The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

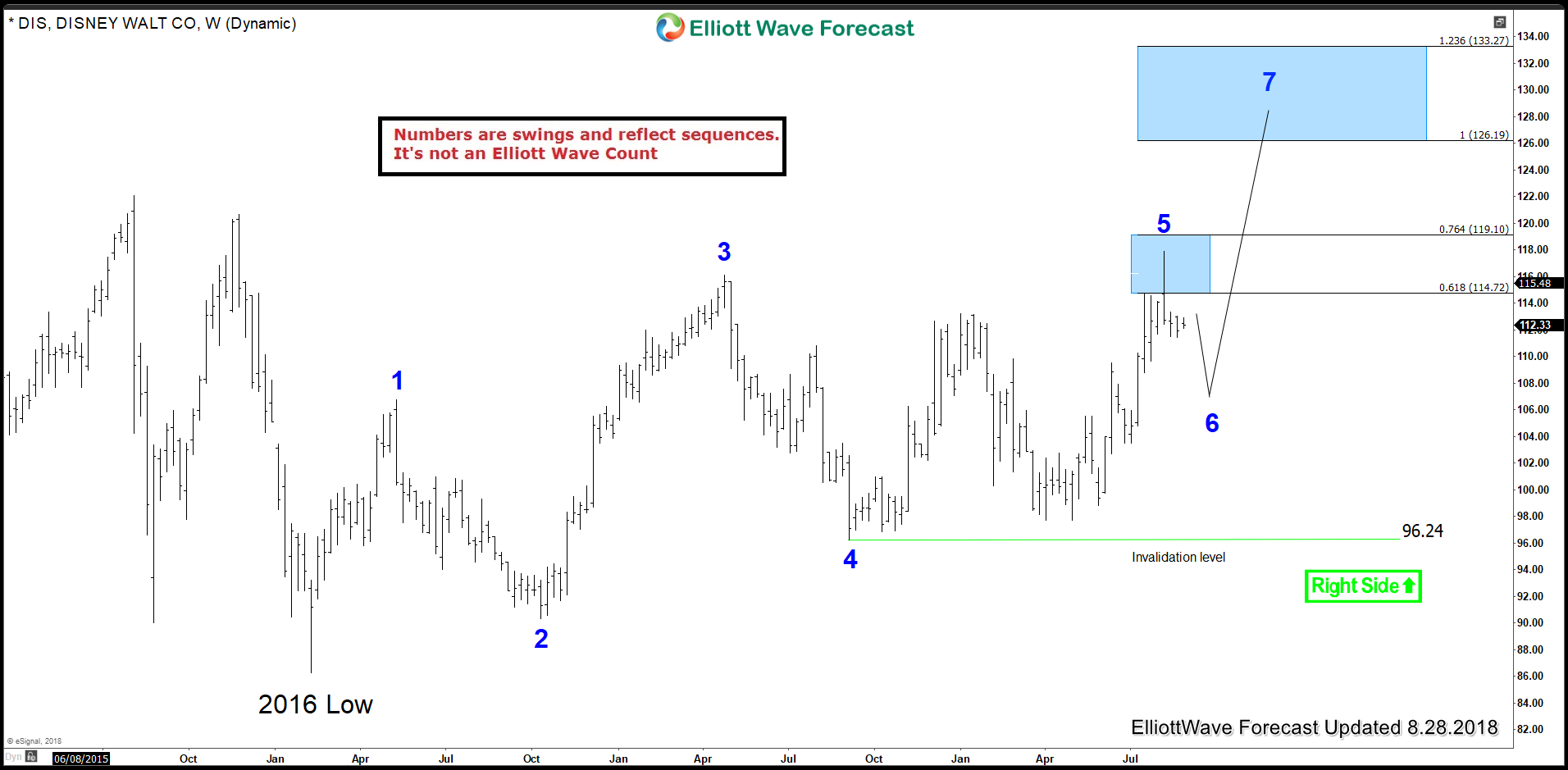

Disney DIS Bullish Sequence Looking For New All Time Highs

Read MoreIn the recent 3 years, Walt Disney stock price (NYSE: DIS) hovered between $120 and $90 without any real trending momentum. Last year, we looked for a potential break to new all time highs in Disney based on few scenarios which seems to be still playing out. Taking a look at the weekly chart, we […]

-

Dow Jones Futures Elliott Wave View: Reacting Higher From Blue Box

Read MoreHello fellow Traders. In this blog, we will have a look at some recent short-term Elliott Wave charts of the Dow Jones Industrial which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 08/23/18 indicating that Dow Jones ended the cycle from 08/15 low in black wave […]

-

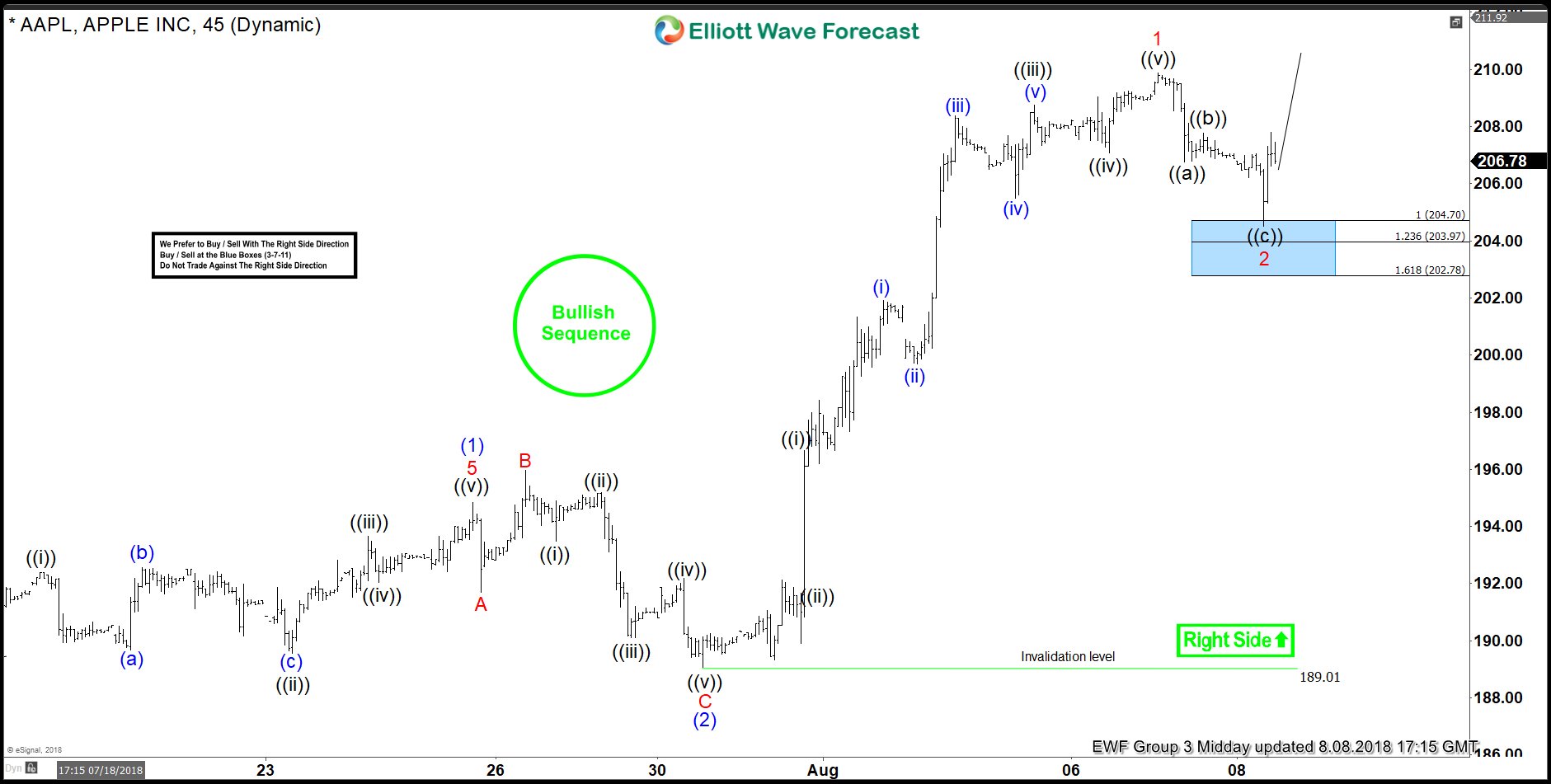

APPLE Buying The Dips in 3-7-11 Swings

Read MoreHello fellow traders. Another trading opportunity we have had lately is long trade in APPLE . In this technical blog we’re going to take a quick look at the Elliott Wave charts of APPLE published in members area of the website. As our members know, the stock has had incomplete bullish sequences in the cycle […]

-

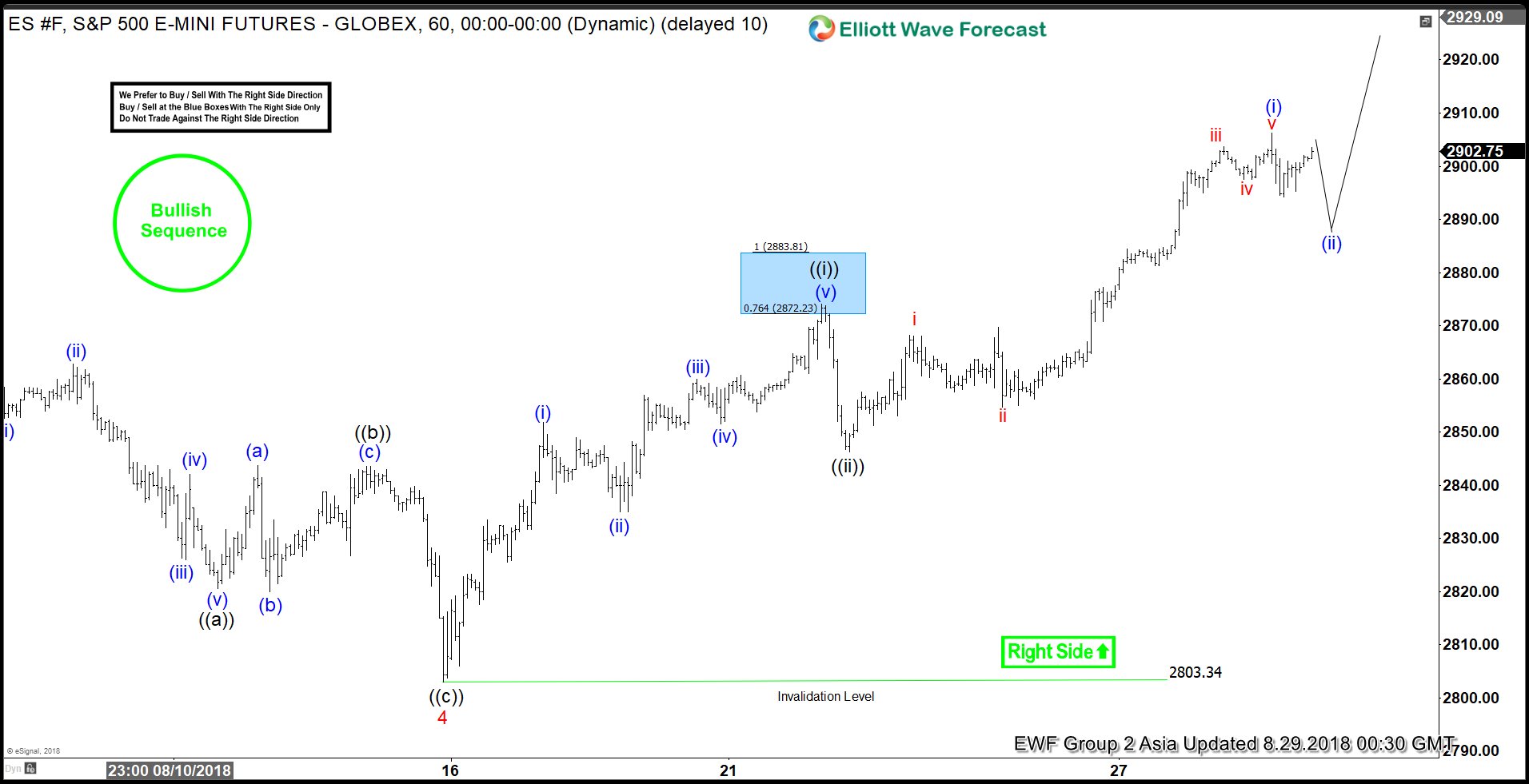

S&P500 Mini Futures: Extending Higher As Impulse

Read MoreS&P500 Mini Futures ticker symbol: $ES_F short-term Elliott wave view suggests that the decline to $2803.34 low ended Minor wave 4 pullback. The internals of that pullback unfolded as Elliott wave zigzag correction. The lesser degree Minute wave ((a)) ended in 5 waves at $2820.5 low. Then the bounce to $2843.50 high ended Minute wave […]

-

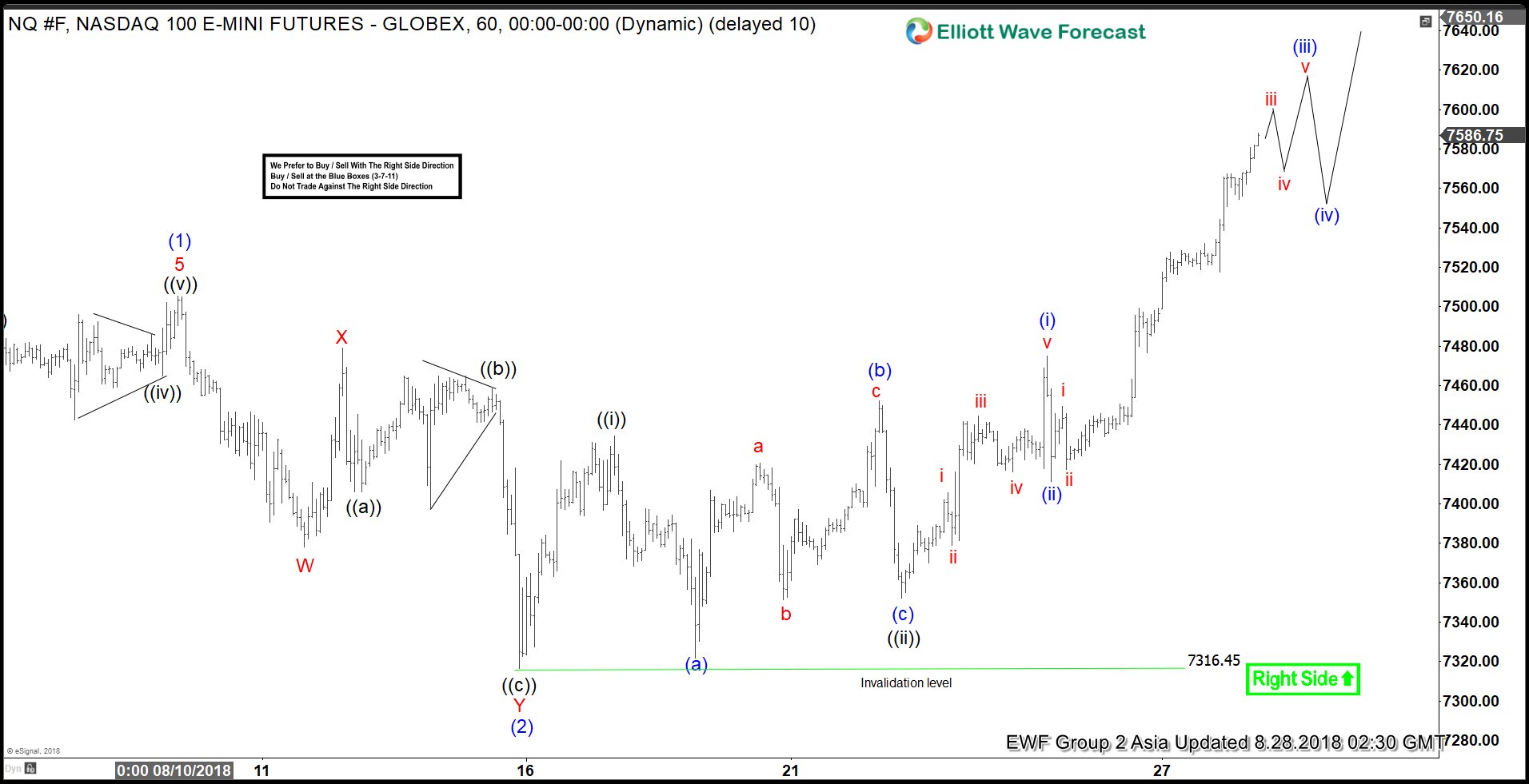

NASDAQ Elliott Wave Analysis: Nesting Higher As Impulse

Read MoreNASDAQ ticker symbol: $NQ_F short-term Elliott wave analysis suggests that the rally from 7/30 low ($7167.75) to $7505.25 high ended Intermediate wave (1). The internals of lesser degree cycles within Intermediate wave (1) unfolded as 5 waves impulse structure. Down from there, the correction against that cycle in Intermediate wave (2) pullback is proposed complete at […]

-

AT&T Elliott Wave View: Rallying as Impulse with Nest

Read MoreAT&T (ticker symbol T) Short-term Elliott Wave view suggests that the pullback to $31.76 ended Minor wave 2. The stock is rallying from there within Minor wave 3 as an impulse Elliott Wave structure with a nest. An impulse structure subdivides in 5 waves and we can see up from $31.76, the rally to $33.58 […]