The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Better Restaurants with Toast, Inc (TOST) Support

Read MoreToast, Inc. (TOST) operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale. In addition, the company offers payroll and team management. Further, it offers reporting and analytics, Toast shop, and Toast partner connect and application programming interfaces. The […]

-

Best Stocks for Swing Trading in 2025

Read MoreWhat is Swing Trading? Swing trading is a trading trick that involves regular buying to selling, at lows and highs for a relatively shorter period, this period varies from a few days to a few weeks. It should not be confused with day trading, where trades are closed on the same day they are bought. […]

-

Elliott Wave View: S&P 500 Futures ($ES) Wave 5 In Progress

Read MoreS&P 500 Futures (ES) Has Resumed Higher in wave 5. This article and video look at the Elliott Wave path of the Index.

-

Best Monthly Dividend Stocks with High Yield

Read MoreHigh-yield Dividend Stocks are usually those that consistently increase their dividend payout. These stocks provide investors with a reliable and steadily growing income over time. Additionally, they have demonstrated resilience during economic challenges. Another noteworthy point here is that these dividend-paying stocks have exhibited higher returns with considerably lower volatility. Therefore, many financial experts are […]

-

Berkshire Hathaway BRK.B Expected To Resume Daily Bullish Trend

Read MoreBerkshire Hathaway Inc. (NYSE: BRK.B) is trading to the upside within a strong Bullish trend since October 2022. In this article, we dive into the latest developments and signals that suggest a promising bullish trajectory based on Elliott Wave Theory. BRK.B is looking to establish an impulsive 5 waves advance before ending 2022 cycle. Wave I at […]

-

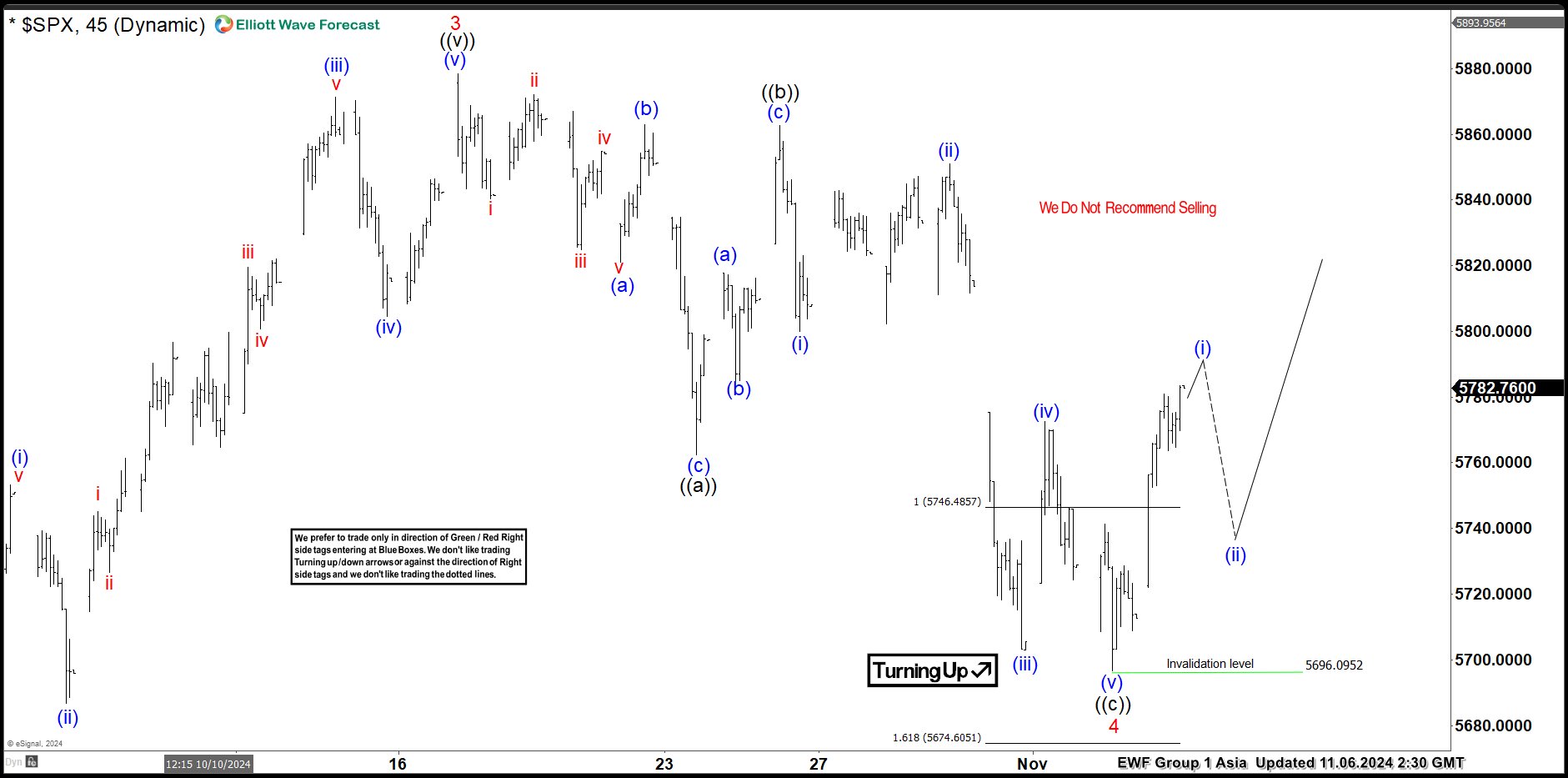

Elliott Wave View Calling for S&P 500 (SPX) to Extend Higher

Read MoreS&P 500 (SPX) Ended A Flat Correction and Resumed HIgher. This article and video look at the Elliott Wave path of the Index.