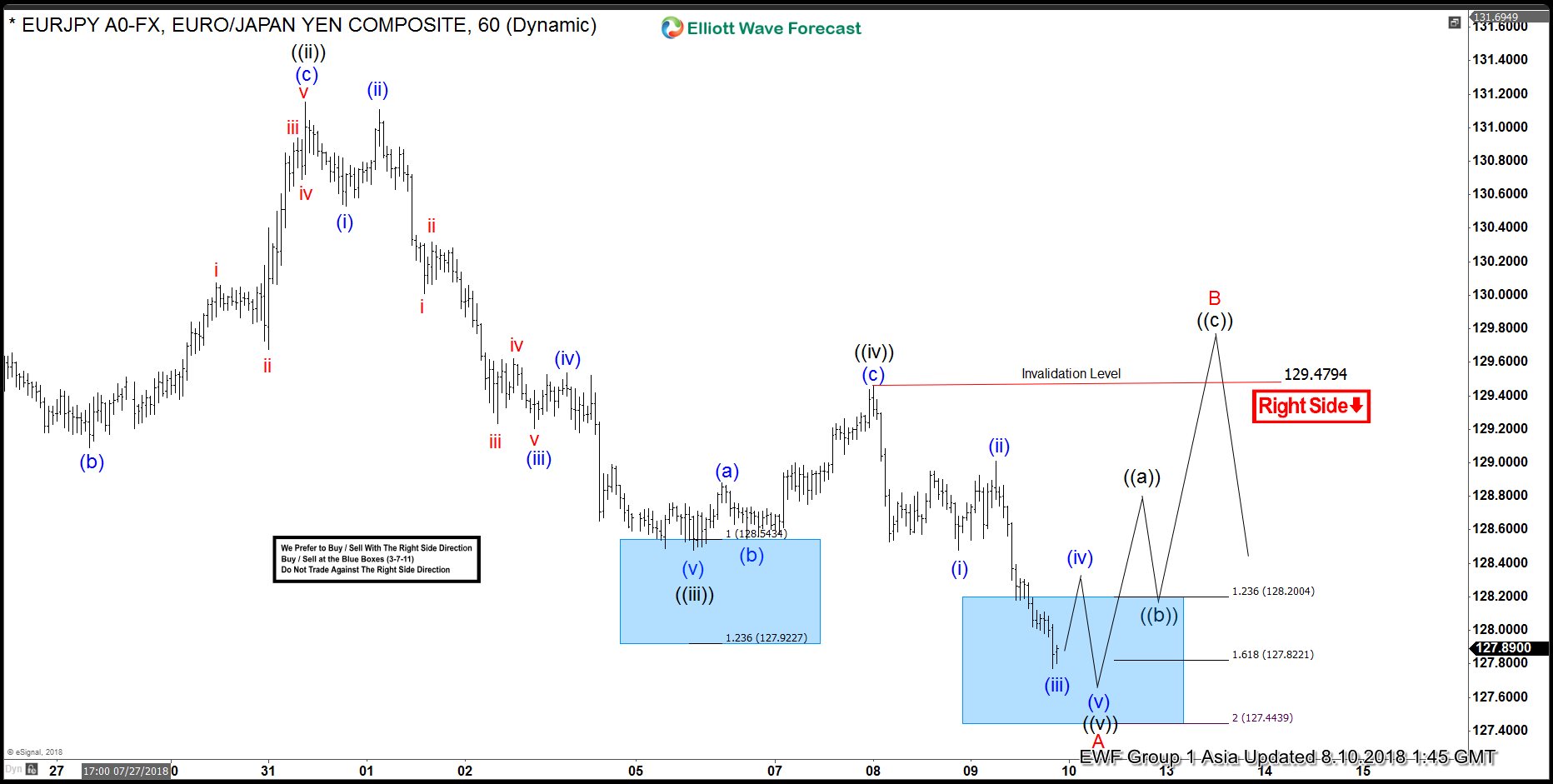

EURJPY 1 Hour Chart 9.21.2018

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 76 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial