The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

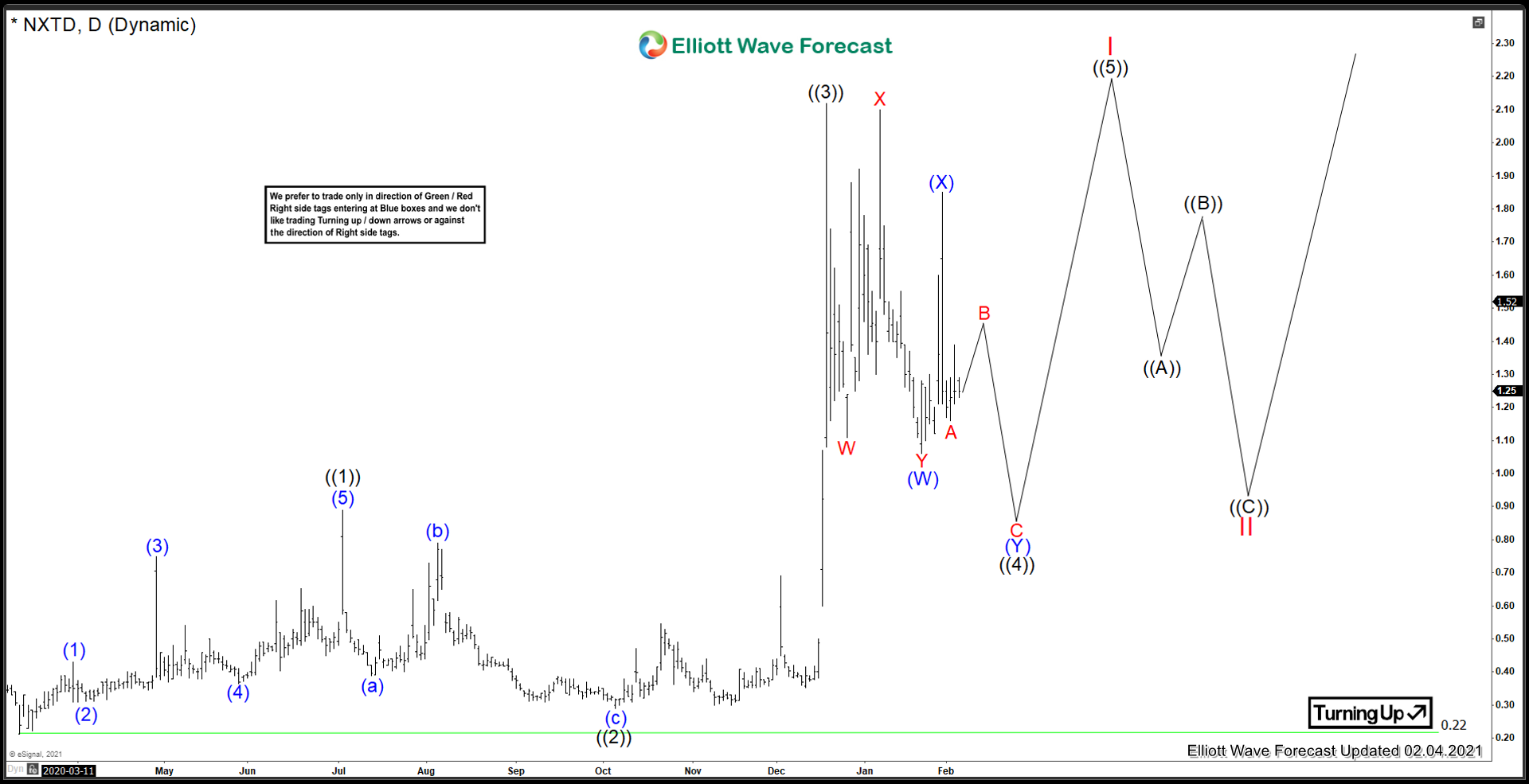

NXT -ID ($NXTD) Close to moving higher

Read MoreWith Bitcoin recently breaking out to new all time highs the Crypto and Blockchain market has reached fever pitch. NXT -ID isn’t your typical crypto stock, but it is in the related field of blockchain. Lets take a look at what the company does: “NXT-ID is a manufacturer and distributor of non-monitored and monitored personal […]

-

Elliott Wave View: Nasdaq All-Time High Imminent?

Read MoreNasdaq is close to making a new all-time high. In this article and video, we look at the short term Elliott Wave path for the Index.

-

Elliott Wave View: Dow Futures Attempting All-Time High

Read MoreDow Futures Attempts to Rally to New All-Time High. In this article and video, we will look at the Elliott Wave path of the Index.

-

BABA Forecasting The Bounce After Double Correction Lower

Read MoreIn this blog, we take a look at the past performance of Daily Elliott Wave charts of BABA, In which our members took advantage of the blue box areas.

-

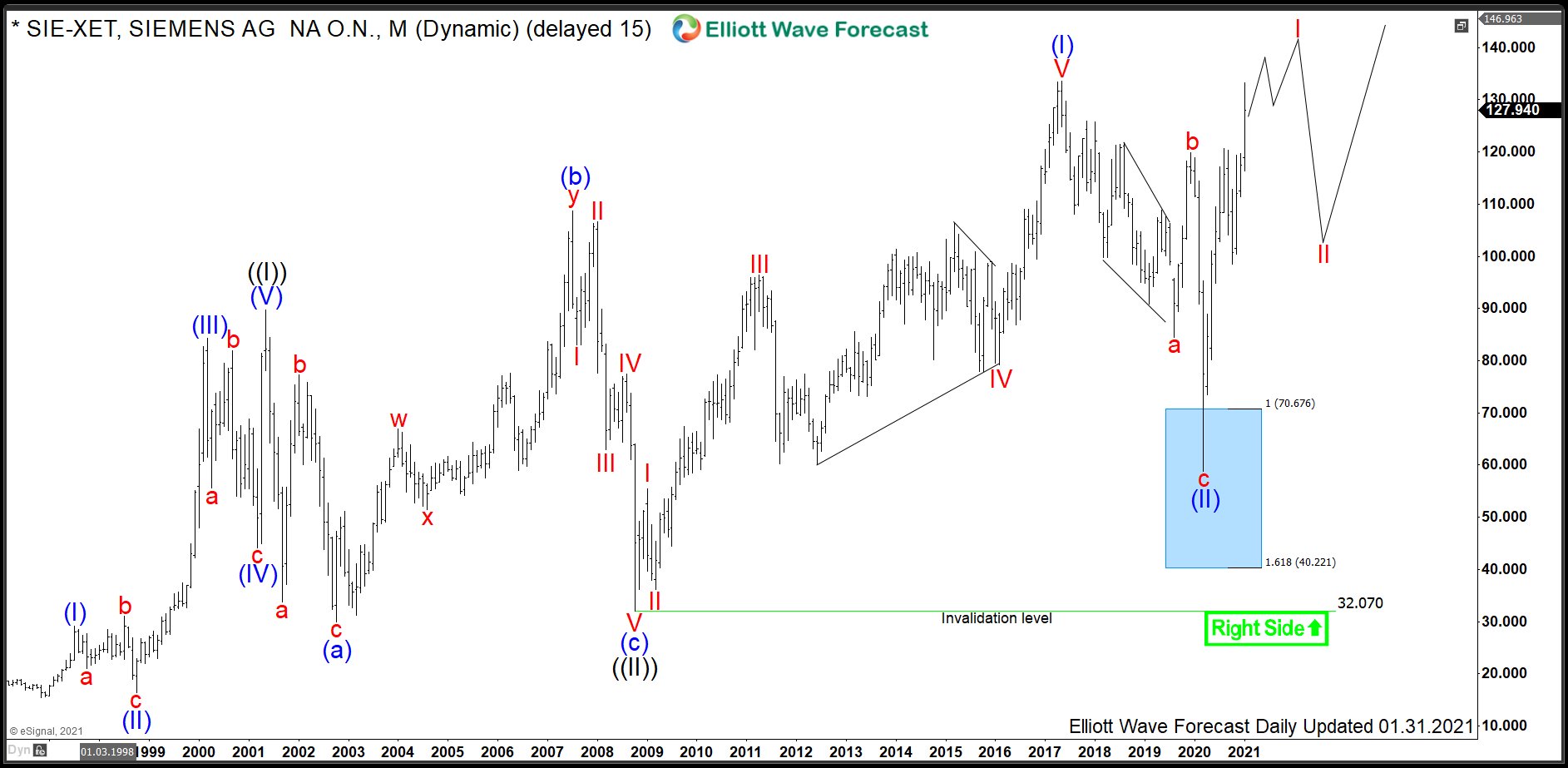

$SIE : Manufacturing Giant Siemens Should Continue Rally

Read MoreSiemens SE is a German multinational conglomerate company and by revenue the largest industrial manufacturing enterprise in Europe. Company’s principal business divisions are Industry, Energy, Healthcare, Infrastructure & Cities. Founded in 1847 and headquartered in Munich, Germany, the company employs approx. 385’ooo people worldwide. Siemens is a part of both DAX30 and of SX5E indices. […]

-

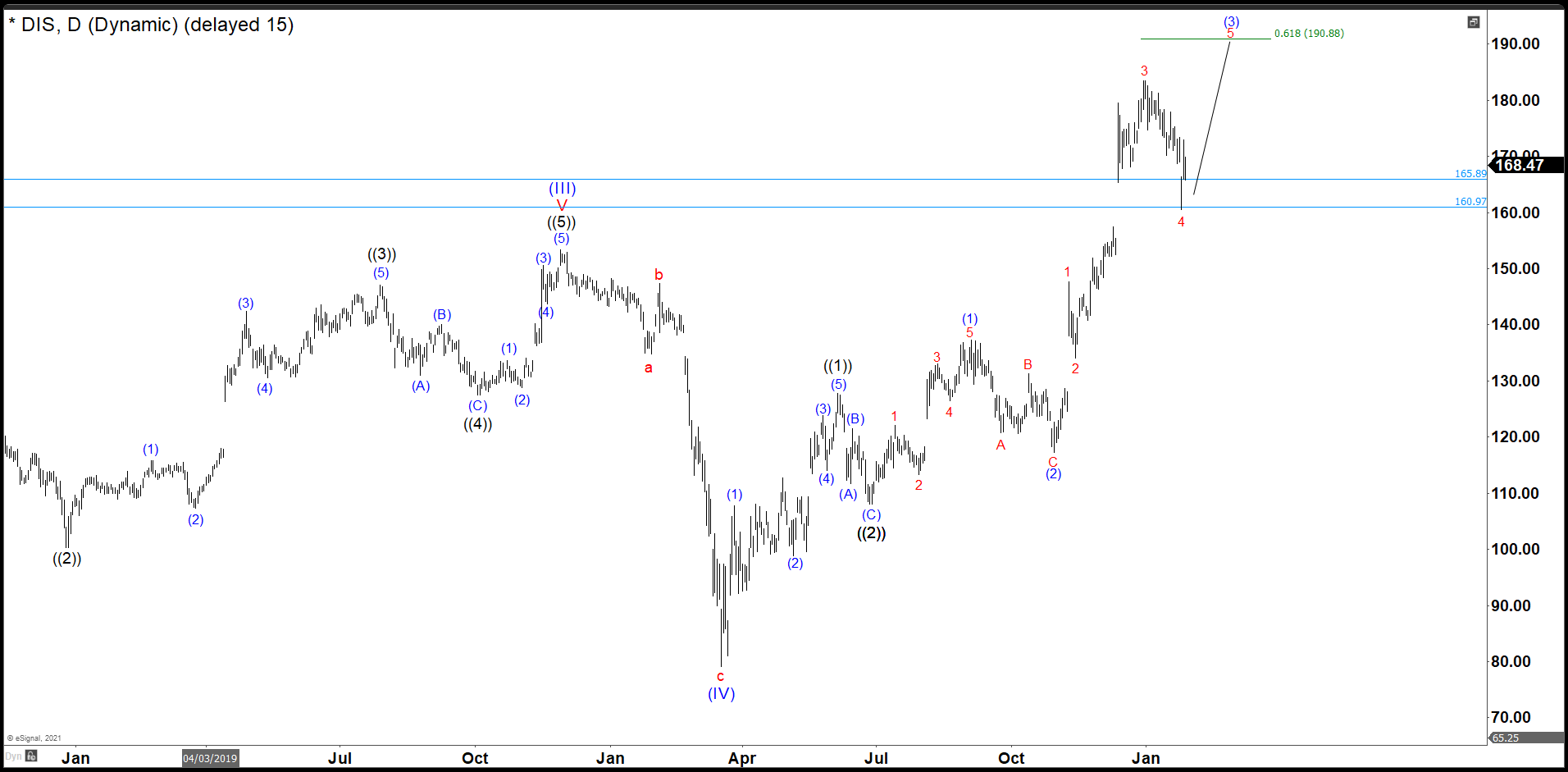

Disney Completed A Wave 4 And We Are Looking For 5 Swings Up

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]