The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: SPY Looking to Resume Higher

Read MoreSPDR S&P 500 ETF (SPY) is looking to resume higher in impulsive structure. This article and video look at the Elliott Wave path.

-

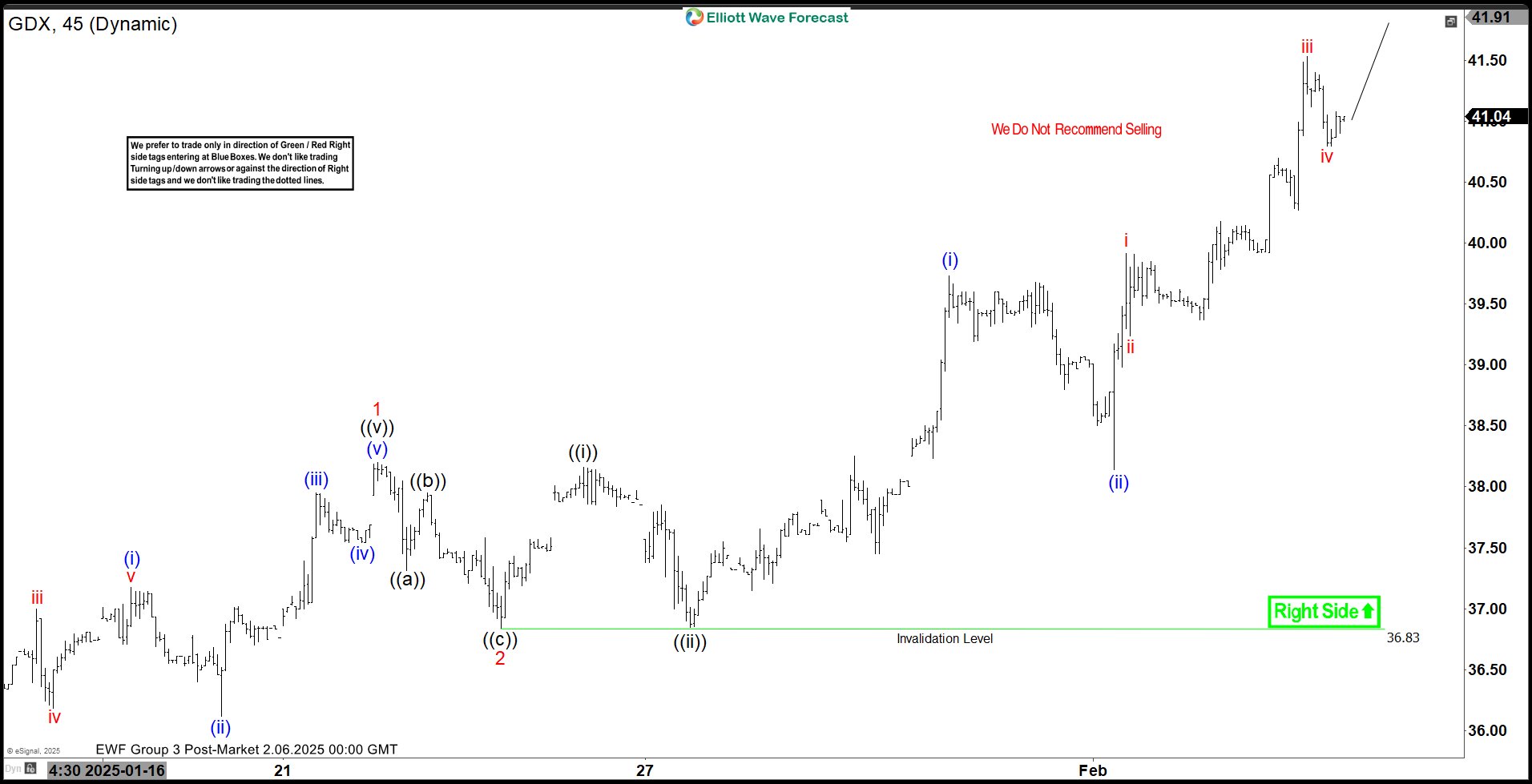

Elliott Wave View: Gold Miners ETF (GDX) Impulse Rally in Progress

Read MoreGold Miners ETF (GDX) looks for further upside in a nesting impulse and dips to find support. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Bitcoin (BTCUSD) Short Term Pullback to Find Support

Read MoreBitcoin (BTCUSD) has started the next leg higher. This article and video look at the Elliott Wave path of the crypto-currency

-

NANO Nuclear Energy (NNE) Favors Rally Towards $52

Read MoreNANO Nuclear Energy Inc., (NNE) operates as microreactor technology company, developing solid-core battery reactor & low-pressure coolant reactor. It comes under Industrials Sector & trades as “NNE” ticker at Nasdaq. NNE is trading higher since inception this year from May-2024. It is in impulse sequence from $3.25 low & continue towards $52.03 or higher levels, […]

-

Elliott Wave View: Eurostoxx (STOXX) Pullback Should Find Support

Read MoreEurostoxx (STOXX) breaks to new all-time high and should continue to extend higher. This article and video look at the Elliott Wave path.

-

Peloton Interactive Inc. $PTON: 5 Waves Ended – Corrective Pullback Underway

Read MoreHello Traders! Today, we’ll dive into the 4H Elliott Wave structure of Peloton Interactive Inc. ($PTON) and explain why the corrective pullback could present an excellent buying opportunity. Let’s analyze the price action and forecast the next steps. About Peloton Interactive Inc. Peloton Interactive, Inc. is an American exercise equipment and media company based in New York […]