The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

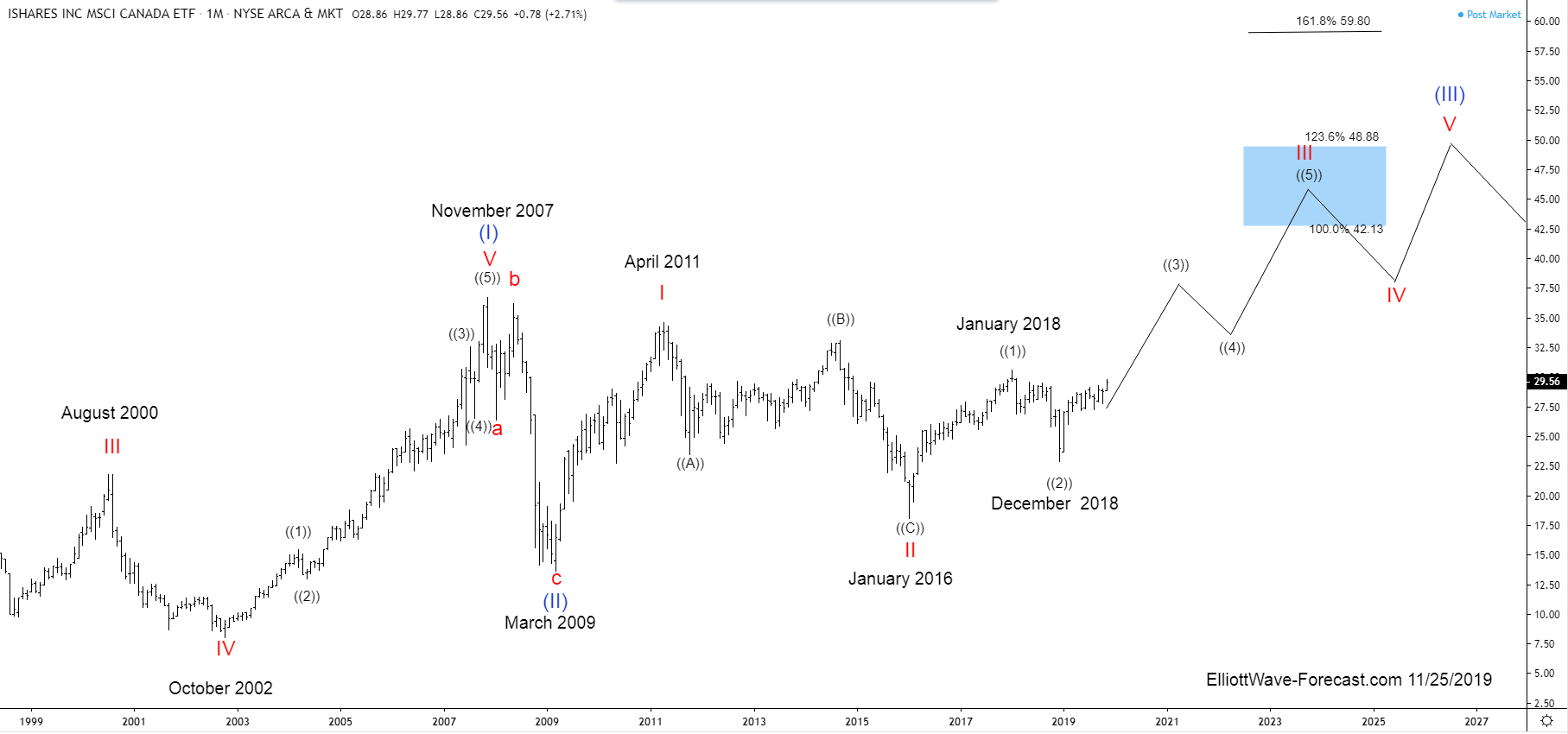

$EWC iShares MSCI Canada ETF Long Term Cycles & Elliott Wave

Read More$EWC iShares MSCI Canada ETF Long Term Cycles & Elliott Wave Firstly the EWC instrument inception date was 3/12/1996. The iShares MSCI Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the long […]

-

Will the Passing of Hong Kong Human Rights and Democracy Act Threaten Stock Market Rally?

Read MoreSome market participants worry that the passing of Hong Kong Human Rights and Democracy Act can reverse the gain in stock market. Both the US Senate and House of Representative overwhelmingly voted 417 to 1 in favor of passing the bill. It is now waiting for President Donald Trump to sign. According to Bloomberg, Trump […]

-

Elliott Wave View: Correction in Russell Should Find Buyers

Read MoreRussell decline from Nov 5, 2019 high is corrective and pullback should find support in 3, 7, 11 swing. This video looks at the Elliott Wave path.

-

Elliott Wave View: Further Downside in Exxon Mobil

Read MoreExxon Mobil shows an incomplete sequence from April 23, 2019 high favoring further downside. This video looks at the Elliott Wave path.

-

Elliott Wave View: DAX Resumes Higher

Read MoreCycle from Dec 27, 2018 low remains incomplete and can see further upside. This article and video look at the Elliott Wave path.

-

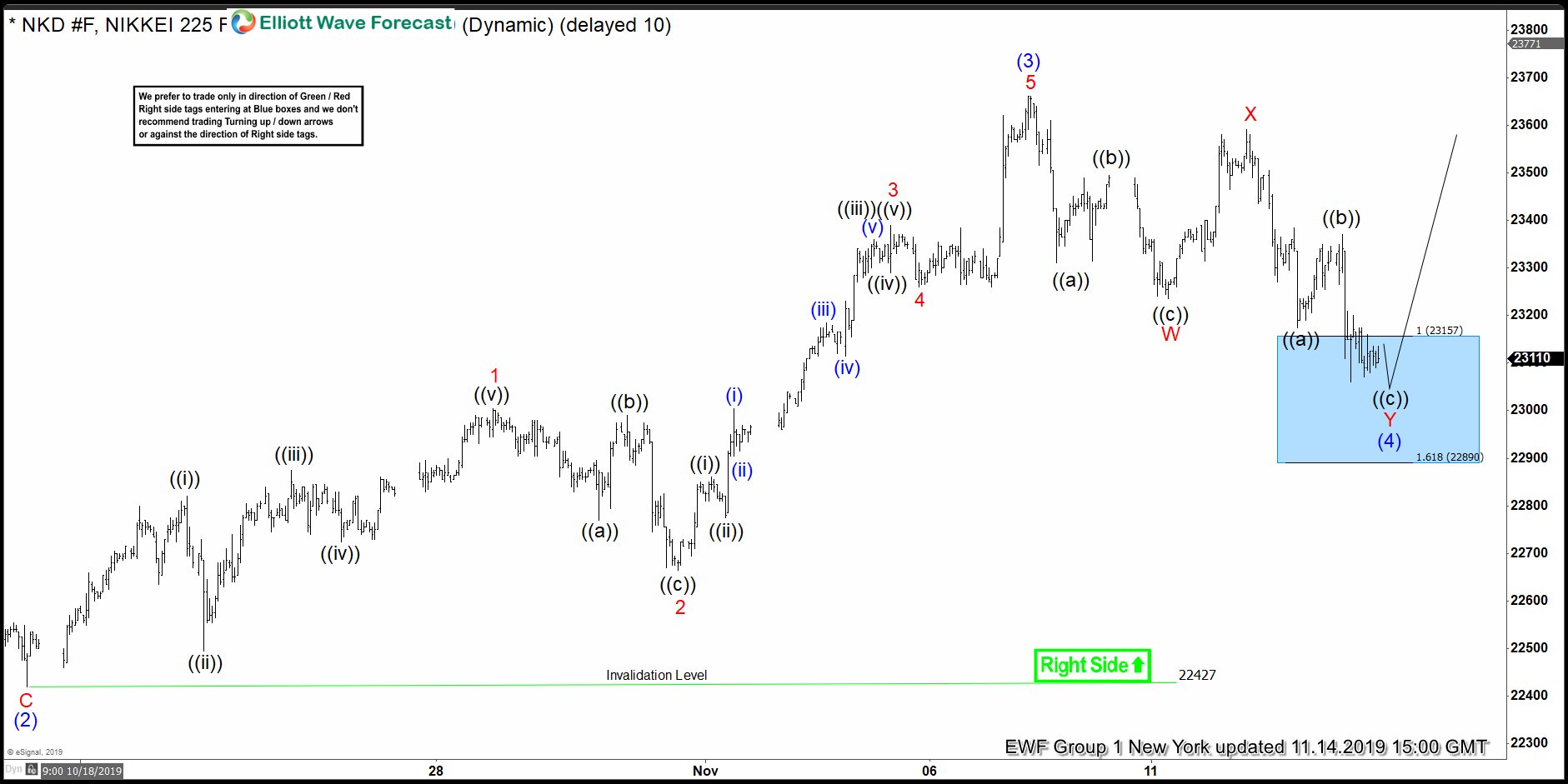

NIKKEI ( $NKD_F ) Made Bounce From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in the membership area of the elliottwave-forecast . As our members know, NIKKEI ended cycle from the 22427 low as 5 waves structure. We got 3 waves pull back , when the price reached Equal Legs […]