The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Will NextEra Energy (NEE) Continue Bullish Trend or Correcting Lower?

Read MoreNextEra Energy, Inc., (NEE) is an American Energy company through its subsidiaries generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity, through wind, solar, nuclear, natural gas & other clean energy. It is based in June Beach, Florida, comes under Utility sector & trades as […]

-

Elliott Wave View on GDX Favors Pullback Before Rally

Read MoreShort Term Elliott Wave View in GDX suggests the zigzag correction should find support towards extreme areas before resume higher to finish the impulse sequence from 5-August, 2024 low. It is showing higher high sequence in daily from September-2022 low and expect short term rally to continue against August-2024 low. Since 5-August, 2024 low, it […]

-

Riding the Wave: ( $XLU)’s Impressive Rally and What’s Coming Next Part 2

Read MoreHello everyone! In today’s article, we will follow up on the past performance of the SPDR Utilities Select Sector ETF ($XLU) forecast. We will also review the latest weekly count. First, let’s take a look at how we analyzed it back in October 2023. $XLU Weekly Elliott Wave View – October 2023: In October 2023, we […]

-

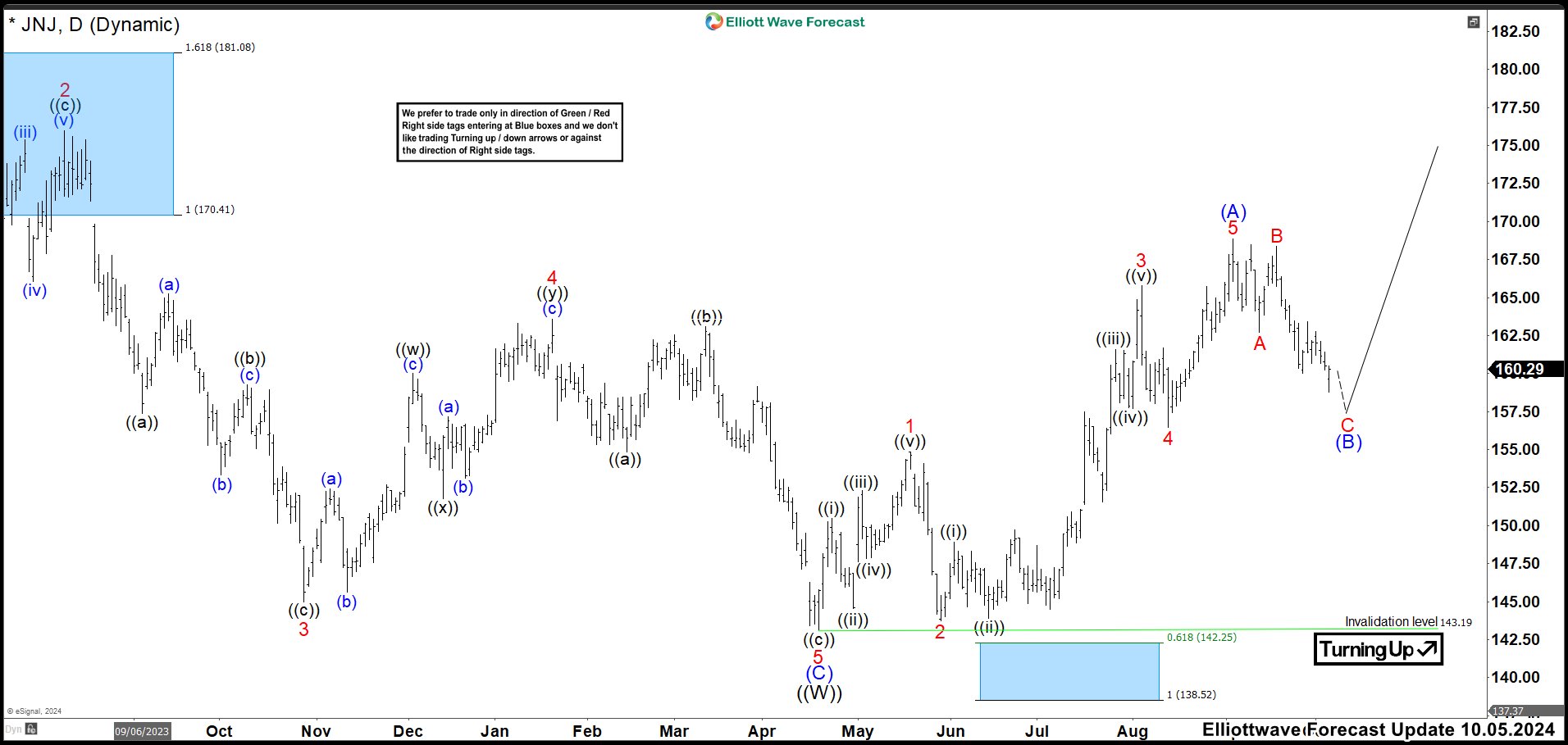

JNJ Should Continue Higher at Least to Complete a Pullback

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

International Business Machine Corp (IBM): Showing a Bullish Sequence And Looking for A $400.00 Target

Read MoreInternational Business Machine (IBM) shows a bullish sequence favoring more upside. This article and video look at the Elliott Wave path of the stock.

-

Caterpillar Inc ( CAT): Trading Higher Within A Wave (III), Target Above $600.00

Read MoreCaterpillar (CAT) rally in a nesting impulsive structure. This article and video look at the Elliott Wave path of the stock.