The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

NIKKEI: Elliott Wave Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NIKKEI published in members area of the website. As our members know NIKKEI has been correcting the cycle from the 3/26 low (20190). We expected price to reach extreme zone at 21994-21377 to complete […]

-

Elliott Wave Analysis: Amazon May Start Another Extension Higher

Read MoreAmazon ticker symbol: $AMZN short-term Elliott wave analysis suggests that pullback to $1646.48 low ended intermediate wave (2). Above from there, the stock is rallying higher in intermediate wave (3) higher. The internals of that extension higher is unfolding as Elliott wave impulse structure with sub-division of 5 waves structure in lesser degree Minor wave 1, […]

-

Elliott Wave Analysis: Amazon Showing Impulse Rally

Read MoreAmazon ticker symbol: $AMZN short-term Elliott wave analysis suggests that the cycle from 6/25/2018 low ($1646.31) is rallying higher in an impulse structure. This suggests that the internal sub-division of each leg higher is unfolding as 5 waves structure of lesser degree i.e Minute wave ((i)), ((iii)) & ((v)), whereas Minute wave ((ii)) & ((iv)) […]

-

Facebook Elliott Wave Analysis: Correction Taking Place

Read MoreFacebook ticker symbol: $FB short-term Elliott Wave analysis suggests that the decline to $192.22 low ended cycle degree wave II as double three structure. Up from there, the stock is rallying higher and making new all-time highs within cycle degree wave III. Up from $192.22 low, the rally to $208.2 high ended primary wave ((1)). […]

-

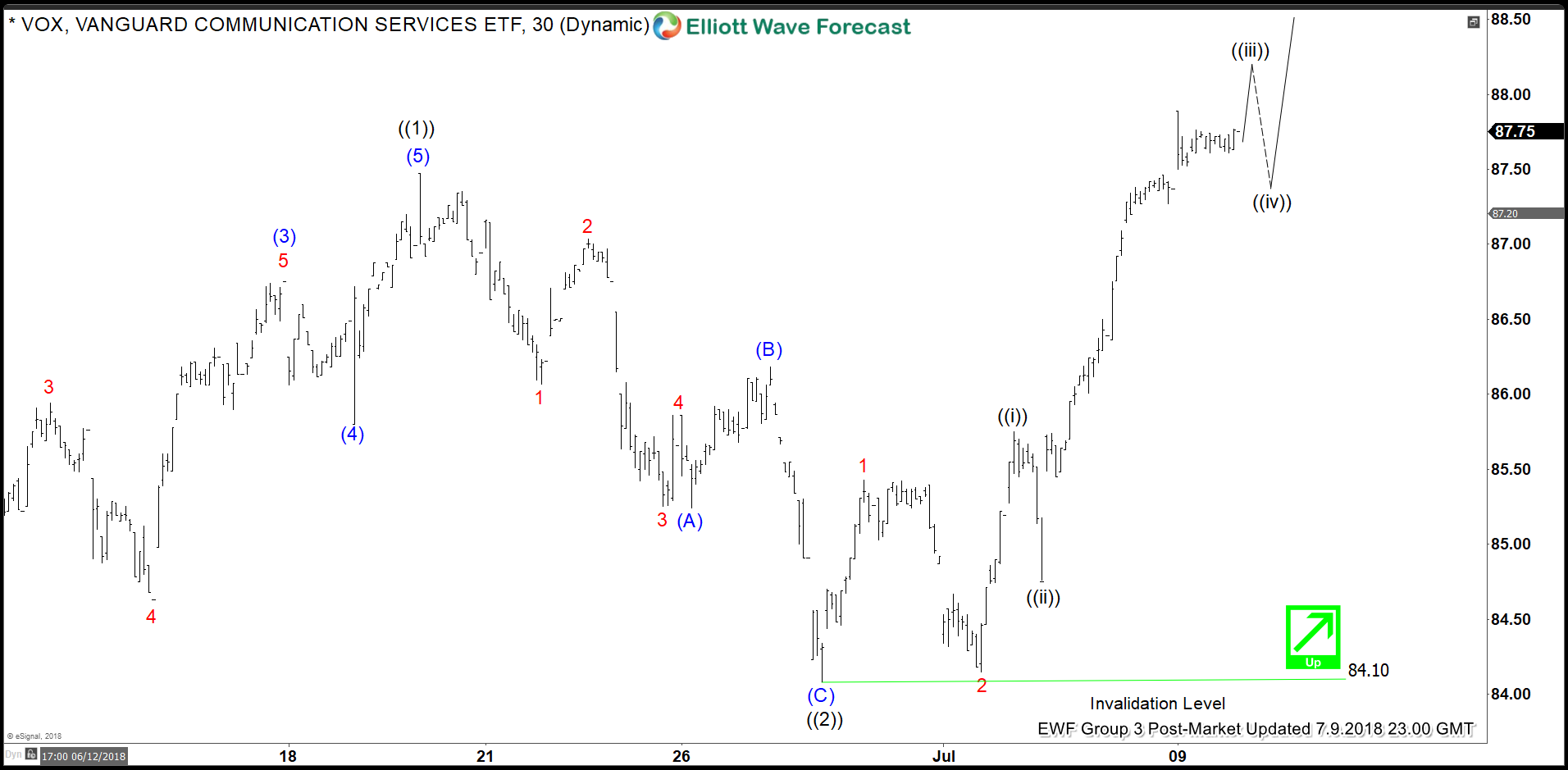

VOX Elliott Wave Analysis: Started Another Extension Higher

Read MoreVOX ETF short-term Elliott wave analysis suggests that the rally to $87.38 high ended primary wave ((1)) as an impulse with extension. Down from there, the pullback to $84.10 low ended primary wave ((2)). The internals of that pullback unfolded as Elliott wave zigzag correction where intermediate wave (A) ended in 5 swings at $85.24. Intermediate […]

-

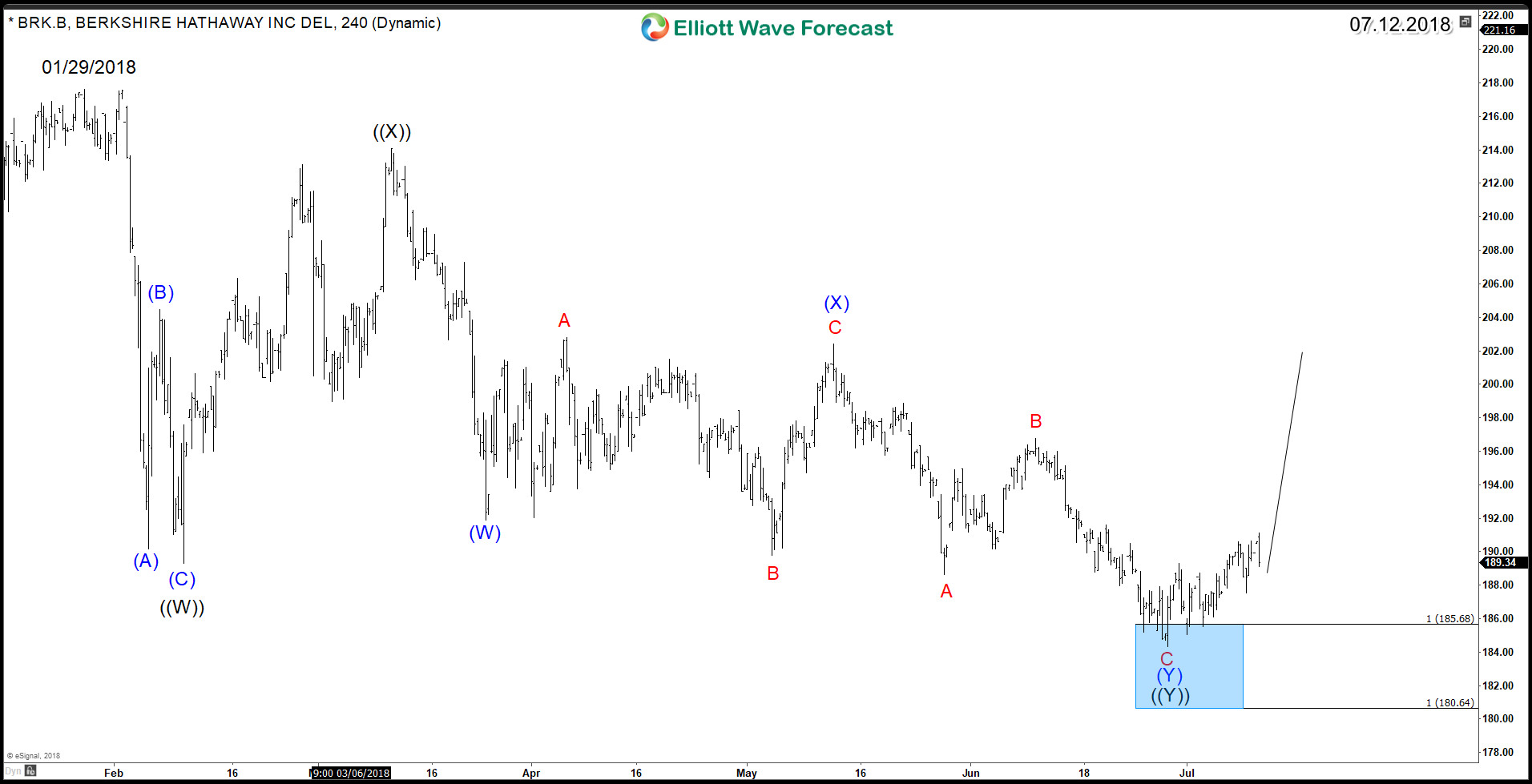

Berkshire Hathaway Stock Aiming for Recovery

Read MoreBerkshire Hathaway (Class A NYSE: BRK.A – Class B NYSE: BRK.B) is currently the seventh largest company in the S&P 500 Index by market capitalization. The company ,lead by Warren Buffett, has averaged an annual growth in book value of 19.0% to its shareholders since 1965. Berkshire Hathaway Class B NYSE: BRK.B is one of the […]