The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Nike Rally Expected to Fail

Read MoreNike (Ticker: NKE) shows an incomplete sequence from January 22, 2020 high suggesting further downside is likely. The decline from January 22 high is unfolding as a double three Elliott Wave structure where wave ((W)) ended at 85.15 and wave ((X)) ended at 94.98. The stock has resumed lower within wave ((Y)) and the internal […]

-

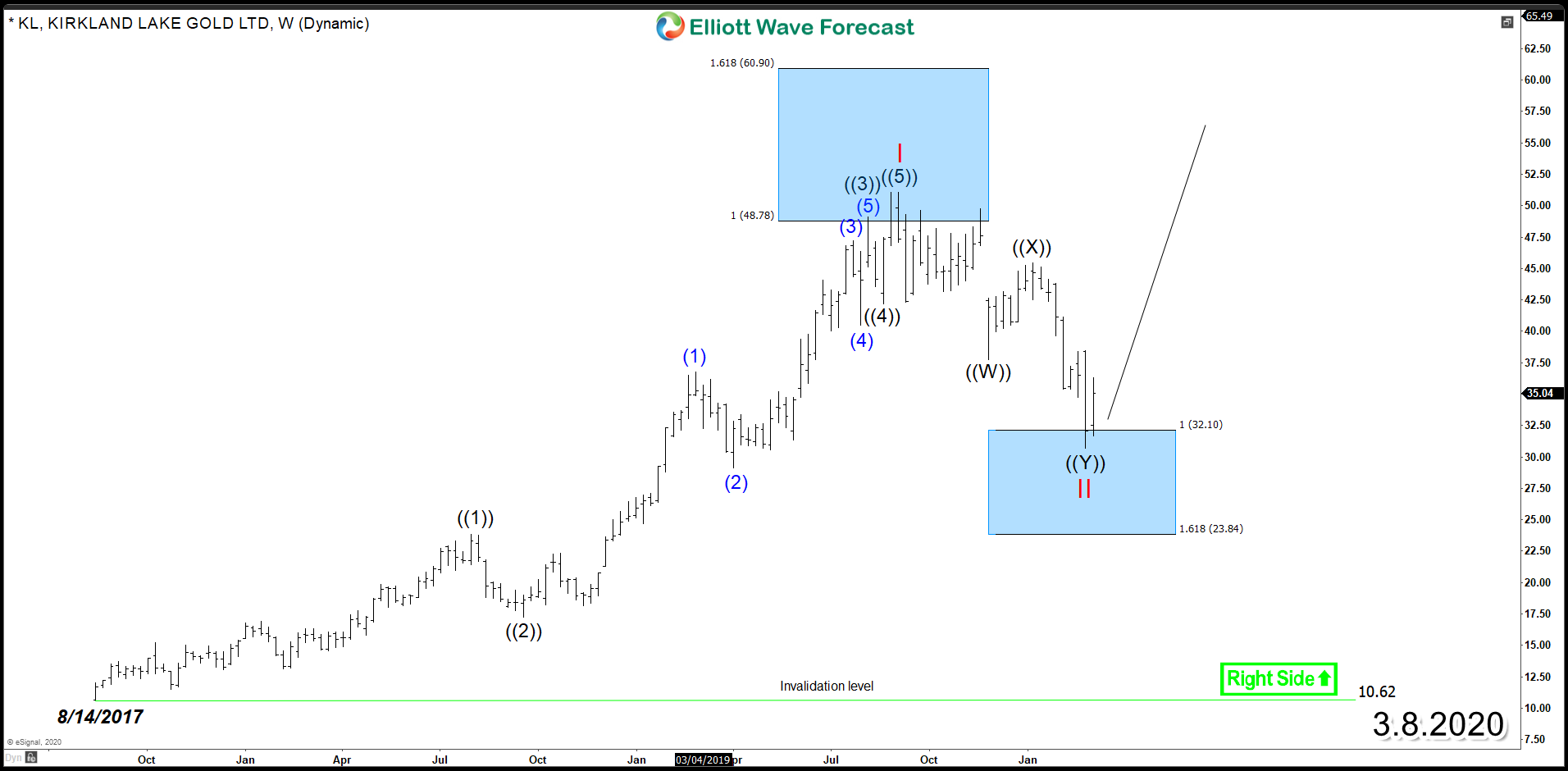

Kirkland Lake Gold Ltd. (NYSE: KL) New All-Time-High in Sight

Read MoreKirkland Lake Gold Ltd. (NYSE: KL) is gold mining growing company with highly productive yet low-cost mining operations in Canada and Australia. Last month, the company reported its revenue in Q4 2019 totaled $412 million, 47% higher than Q4 2018 and an 8% increase from the previous quarter. On a year-over-year basis, both higher gold sales and an increase in gold price contributed to about […]

-

Elliott Wave View: Gilead Sciences ($GILD) Bullish Cycle Heating Up

Read MoreGilead Sciences ($GILD) showing signs that it may be in the beginning stages of new bullish cycle. The Long term chart shows a completed bullish sequence in 5 waves for Blue (I) which topped on June 22/2015 at 123.37. From there a corrective sequence took place for Blue (II) which bottomed on Dec 26/2018 at […]

-

Home Depot (HD) Ending 2008 Cycle, $267 Remains Target

Read MoreThe 2009 cycle is ending across the World Indices. Many Indices show five waves already since the lows, but some have been weak since the previous peak sometimes around 2018. Indices like $FTSE, among others, are reaching the Blue Box area since 2018. The following chart shows the extreme area in $FTSE: FTSE Reaching Extreme […]

-

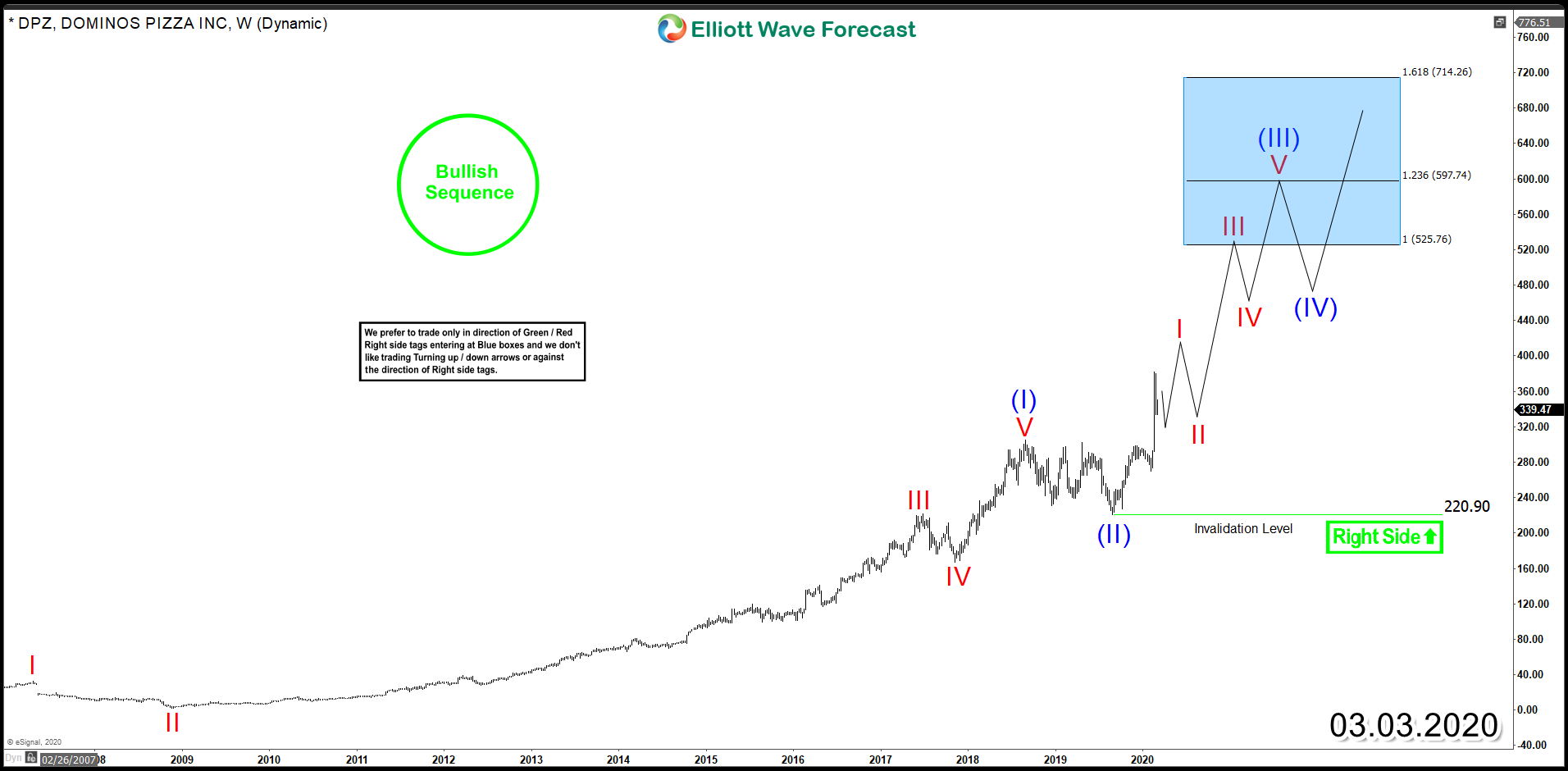

Domino’s Pizza (NYSE: DPZ) Started a New Bullish Cycle

Read MoreDomino’s Pizza (NYSE: DPZ) is an American multinational pizza restaurant chain. Last month, it reported a strong fourth-quarter revenue and earnings per share and also it surprised investors by posting accelerating sales growth at the close of fiscal 2019. Domino’s also said it’s increasing its quarterly dividend by 20%, to $0.78 per share. If we take […]

-

Elliott Wave View: Peloton ($PTON) The Next Leg Up

Read MorePeloton ($PTON) had a very nice run before topping December 2019, and may be ready for the next leg up. The caveat with analyzing companies that have recently gone public is there is not much history to analyze. However, the structure that Peloton has since hitting the all time lows suggests the next bull run […]