The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

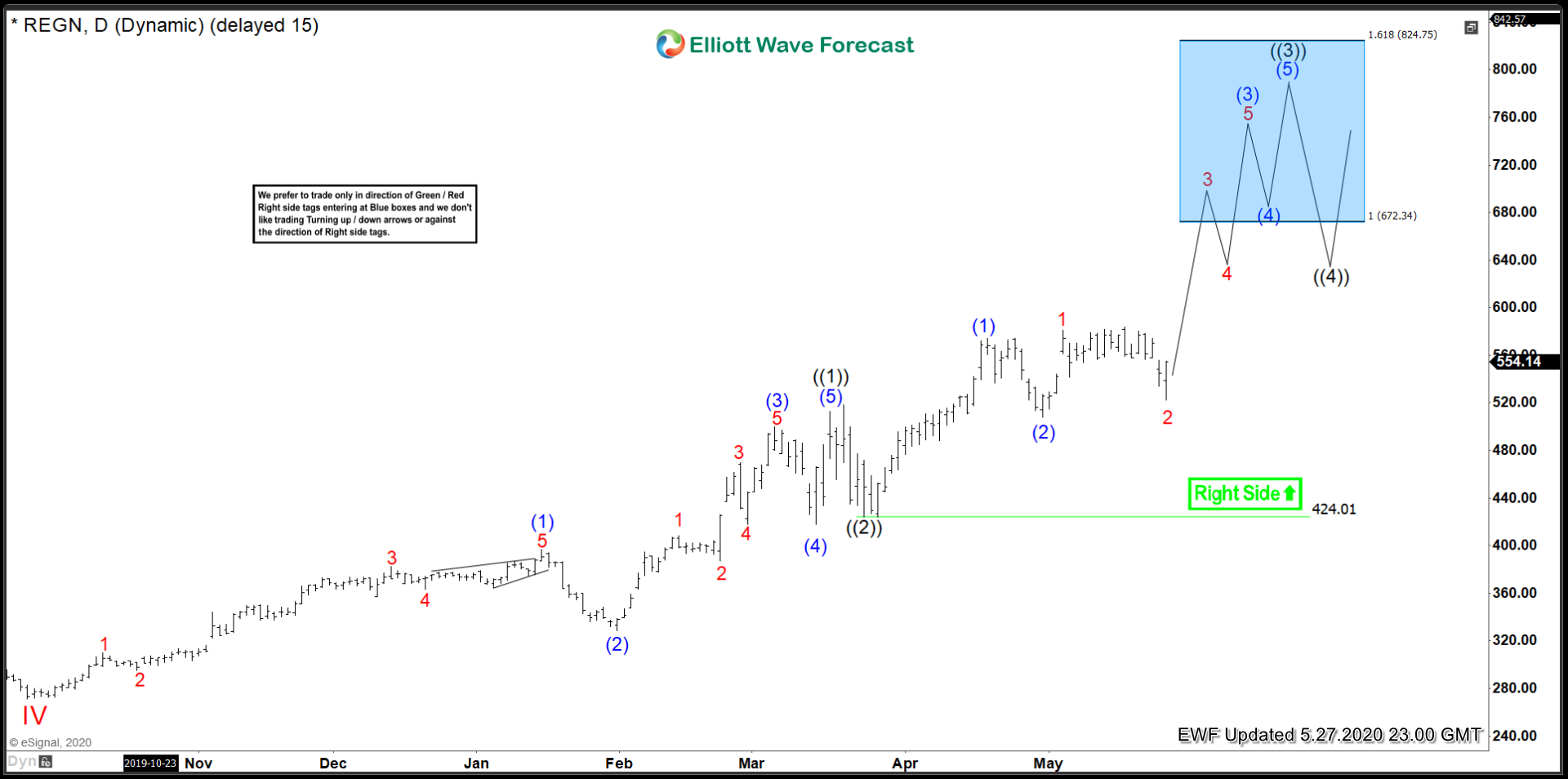

Regeneron Pharmaceuticals Inc ($REGN) More Upside In Store

Read MoreThe next entry in the theme of Corona Virus stocks is Regeneron Pharmaceuticals Inc. Regeneron is a Nasdaq-100 component, and has been one of the blue chips of Biotech for some time. However, the outbreak has really given Regeneron the boost it needs to break out and continue its long term trend. It remains very […]

-

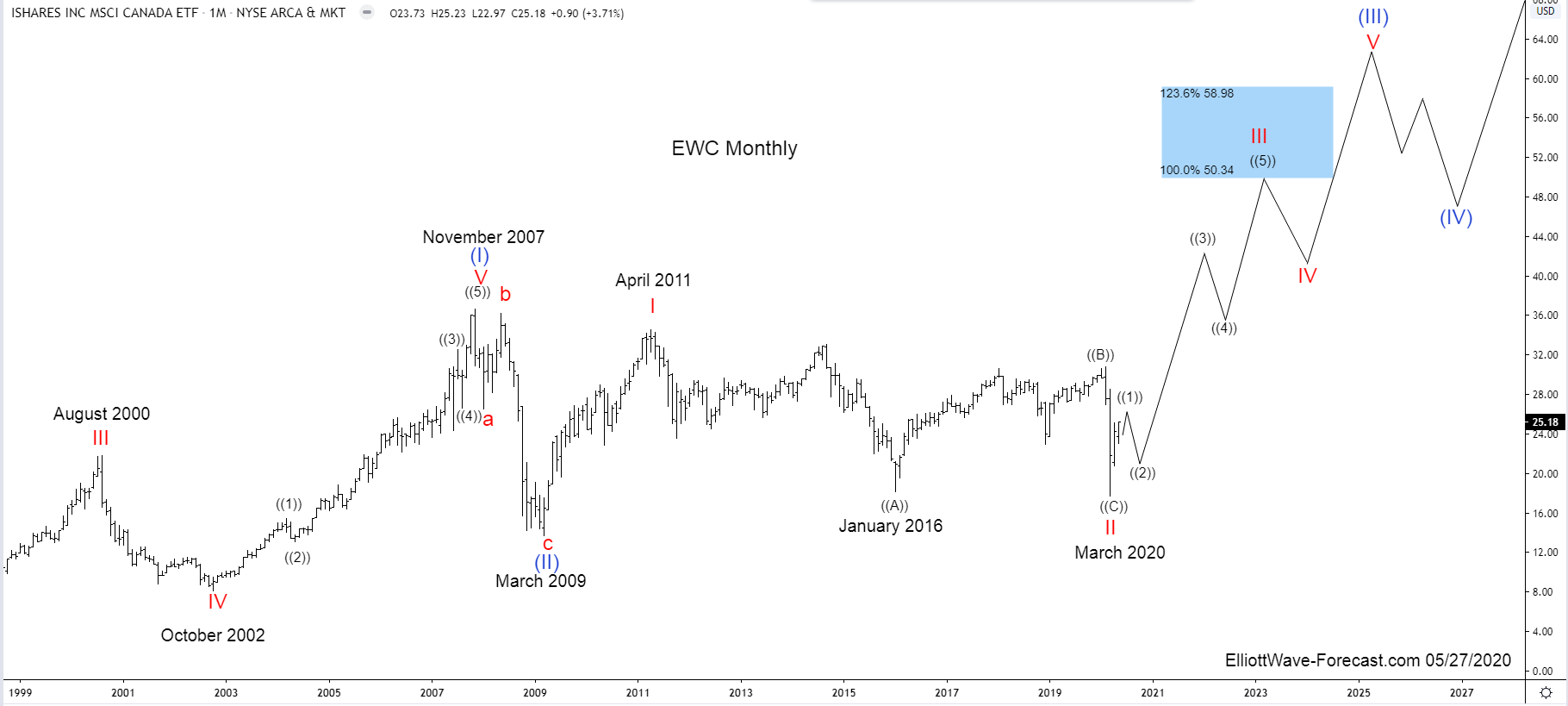

$EWC iShares MSCI Canada ETF Elliott Wave & Long Term Cycles

Read More$EWC iShares MSCI Canada ETF Elliott Wave & Long Term Cycles Firstly the EWC instrument inception date was 3/12/1996. The iShares MSCI Canada ETF seeks to track the investment results of an index composed of large and mid-sized companies in Canada. This is of course reflected in the price. The best Elliott Wave reading of the […]

-

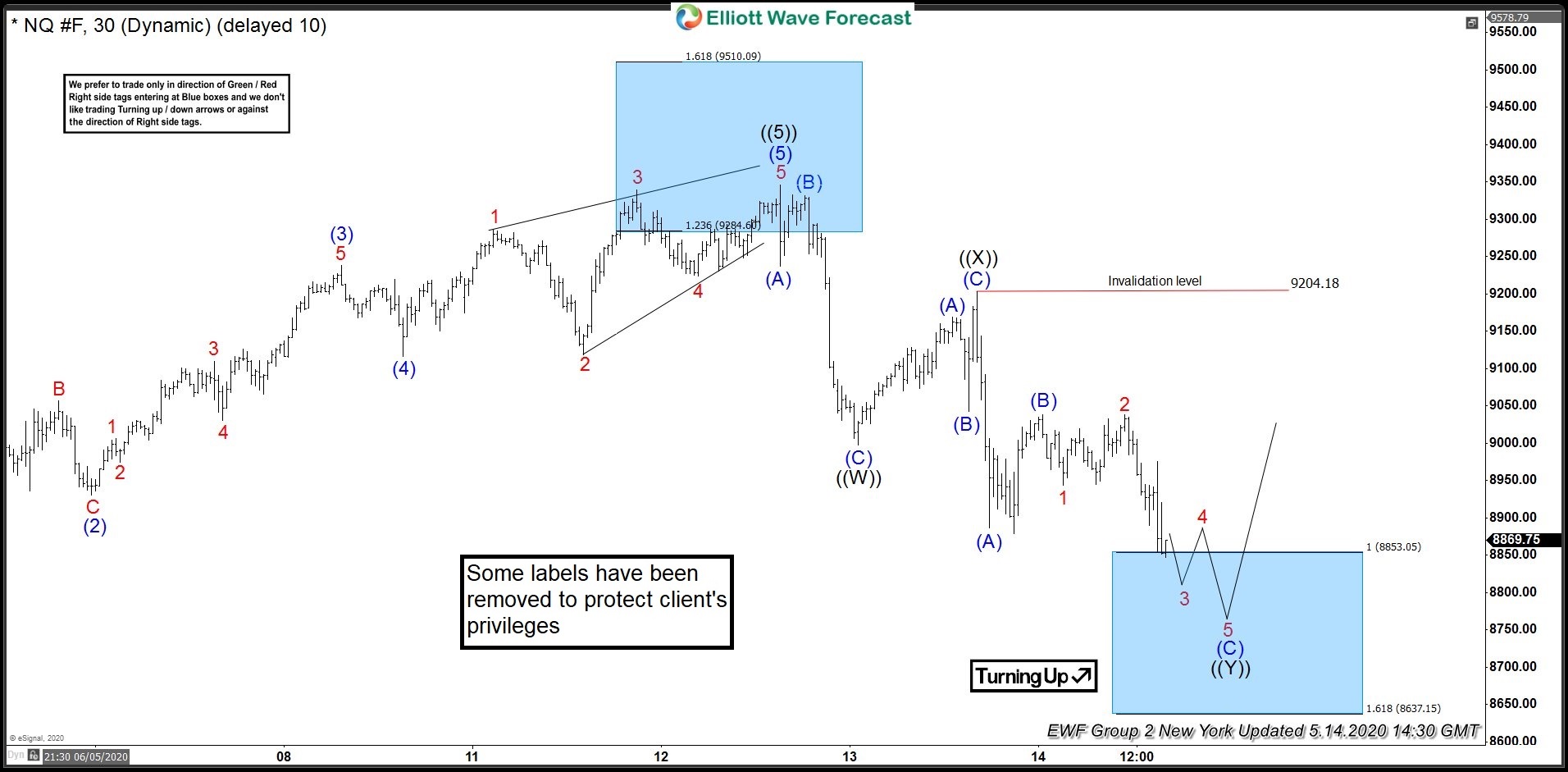

NASDAQ: Reacted Strongly From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of NASDAQ In which our members took advantage of the blue box areas.

-

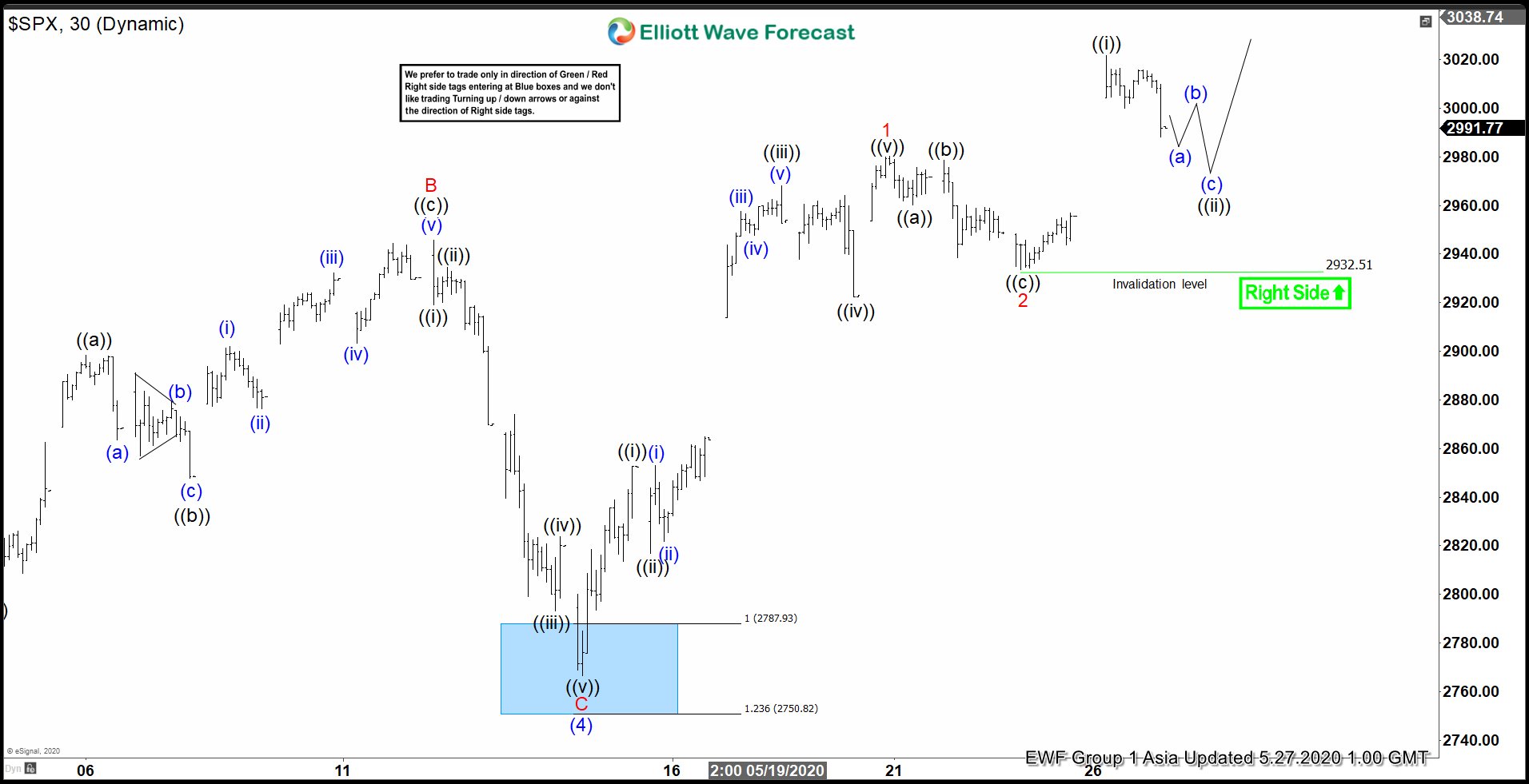

Elliott Wave View: SPX Dips Remain Supported

Read MoreSPX continues to rally as an impulse from March low. Dips should be supported in 3, 7, 11 swing.This article & video look at the Elliott Wave path.

-

Elliott Wave View: Apple Remains Supported

Read MoreApple (AAPL) rally from March 23 low is unfolding as an impulse, favoring more upside. This analysis and video look at the Elliott Wave path.

-

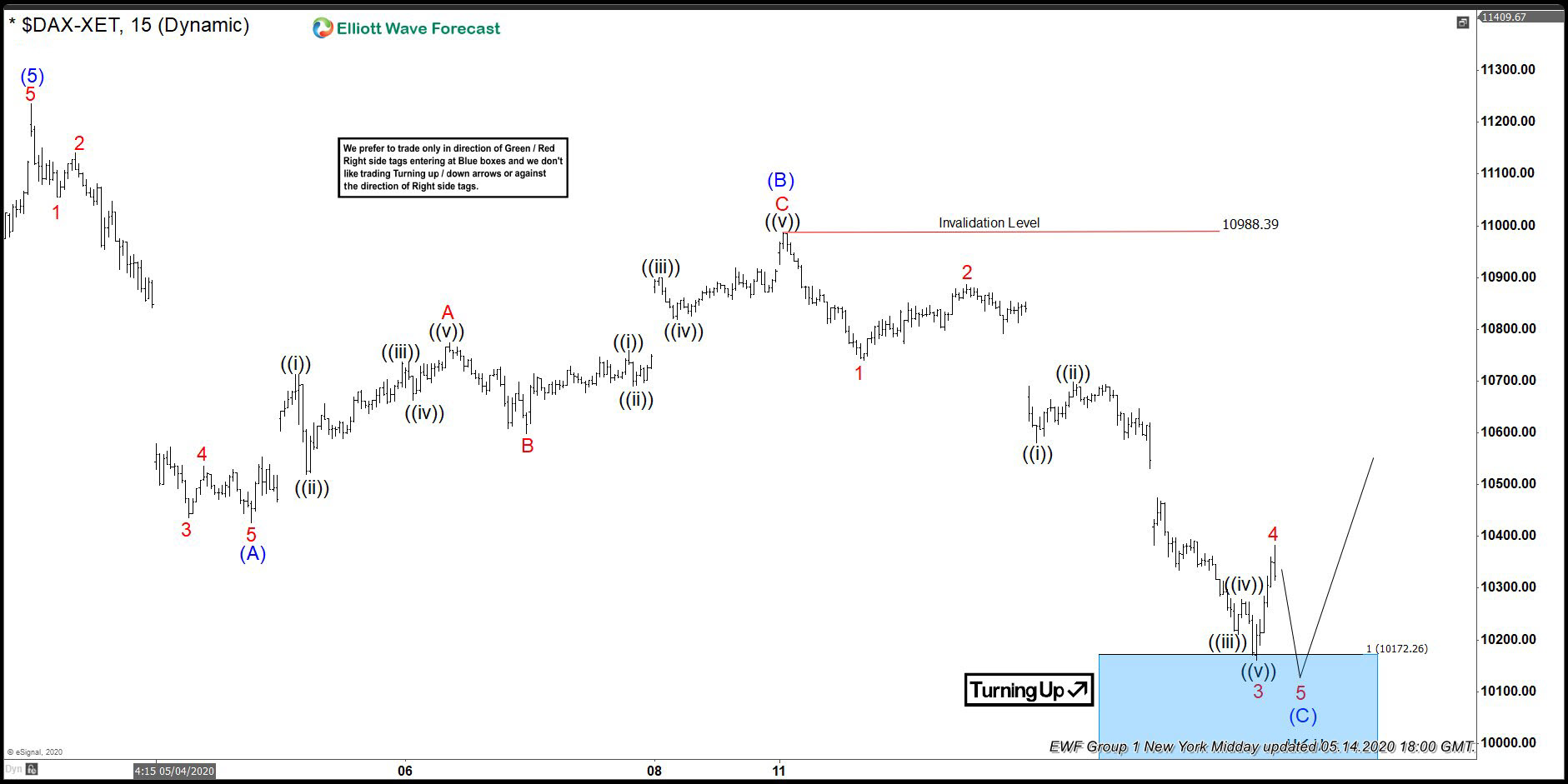

DAX Elliott Wave Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of DAX . As our members know DAX has recently given us pull back against the March 8239.5 low that has unfolded as Elliott Wave Zig Zag Pattern. We were calling cycle from the March low […]