The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

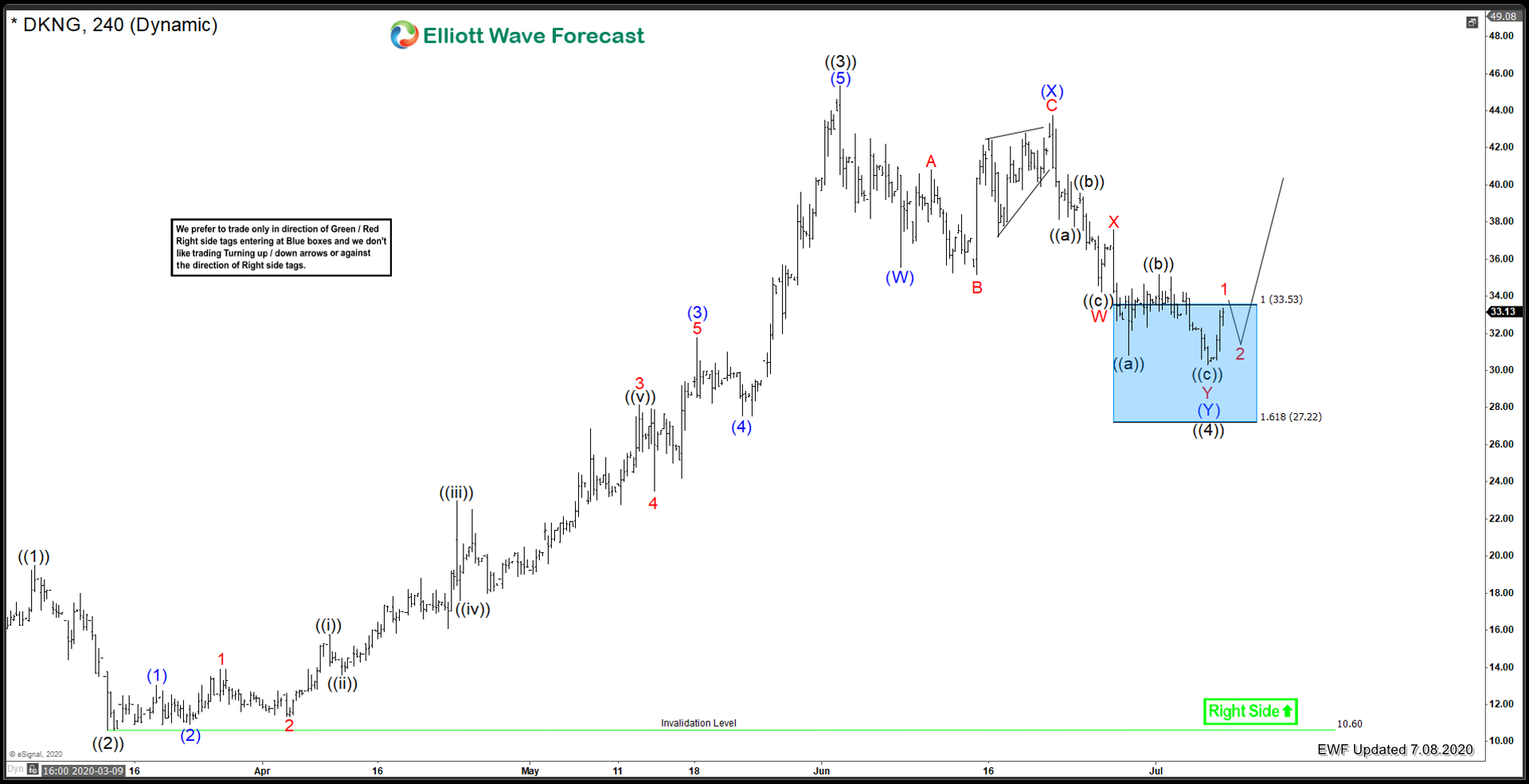

Draftkings Inc. ($DKNG) Room For More Upside

Read MoreThe Corona Virus has had its toll on the marketplace in general. But some select names have remained resilient through the decline, DraftKings is one of those names. Draftkings went public on April 24/2020. The announcement was made in December 2019 of a reverse takeover of an already public company. Prices reacted to that news […]

-

Elliott Wave View: Amazon (AMZN) Dips Should Continue to Find Support

Read MoreAmazon (AMZN) ended the cycle from June 29 low. Alternately, the stock could have ended cycle from March low and is now doing a large degree pullback.

-

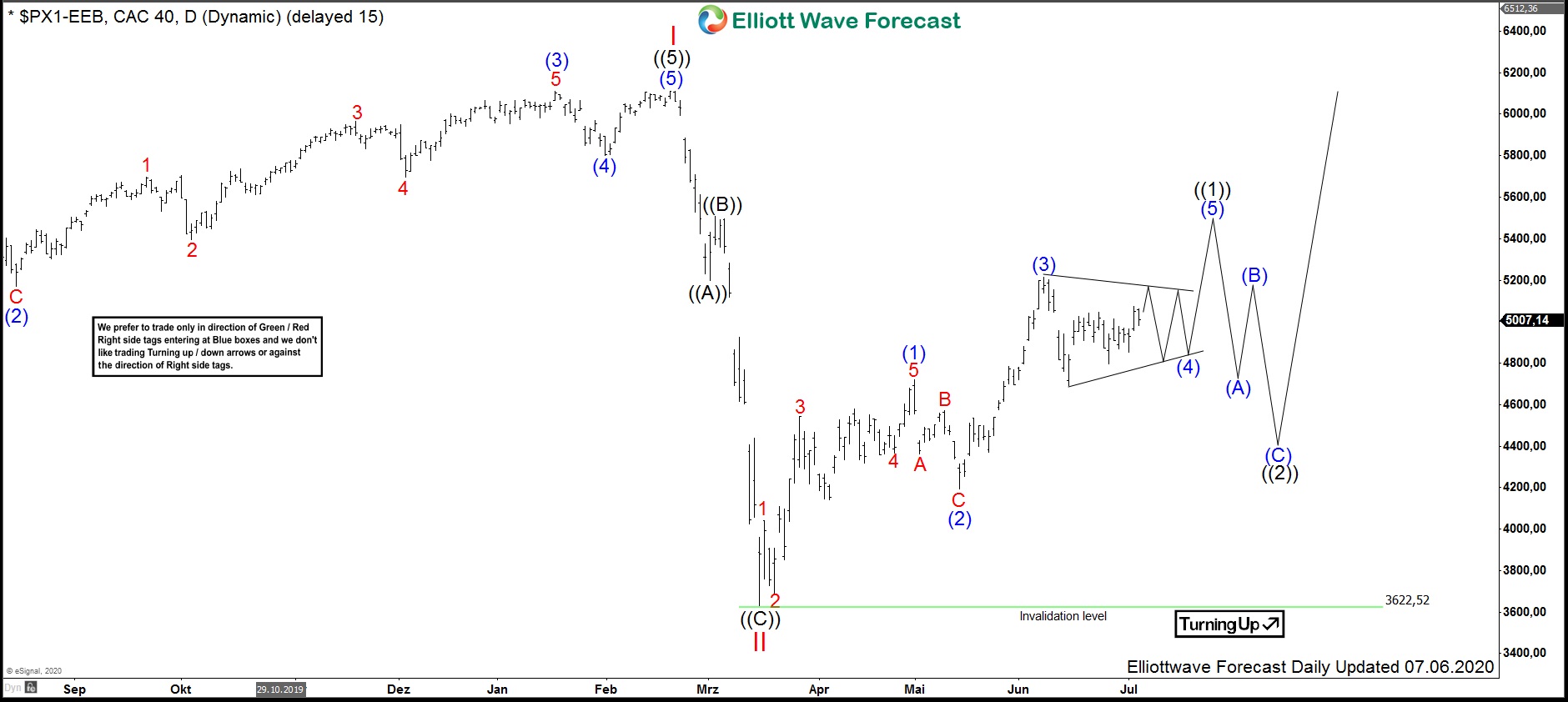

$CAC40 : French Stock Market Index is Looking Higher

Read MoreCAC40 is a French stock market index representing a capitalization-weighted measure of the 40 most significant stocks on the Euronext Paris; the ticker is $PX1. The drop in indices in February-March 2020 which many still relate to COVID-19 events has marked most probably a significant low in world indices. It seems like CAC40 has also found […]

-

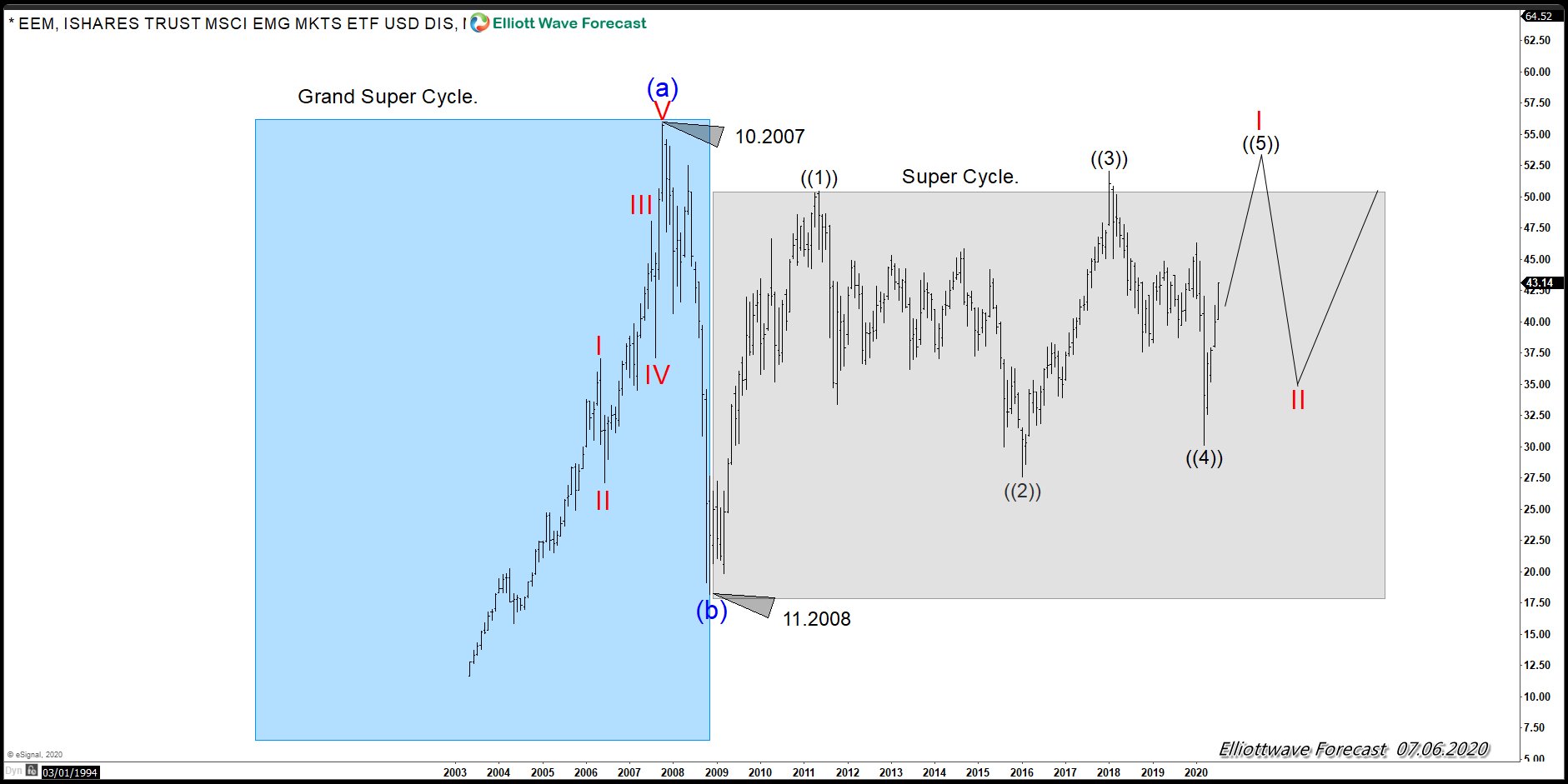

EEM Emerging Markets Getting Ready For A Big Move.

Read MoreEEM (The Emerging Market ETF) could be getting ready for a huge move higher. The ETF has been sideways since the peak in 2007. EEM looks weaker when compared to the rest of the World Indices because of its inability to break above the 2007 highs, whereas almost every indices have already broken above that high. […]

-

$SMH Semiconductors Long Term Cycles & Elliott Wave

Read More$SMH Semiconductors Long Term Cycles & Elliott Wave Firstly as seen on the monthly chart shown below. There is data back to May 2000 in the ETF fund. Data suggests the fund made a low in November 2008. This low has not been taken out in price. The cycles in this instrument tends to reflect the […]

-

Elliott Wave View: SPY Looking to Extend Higher

Read MoreSPY extended higher from June 29 low. While above that low, expect dips in 3,7,11 swings to find support for more upside.