It seems these days there is no shortage of companies riding the coat tails of the Bitcoin and blockchain. SOS is a company based out of China, that has been involved in blockchain sector for some time. However, recently has shifted focus to mining for Bitcoin. Lets take a look at what they do:

“SOS is a high-tech company with AI block chain as the core technology, headquartered in Qingdao. The company provides customers with rescue, big data, trade, digital asset management and other information technology services through AI block technology + satellite communication.

Company headquarters is located in Qingdao, focus on big data accumulation, cloud computing. The SOS cloud emergency rescue service SaaS platform dominated by three products: basic cloud (medical rescue card, automobile rescue card, financial rescue card, rescue mutual aid card), cooperative cloud (information rescue center, intelligent big data, intelligent software and hardware), and information cloud (news today, e-commerce today). It provides information security services and marketing-related data, technology and solutions for emergency rescue services such as insurance, finance, medical care, health, automobile, safety and mutual aid, and builds an international efficient rescue service system by driving big data with technology.”

Recently in 2021 they announced intent, and also receipt, of an initial tranche of bitcoin mining rigs. This has really helped fuel the speculation on this stock. Lets dig into the charts!

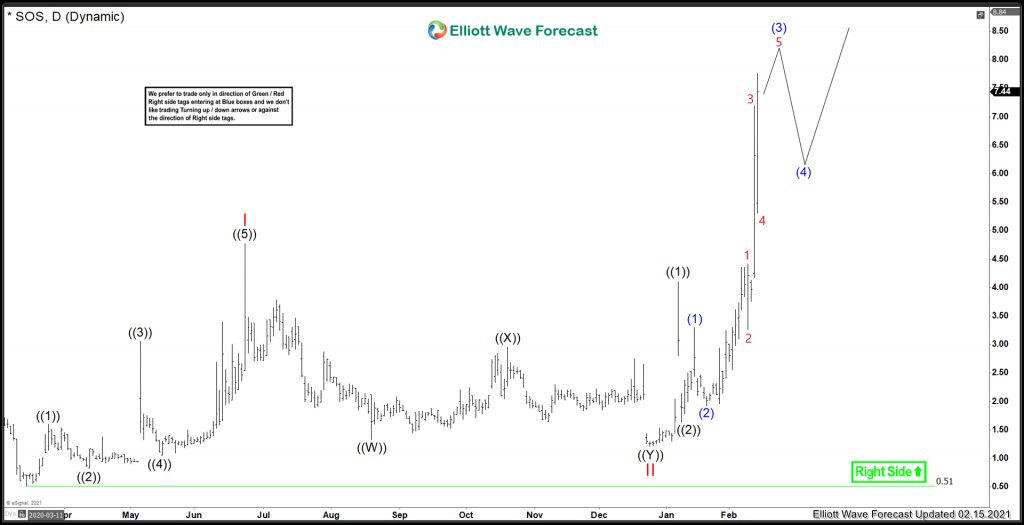

SOS Daily Elliottwave View:

Medium term term view from the all time low in March 2020 for $SOS is painting a similar picture to many other BTC mining companies. There is enough evidence to support an extended wave III in progress right now. From the low of 0.51 set in March 2020, the stock had a choppy advance for Red I. Red II took nearly 6 months to correct the rally from March 2020 low. The announcement of their entry into bitcoin mining solidified the II low and started the next leg higher. Since then, it has counted as an extended Red III in progress. It has most recently just taken the peak from June 2020, creating a new incomplete bullish sequence. Momentum is still very strong on this name which gives evidence to the fact that it is still in the heart of a wave 3 advance.

In Conclusion, with the data that is present, this stock is favouring further extension higher. Subsequently, SOS may just be getting started with many more swings needed in the sequence to complete a 5 waves higher from the March 2020 low.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our free 14 day trial today. Get free Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back