The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

VivoPower International ($VVPR) Close To Longer Term Low

Read MoreClean and renewable energy goes hand in hand with the EV sector in 2020. VivoPower has its hand in both sectors and has had an explosive move off the March 2020 low. This stock moved from 59 cents to a peak of 24.33 which is about a 4100% move. It would make sense that the […]

-

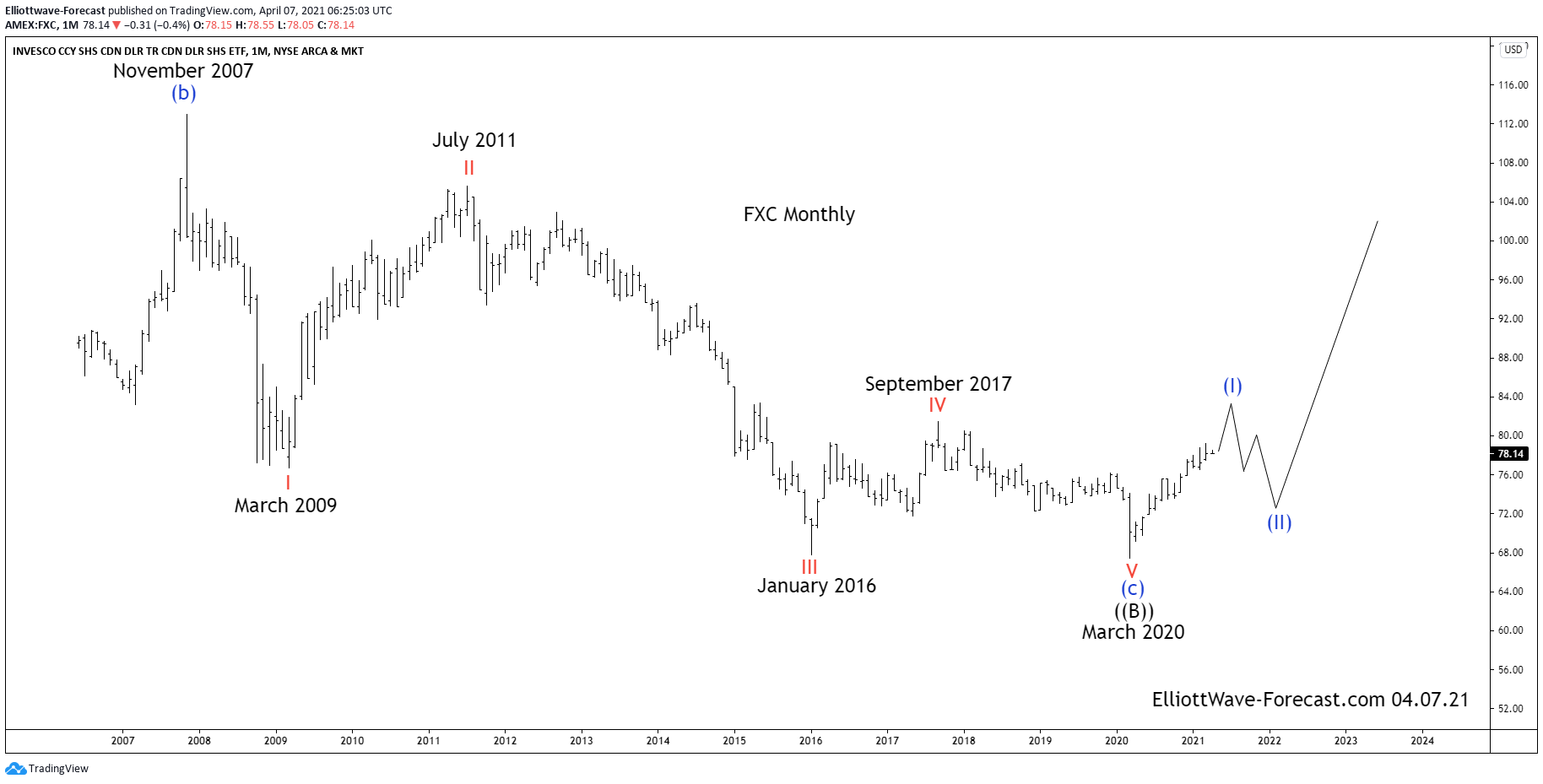

$FXC Canadian Dollar Trust Elliott Wave & Long Term Cycles

Read More$FXC Canadian Dollar Trust Elliott Wave & Long Term Cycles Firstly the FXC instrument inception date was 6/26/2006. The instrument tracks changes of the value of the Canadian dollar relative to the U.S. dollar. It increases in value when the ‘loonie’ strengthens and declines when the dollar appreciates. In January 2002 the USDCAD forex pair made […]

-

NASDAQ Elliott Wave View: Extending Higher In Wave Three

Read MoreNASDAQ is extending higher in wave three. Dips should continue to find support in 3, 7, or 11 swings. This article & video look at the Elliott Wave path.

-

$FXA Longer Term Cycles and Elliott Wave Analysis

Read More$FXA Longer Term Cycles and Elliott Wave Analysis The FXA ETF fund is the Australian dollar tracking fund that has an inception Date of 06/21/2006. With that said the fund mainly reflects the currency spot price of the AUDUSD forex pair. The data available from the Reserve Bank of Australia at their website suggests the spot […]

-

BABA Finds Sellers In The Blue Box And Reacts Lower

Read MoreIn this blog, we take a look at BABA’s almost perfect reaction lower from the recent blue box. Let us take a look at the 1 hour chart from 3/29/2021. BABA ended a cycle correction at 241.60 peak for red wave B. Down from there, the stock made a five wave impulse decline in black wave […]

-

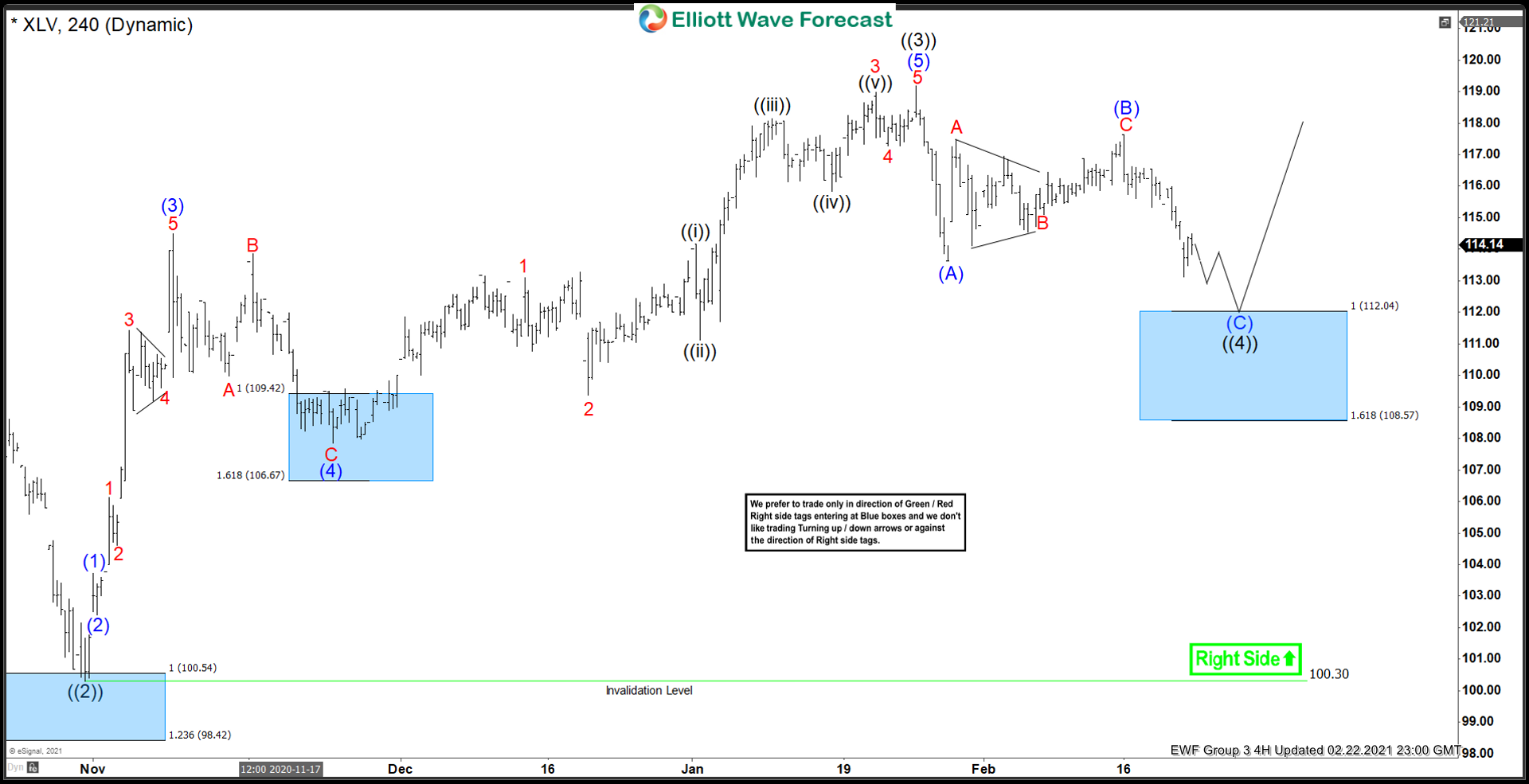

XLV Reacted Higher From The Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4 hour Elliott Wave charts of XLV, In which our members took advantage of the blue box areas.