The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Impulsive Rally in FTSE Favors Upside

Read MoreElliott Wave view suggests FTSE ended a double three correction in wave ((ii)) on July 25 low (7464.50). We can see from the chart below the internal of wave ((ii)) as a double three. Wave (w) ended at 7475.49, wave (x) ended at 7598.60, and wave (y) of ((ii)) ended at 7464.50. After ending wave […]

-

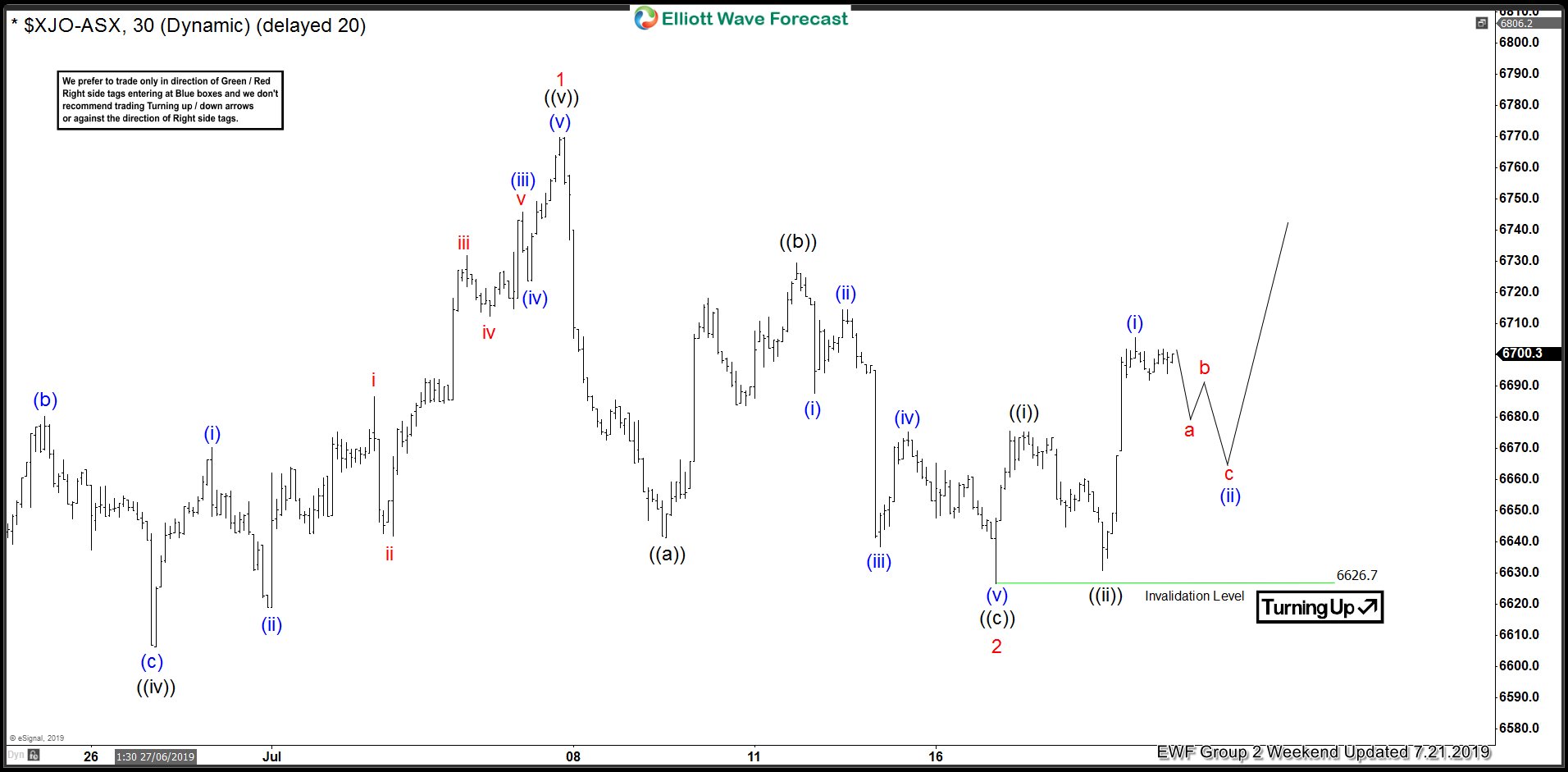

$ASX Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of ASX. As our members know ASX is another Index that is showing incomplete bullish sequences in the cycle from the December 2018 low. Rally from the 5413.6 low is showing incomplete impulsive structure, calling for […]

-

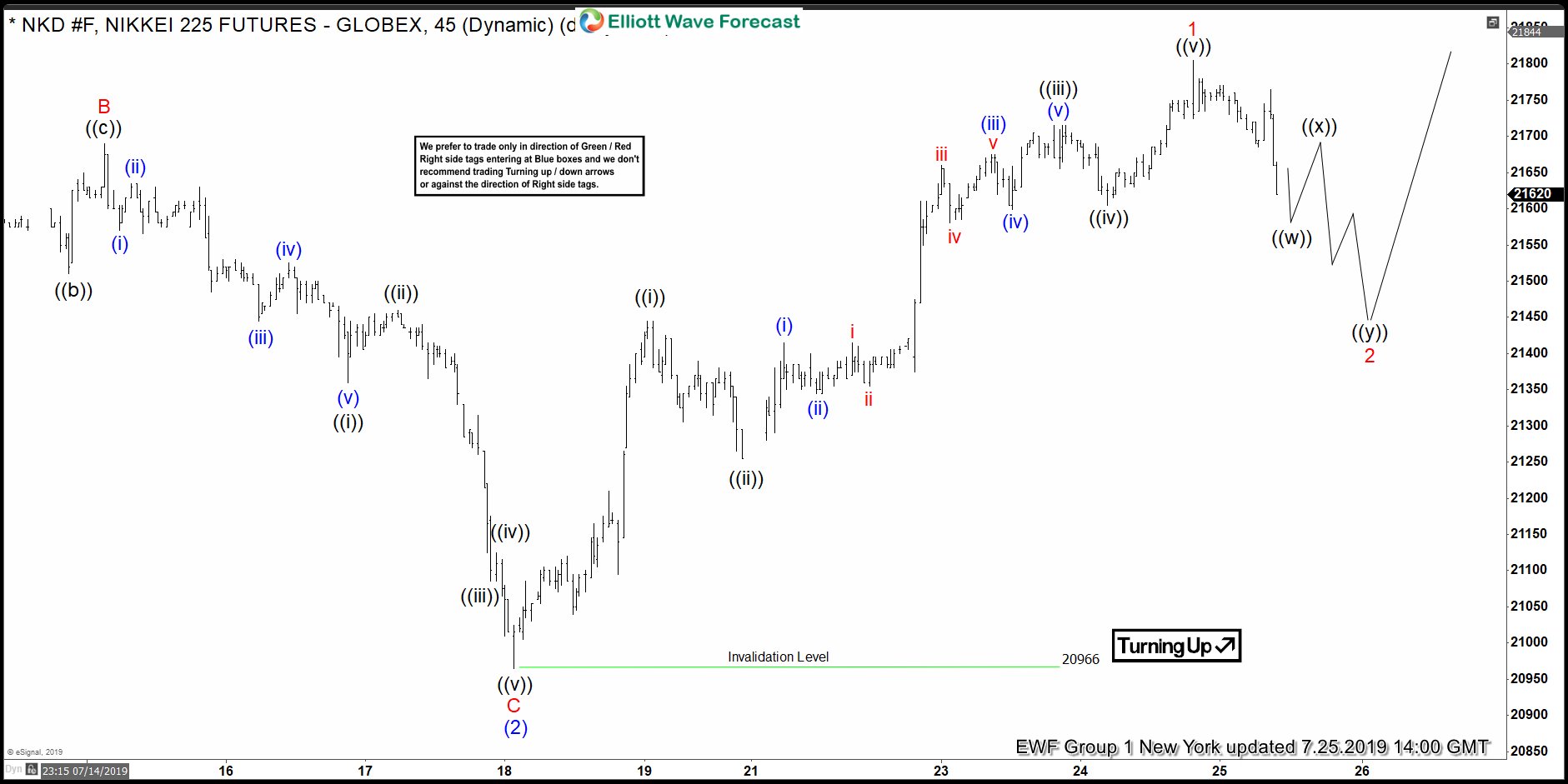

Nikkei Elliott Wave View: Leading The Move Higher

Read MoreNikkei ended the short term correction against 6/03/2019 low at 20966 low. This article and video shows the next Elliott Wave path.

-

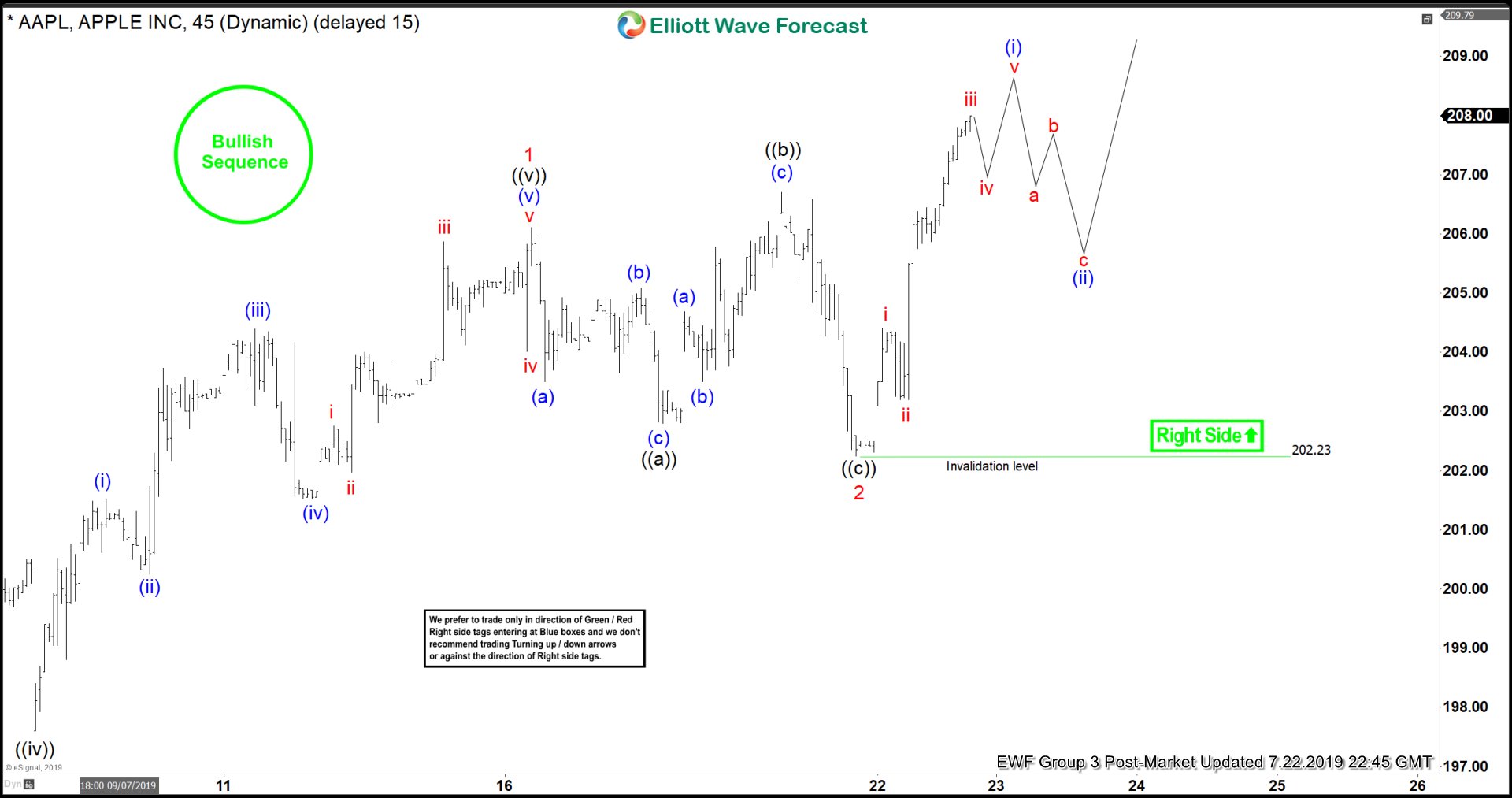

Apple Elliott Wave View: Break Higher Is Imminent

Read MoreApple shows a bullish sequence from June 04 low favoring more upside calling for a potential break higher. This article & video show the Elliott Wave path.

-

S&P 500 Futures (ES_F) Elliott Wave View: Correction Ended

Read MoreElliott wave view in S&P 500 Futures (ES_F) shows a bullish sequence from December 26, 2018 low favoring the further upside. In the short-term chart below, the index ended the 5 waves rally from 6/13/2019 low within wave ((i)) at $3023.50 high. Down from there, the index corrected the rally from 6/13/2019 low in wave […]

-

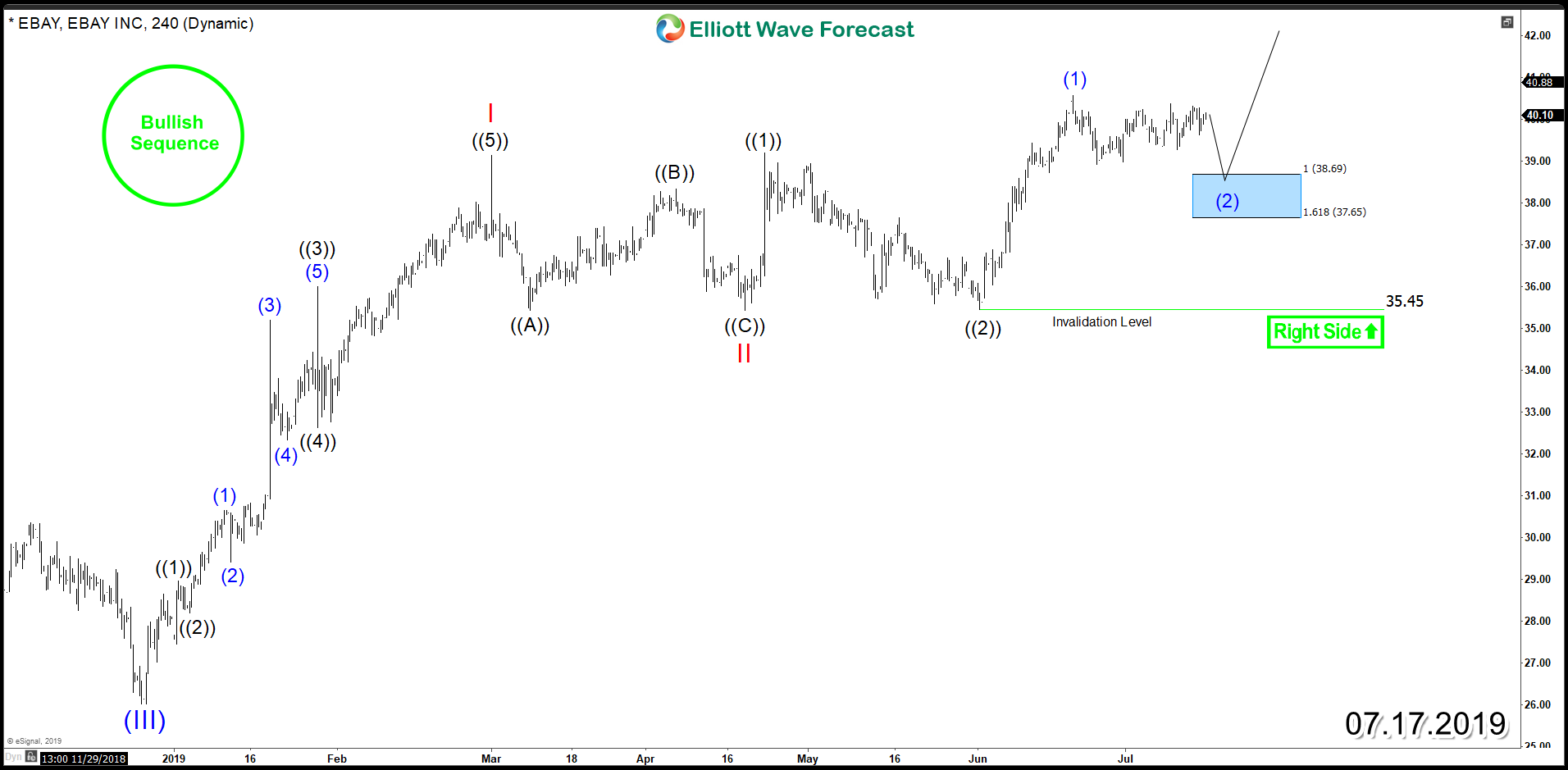

eBay Rally Aiming For Break To New All Time Highs

Read MoreeBay (NASDAQ: EBAY) is the world’s largest online marketplace that facilitates consumer-to-consumer and business-to-consumer. The company was founded in 1995 and currently operating in about 30 countries. The stock is up nearly 40% so far this year and the move higher was supported by a better-than-expected first-quarter results which saw improvement across several key operating metrics. The company is […]