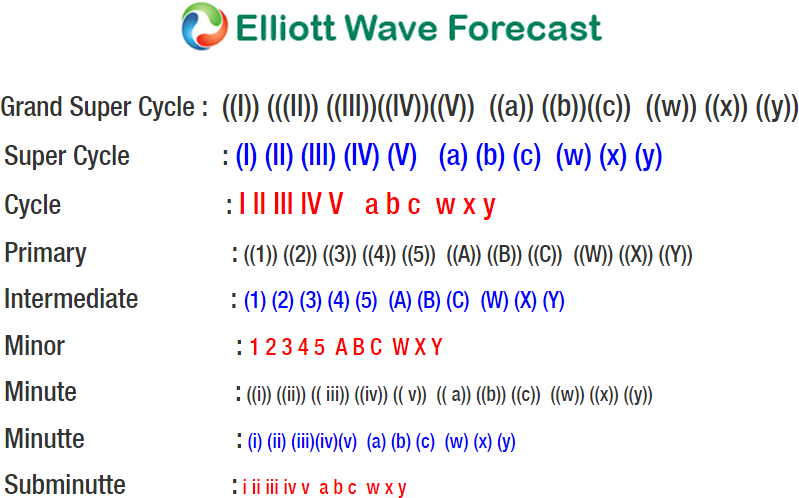

Short term Elliott wave view in SPX suggests that the rally from 1/23 low is unfolding as a 5 waves Elliott wave impulse structure where Minor wave 1 ended at 2301, Minor wave 2 ended at 2267.2, and Minor wave 3 is proposed complete at 2371.5. Internal of Minor wave 3 shows an extension and subdivided also as an impulse structure where Minute wave ((i)) ended at 2289.1, Minute wave ((ii)) ended at 2271.6, Minute wave ((iii)) ended at 2368.2 and Minute wave ((iv)) ended at 2352.6. Unless we are still in Minute wave ((iii)) of Minor 3, the Index could have started the Minor wave 4 pullback to correct the cycle from 1/31 cycle Minor wave 2. Target for Minor wave 4 pullback is towards 2352-2345 area before finding buyer’s again for resumption of trend higher into the proposed Minor wave 5 of A towards 2378-2406 area, provided that pivot at 2267 low remains intact. Afterwards index is expected to start a larger 3 waves pullback in wave B to correct the cycle from 1/23 low. We don’t like selling the Index and expect buyers to appear after Minor wave 4 pullback is complete in 3, 7, or 11 swings.

Spx 1 hour chart

At Elliottwave-Forecast, we offer 24 hour coverage of 52 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits. Check out our 14 day Trial to sample everything we have to offer.

Back