The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

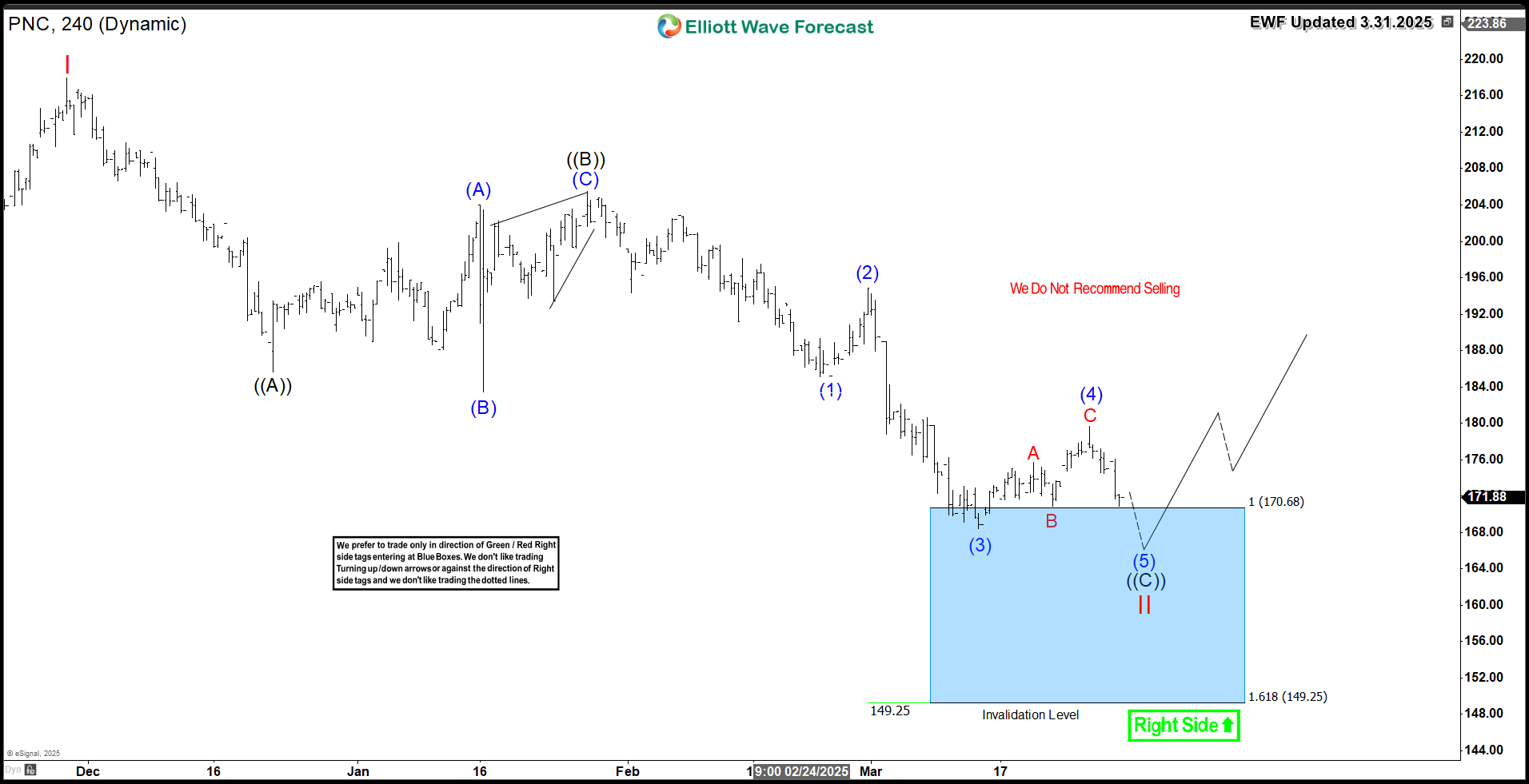

PNC Financial Services Aiming For Reaction To The Upside

Read MorePNC Financial Services (NYSE: PNC) is down more than 20% in the recent 4 months. Investors are looking for clues into the current decline to prepare a plan for the next move. We’ll use the Elliott Wave Theory to define the technical structure and understand the potential path. Since December 2024 peak, PNC is showing a clear 3 […]

-

Pop Mart (9992) Demonstrates Exceptional Bullish Drive

Read MorePop Mart (9992) shows very strong bullish momentum and the stock should continue to be supported. This article looks at the Elliott Wave path.

-

Elliott Wave Perspective: Dow Futures (YM) Poised to Continue Its Rally

Read MoreDow Futures (YM_F) completed correction & is beginning to trend upward. This article & accompanying video explore the Elliott Wave trajectory of the Index.

-

Sprott Physical Silver Trust (PSLV) Long Term Bullish Outlook

Read MoreSprott Physical Silver Trust (PSLV) rally from 2020 low takes the form of an impulse favoring upside. This article and video look at the Elliottwave path.

-

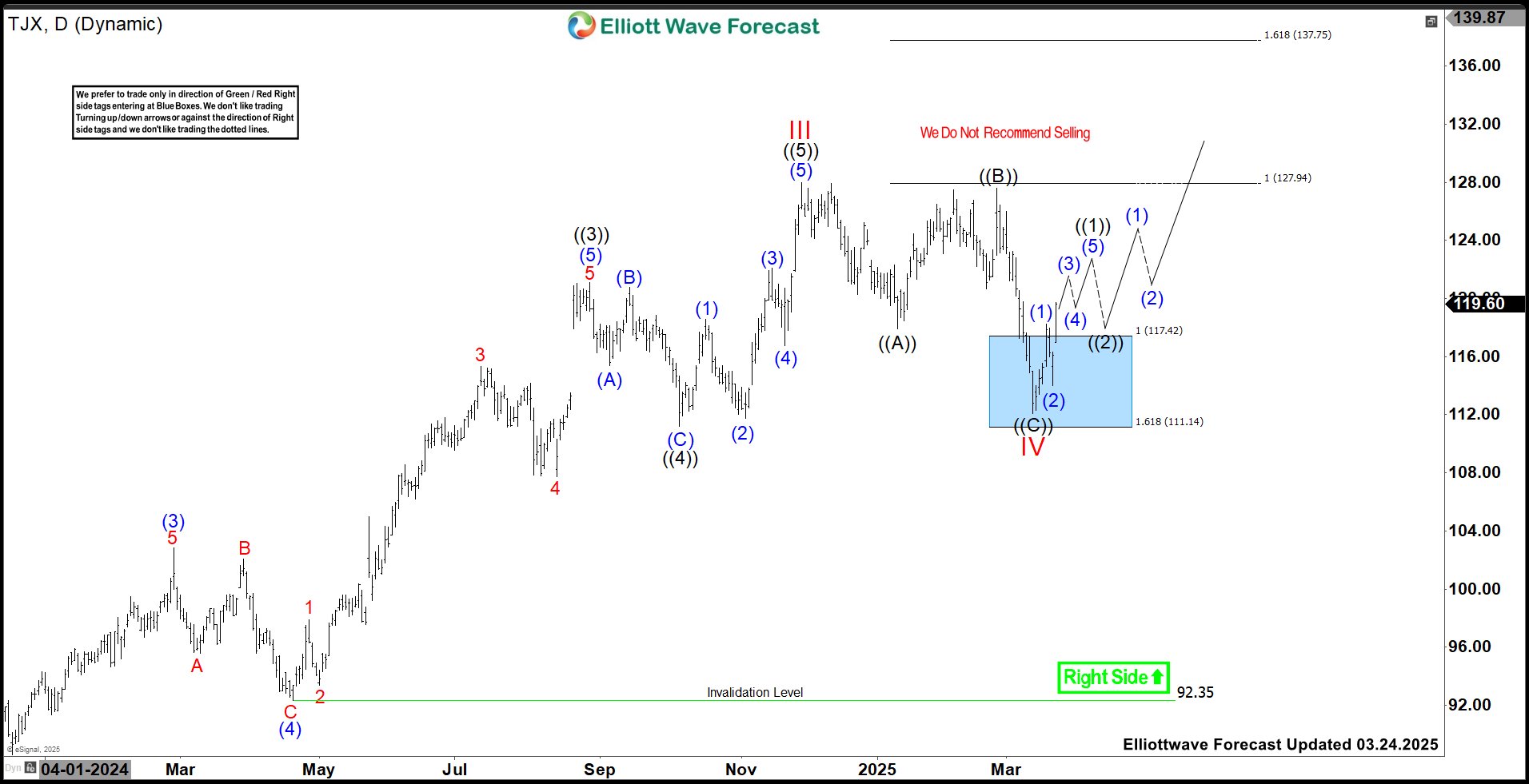

TJX Companies (TJX) Continue Rally Towards $137

Read MoreTJX Companies, Inc., (TJX) operates as an off-price apparel & home fashions retailer in Unites States, Canada, Europe & Australia. It operates through four segments: Marmaxx, HomeGoods, TJX Canada & TJX International. It comes under Consumer Cyclical sector & trades as “TJX” ticker at NYSE. TJX favors bullish weekly sequence & expect rally to extend […]

-

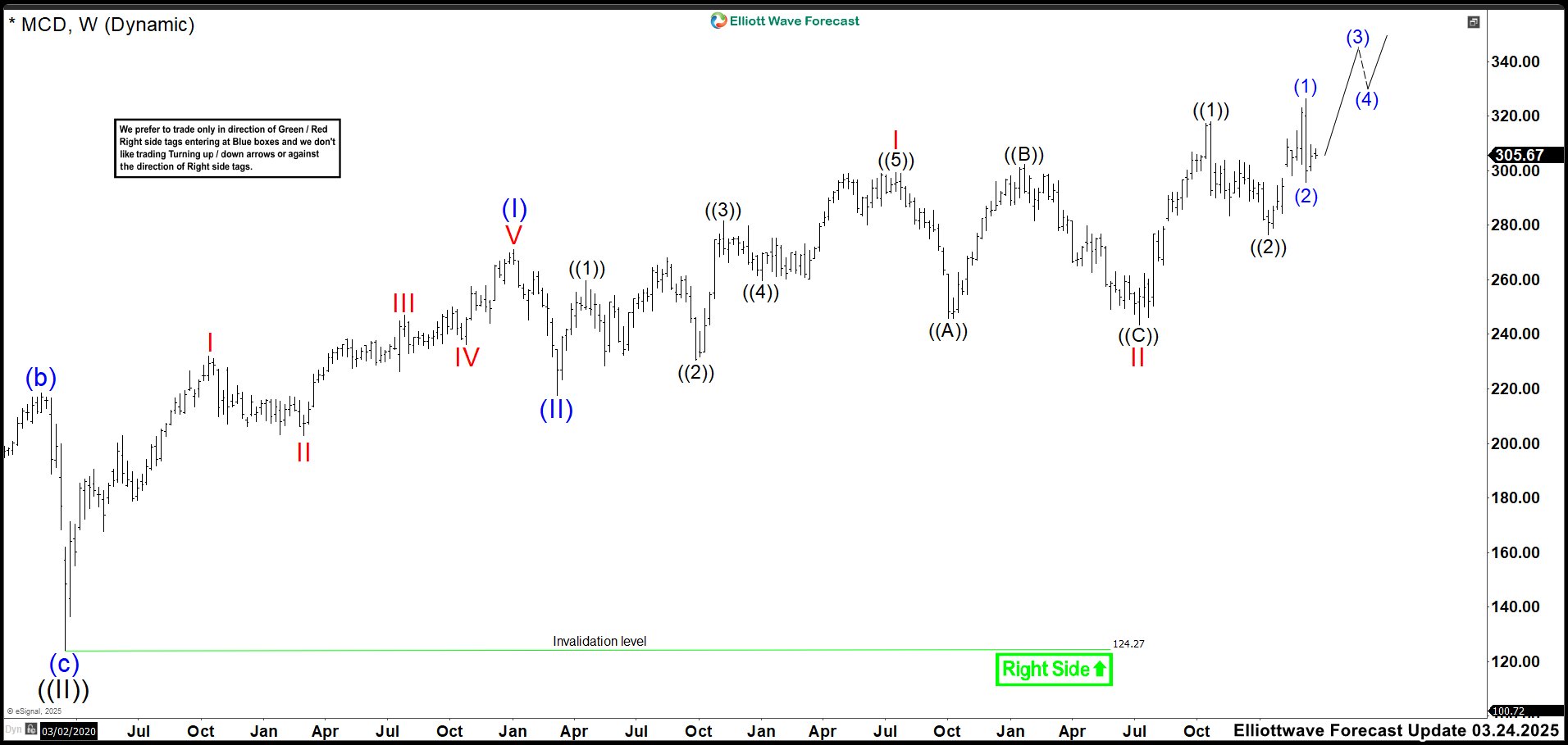

McDonald’s (MCD): Continuing the Bullish Trend with Wave ((3))

Read MoreMcDonald’s (MCD) stock is on track to deliver moderate growth throughout 2025. Analysts expect an average price target of $323.39, offering a potential upside of 5.79% from its current level. Furthermore, monthly forecasts highlight price fluctuations between $282 and $370, influenced by market conditions. Menu innovation, digital initiatives, and geographic diversification strengthen its position and […]