The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

JPMorgan Chase (NYSE: JPM) Aiming for New All Time Highs

Read MoreJPMorgan Chase (NYSE: JPM) is the largest bank in the United State. It is a multinational banking and financial service provider that was formed as a result of a merger of several banking companies in 1996. The Banking sector took its biggest hit during the financial crisis in 2008 as many banks announced bankruptcy and other […]

-

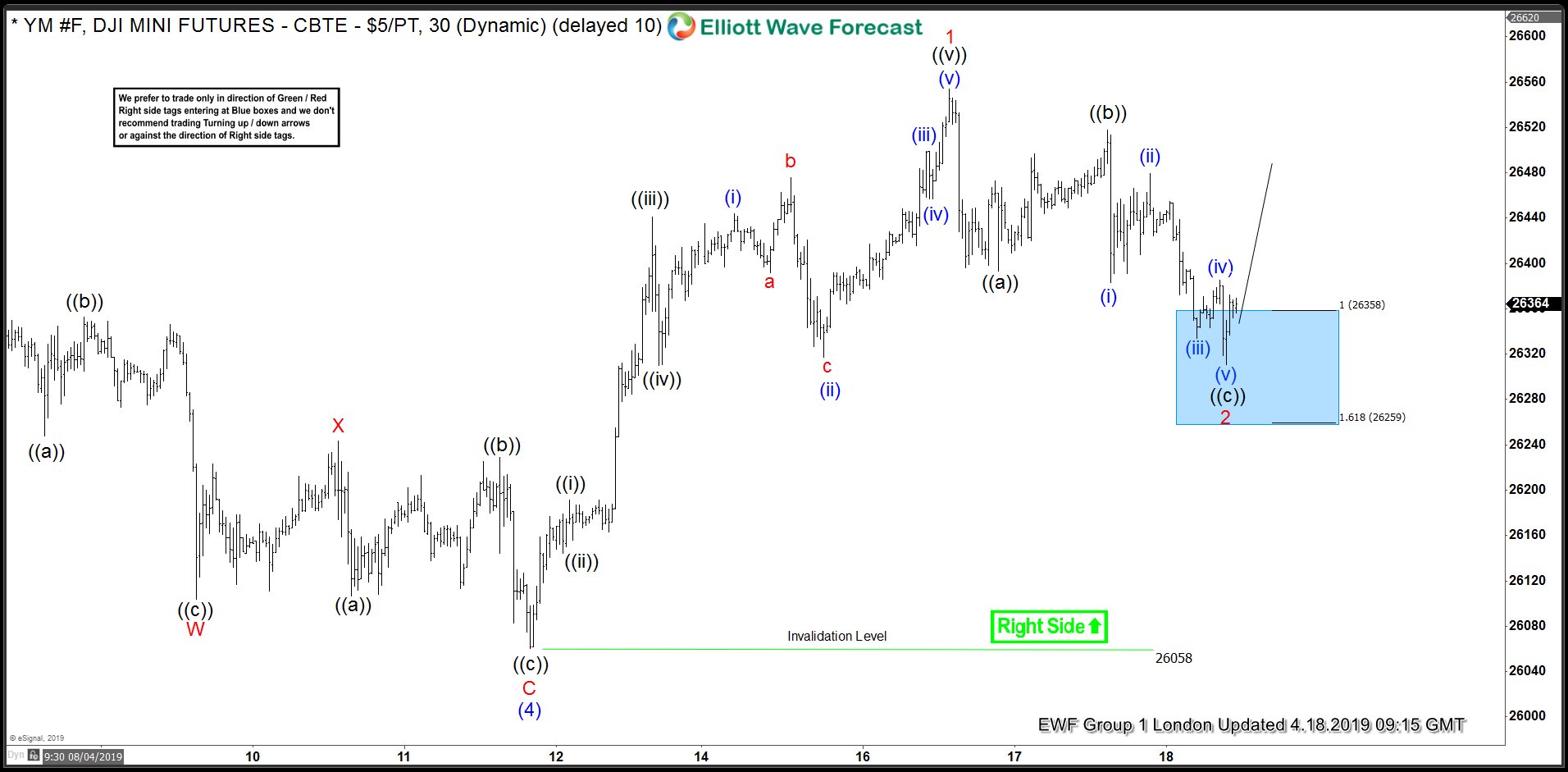

DJI ( $YM_F ) Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DJI Mini Futures ( $YM_F ). As our members know DJI is showing incomplete bullish sequences in the cycle from the December 2018 low . Break of 02/25 peak, has made DJI bullish against the […]

-

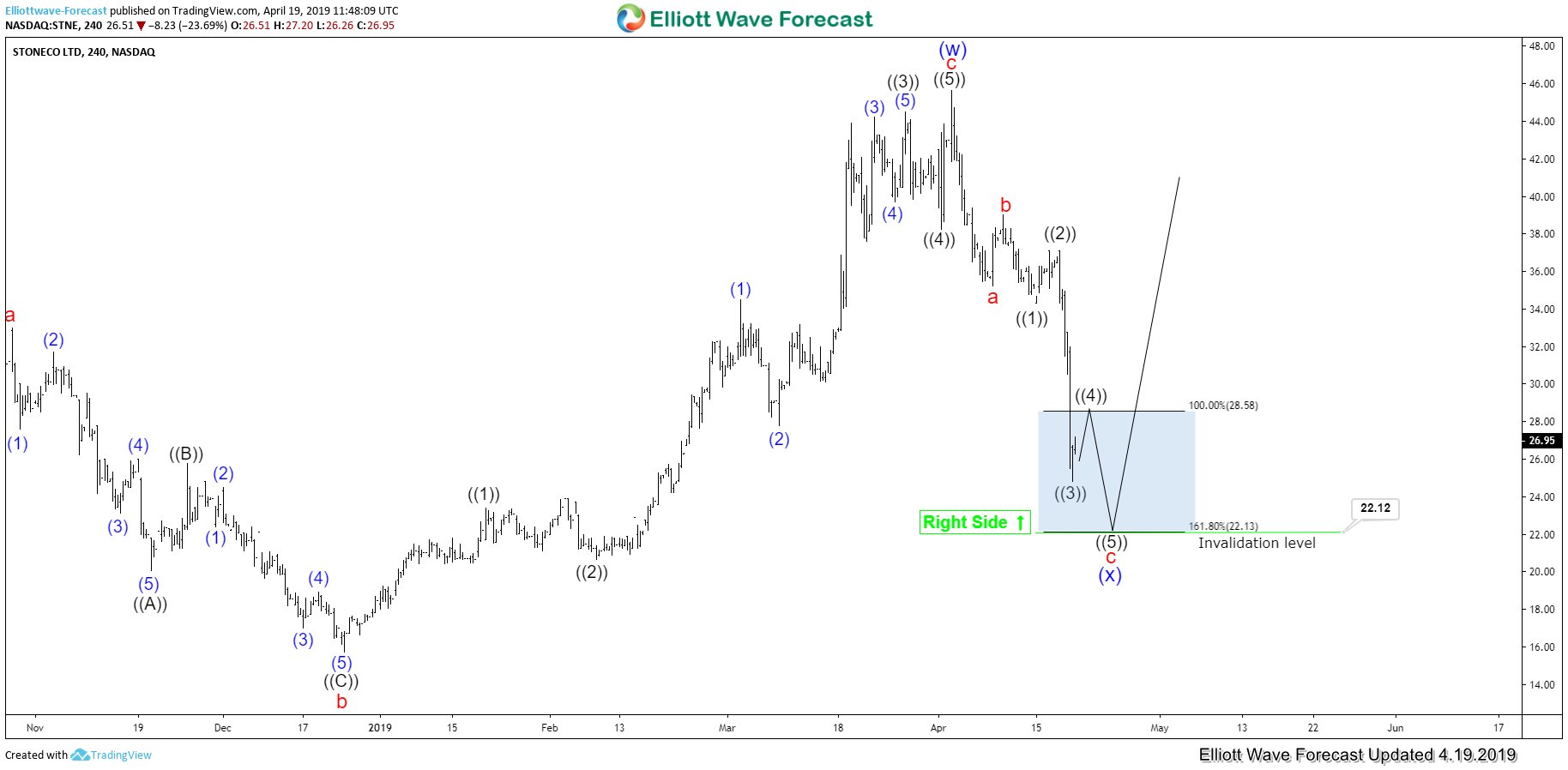

STONECO LTD ( STNE ): Reaching The Elliott Wave Blue Box Area

Read MoreStONECO LTD ticker symbol: STNE is correcting the IPO low cycle as Elliott wave zigzag structure & has managed to reach blue box area

-

The CAC 40 Long Term Swing Count Suggests Bullish Cycles

Read MoreThe CAC 40 Long Term Swing Count Suggests Bullish Cycles Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree […]

-

Intel Corporation (INTC) Bullish Structure Favors More Upside

Read MoreIntel Corporation (NASDAQ: INTC) is second largest and second highest valued chipmakers in the world. It designs and manufactures microprocessors and platform solutions for the global personal computer and data center markets. Looking at the company’s Fundamental situation, its return on Total Capital is 23.43 and its Return on Invested Capital has reached 20.60%. Its Return […]

-

Elliott Wave View Favors More Upside in BAC

Read MoreBAC shows a bullish sequence from Dec 25, 2018 low. This article and video explains the short term Elliott Wave path for the stock.