The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Bit Digital Inc. ($BTBT) Next Cycle Higher Has Commenced

Read MoreWith Bitcoin having rallied over 40K from the March 2020 low, Crypto and Blockchain markets continue to show potential. Bit Digital is a company that experienced a large vertical rally in late 2020. After that, it has been correcting the whole rally in a large wave II. Bit Digital touts itself as one of the […]

-

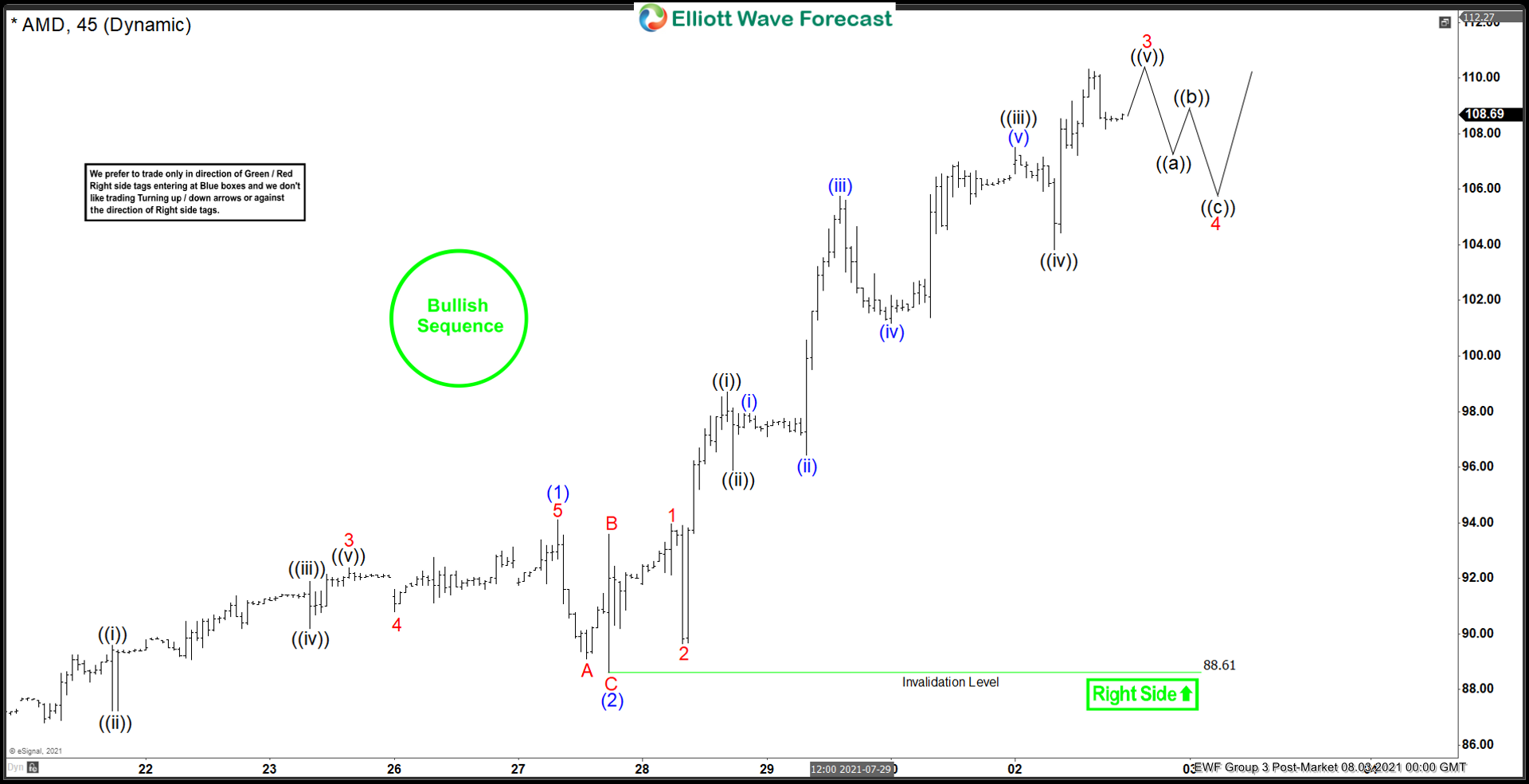

Elliott Wave View: AMD Looking for Further Upside

Read MoreAdvanced Micro Devices (AMD) extends to new all-time high and structure looks incomplete. This article and video look at the Elliott Wave path.

-

Best NFT Stocks to Buy in 2024

Read MoreWhat is an NFT? NFT stands for non-fungible tokens. An NFT is a digital asset that represents real-world objects like art, music, in-game items, and videos. NFTs are traded online using blockchain technology, similar to top cryptocurrencies. NFTs holders also get a digital certificate of authenticity indicating ownership. And for art collectors ownership is more valuable than the […]

-

Shopify (NYSE: SHOP) Pulling Back in Wave IV

Read MoreThis blog provides an Elliott Wave update to our previous blog here –> Shopify (NYSE: SHOP) Wave V in progress Shopify has extended higher to end wave III as the previous blog suggests. Now it is in wave IV correction and still has chance to extend higher again later. SHOP Weekly Chart August 2, 2021 Weekly […]

-

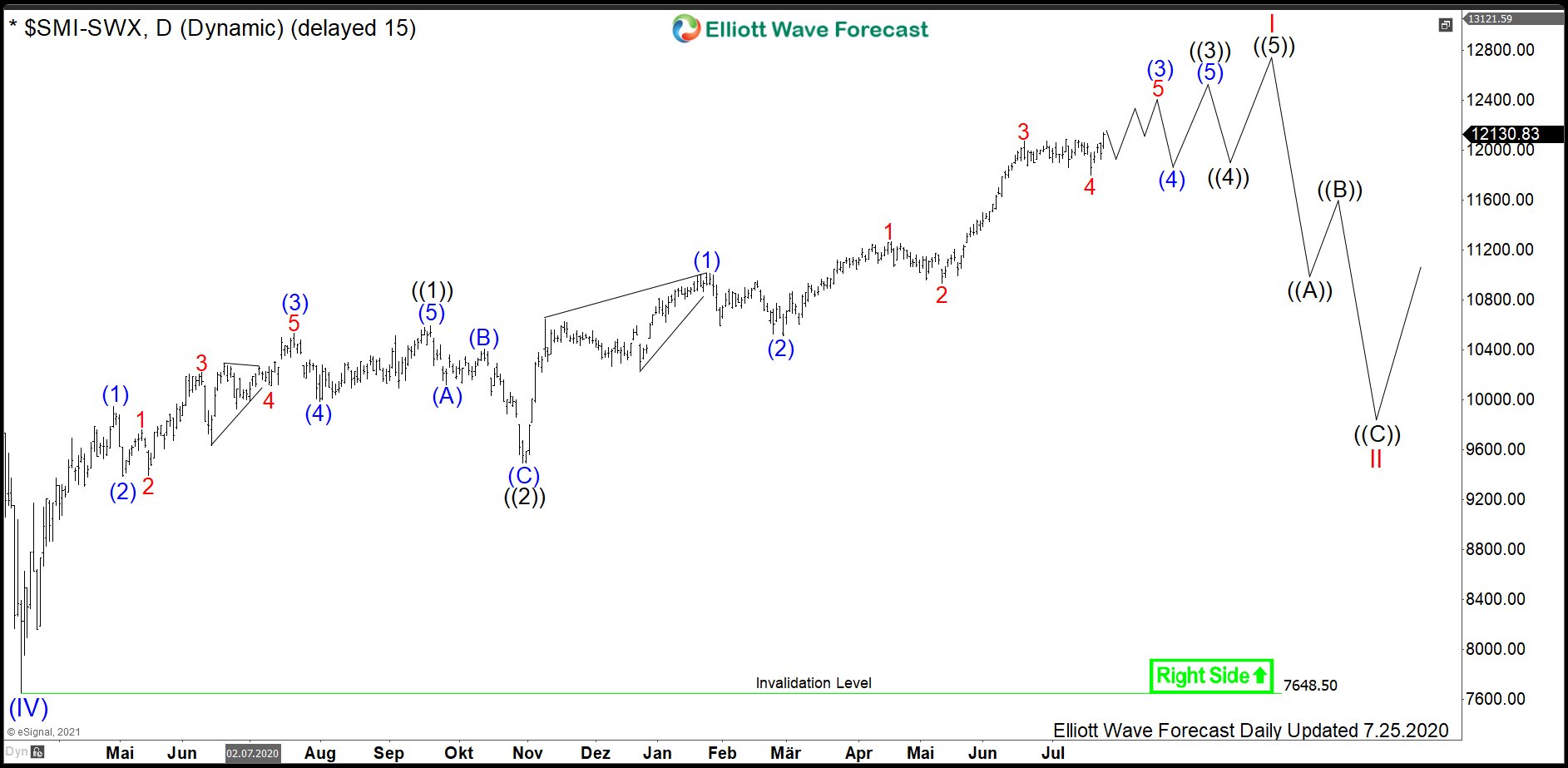

$ SMI : Daily Cycle of Swiss Market Index to Extend Higher

Read MoreAfter 9 months, we present here an updated view on the Swiss Market Index (SMI). SMI represents a capitalization-weighted measure of the 20 most significant stocks on the SIX Swiss Exchange in Zurich; the ticker is $SMI. In the initial blog article from November 2020, we were calling the “COVID-19” drop in February-March 2020 to become a […]

-

$EDF : Electric Utility Giant EDF to Catch Up the Energy Sector

Read MoreÉlectricité de France S.A. (literally, Electricity of France), commonly known as EDF, is a French multinational electric utility company. The operations include electricity generation and distribution, power plant design, construction and dismantling, energy trading and transport. Founded in 1946 and headquartered in Paris, France, the company is largely owned by the French state. EDF is a part […]