The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

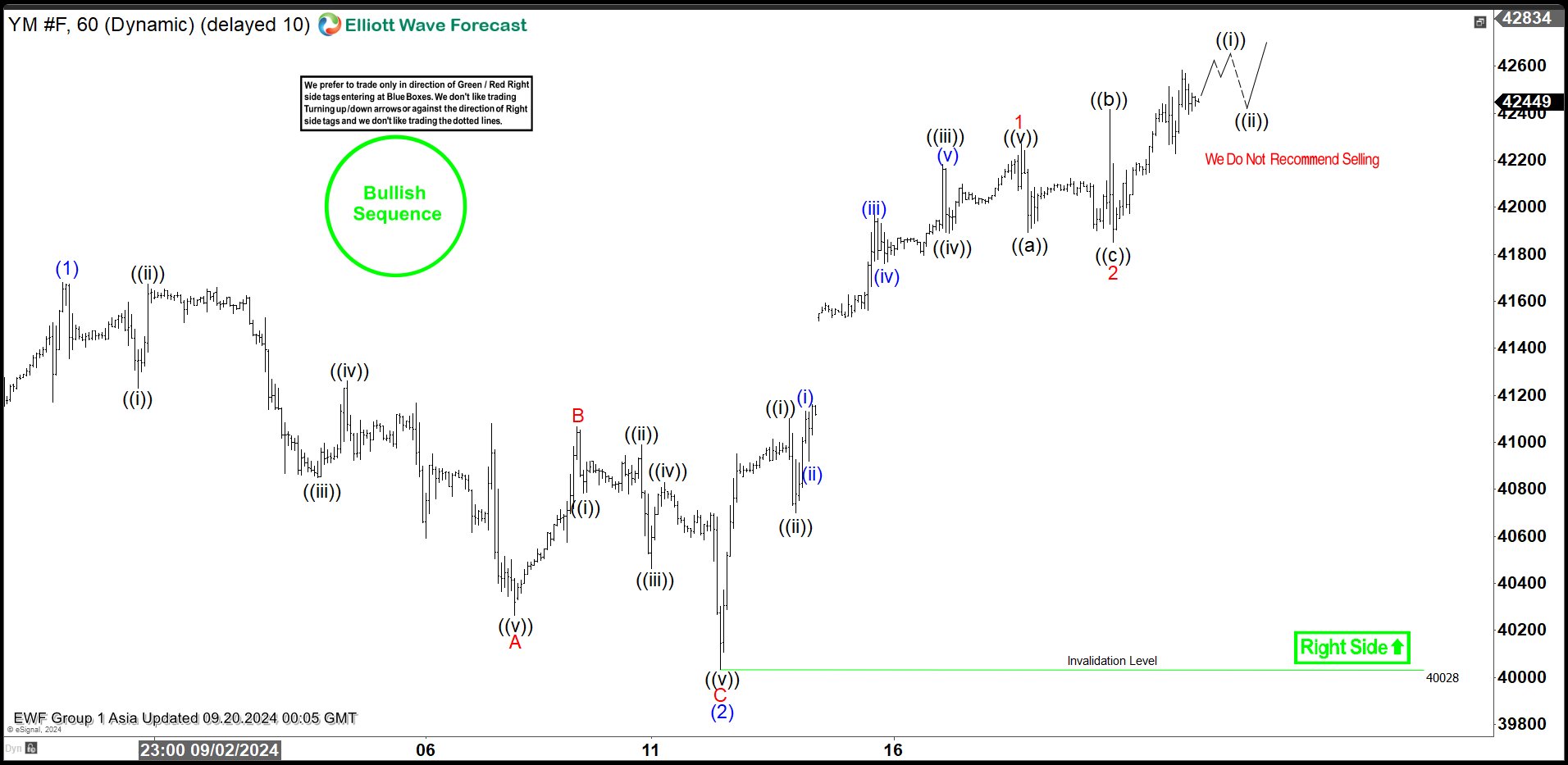

Intraday Elliott Wave View on Dow Futures (YM) Favors the Bullish Side

Read MoreDow Futures YM has resumed higher and continues to be bullish against Sept low. This article and video look at the Elliott Wave path.

-

Coca-Cola Co (NYSE: KO) Weekly Bullish Sequence

Read MoreCoca-Cola Co (NYSE: KO) started a new bullish cycle on October 2023. As discussed in our previous article, the stock rallied from our blue box area after ending a corrective double three structure. The impulsive rally suggested the start of wave III to the upside and this year KO managed to break above 2022 into […]

-

Elliott Wave View on S&P 500 ETF (SPY) New All-Time High Suggests Right Side Remains Higher

Read MoreS&P 500 ETF (SPY) has extended to new all-time high suggesting the right side remains higher. This article and video look at the Elliott Wave path.

-

NexGen Energy (NXE) May Have Ended Correction

Read MoreNexGen Energy Ltd. (NXE) is a uranium exploration and development company based in Vancouver, British Columbia. They focus on high-impact projects in the Athabasca Basin in Saskatchewan, Canada. This area is known for having the highest-grade uranium deposits in the world. Below is the latest long term update of the stock. $NXE Weekly Elliott Wave Chart […]

-

Elliott Wave View on Nasdaq (NQ) Calling the Next Bullish Leg Has Started

Read MoreNasdaq (NQ) has started the next leg higher after ending pullback. This article and video look at the Elliott Wave path for the Index.

-

Invesco Commodity Index Fund ( $DBC) Elliott Wave Structure Favors More Downside.

Read MoreHello Traders! In this technical blog we are going to take a look at the Elliott Wave path in Invesco Commodity Index Fund ($DBC) and explain why the ETF should see more downside in a ZigZag ABC correction towards a Blue Box area. The fund pursues its investment objective by investing in a portfolio of […]