The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Bitfarms ($BFARF $BITF.CA) Looking Higher

Read MoreBitcoin miners have had a great 2021 but can it continue? Bitfarms is one of the worlds largest public bitcoin miners and has an incomplete bullish sequence, lets take a look at the company profile: “Founded in 2017 Bitfarms is one of the one of the largest public bitcoin mining operations in the world. Bitfarms […]

-

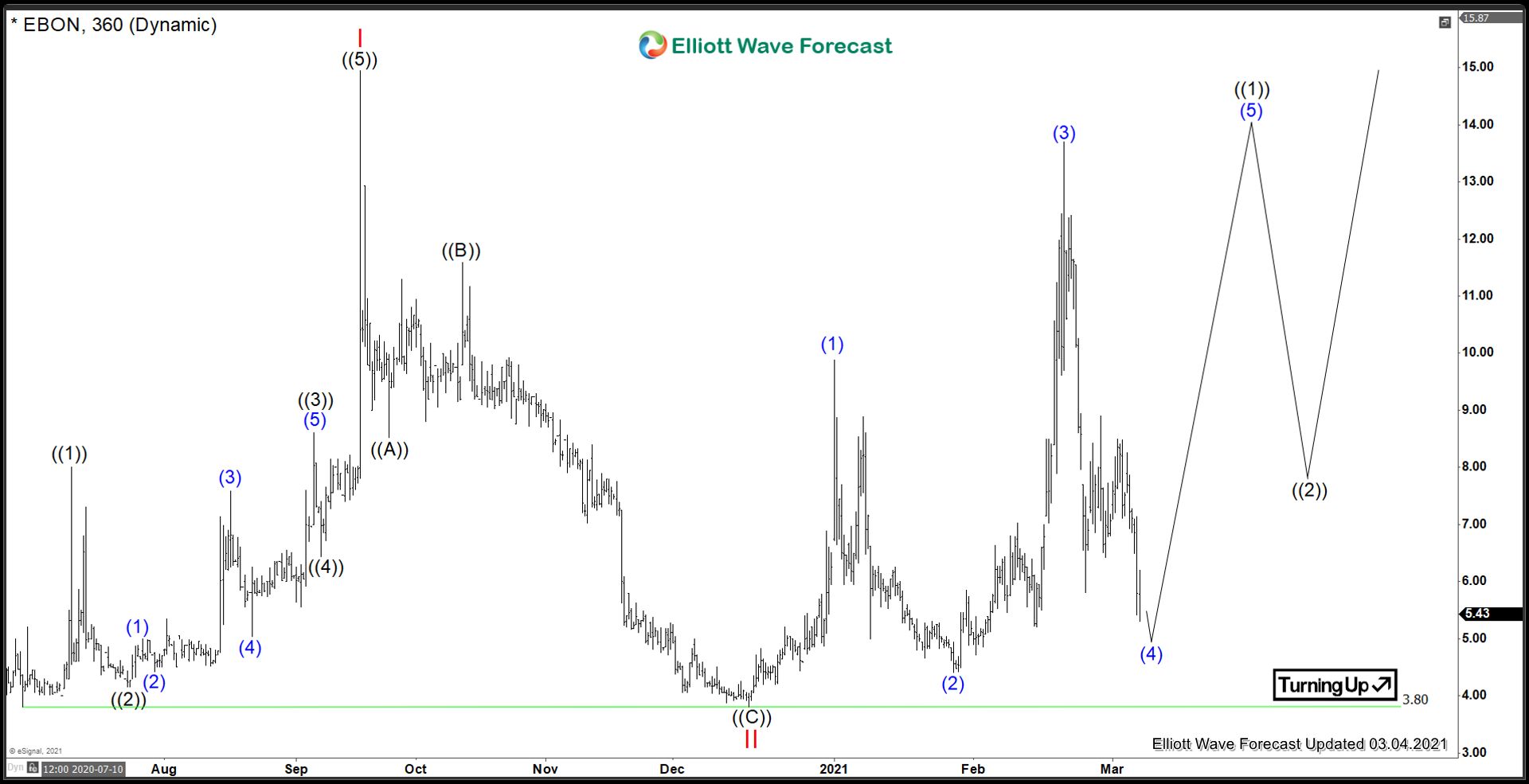

Ebang International Holdings ($EBON) Nesting for higher

Read MoreBitcoin hardware makers are like the picks and shovels of the gold rush in California. Ebang is a shovel maker, in the new Bitcoin era. Ebang has had a nice run so far but is there more in store? lets take alook at the company profile. “Ebang International Holdings Inc. is a blockchain technology company […]

-

GE Elliott Wave Forecasting Buyers At The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of GE In which our members took advantage of the blue box areas.

-

Elliott Wave View: New High in DAX Supports Further Upside

Read MoreDAX has made a new all-time high suggesting the next leg higher has started. This article and video look at the Elliott Wave path.

-

Exxon Mobil (XOM): Forecasting The Elliott Wave Path

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XOM In which our members took advantage of the blue box areas.

-

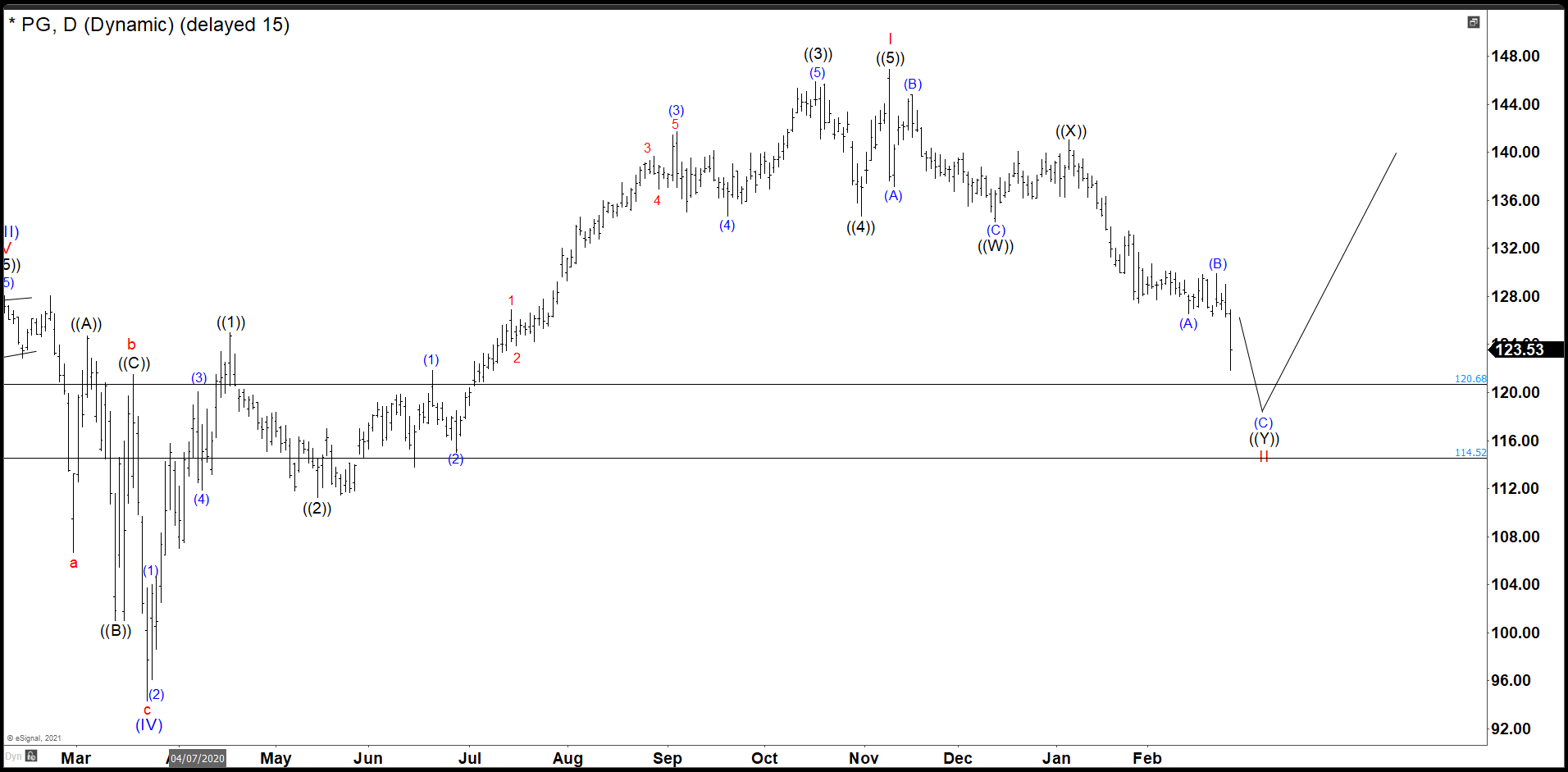

PG Continue Lower As Expected To The Bounce Area

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost and PG was no exception. PG did not only recover the lost, but It also reached historic highs. We are going to try to build an impulse from wave II when it is completed with a target around to $167.14 […]