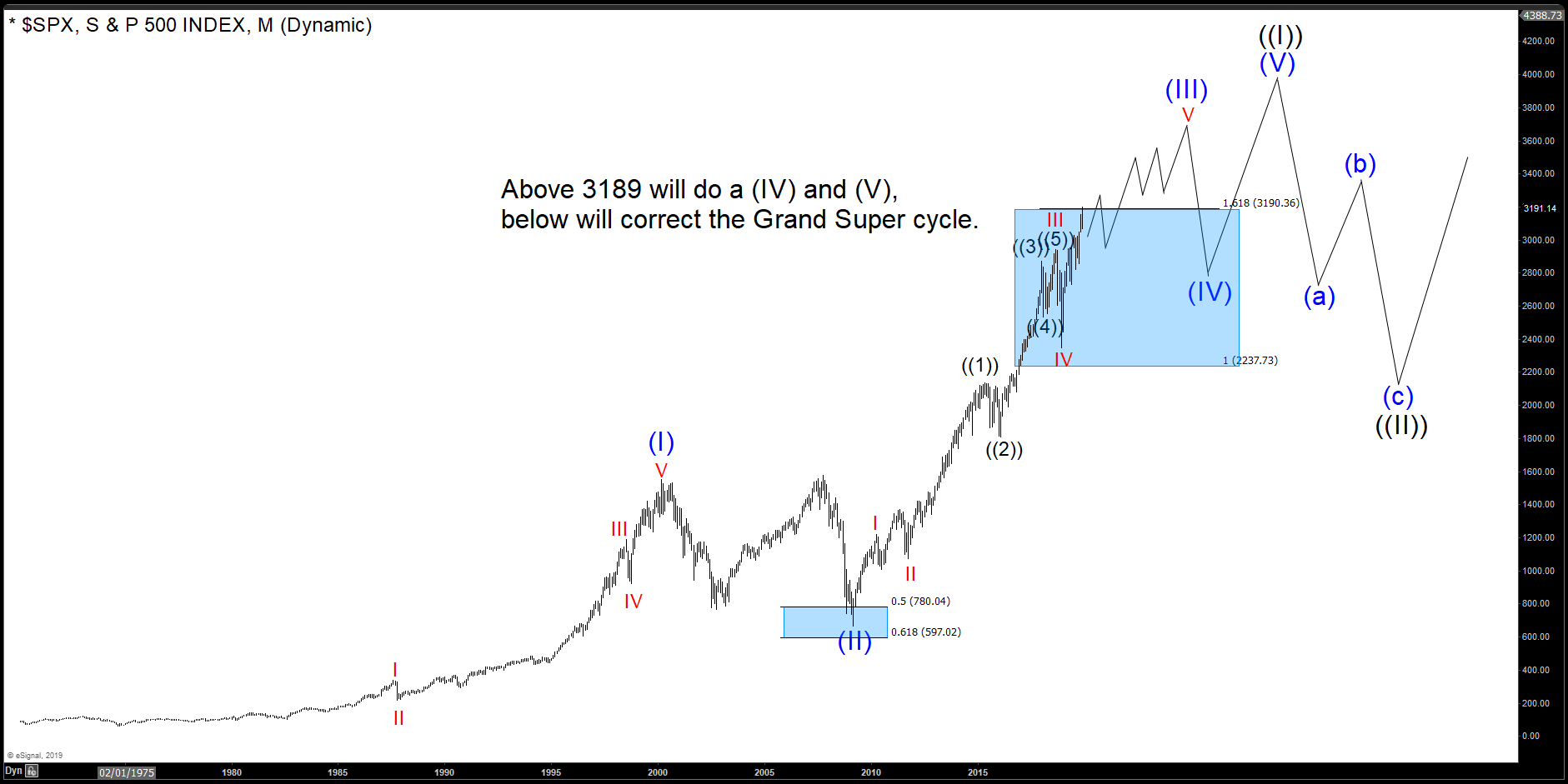

The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

World Indices Up and Running

Read MoreAs we have anticipated and communicated in every opportunity, world indices keep trading into new all-time highs. They should still continue to extend in years to come. It is easy to try picking the tops after the rally since 2009 by looking for completion of five waves and pointing at the momentum divergence. At EWF, […]

-

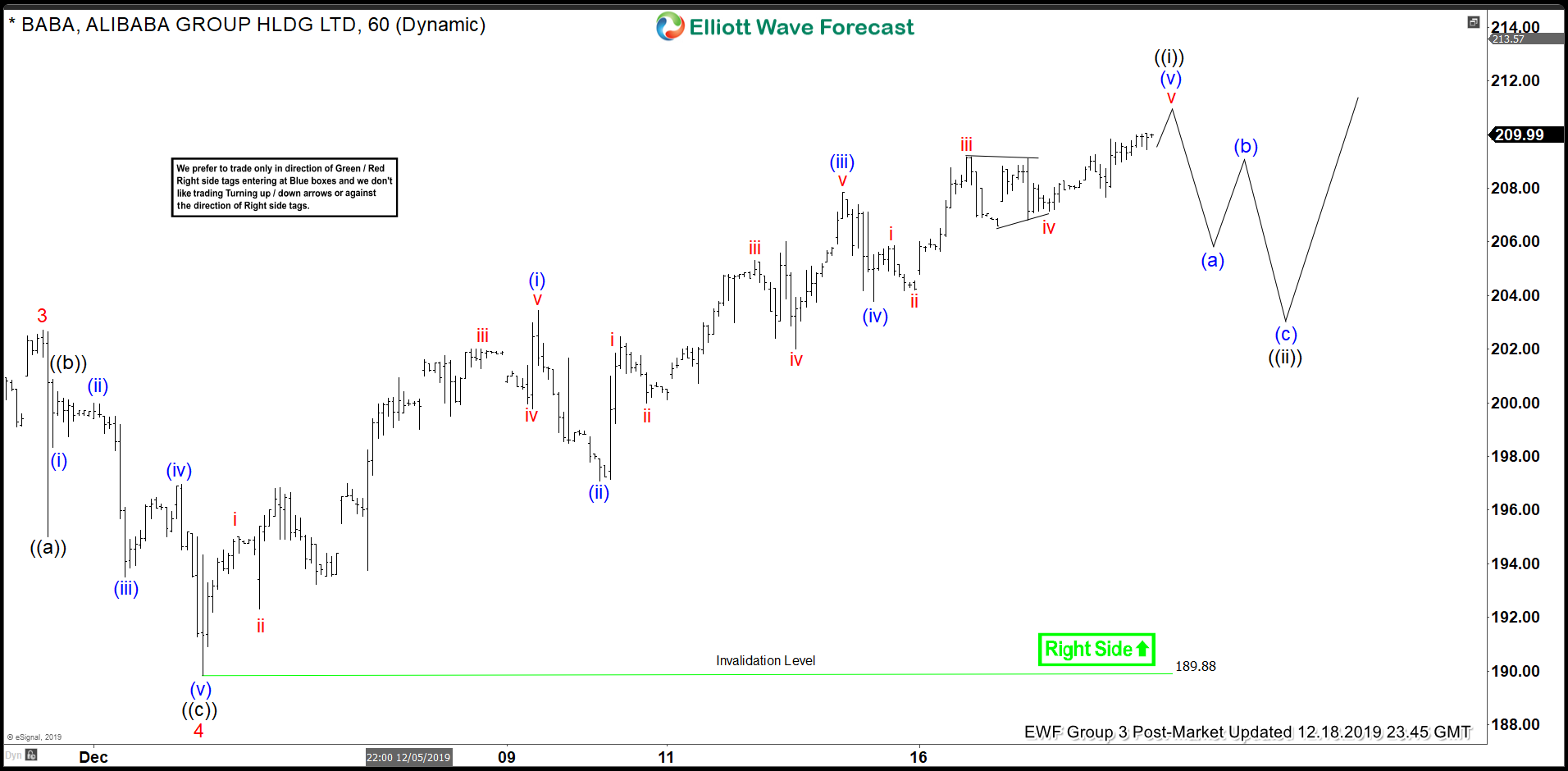

Elliott Wave View: Bullish Outlook in Alibaba

Read MoreElliott Wave view in Alibaba ($BABA) suggests that stock rallies as a 5 waves impulsive Elliott Wave structure from August 5, 2019 low. On the 1 hour chart below, we can see wave 3 of this impulse ended at 202.71. Stock then pullback in wave 4 on December 3, 2019 low at 189.88. Stock has […]

-

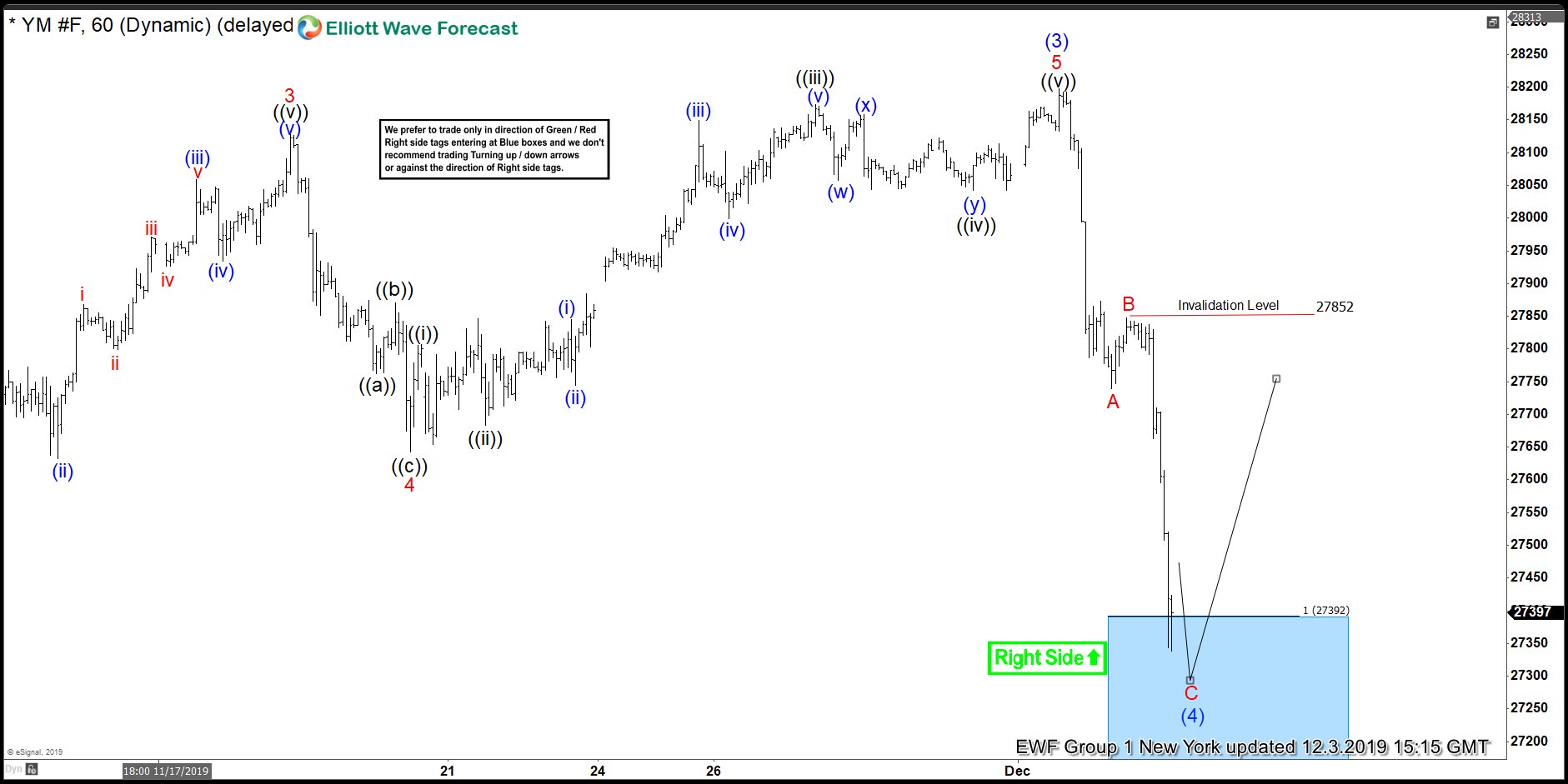

$YM_F ( Dow Futures) Elliott Wave: Forecasting The Rally From Blue Box

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of $YM_F. In which our members took advantage of the blue box areas.

-

Elliott Wave View: DAX Pullback Should Find Buyers

Read MoreElliott Wave view in DAX suggests that Index shows an incomplete bullish sequence from December 27, 2018 low favoring more upside. On the 1 hour chart below, we can see the rally to 13374.27 ended wave 3 and the pullback to 12890.56 on December 10, 2019 low ended wave 4. The Index has resumed higher […]

-

FXE Longer Term Cycles and Elliott Wave

Read MoreFXE Longer Term Cycles and Elliott Wave Firstly as seen on the weekly chart shown below the instrument made a high in April 2008. There is data back to December 2005 in the ETF fund. Data correlated in the EURUSD foreign exchange pair suggests the high in April 2008 was the end of a cycle up […]

-

Elliott Wave View: Nikkei Should Extend Higher

Read MoreElliott Wave view in Nikkei (NKD_F) suggests that the Japanese Index ended wave (4) on December 3 at 22898. This is part of a bigger impulsive 5 waves rally from August 25, 2019 low (not shown on the chart). Up from August 25, 2019 low, wave (1) ended at 21970, wave (2) pullback ended at […]