The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

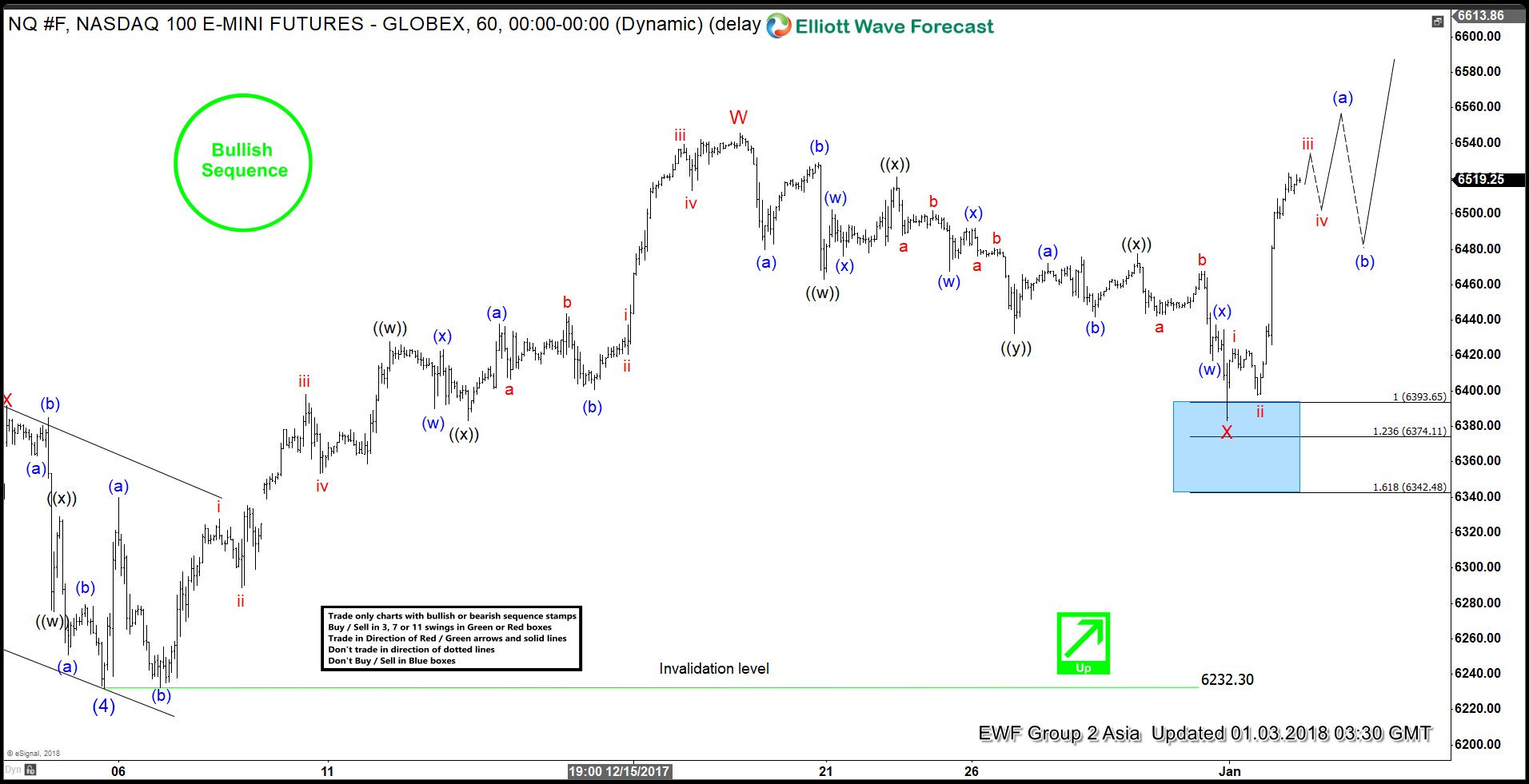

Elliott Wave Analysis: Nasdaq Ended Correction

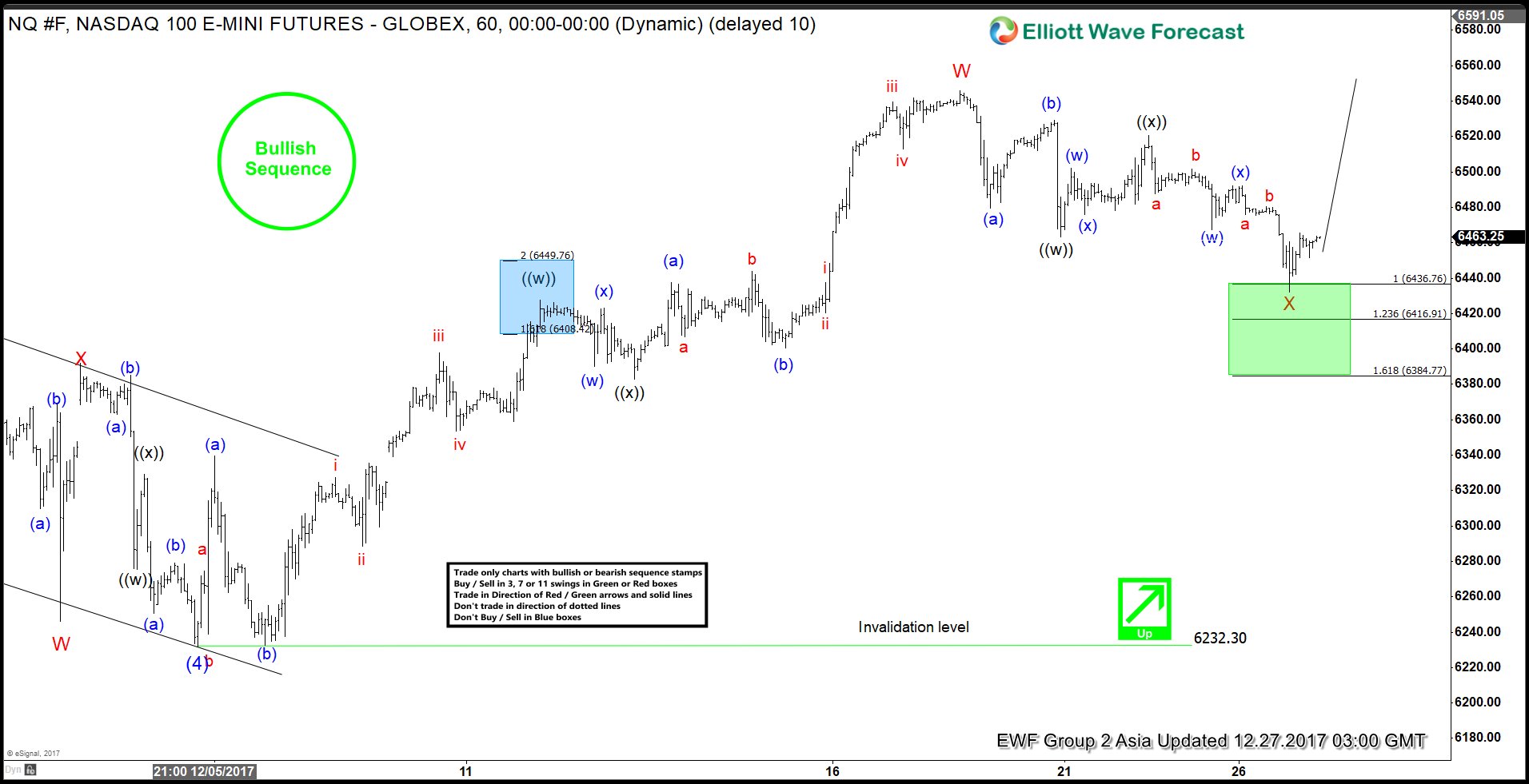

Read MoreElliott Wave view for Nasdaq suggests that the Index has ended the correction to the cycle from 12/5 low at 6383.25 and from there it it has started the next leg higher. Up from Intermediate wave (4) low on 12/5, the rally unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X […]

-

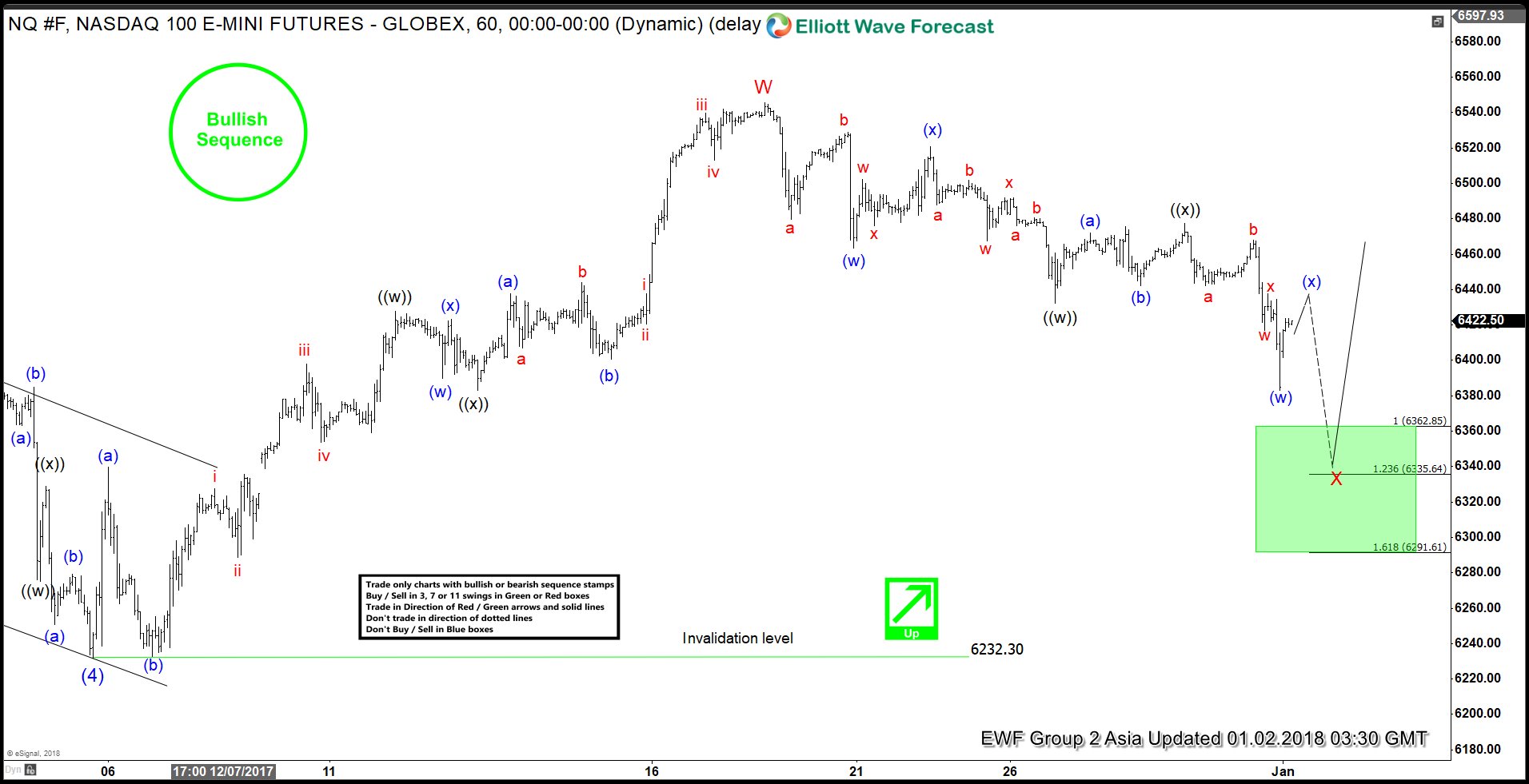

Elliott Wave Analysis: Nasdaq Correcting cycle from 6232.3 low

Read MoreNasdaq Short Term Elliott Wave view suggests that the Index is correcting the rally from 12/5 low (6232.3). While dips remain above Intermediate wave (4) at 6232.3, expect Index to extend higher. Rally from Intermediate wave (4) low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is in progress […]

-

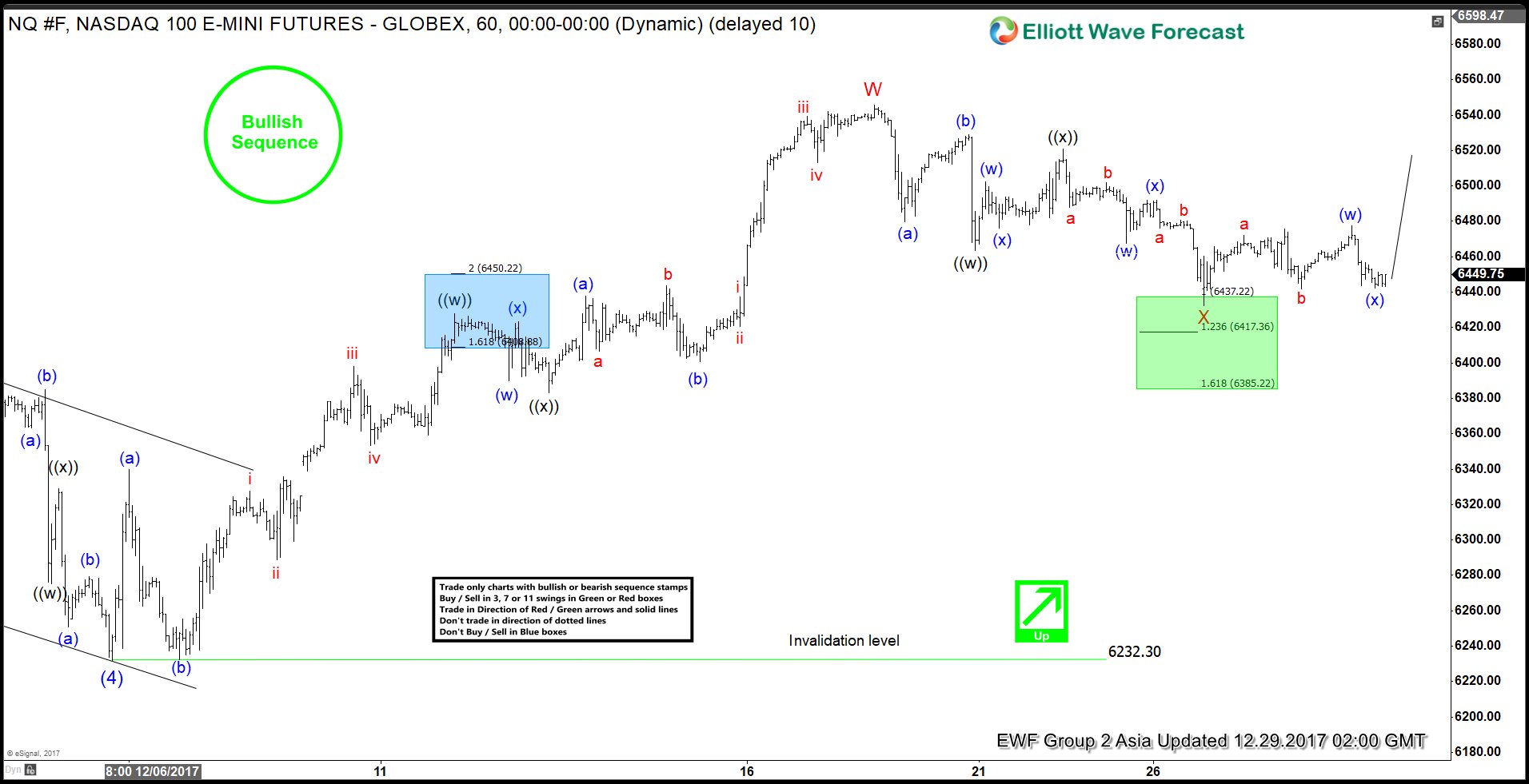

Nasdaq Elliott Wave Analysis: More Upside Favored While Above 6232.3

Read MoreNasdaq Short Term Elliott Wave view suggests that the Index remains bullish as far as pullbacks stay above Intermediate wave (4) at 6232.3. Rally from Intermediate wave (4) low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is proposed complete at 6432.25 in the green box. Internal of Minor […]

-

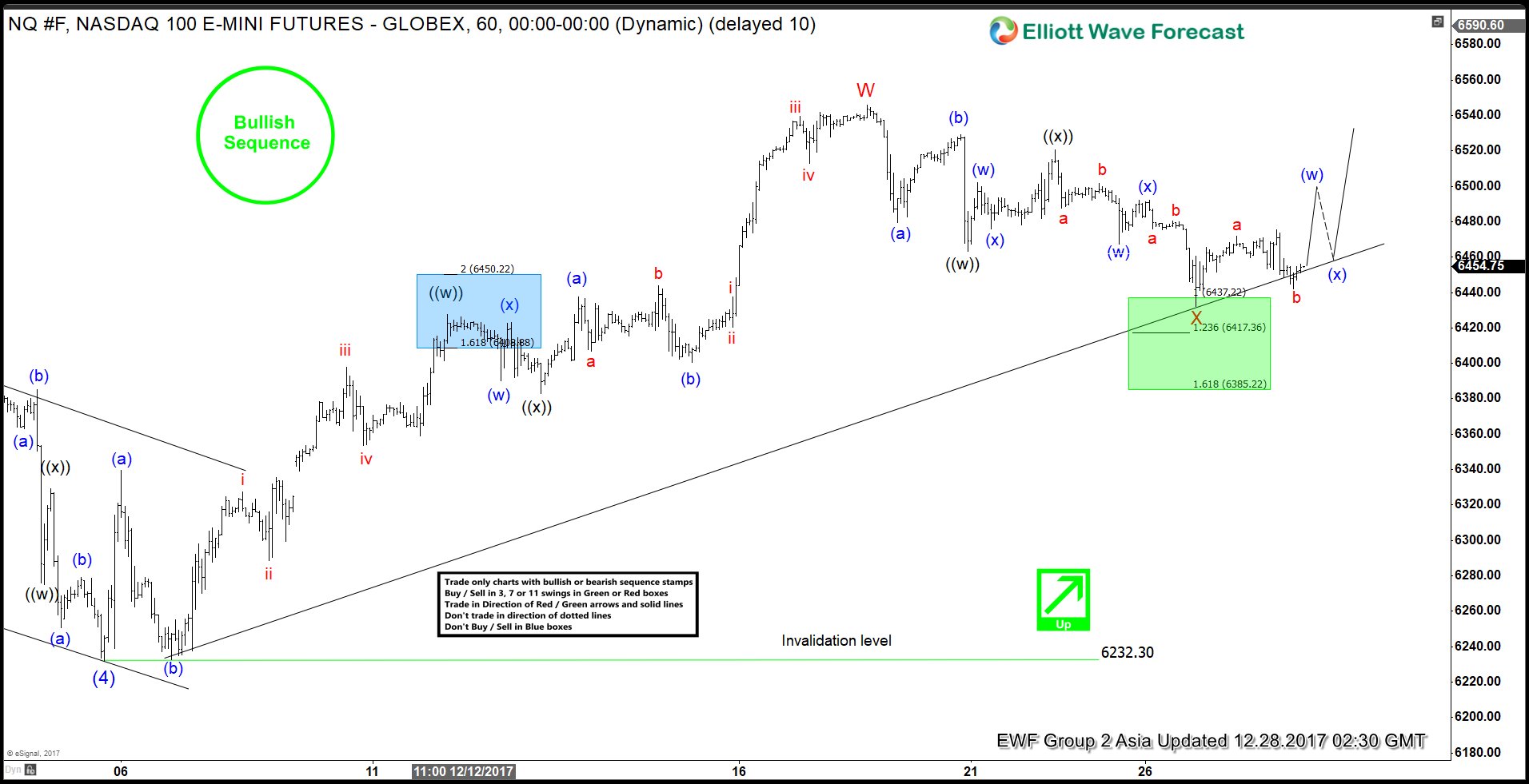

Elliott Wave Analysis: Nasdaq Looking to Extend Higher

Read MoreNasdaq Short Term Elliott Wave view suggests that Intermediate wave (4) ended at 6232.3. Since then, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The subdivision of the first leg Intermediate wave W unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at 6383, […]

-

Nasdaq Elliott Wave Analysis: Upside Resumes

Read MoreNasdaq Short Term Elliott Wave view suggests that the decline to 6232.3 ended Intermediate wave (4). Up from there, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The first leg Intermediate wave W unfolded also as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at […]

-

SPX Intra-Day Elliott Wave Analysis

Read MoreSPX Intra Day Elliott Wave view suggests that rally from 11.15 low at 2557.45 is unfolding as an Ending Diagonal where Minor wave 1 ended at 2665.19 and Minor wave 2 pullback ended as a zigzag correction at 2624.19 low. Minor wave 3 is in progress as a double correction with a target of 2731 – 2757. Up from 2624.19, Minutte wave (a) […]