$UUP Can See Another High In The Longer Term Cycles

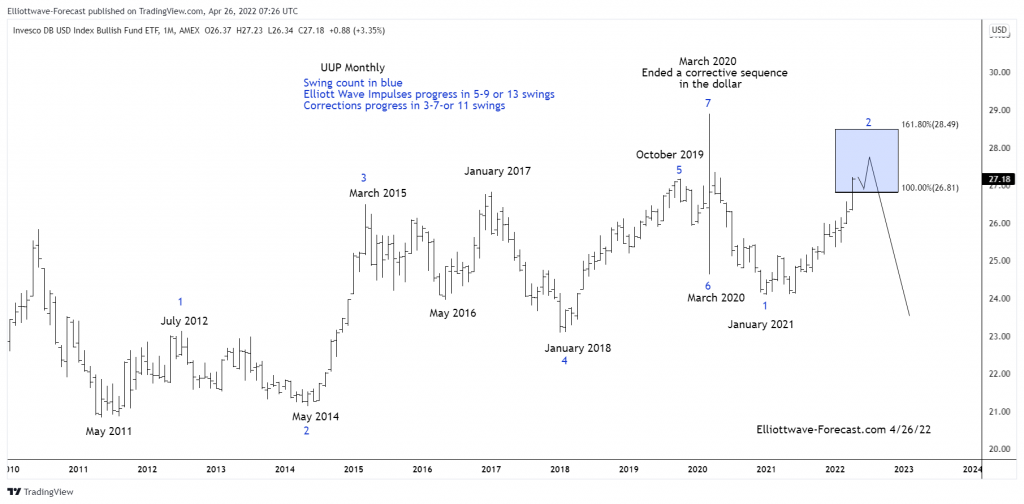

Firstly the dollar tracking ETF fund UUP inception date was 2/20/2007. Interestingly the dollar index has a low in March 2008. The UUP ETF fund shows a low in May 2011. The dollar index did make a pullback cycle low in May 2011 however it was well above the March 2008 lows. The cycle up from the May 2011 lows in UUP is the focus of this analysis where it begins on the monthly chart. It’s expected to see some further downside relatively soon before any more larger bounces higher in the longer term cycles.

The analysis continues below the $UUP monthly chart.

Secondly the cycle up from the May 2011 lows in UUP appears to have advanced higher with some overlap in the cycles. From the May 2011 lows the dollar instrument appears to have 7 swings in place to the March 2020 highs. This cycle from the May 2011 lows to the March 2020 highs is a corrective sequence.

Thirdly and in conclusion. The decline from the March 2020 highs suggests further downside in the dollar for some time to come. March 2020 saw some fast 6th & 7th swings. The best reading of the cycles now suggests the price action from there to the January 2021 lows were an impulsive five waves of larger degree. The cycle from the January 2021 lows is mature however the dollar can see another high in the blue box extension area before resuming a larger downtrend.

Thanks for looking. Feel free to come visit our website. Please check out our services for 14 days to see if we can be of help. Kind regards & good luck trading. Lewis Jones of the ElliottWave-Forecast.com Team.

Back