The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

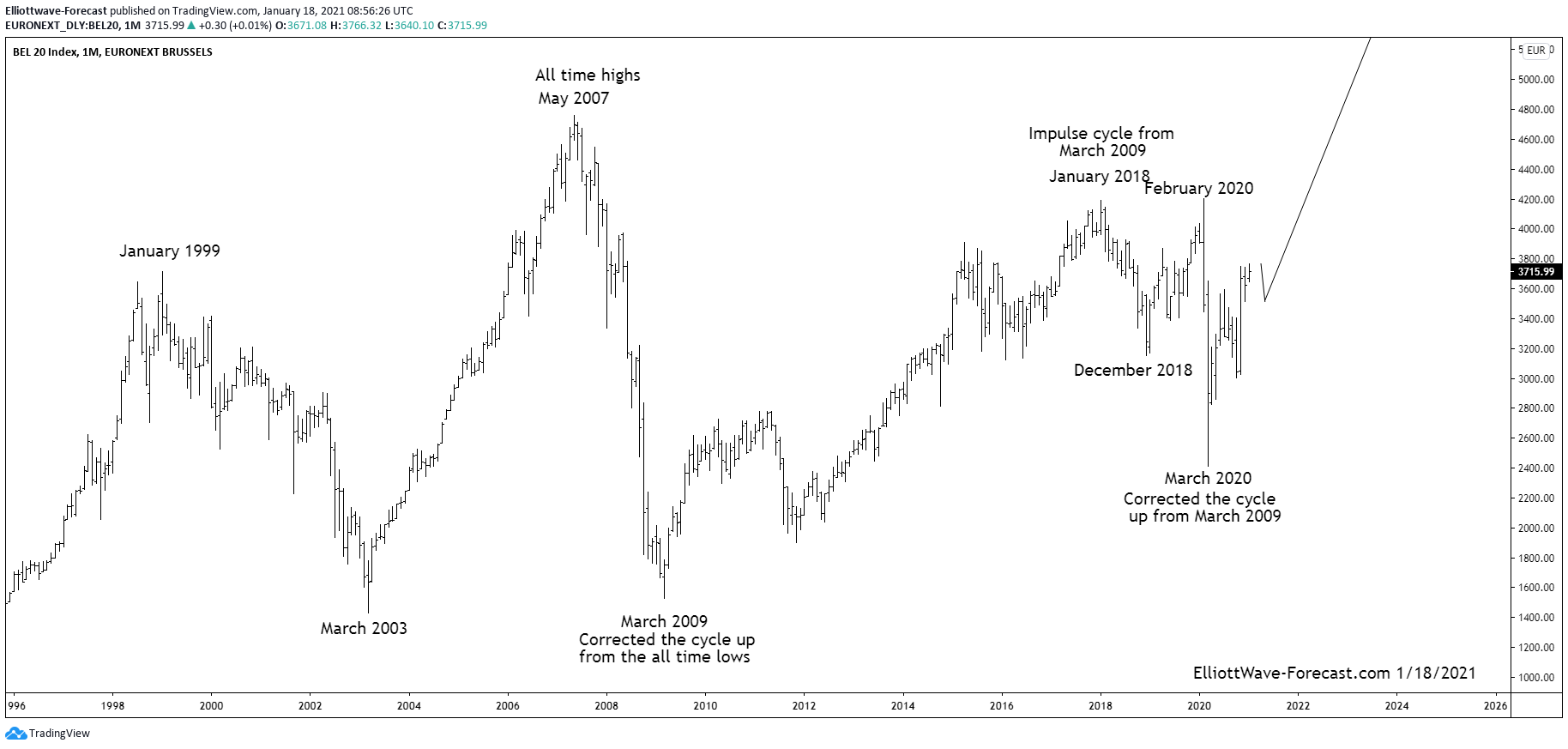

The $BEL20 Index Longer Term Bullish Cycles and Swings

Read MoreThe $BEL20 Index Longer Term Bullish Cycles and Swings Firstly the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other […]

-

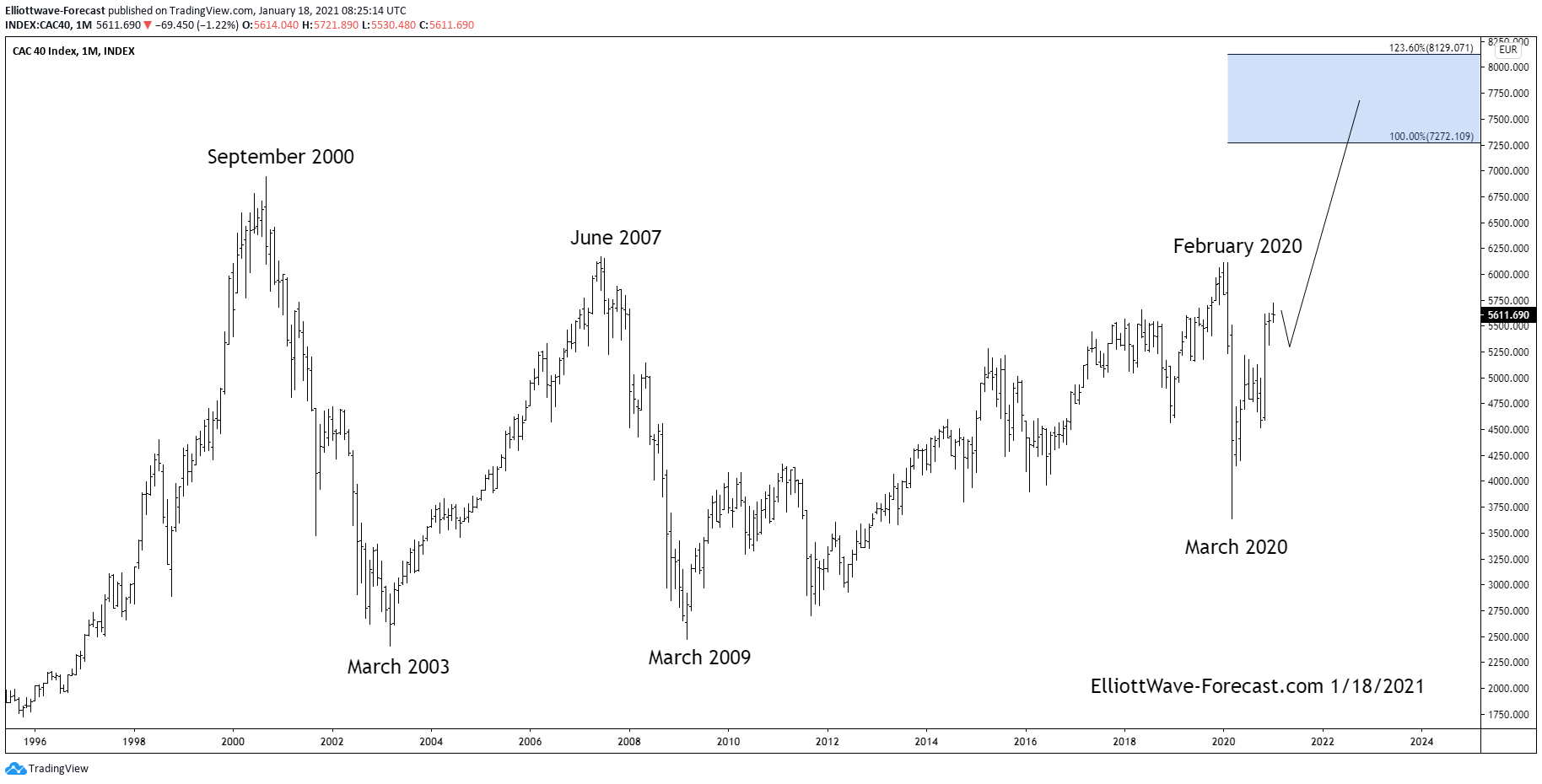

The $CAC40 Longer Term Bullish Swings and Cycles

Read MoreThe $CAC40 Longer Term Bullish Swings and Cycles Firstly the CAC 40 index has been trending higher with other world indices where in September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger degree pullback. From […]

-

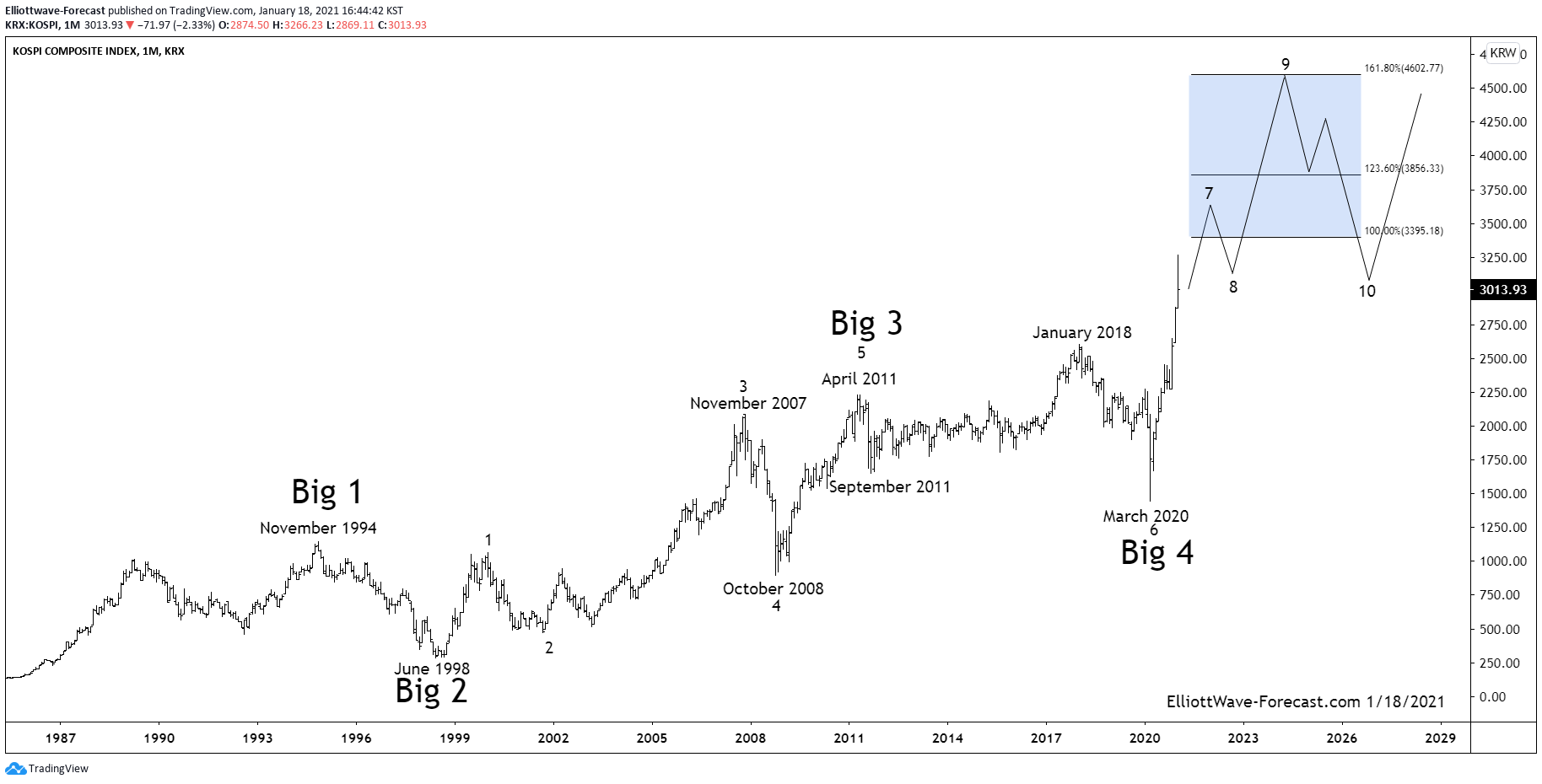

Kospi Longer Term Bullish Sequence & Swing Count

Read MoreKospi Longer Term Bullish Sequence & Swing Count The KOSPI Index in the long term has been trending higher with other world indices since inception in 1983. The index began with a base value set at 100 and trended higher until it ended that cycle in 1994. The index then corrected that cycle with the dip […]

-

$ADS : Adidas Sportswear Stock to Continue Jogging Higher

Read MoreAdidas is a German multinational corporation designing and manufacturing shoes, clothing and accessories. Created in 1934 by Adolf Dassler and headquartered in Herzogenaurach, Germany, the company is the largest sportswear manufacturer in Europe. Adidas is a part of both DAX30 and of SX5E indices. From the all-time lows, Adidas is showing a strong bullish behavior. […]

-

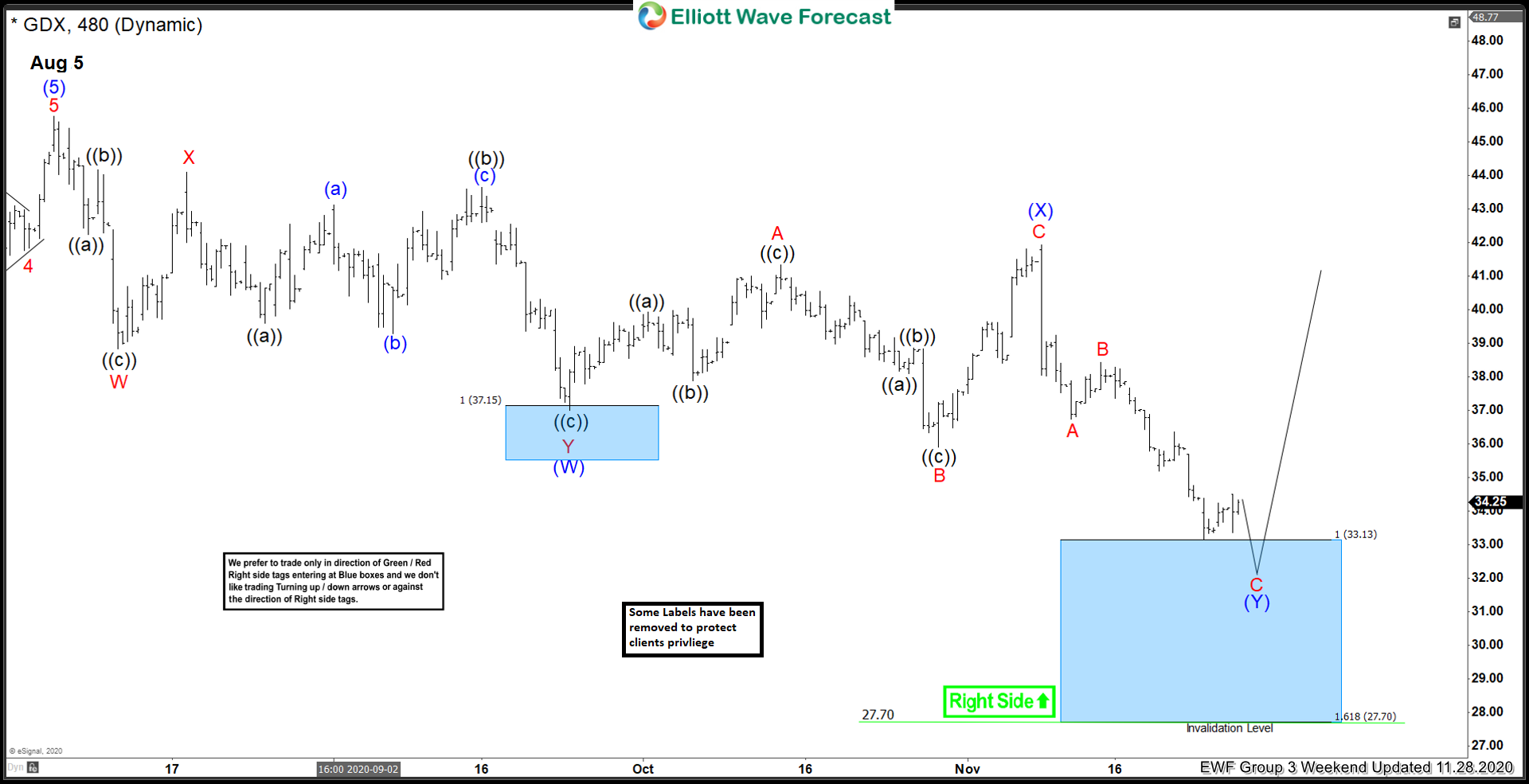

Forecasting The Bounce Higher In GDX From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4 hour Elliott Wave charts of GDX, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Nikkei May Pullback Short Term While Remains Bullish

Read MoreNikkei may end cycle from December low and see a pullback in short term, but trend remains bullish. This article and video look at the Elliottwave path.