The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

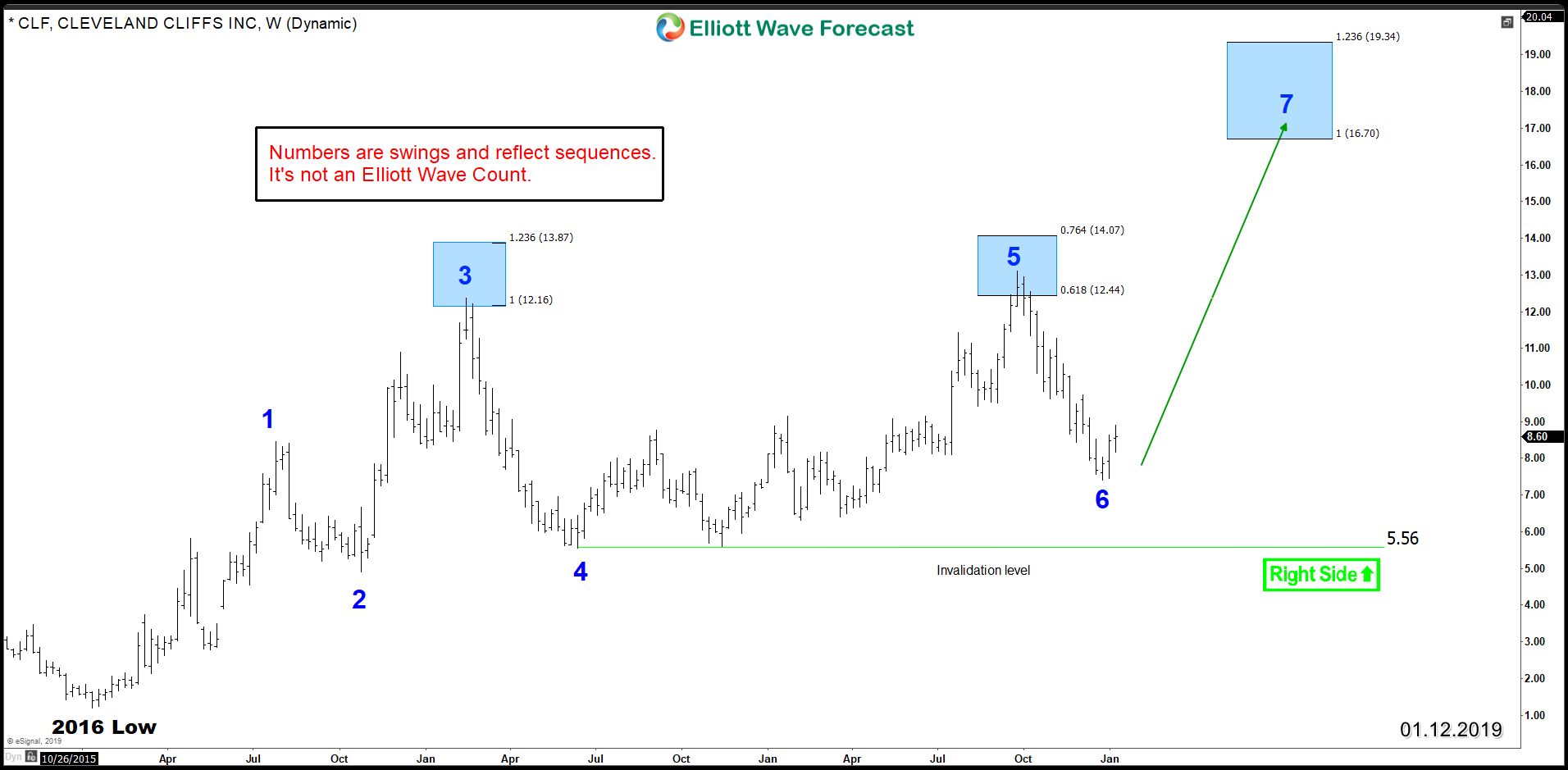

Cleveland Cliffs (NYSE:CLF) Aiming for Double Digits

Read MoreCleveland Cliffs (NYSE:CLF) is an American mining company that specializes in Iron Ore. With the demand for construction steel soaring around the world and specially in China, the price of Iron Ore continues to rise which makes big miners such as CLF, BHP, Rio Tinto and Vale a major beneficiaries thanks to the high-grades of […]

-

Elliott Wave View: Suggesting Continuation Lower In BABA Soon?

Read MoreAli Baba ticker symbol: BABA Elliott wave view suggests that the cycle from 6.05.2018 peak is having lower low sequence & missing the extreme areas to the downside still, which we have highlighted in our previous blog here. Below is the 4 Hour updated Chart from 1/07/2019, showing BABA having a bearish sequence tag & […]

-

IYF Flat from the January 29, 2018 highs

Read MoreIYF Flat from the January 29, 2018 highs The iShares US Financials ETF, symbol IYF appears to be a flat correction lower from the January 29, 2018 highs. It has been persistent and strong enough to suggest it is correcting the bullish cycle up from the February 11, 2016 lows. At this point in time […]

-

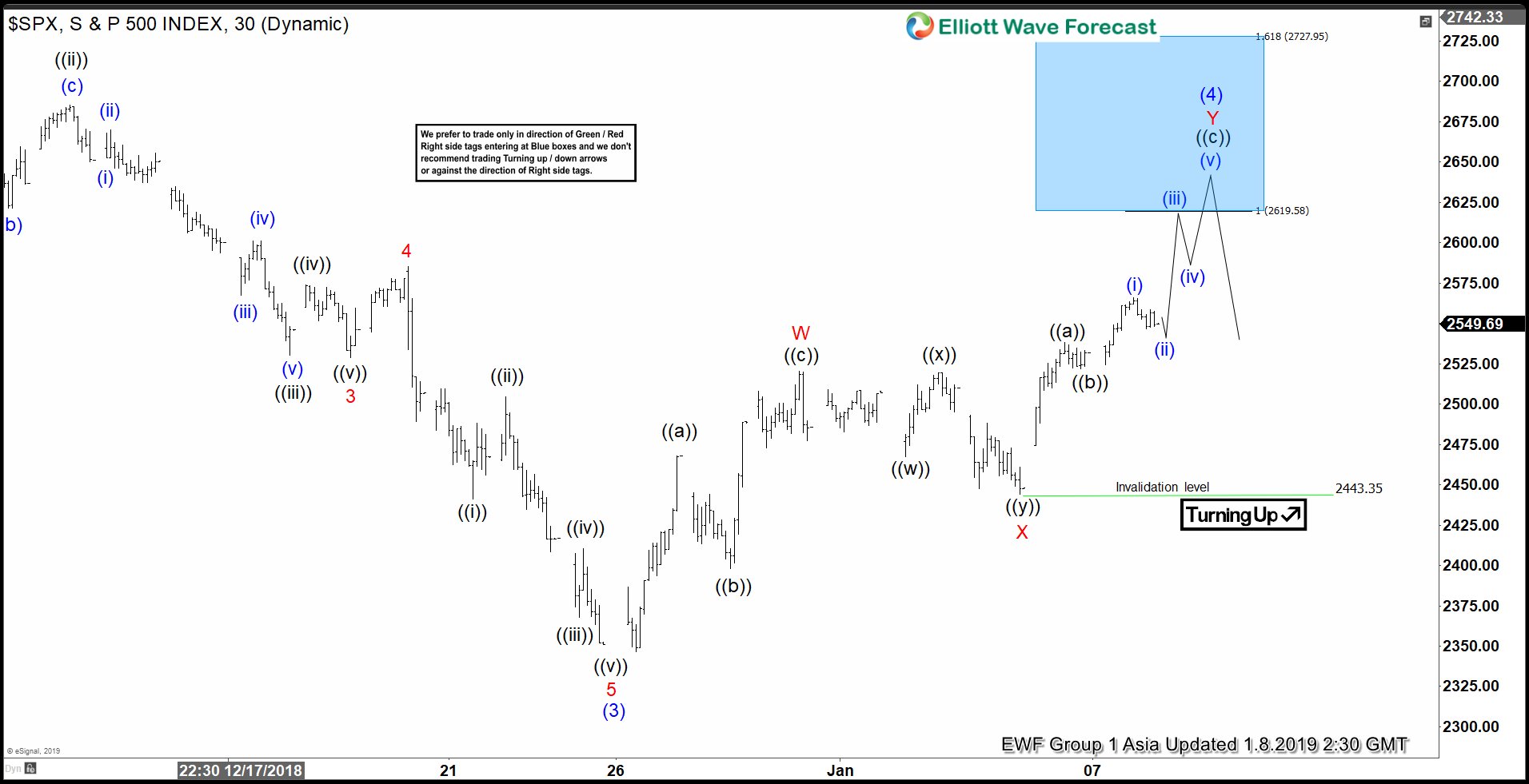

Elliott Wave View looking for SPX Rally to Fail

Read MoreShort term Elliott Wave view in SPX suggests that the decline to 2346.58 ended wave (3). The Index is currently correcting in wave (4) as a double three Elliott Wave structure. Up from 2346.58, wave W ended at 2520.27, wave X ended at 2443.96, and wave Y remains in progress towards 2619.58 – 2727.95 area […]

-

Elliott Wave Analysis: Not The Right Time to Buy Apple

Read MoreWelcome traders, today we will look at a couple of Apple (APPL) charts. After plunging almost 10% on January 3rd, has the tech giant reached a bottom? And do we really have to depend on news to be on the right side of the market?. The following analysis will show you how profitable and efficient it can be […]

-

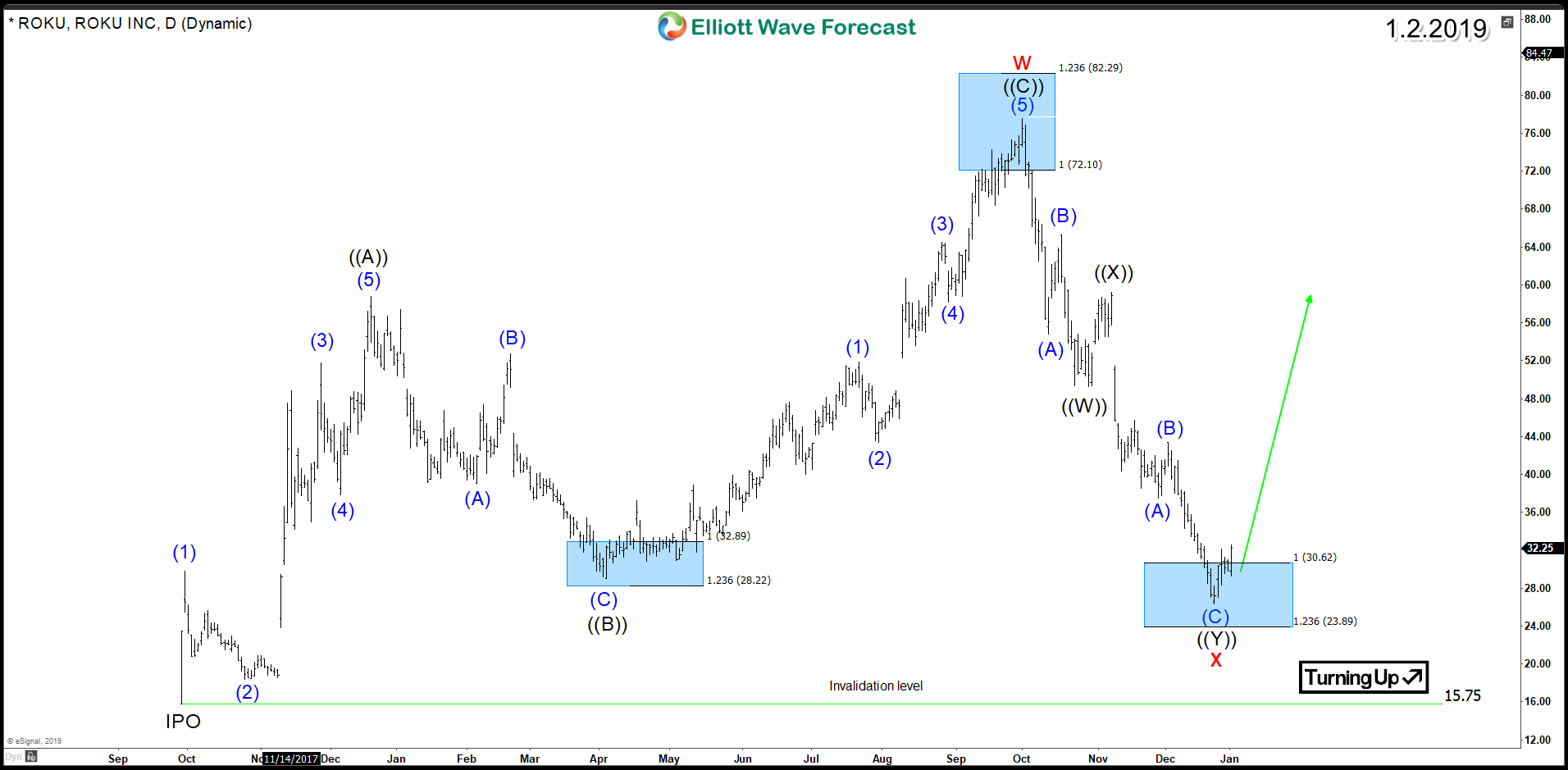

ROKU ElliottWave Corrective Structure Suggesting a Recovery

Read MoreROKU investors had great hopes for 2018 as the streaming TV platform continued it outstanding growth in addition to its stock price surging to new all time highs. However in just 3 months, the stock erased all gains to end up with -40% similar to the rest of stock market in 2018. The company earning report […]