The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Advanced Micro Devices Inc. $AMD Offers A Buying Opportunity and Can Reach $141

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Advanced Micro Devices Inc. ($AMD) through the lens of Elliott Wave Theory. We’ll review how the decline from the March 08, 2024, high unfolded as a 7-swing correction and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock. 7 Swing […]

-

Netflix Perfectly Reacting Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Netflix charts. In which, the stock is showing perfectly reacting higher from blue box area.

-

Elliott Wave View: Bank of America (BAC) Short Term Favors Upside

Read MoreBank of America (BAC) is looking to resume higher after ending wave 4 pullback. This article and video look at the Elliott Wave path of the stock

-

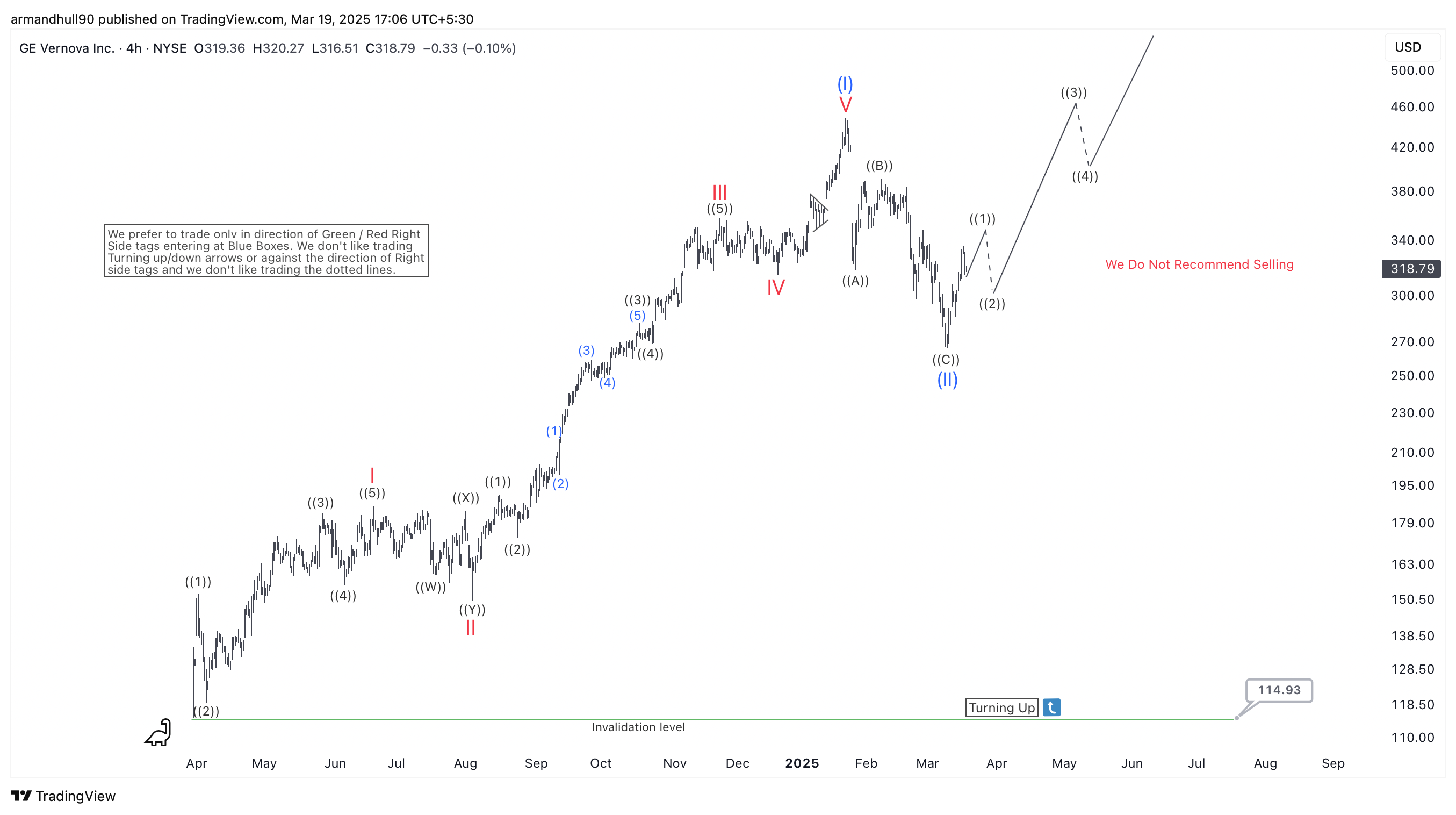

GE Vernova Inc. (GEV) Elliott Wave Forecast: Bullish Trend Set to Continue

Read MoreGE Vernova Inc. (GEV) Elliott Wave Forecast: Bullish Trend Resumes GE Vernova Inc. (GEV) has been trending higher, and its Elliott Wave structure suggests the uptrend will continue. The recent pullback appears to be wave (II), setting the stage for a new bullish move. Elliott Wave Analysis The chart shows a clear five-wave impulse to […]

-

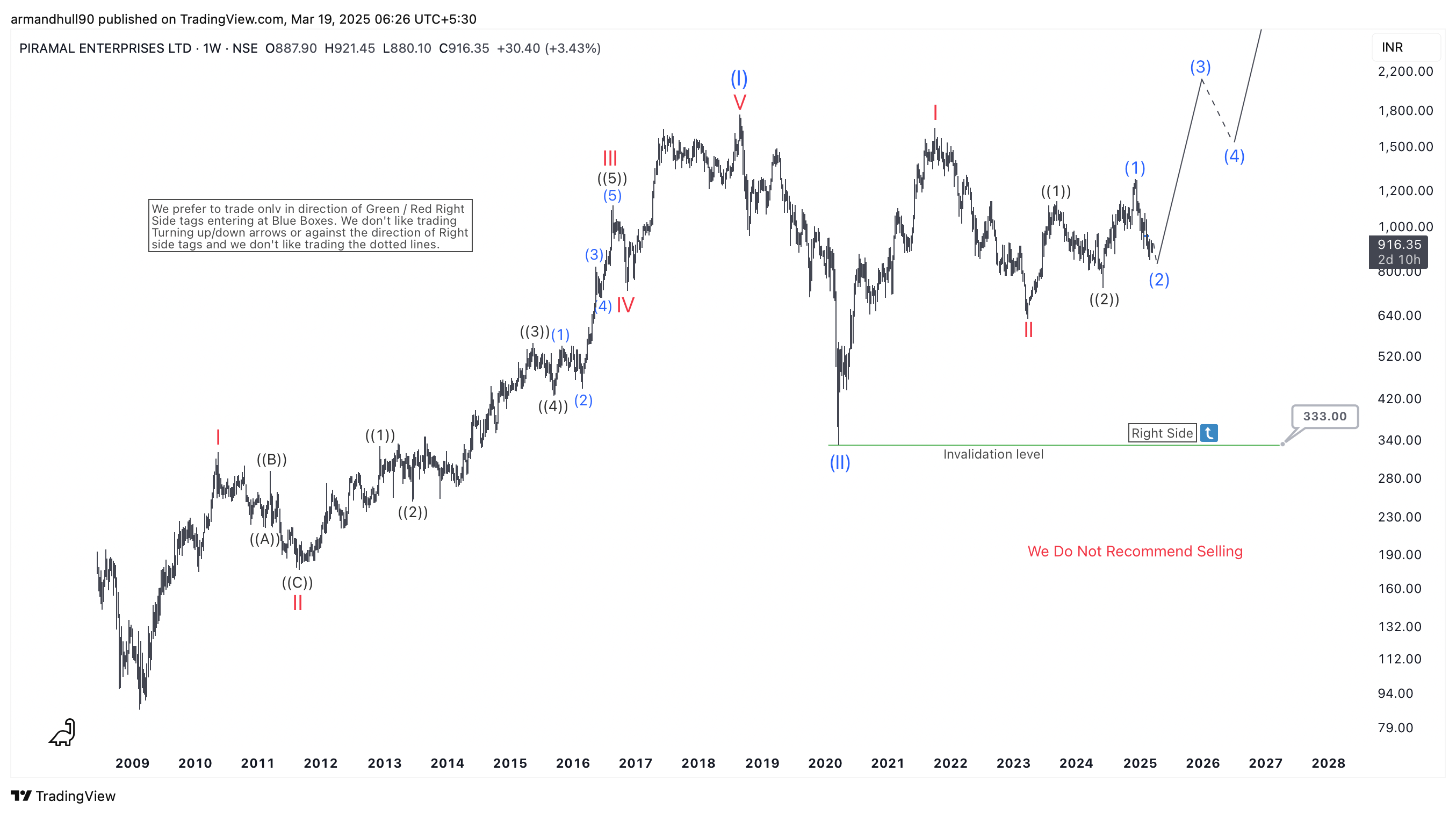

Piramal Enterprises Ltd (PEL) Elliott Wave Analysis: Bullish Cycle Underway

Read MoreElliott Wave Analysis Suggests a Strong Bullish Cycle as PEL Completes Wave II Correction Piramal Enterprises Ltd (PEL) has completed its Wave II correction. Now, the stock is in the early stages of a strong bullish cycle. The Elliott Wave count suggests that the stock has formed a significant bottom and is set to advance […]

-

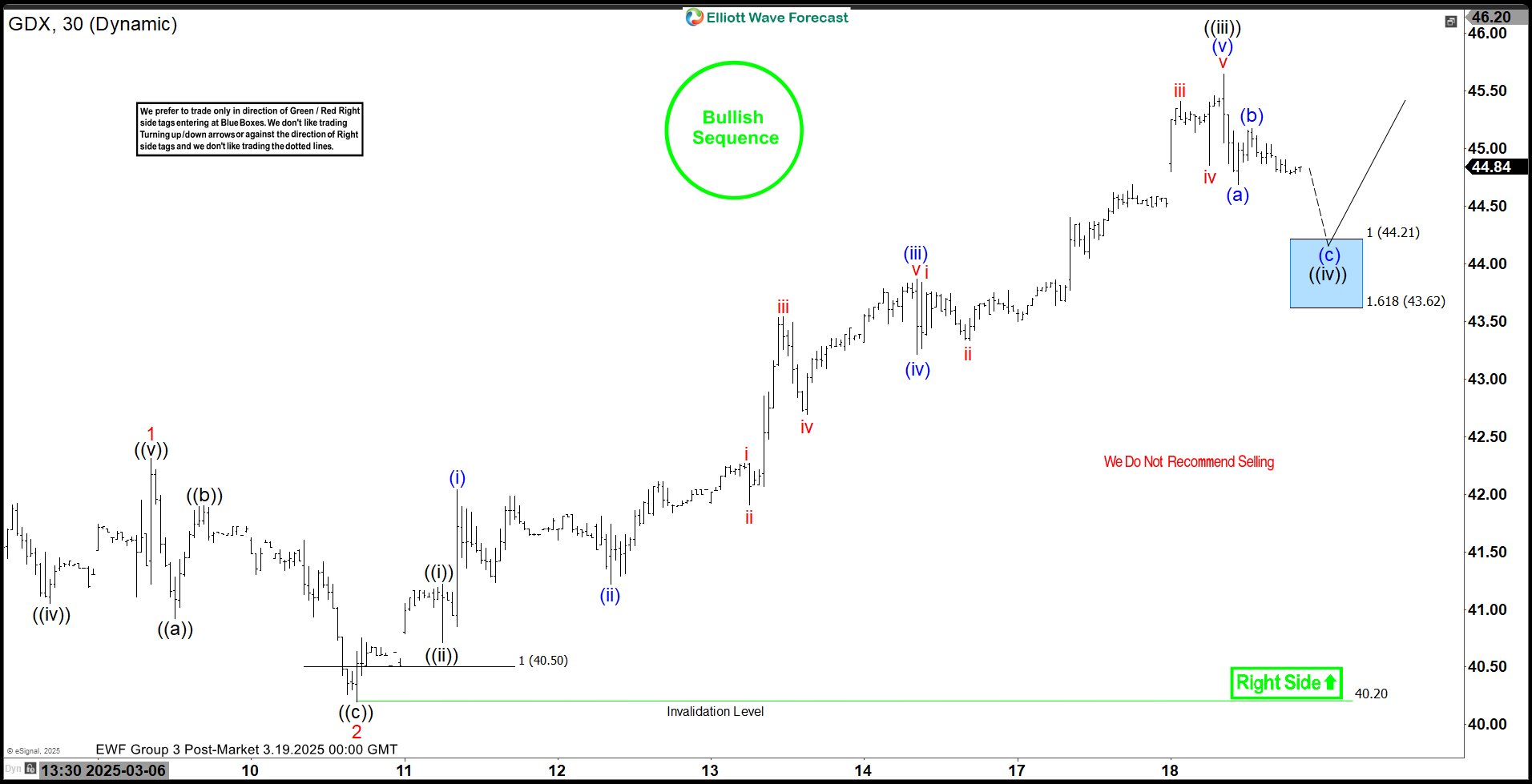

Elliott Wave View: Gold Miners ETF (GDX) Impulse Rally Should Extend

Read MoreGold Miners ETF (GDX) shows an incomplete bullish sequence favoring more upside. This article and video look at the Elliott Wave path.