The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

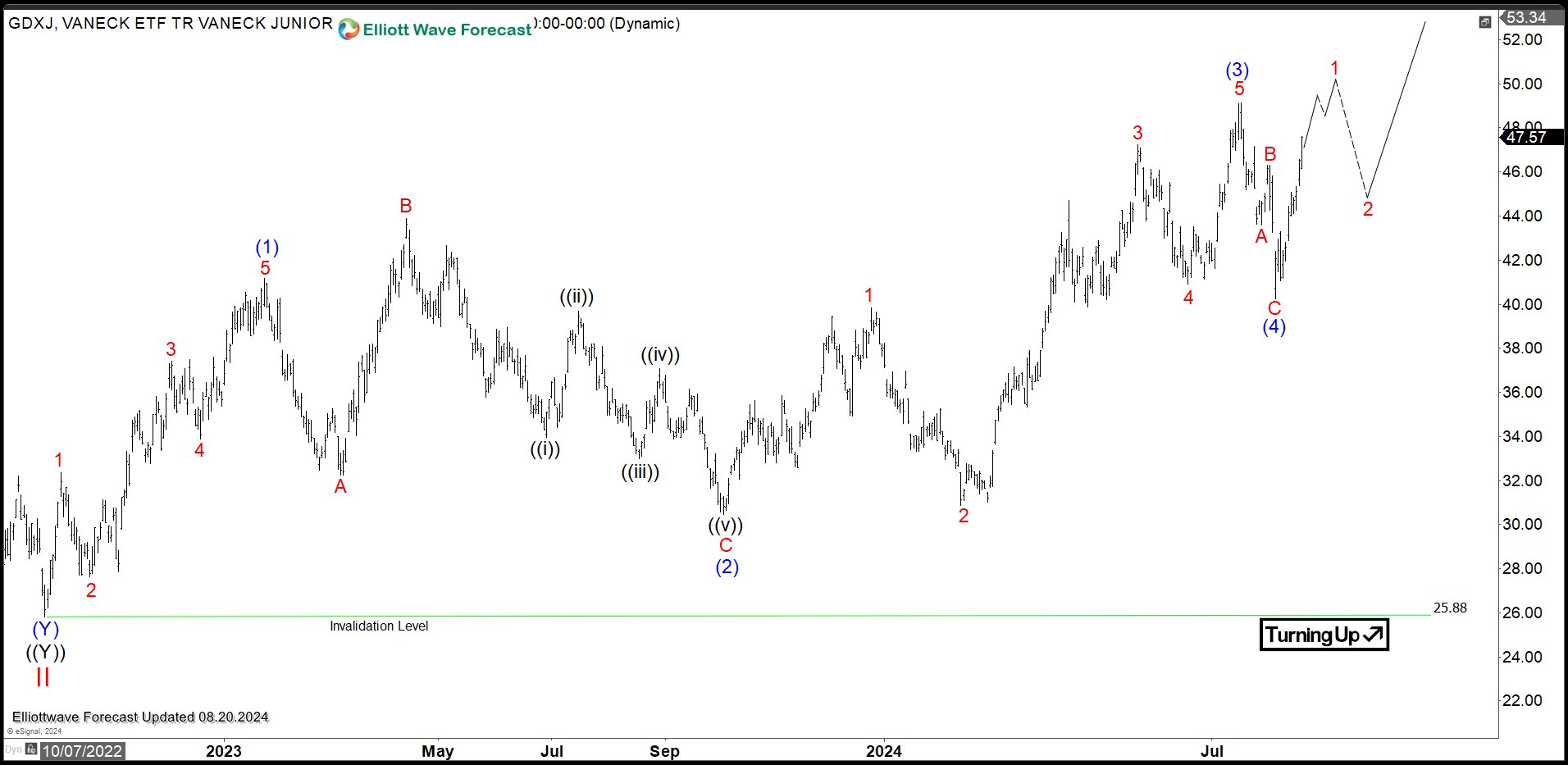

Gold Miners Junior ETF (GDXJ) Extending Higher

Read MoreGold Miners Junior ETF (GDXJ) Has Resumed the Rally Higher. This article looks at the short term Elliott Wave path of the ETF.

-

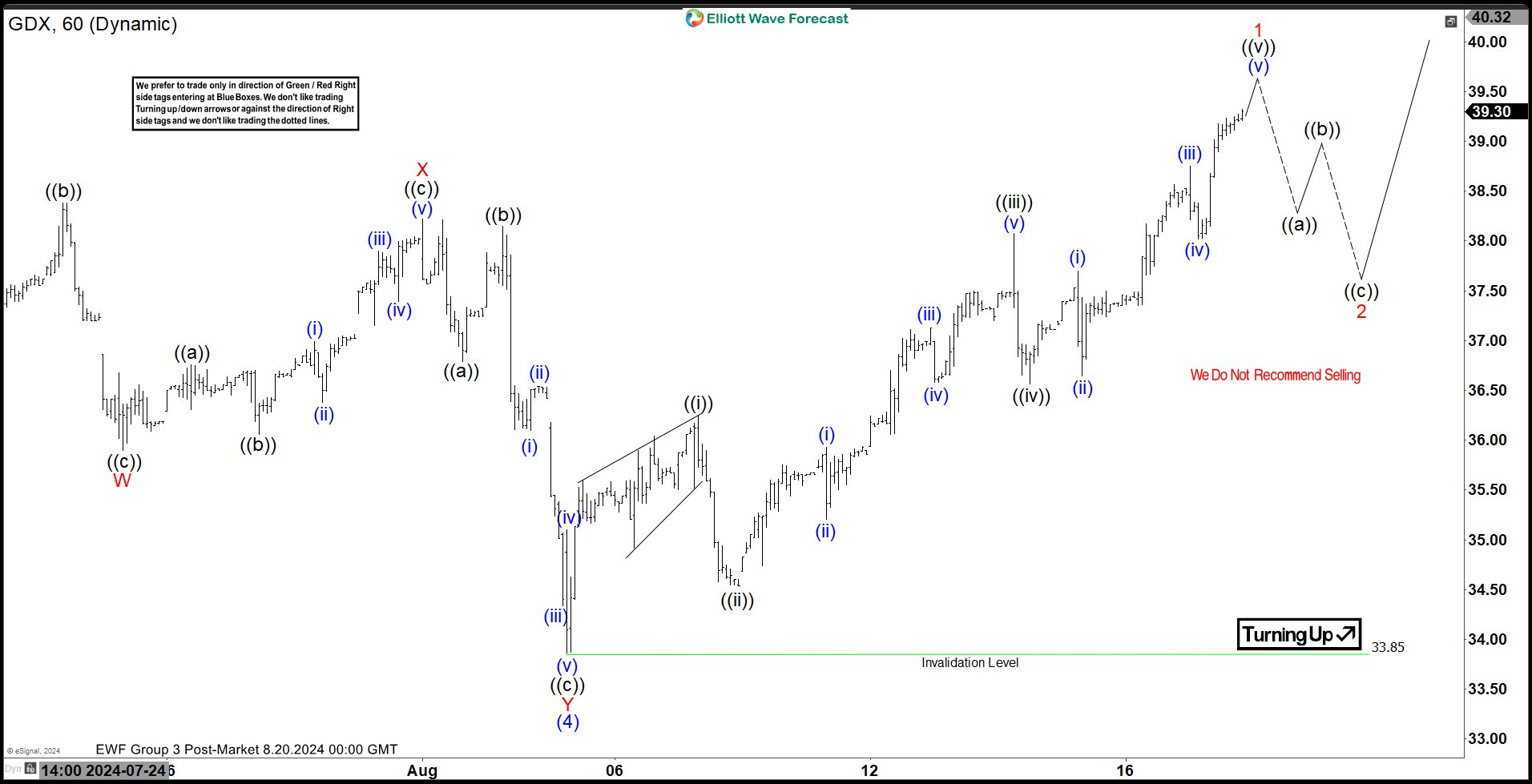

Elliott Wave Intraday Analysis Looking for GDX to Extend Higher

Read MoreRally from 9.26.2022 low in $GDX is currently in progress as a 5 waves diagonal. Up from 9.26.2022 low, wave (1) ended at 36.26 and pullback in wave (2) ended at 25.62. The ETF then extended higher in wave (3) towards 39.4 and pullback in wave (4) ended at 33.85 as the 1 hour chart […]

-

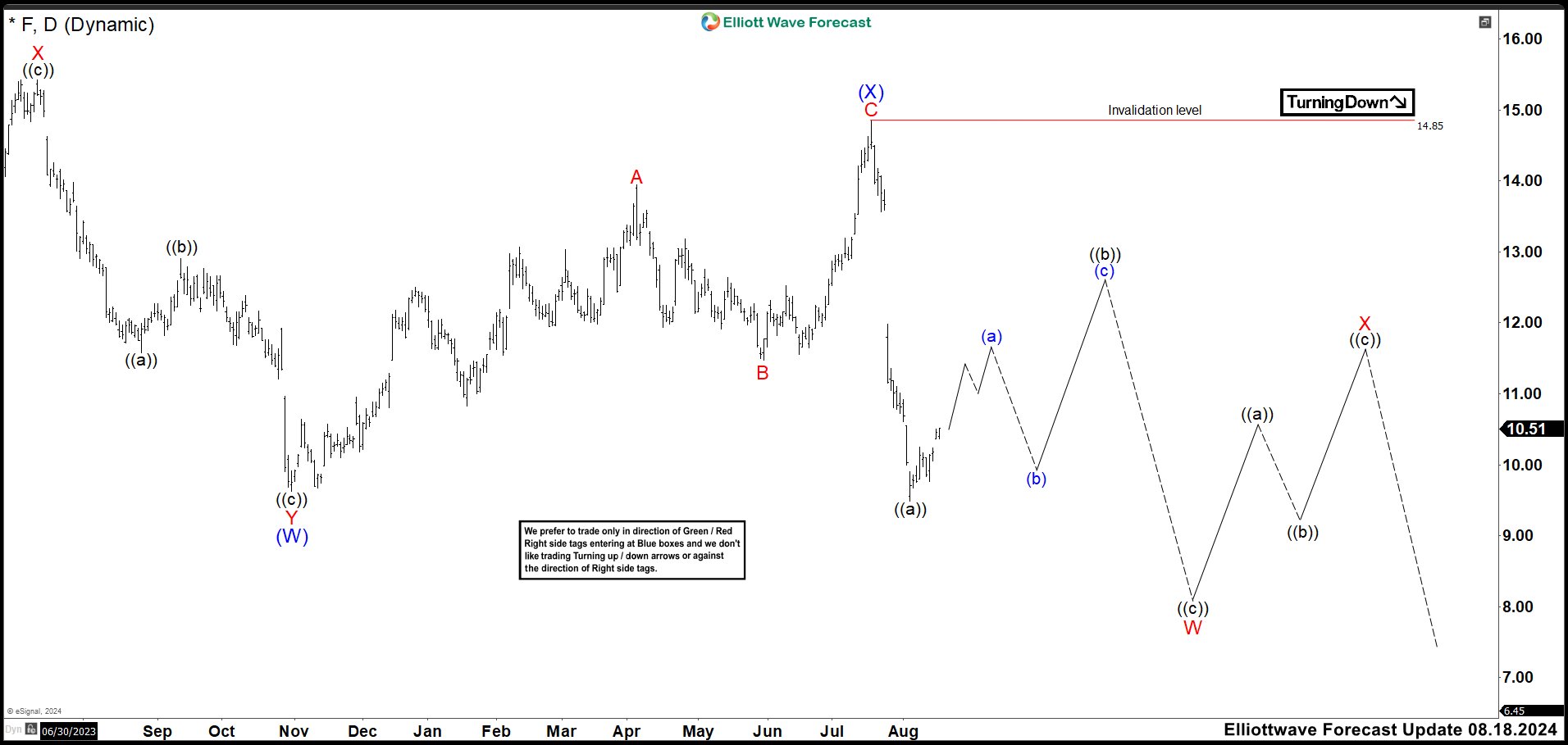

FORD (F) is Still Not Ready to Resume the Rally

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD (F) Daily Chart August 2023 One year ago, we called that Ford (F) needed more downside as price action stays below […]

-

Amazon.com Inc. ( $AMZN) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the Daily Elliott Wave chart of Amazon.com Inc. ($AMZN) . The rally from 3.13.2023 low at $88.06 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & forecast […]

-

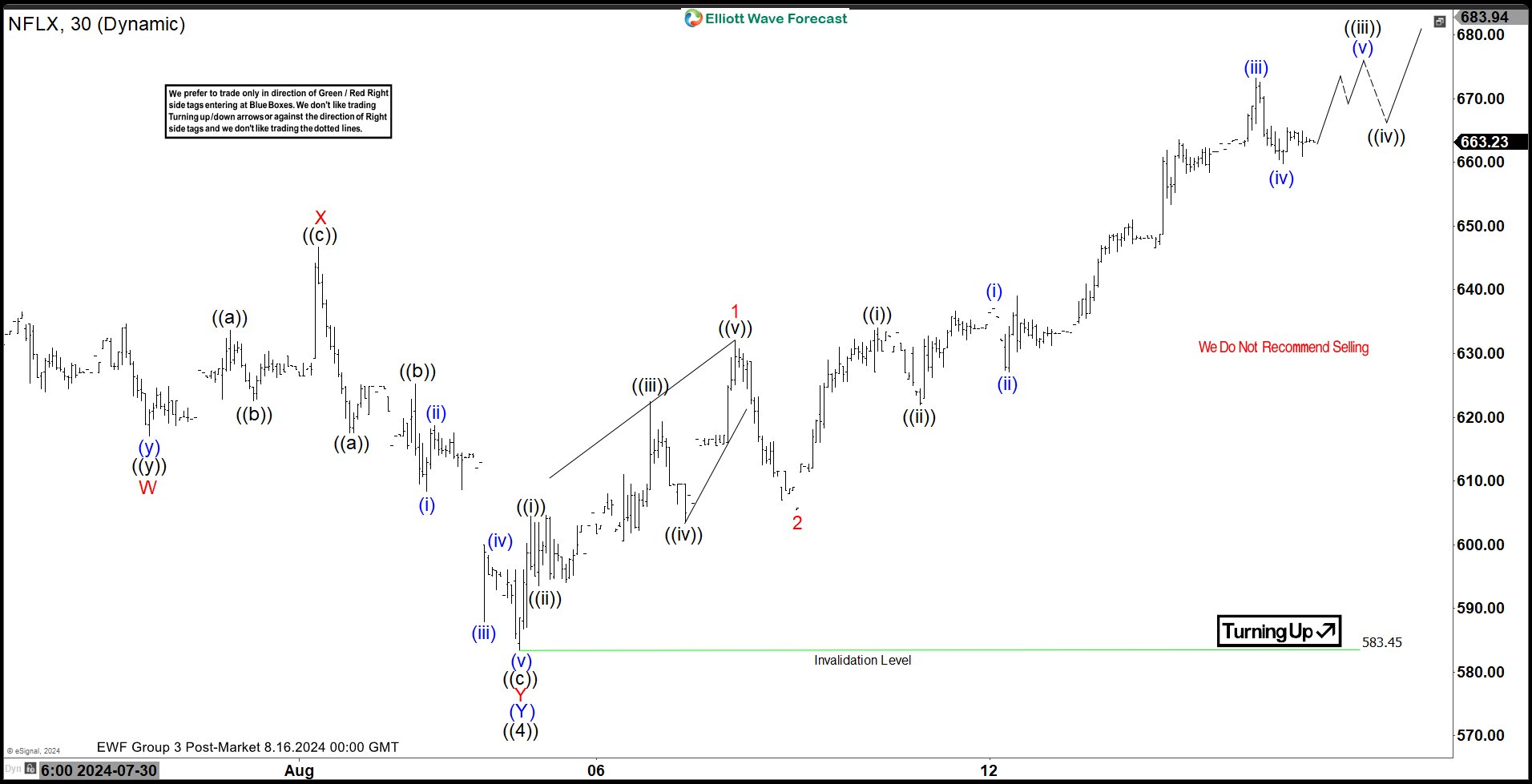

Elliott Wave Intraday Analysis: NFLX Should Continue Rally

Read MoreShort Term Elliott Wave in NFLX suggests that the Stock has completed a bearish sequence from 7.05.2024 high. The decline made a double correction Elliott Wave structure. Down from 7.05.2024 high, wave (W) ended at 600.00 low. Rally in wave (X) ended at 678.97 with internal subdivision as a zig zag correction structure. Up from […]

-

Elliott Wave Intraday Analysis: SPX Resumed the Rally

Read MoreShort Term Elliott Wave View in SPX suggests the trend should continue higher within the sequence started from March 2023 low as the part of daily sequence. It favors upside in wave ((5)) while dips remain above 5124.76 low. Since March 2024 high of (3), it starts a correction as wave (4) ending in April […]