The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

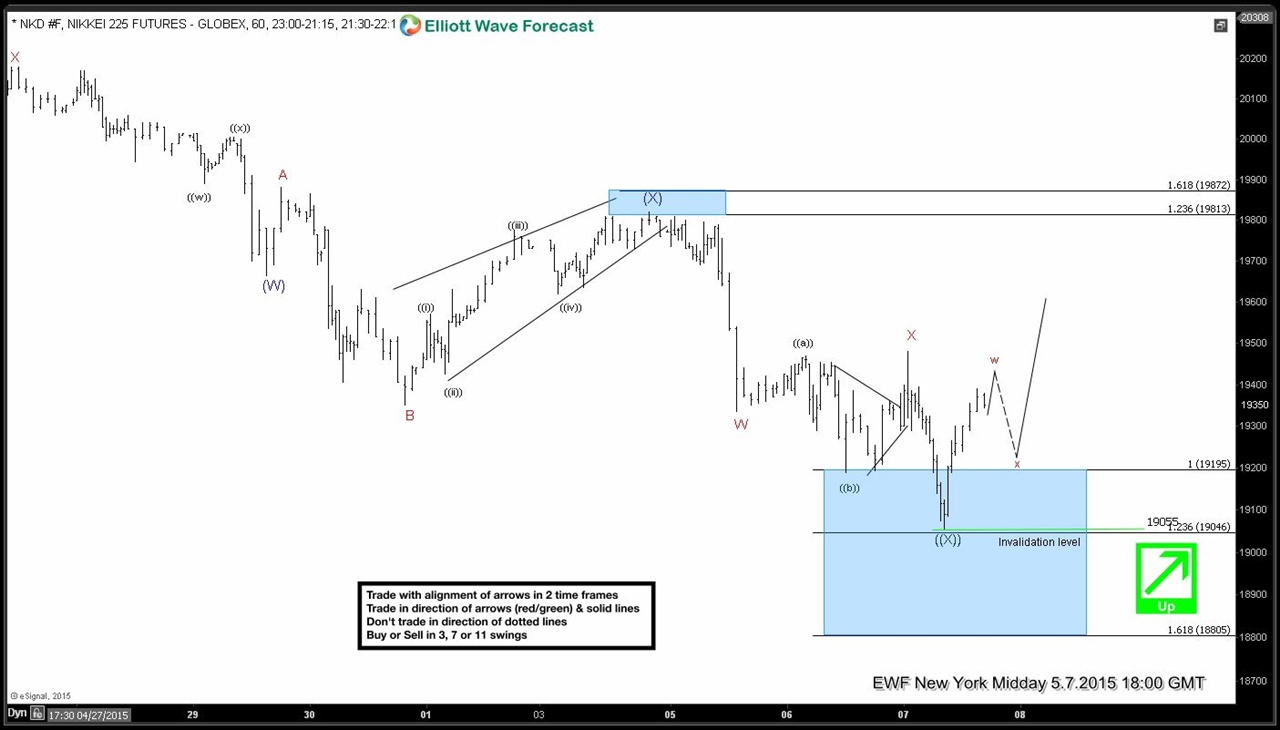

Nikkei (NI225) Short Term Elliott Wave Update 5.7.2015

Read MorePreferred Elliott Wave view suggests wave ((X)) pullback took the form of a double three (W)-(X)-(Y) structure. Wave (W) ended at 19665. Wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. In our last Chart of the Day update, we said wave Y of ((X)) can still make one more low and test 18805 – 19045 […]

-

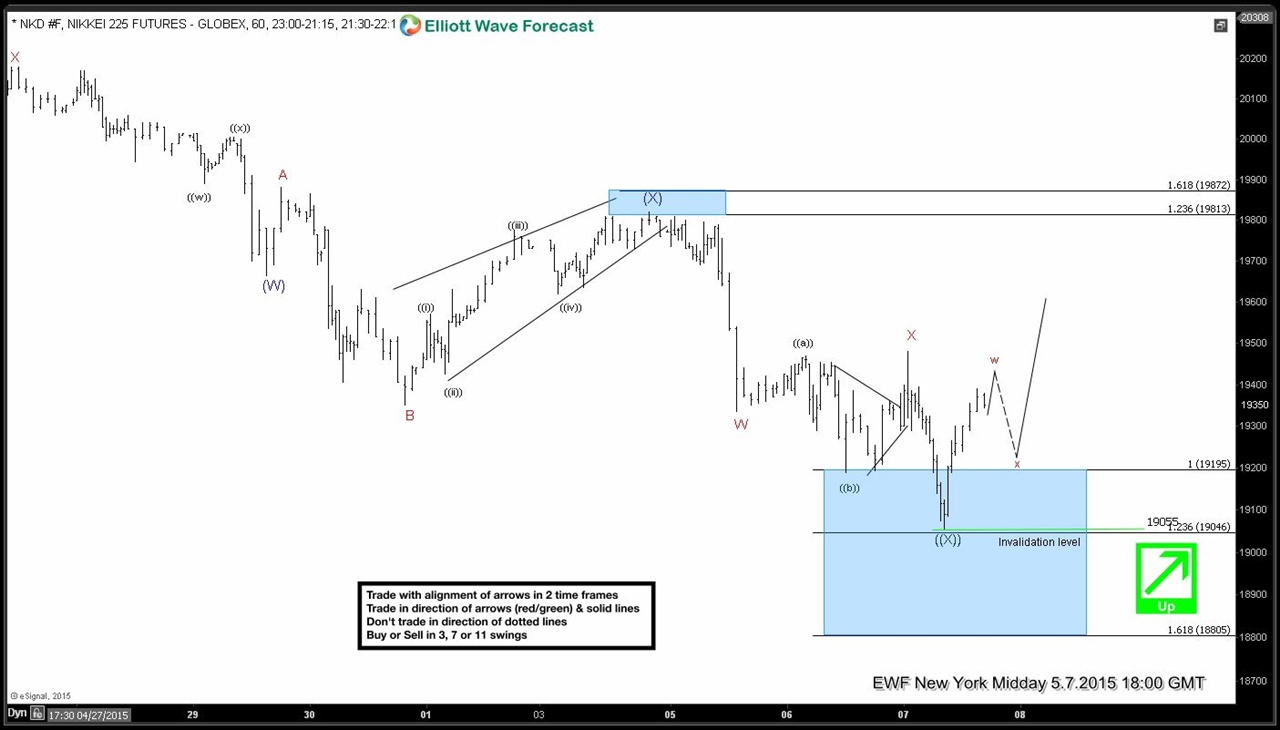

Nikkei (NI225) Short Term Elliott Wave Update 5.6.2015

Read MoreWave ((X)) pullback is in progress and is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) is now in progress and is expected to end at 18805 – 19045 area to complete wave ((X)). […]

-

Nikkei (NI225) Short Term Elliott Wave Analysis 5.5.2015

Read MoreIndex has broken below 19348 low which means we are still in wave ((X)) pull back which is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) low is now in […]

-

IBEX Short Term Elliott Wave Analysis 4.30.2015

Read MoreShort term Elliott Wave view suggests rally to 11883.6 completed wave (Y). Decline from here is taking the form of a double three or WXY structure when wave W ended at 11301, wave X ended at 11684.3, and wave Y lower is in progress. Wave ((w)) of Y ended at 11259.1, wave ((x)) of Y bounce is currently in progress and could retrace 50 […]

-

DOW Short Term Elliott Wave Update 4.27.2015

Read MoreDOW: Cycle from wave (X) low at 17573.71 is currently still in progress until it reaches equal leg of ((w)) and ((x)). Wave ((w)) is complete at 18107.6, wave ((x)) is complete at 17748.53 as expanded flat, and DOW is in progress to complete wave W towards 18285.66 – 18411.55 equal leg area. From this area, […]

-

SPX Short-term Elliott Wave update 4.23.2015

Read MoreSince our last update on SPX500, Index pulled back to 2091 (50 fib) and has rallied to new highs as expected. Focus remain on 2122 – 2139 area to complete red wave “W” which we think would complete a double three i.e. ((w))-((x))-((y)) Elliott wave structure up from 3/11 (2039) low. This is where buyers […]