The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPX Perfectly Reacting Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of SPX charts. The index perfectly reacting higher from the blue box area.

-

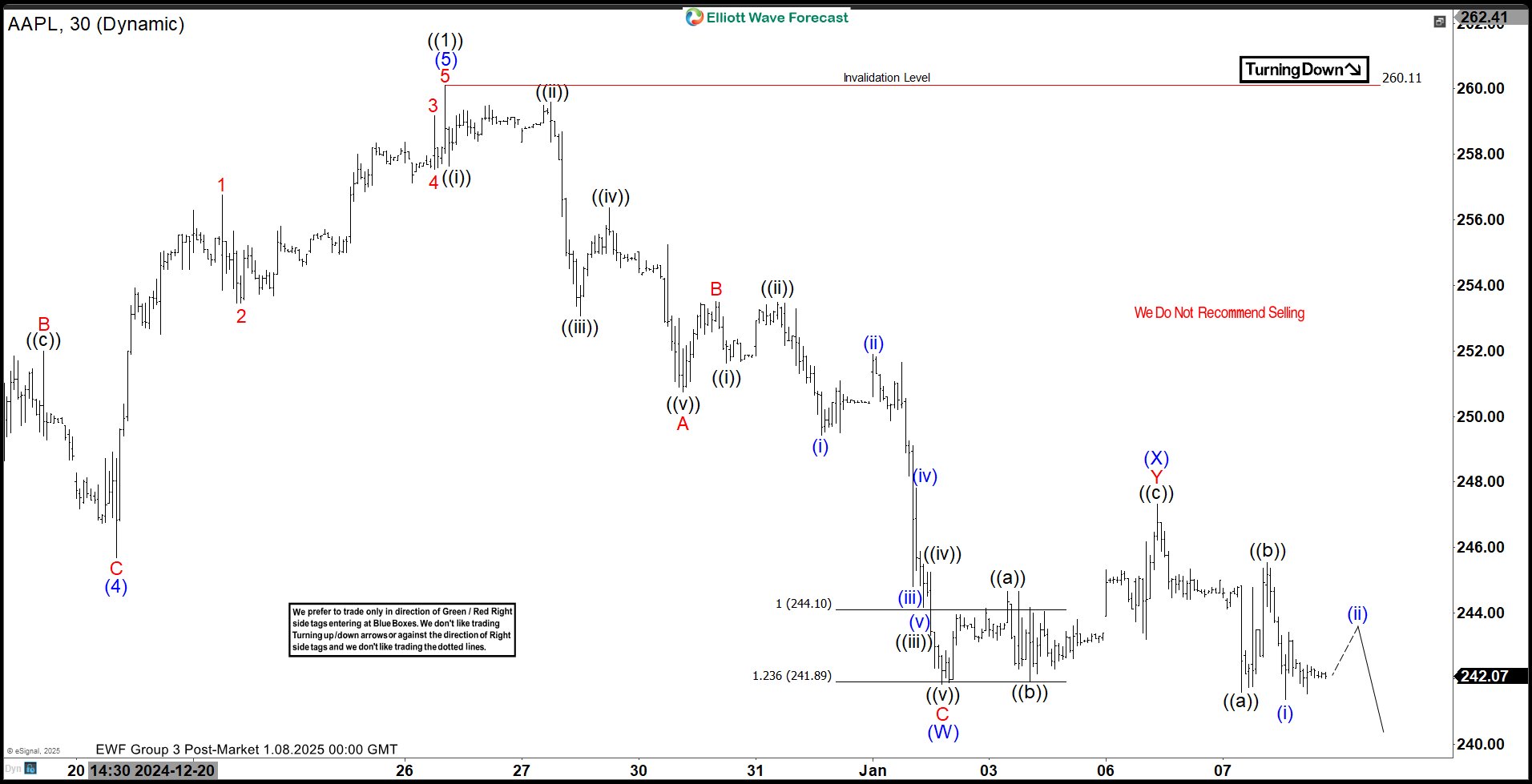

Apple Stock ( AAPL) Incomplete Sequences Forecasting the Path Ahead

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of Apple Stock ( AAPL) published in members area of the website. As probably most of the traders know, The Stock is in overall bullish trend. Recently we forecasted the pull back which has corrected the cycle from the 195.88 […]

-

SMH Semiconductor ETF Rally Continuation Should Be Around the Corner

Read MoreThe VanEck Semiconductor ETF (SMH) is an exchange-traded fund that tracks a market-cap weighted index composed of 25 of the largest U.S.-listed semiconductor companies. The top holdings of SMH include companies like NVIDIA, Taiwan Semiconductor Manufacturing, Broadcom Inc., Texas Instruments, QUALCOMM, ASML Holding N.V., Applied Materials, Inc., Lam Research Corporation, Micron Technology, Inc., and Advanced Micro Devices, Inc. SMH 4 Hour Chart September 11th Last September 11th, we talked […]

-

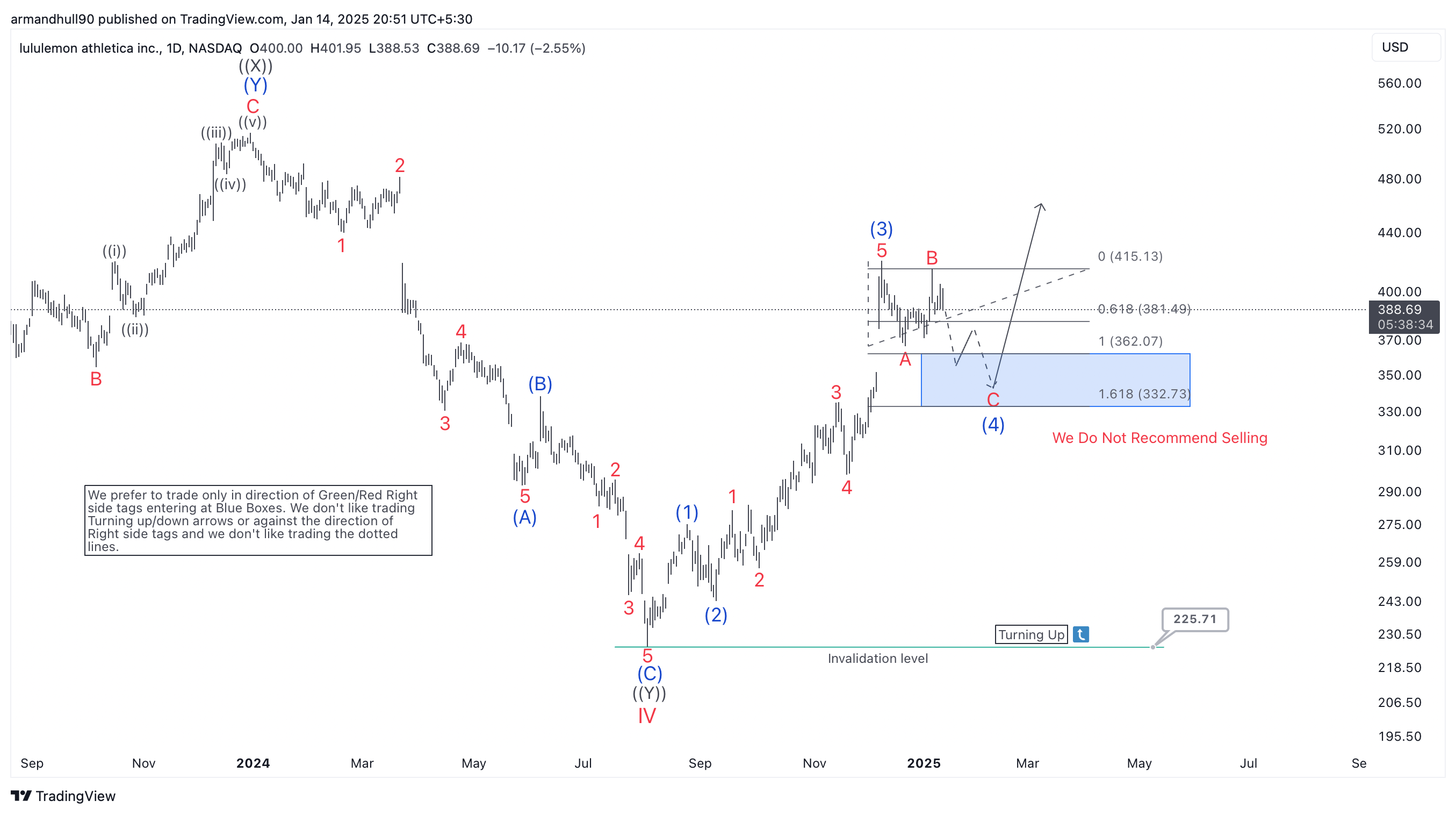

The Elliott Wave Analysis For Lululemon Athletica (NASDAQ: LULU) On Different Timeframes

Read MoreThe Elliott Wave analysis for Lululemon Athletica (NASDAQ: LULU) provides a detailed examination of its ongoing corrective structure within a larger five-wave impulsive sequence. Daily Elliott Wave Counts: On the daily chart, the stock remains in wave (4), a corrective phase within a larger impulsive trend. Wave (4) appears to follow an ABC zigzag pattern. […]

-

GDX Found Sellers As Expected From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of GDX charts. In which, the GDX found sellers as expected from the blue box area.

-

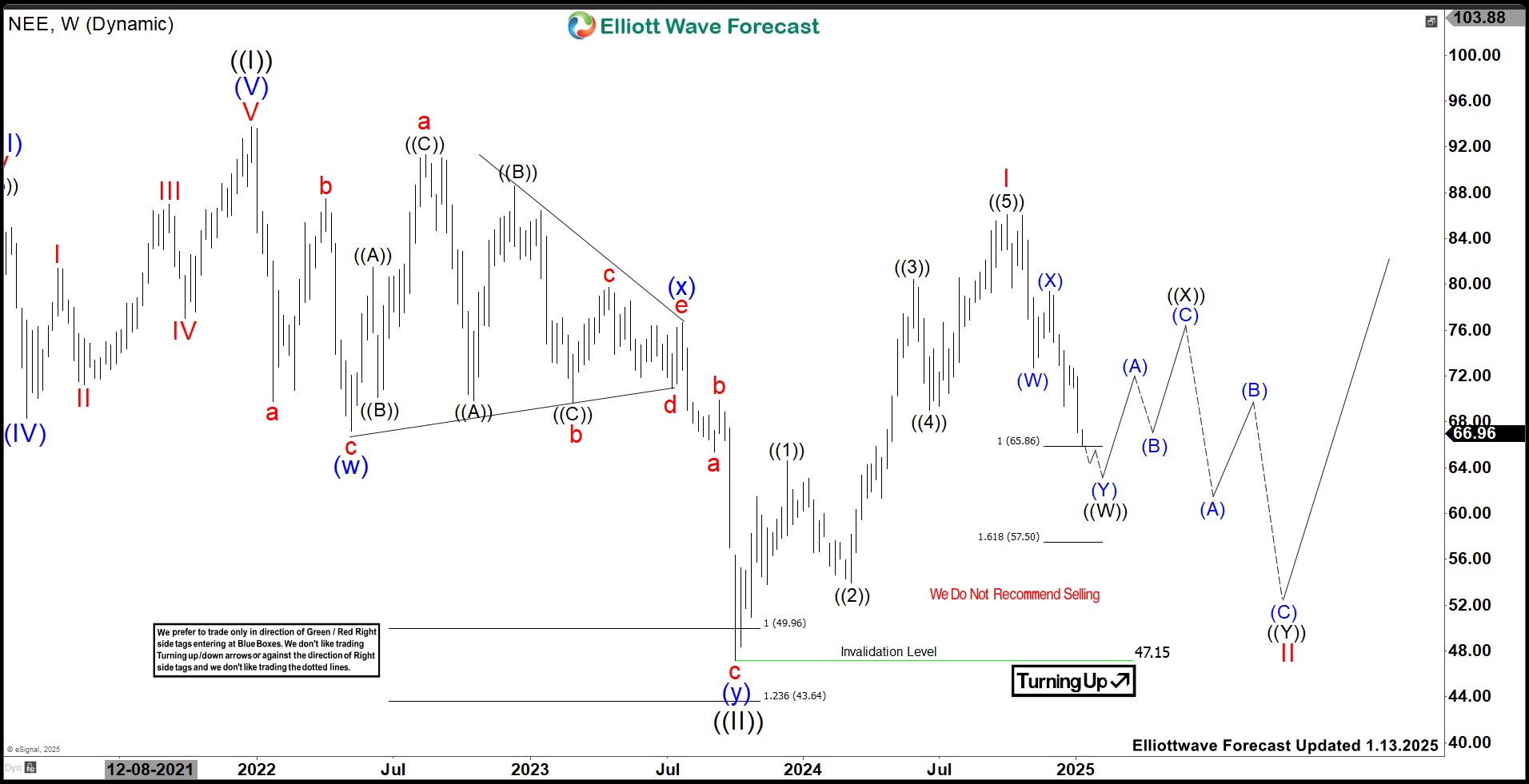

NextEra Energy (NEE) Should Expect Bounce From Inflection Area

Read MoreNextEra Energy, Inc., (NEE) through its subsidiaries generates, transmits, distributes & sells electric power to retail & wholesale customers in North America. The company generates electricity, through wind, solar, nuclear, natural gas & other clean energy. It comes under Utility sector & trades as “NEE” ticker at NYSE. As shown in the last article, NEE […]