The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

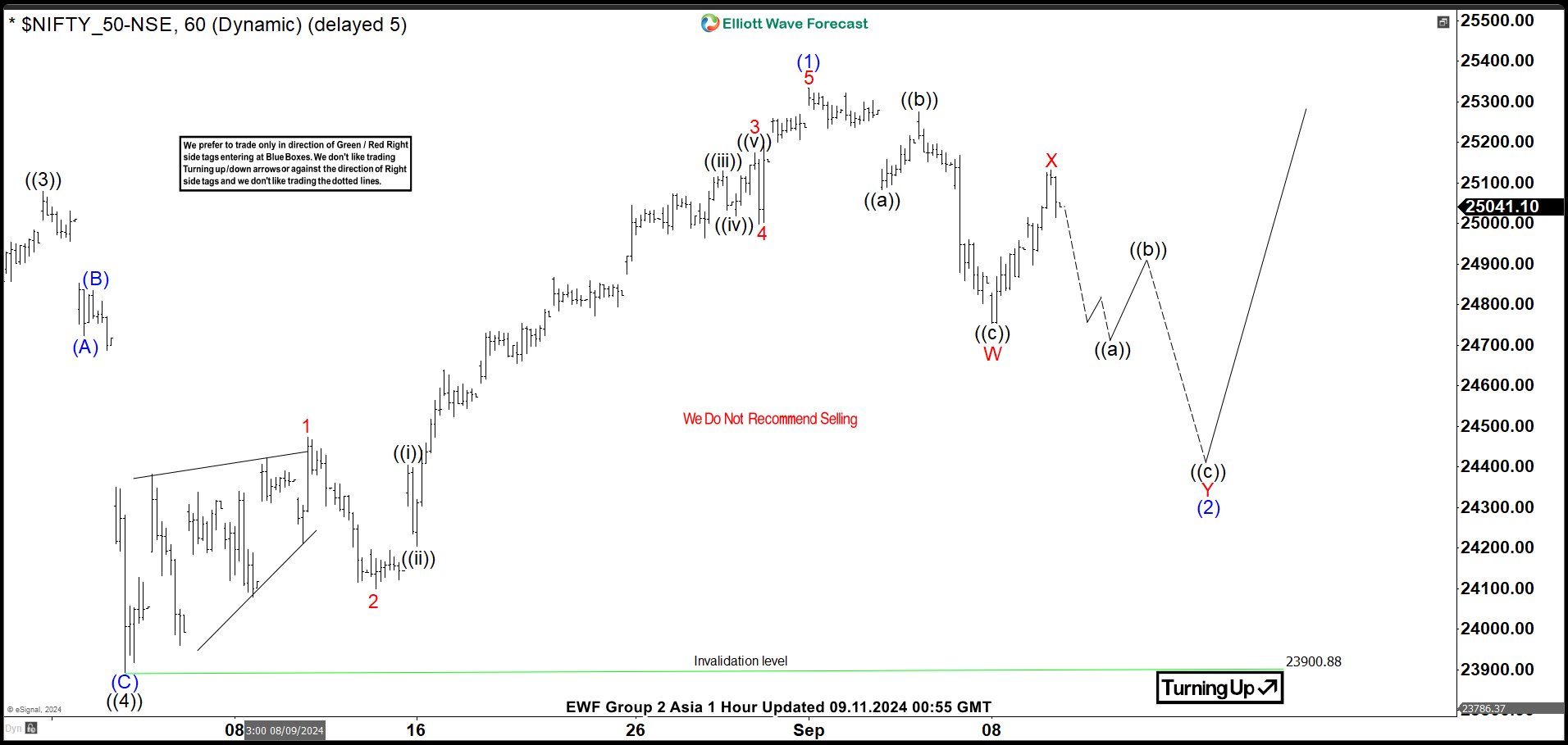

Elliott Wave View on Nifty Remains Bullish Against August Low

Read MoreNifty is in the process of correcting cycle from 8.5.2024 low in 7 swing before it resumes higher. This article and video look at the Elliott Wave path.

-

Palantir (PLTR) Should Keep the Rally to Build a Wave ((3))

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. PALANTIR (PLTR) Weekly Chart May 2024 Palantir ended a cycle at $45.00 in January 2021. Then […]

-

Will Costco Wholesale (COST) Continue Bullish Rally?

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States & globally together with its subsidiaries. It offers branded & private-label products in the range of merchandise categories. It also operates e-commerce websites in the US, Canada, UK & many other countries. It is based in Issaquah, Washington, comes under […]

-

Chevron (CVX) Looking to do A Double Correction

Read MoreChevron Corporation (CVX) is a global leader in the energy sector. It engages in the exploration, production, and refining of crude oil and natural gas. They operate worldwide, with significant activities in North America, South America, Europe, Africa, the Middle East, and Asia-Pacific. Chevron also manufactures and markets petrochemicals through its affiliate, Chevron Phillips Chemical […]

-

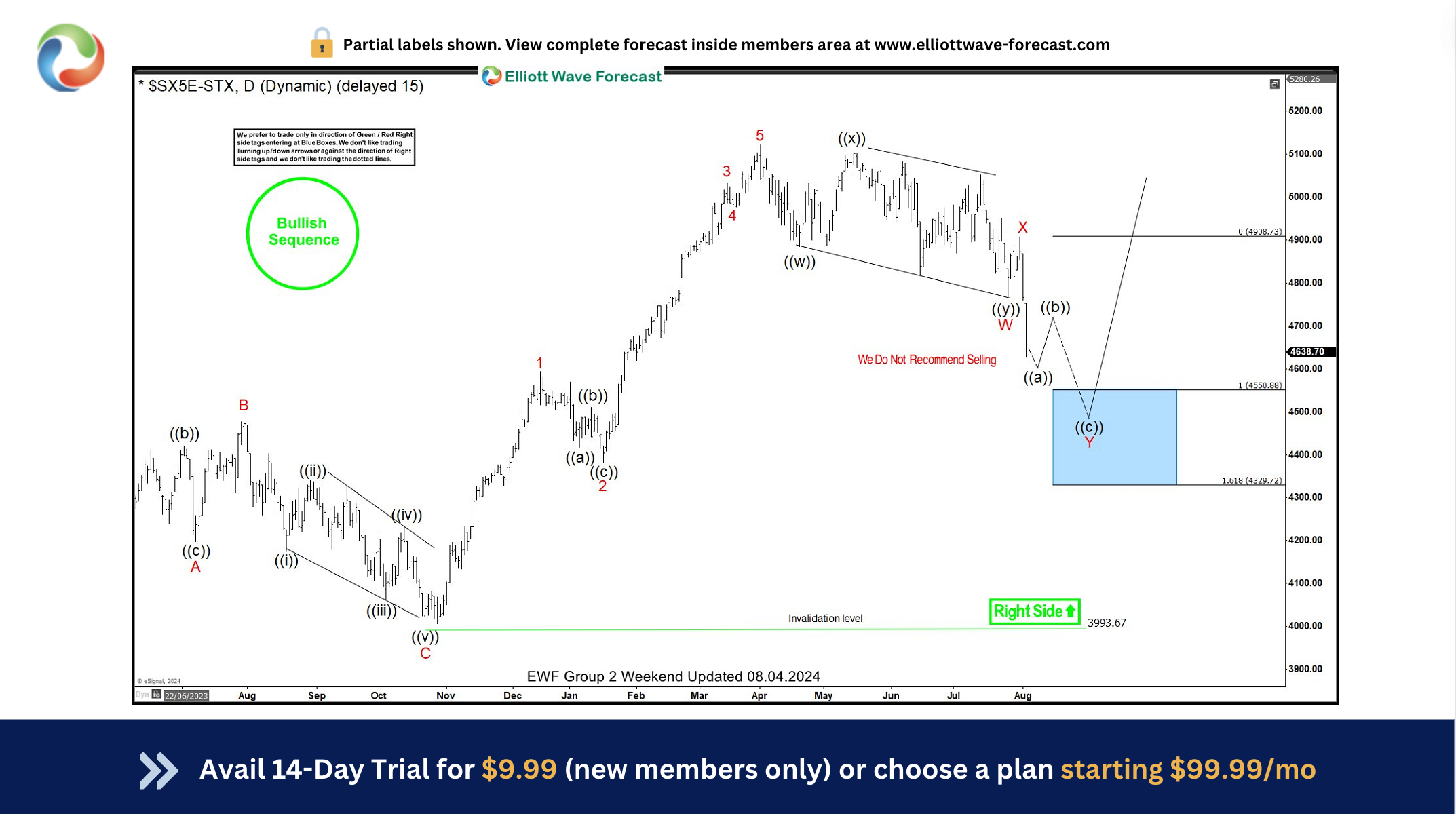

EUROSTOXX (SX5E) Perfect Reaction Higher From Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the Elliott Wave Charts of the Eurostoxx (SX5E) index. We presented to members at the elliottwave-forecast. In which, the rally from the 23 October 2023 low ended as an impulse structure. But showed a higher high sequence with a bullish sequence stamp favored more upside extension […]

-

Coinbase Global Inc. ( $COIN) Elliott Wave Structure Favors More Downside.

Read MoreHello Traders! In this technical blog we are going to take a look at the Elliott Wave path in Coinbase Global Inc. ($COIN) and explain why the stock should see more downside in a 7 swings WXY correction towards a Blue Box area. Coinbase Global, Inc., branded Coinbase, is an American publicly traded company that operates […]