The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

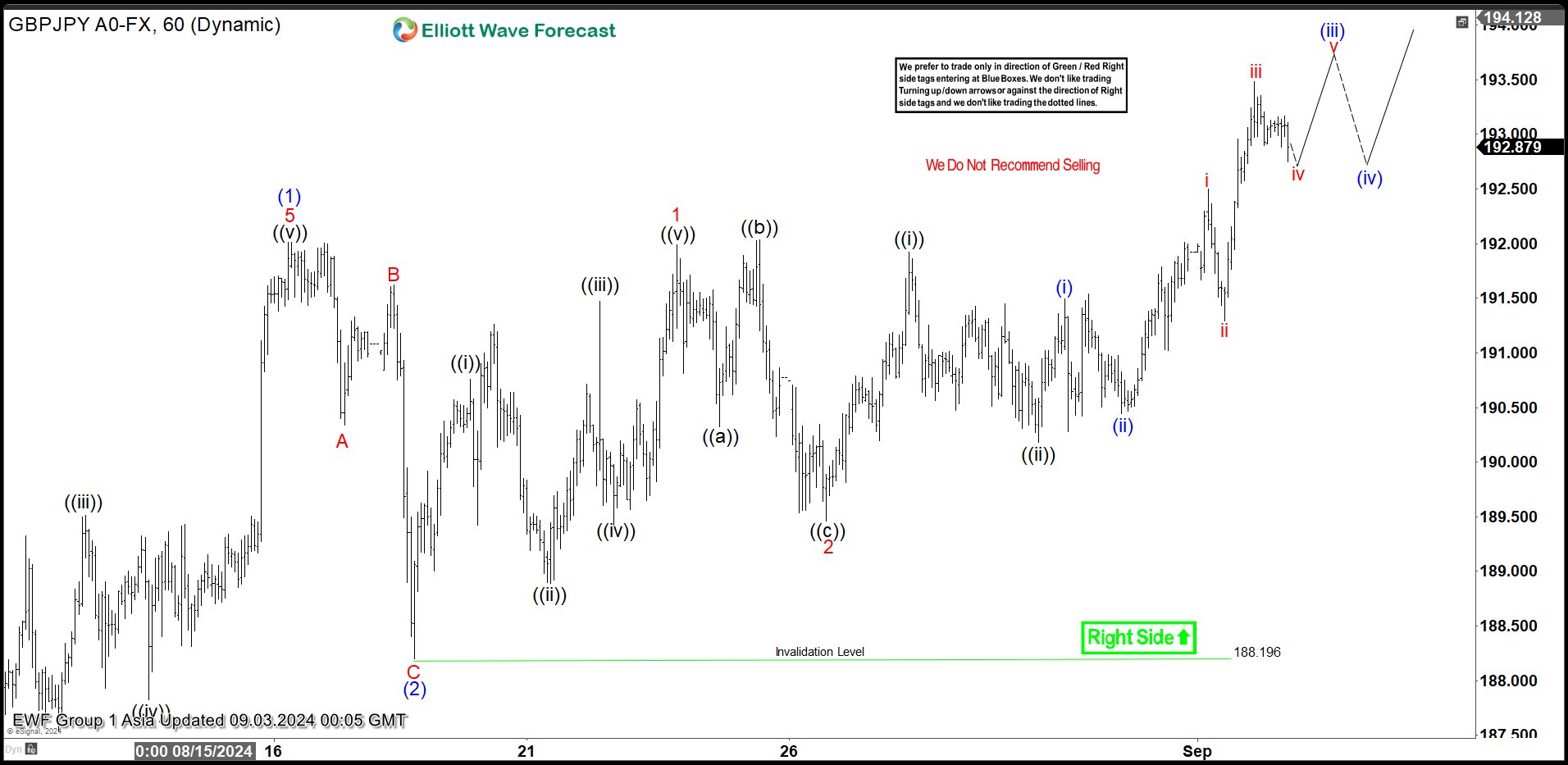

Short Term Elliott Wave Sequence in GBPJPY Calling Further Upside

Read MoreGBPJPY shows bullish sequence from 8.5.2024 low favoring further upside. This article and video look at the Elliott Wave path.

-

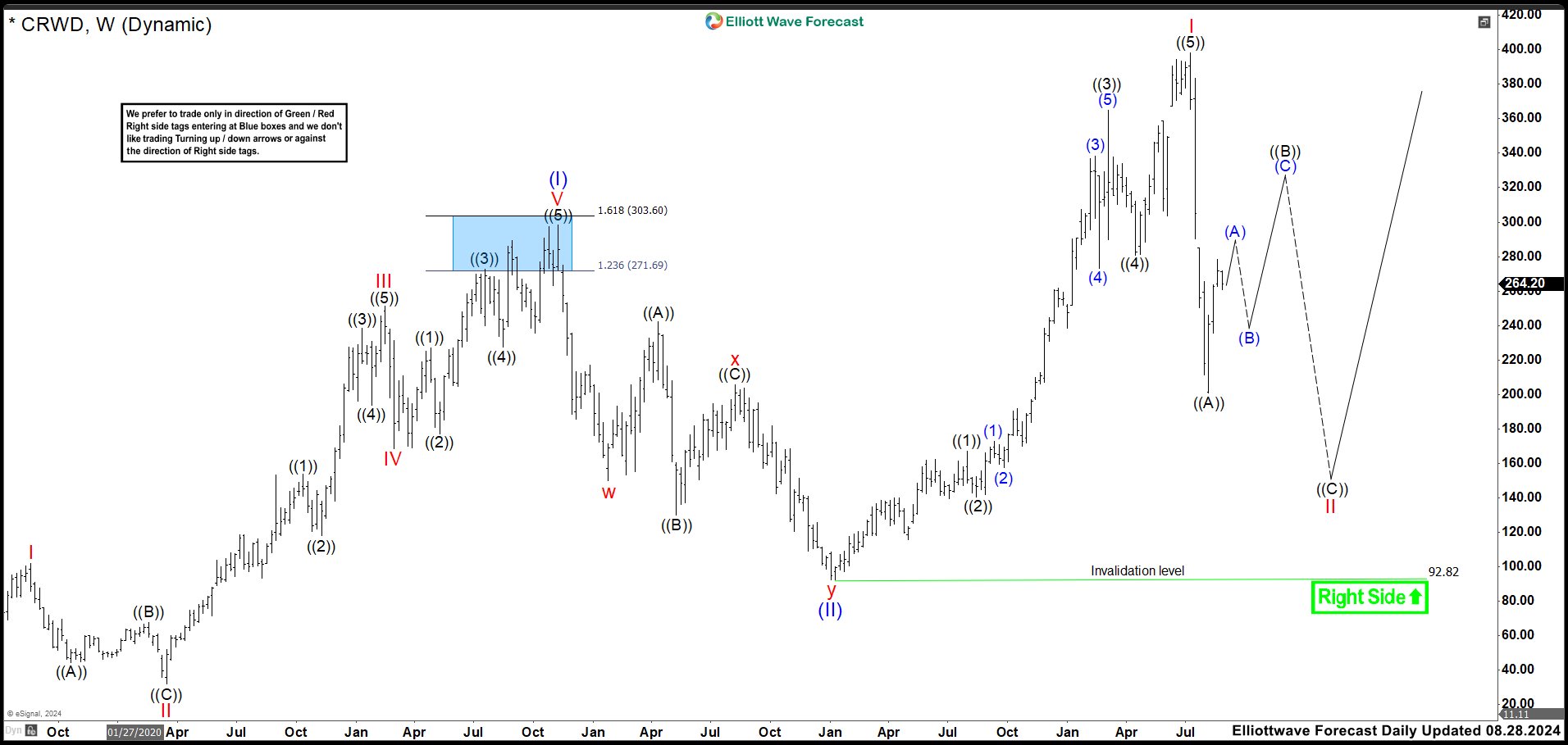

CrowdStrike (CRWD) Is Not Ready to Resume that Rally. Bull Trap Ahead.

Read MoreCrowdStrike Holdings, Inc. (CRWD) is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. CrowdStrike (CRWD) July 2021 Daily Chart The chart above shows the daily view that we forecast 3 years ago. We were expecting to end an very important market cycle in the blue box area between 303.60 […]

-

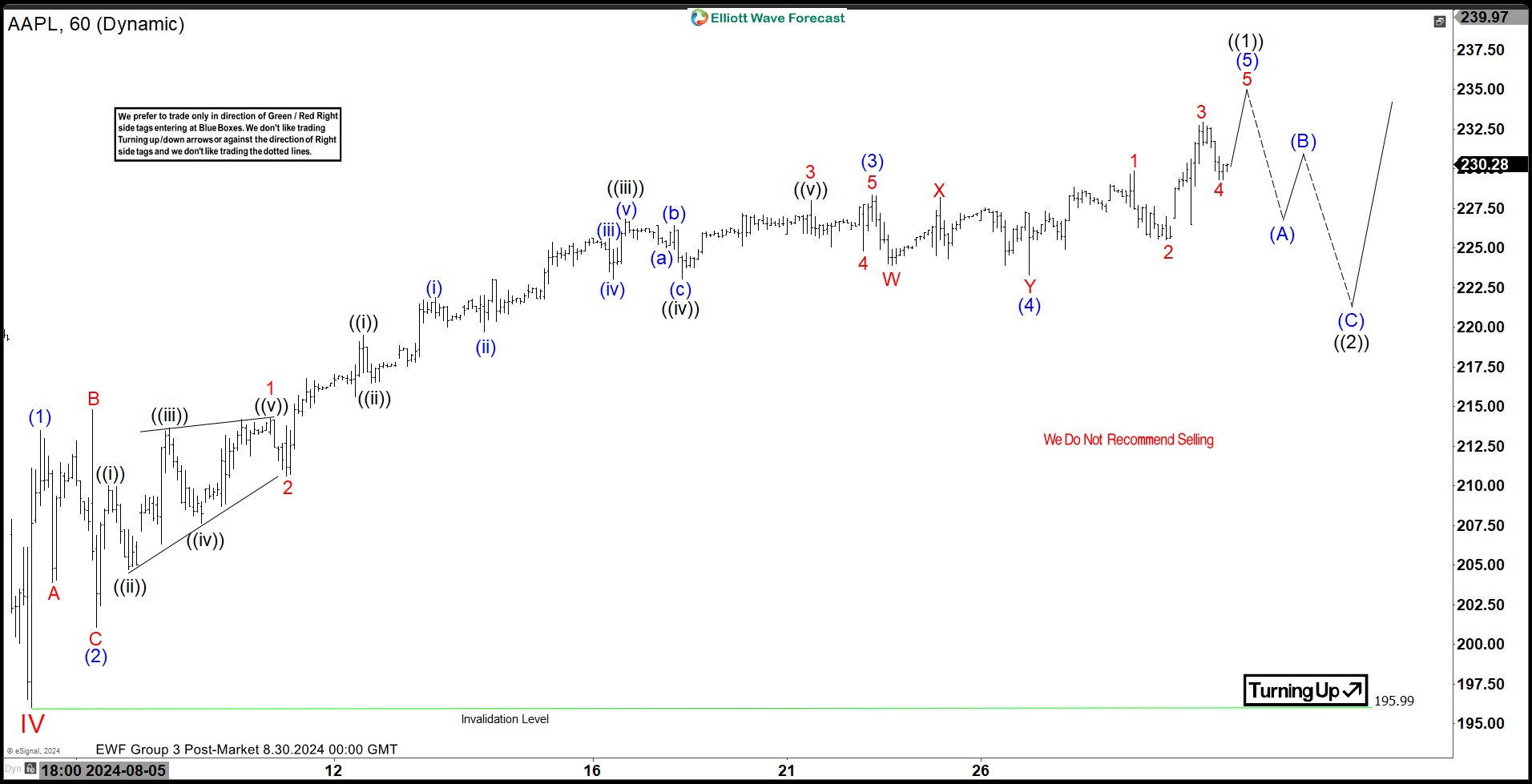

Elliott Wave Analysis on Apple (AAPL) 5 Waves Rally Favors Bullish Side

Read MoreApple (AAPL) is ending cycle from 8.5.2024 low and soon pullback to correct this cycle. This article and video look at the Elliott Wave path of the stock.

-

Elliott Wave Intraday on NVDA Looking for Pullback

Read MoreNvidia (NVDA) is looking to correct that cycle before it resumes higher. This article and video look at the Elliott Wave path.

-

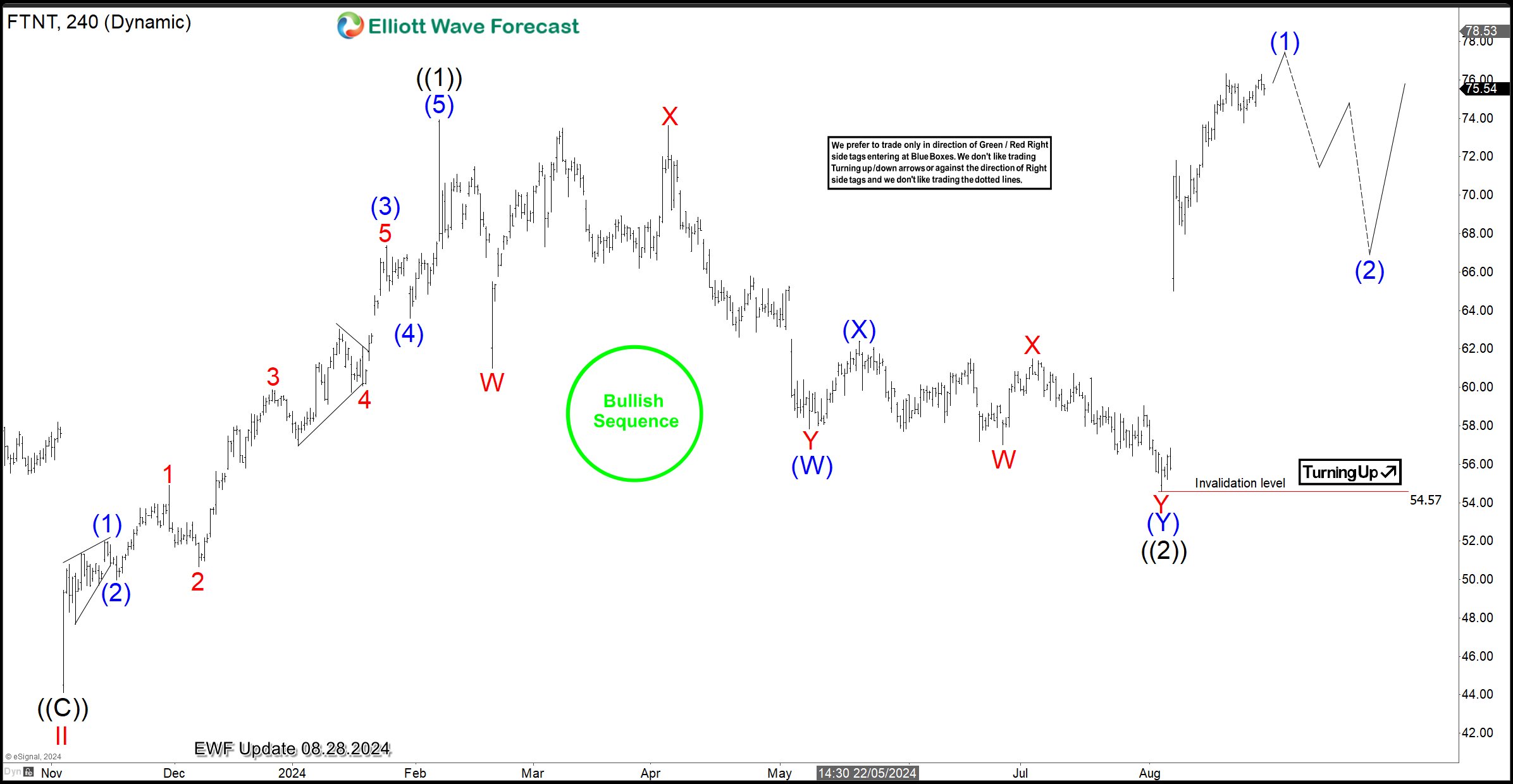

Will FTNT bullish sequence attract buyers from pullbacks?

Read MoreSince its stock became available for trading, FTNT has continued to make profits for its investors. Similarly, speculators have been able to find positions from pullbacks as the stock has maintained a bullish sequence since 2009. This blog post will reveal when traders can jump into another trade from the dip. This is from the […]

-

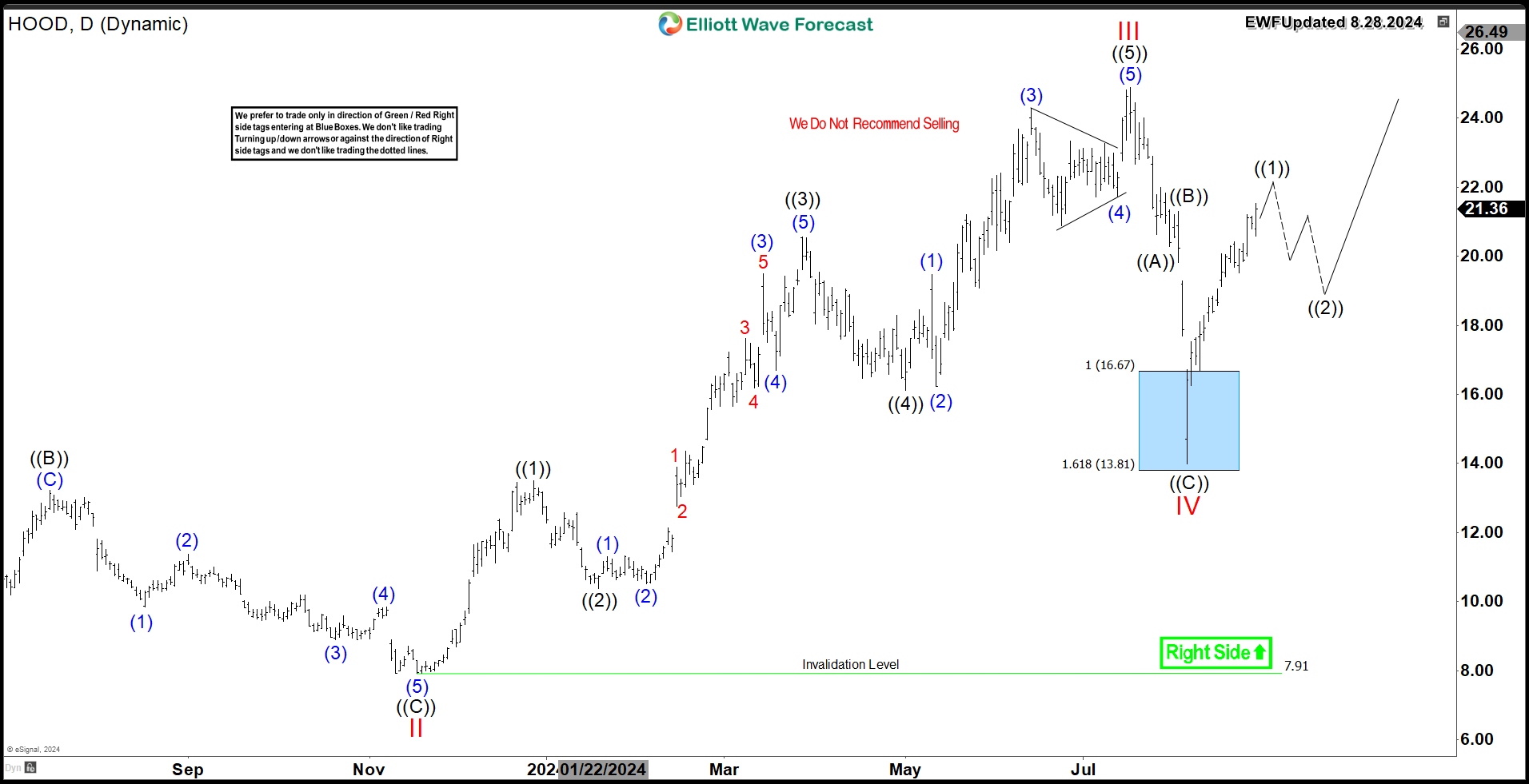

Robinhood (NASDAQ: HOOD) Rallied From Blue Box Area

Read MoreRobinhood Markets Inc. (HOOD : NASDAQ) is a California-based financial technology (fintech) company that operates an online discount brokerage with commission-free trading. In this article, we will analyze the technical structure based on the Elliott Wave Theory and highlight its potential growth. HOOD main cycle started in June 2022 establishing an impulsive structure to the upside. […]