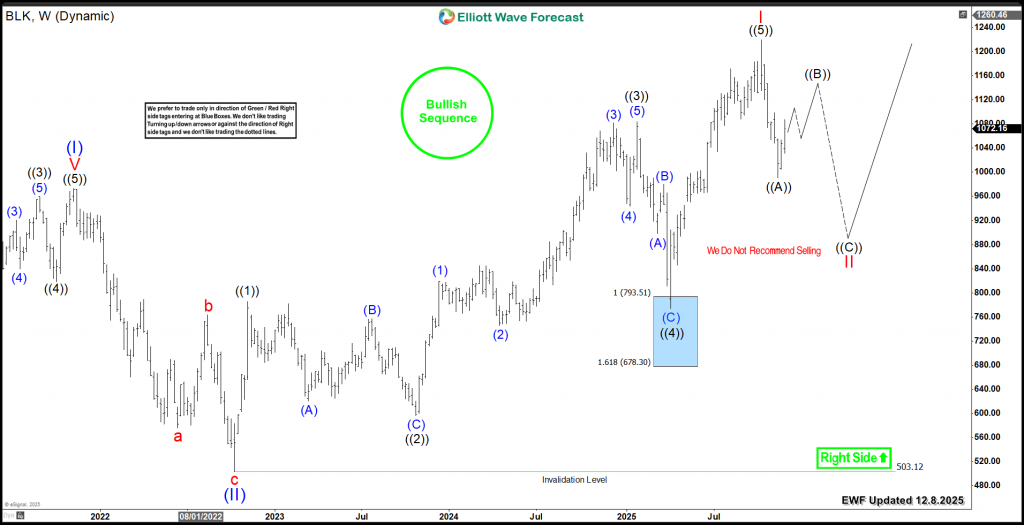

We previously mapped BlackRock’s (NYSE: BLK) bullish weekly path earlier this year. Today, our analysis continues with the Elliott Wave structure behind its rally from the 2022 low. This update highlights the next high-probability buying opportunity emerging for the stock.

Elliott Wave Analysis

BlackRock (BLK) Weekly Chart 12.8.2025

Conclusion

BlackRock’s larger-degree bullish cycle remains firmly intact. Therefore, investors should continue targeting buying opportunities within weekly and daily pullbacks. Utilize our Elliott Wave strategy for precise entry timing. Specifically, establish positions after a 3, 7, or 11-swing correction completes. Additionally, our proprietary Blue Box system highlights high-probability zones with pinpoint accuracy. As a result, this disciplined method gives traders the clarity and confidence to catch the next bullish leg.

Explore our system to gain deeper insights into this methodology.