The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

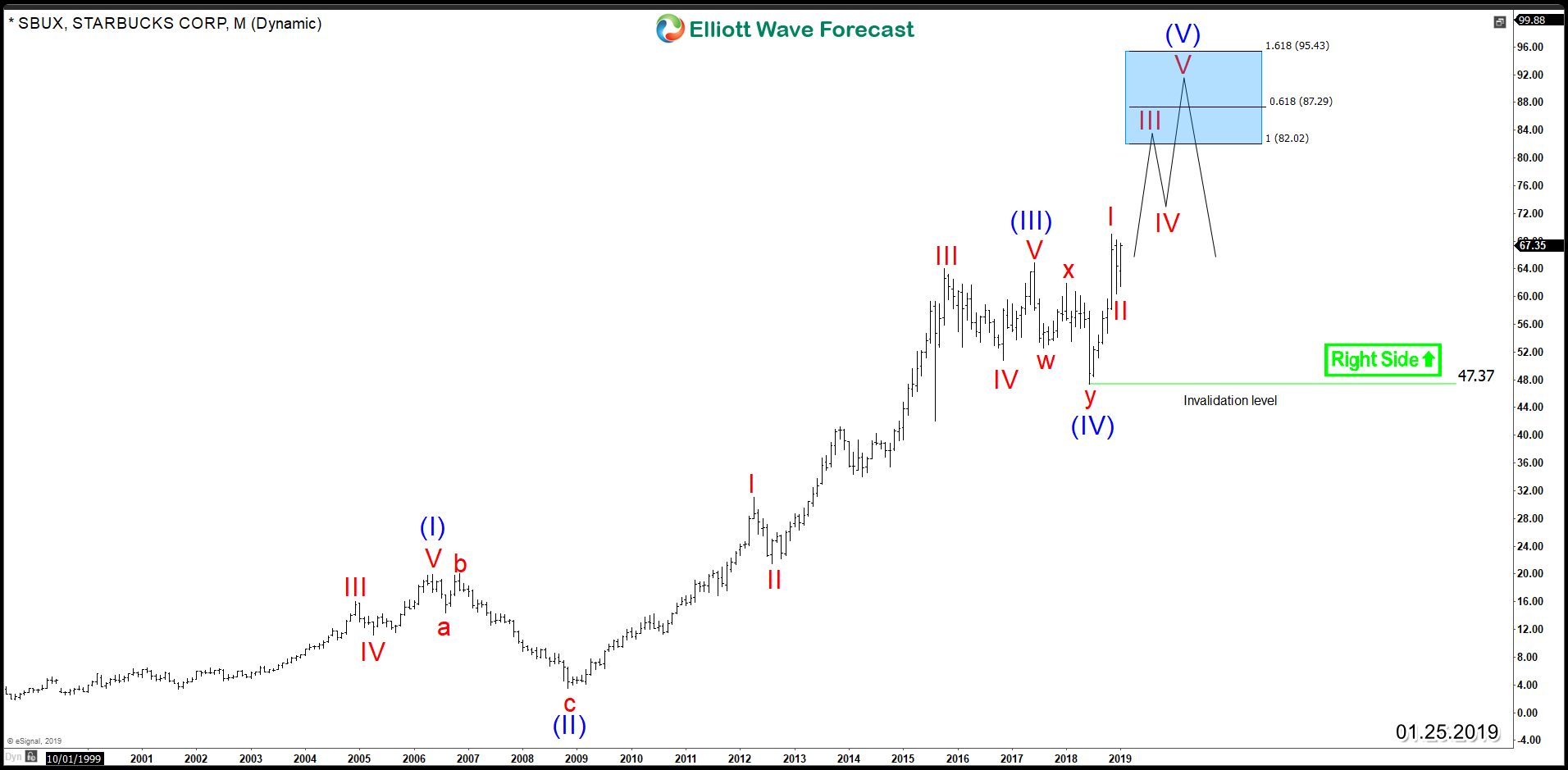

Starbucks (NASDAQ: SBUX) – Leading The Bull Market

Read MoreStarbucks (NASDAQ: SBUX) is American coffeehouse chain and it’s also the 3rd largest fast food restaurant chain by number of locations around the world. The coffee giant boosted sales by the end of the 2018 and its revenue and earnings beat expectations for the second consecutive quarter. 2018 was a red year for the stock market, […]

-

Elliott Wave View: Alibaba Ending 5 Waves Move

Read MoreThis article and video explains the short term path of Alibaba. The stock is in the process of ending 5 waves from 12/24/2018 low & still can see another leg higher.

-

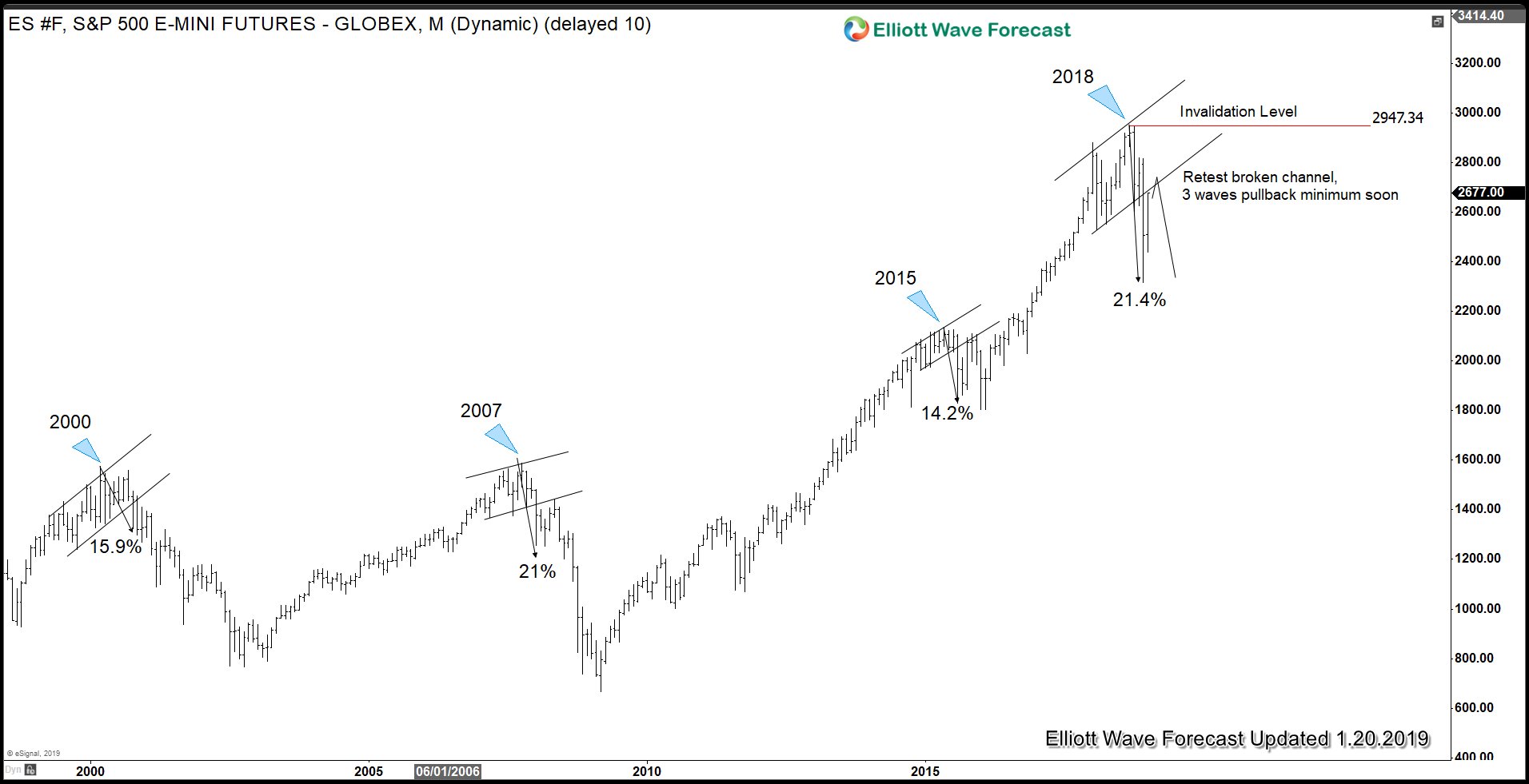

Is S&P 500 Ready to Make All-Time High?

Read MoreS&P 500 formed a significant high at 2947 on Sept 21, 2018 after a 342% rally in 10 years. During the entire rally from year 2009 low, there was no major correction in the Index, that is until last year. In less than 3 months, the Index has dropped 21.4% from the peak. The Index […]

-

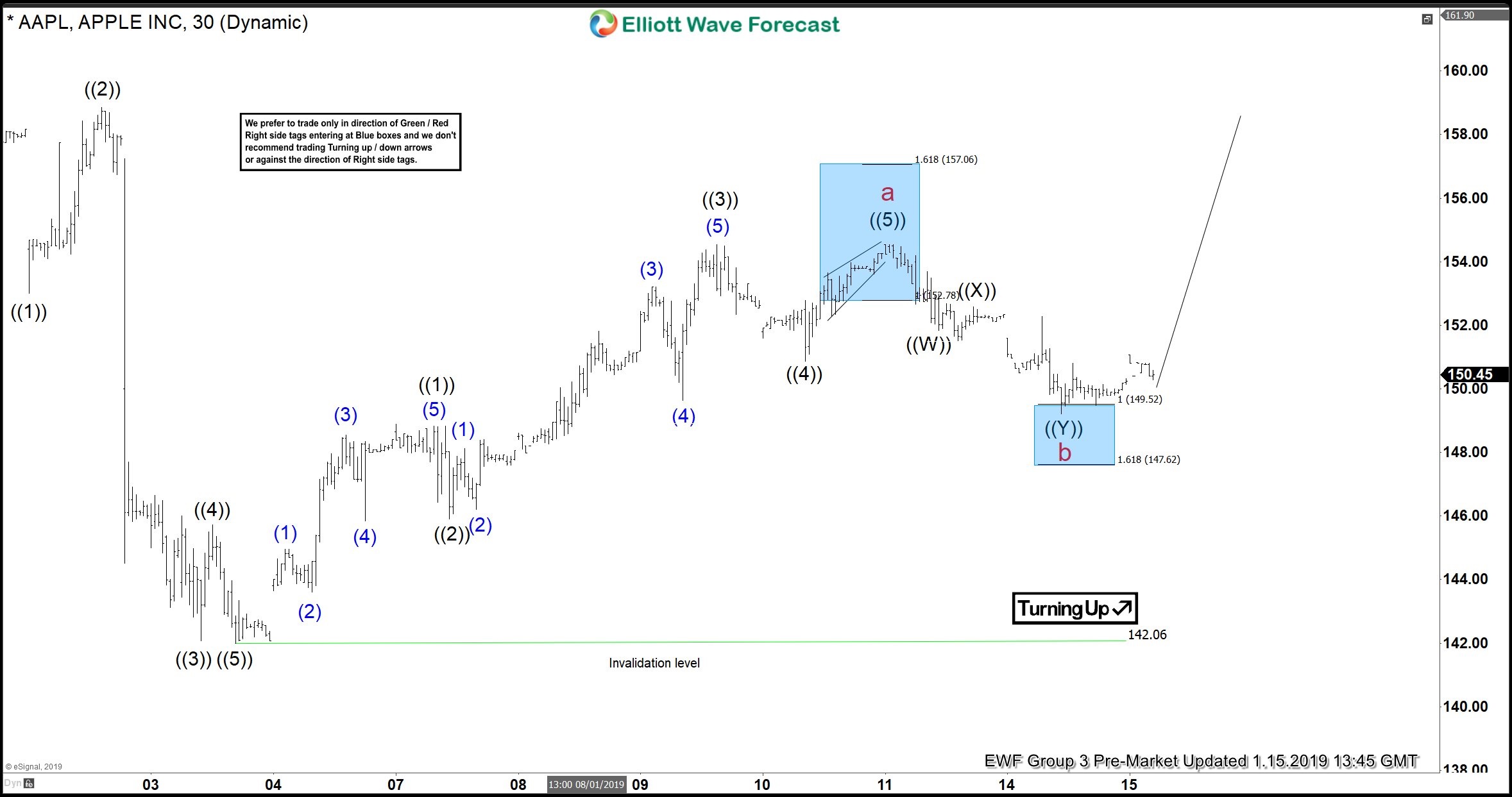

Apple Forecasting The Elliott Wave Bounce

Read MoreIn this technical blog, we are going to take a look at the past performance of Apple ticker symbol: $AAPL, 1 hour Elliott Wave charts that we presented to our clients. We are going to explain the structure and the forecast below. Apple 1 Hour Elliott Wave Chart From 01/13/2019 Above is the 1 Hour Elliott […]

-

Elliott Wave View: FTSE Can See Another Leg Higher

Read MoreShort term Elliott Wave view in FTSE suggests that the decline to 6534.59 ended wave ((A)). Wave ((B)) bounce is in progress as a zigzag Elliott Wave structure. Up from 6534.59, wave (A) ended at 7001.94. The internal of wave (A) unfolded as a 5 waves Impulse Elliott Wave structure. Wave 1 ended at 6752.54, […]

-

TSLA Leading Stocks Lower

Read MoreThe current price action and Elliott wave analysis suggest further declines for TSLA shares. Not even a full month into the new year TSLA shares have already seen 2 large declines. The first drop was blamed on a pricing adjustments for U.S. vehicles. The 2nd drop is being blamed over layoffs and unappealing guidance. Bearish […]