The social networking giant Twitter (NYSE:TWTR) has become the number one platform for government leaders and it’s still considered one of the best places for breaking news.

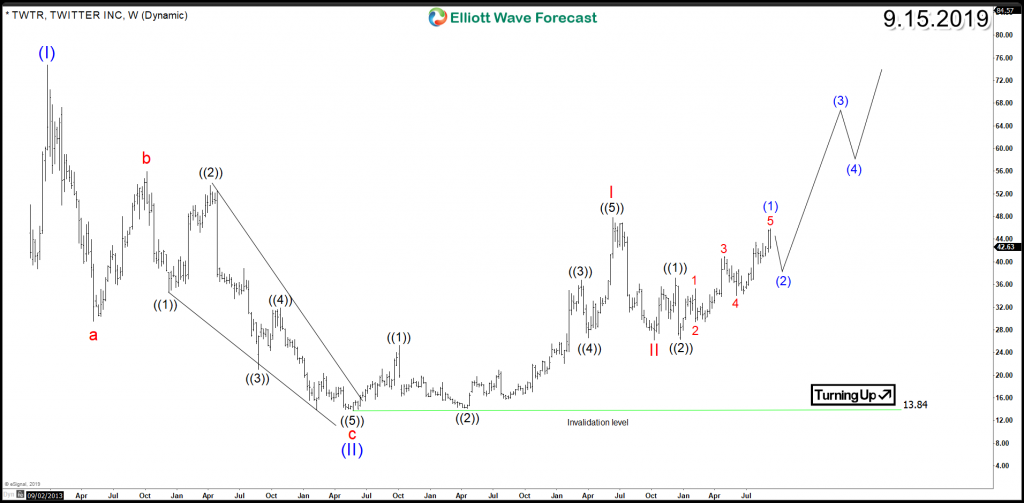

For the first time in the company’s history, Twitter made a profit in the fourth quarter of the 2017 just one year after its stock established a major bottom. Since 2016 low $13.6 low, TWTR rallied higher with an impulsive 5 waves advance toward $47 peak. followed by 3 waves pullback which ended on October 2018 at $26.2.

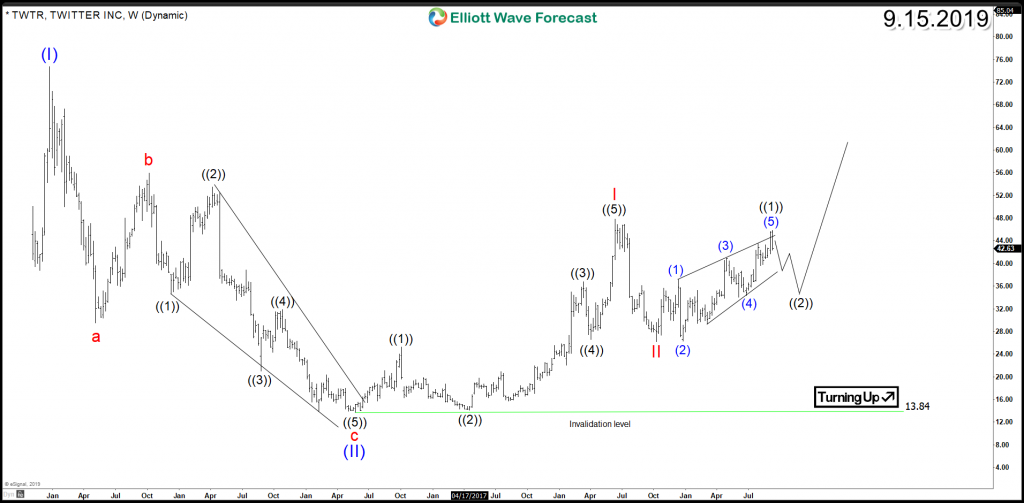

Up from there, the stock started rallying again showing an impulsive structures which can establish a new bullish trend and the current pullback is the one to define the next path depending on the type of correction taking place and which cycle has ended within the recent rallies.

The most aggressive view with an Elliott Wave theory would suggest a bullish nest taking place within wave III which since October 2018, so the short term pullbacks should remain supported in 3 or 7 swings to allow the stock to resume the rally without any deep correction. The second scenario is representing a leading diagonal which ended early on September 2019 so consequently a larger 3 waves correction will be taking place against $26.2 before buyers show up again to resume the trend.

Twitter TWTR Weekly Chart 1

Twitter TWTR Weekly Chart 2

However, despite the 2 bullish path presented above, another less likely bullish scenario isn’t denied yet as stock holds below 2018 peak. A double three correction lower toward $24 – $19 can still take place later on which will represent another hedging area from where a 3 waves bounce at least can take place.

As a conclusion, as long as TWTR pullbacks remain above $26.2 low, then the stock can rally higher to break 2018 peak as part of a new impulsive cycle to the upside to take the stock toward first target at $60 followed by a second target at new all time highs $81.

Get more insights about Technology Stocks by trying out our services 14 days . You’ll learn how to trade our blue boxes using the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

Back