The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: S&P 500 (SPX) Extending Higher in Wave 5

Read MoreSPX rallies as in impulse from October 4 low looking for further upside. This article and video look at the Elliott Wave path.

-

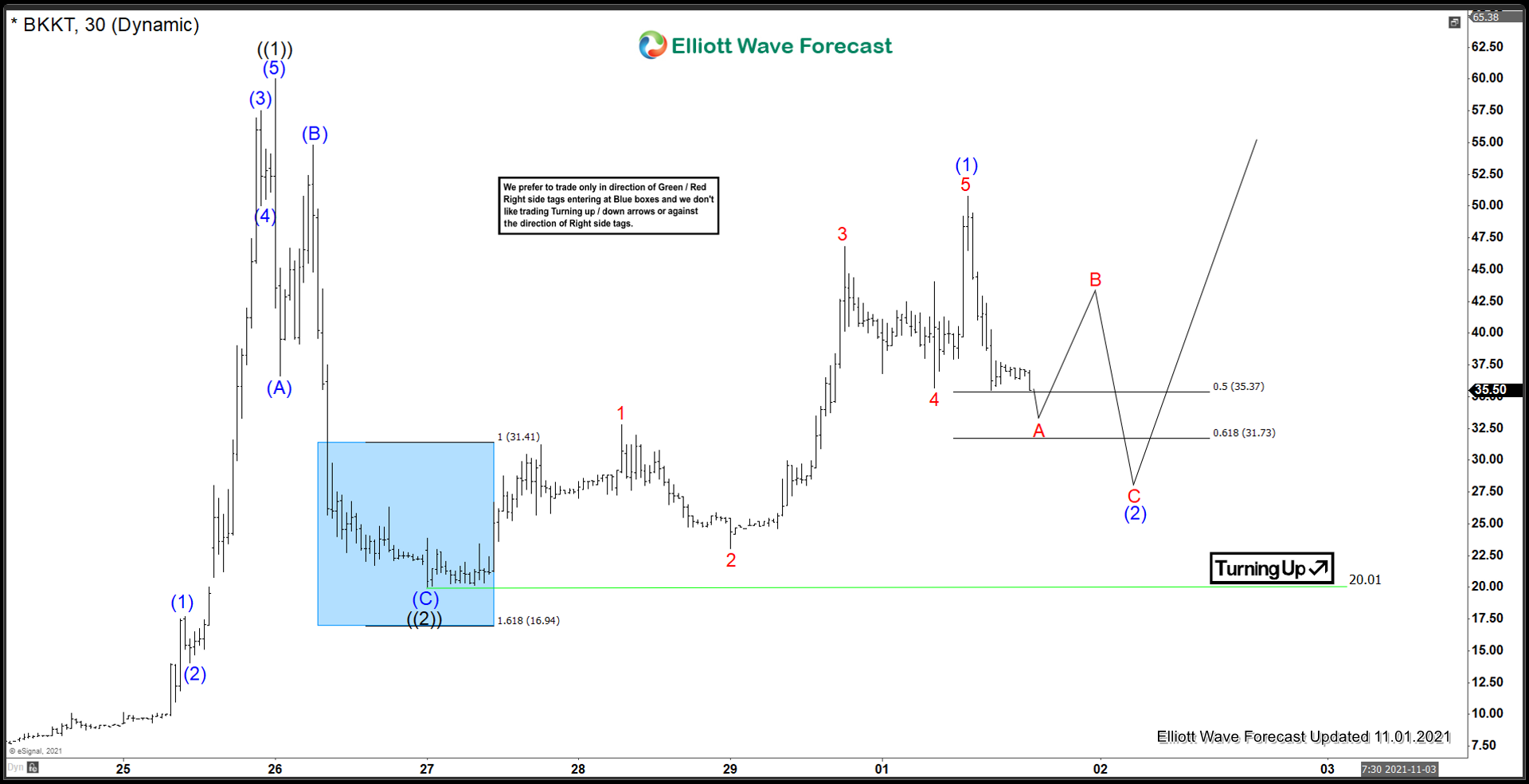

BAAKT ($BKKT) Bullish Potential On Tap

Read MoreAnother day, another meme stock rallies. This week, Bakkt is the company I want to focus on. This is another Crypto focussed stock. However, it has a large deal behind it, being a Mastercard deal whereby Bakkt assists mastercard with its users to pay in crypto. Lets take a look at the company profile: “Our […]

-

7 Best Swing Trading Stocks To Buy Now

Read MoreSwing Trading is a style of investment where investors buy and hold stocks in anticipation of price movement. The objective of the Swing Trading style is to earn from any potential price movement or possible swing in the market. Profit on each trade is substantially smaller as the holding period is smaller. But these small […]

-

Elliott Wave View: DAX Finishing Wave 5

Read MoreDAX shows impulsive rally from October 6 low looking for more upside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: CDEV Pullback Should Supported & Extend higher

Read MoreCentennial Resource Development, Inc. ( CDEV ), is an independent Oil & Natural gas company from Energy Sector, focuses on the development of unconventional oil & associated liquid rich natural gas reserves in US. It trades under CDEV ticker at Nasdaq. CDEV – Elliott Wave View on Daily chart: Since 2016, CDEV made all time […]

-

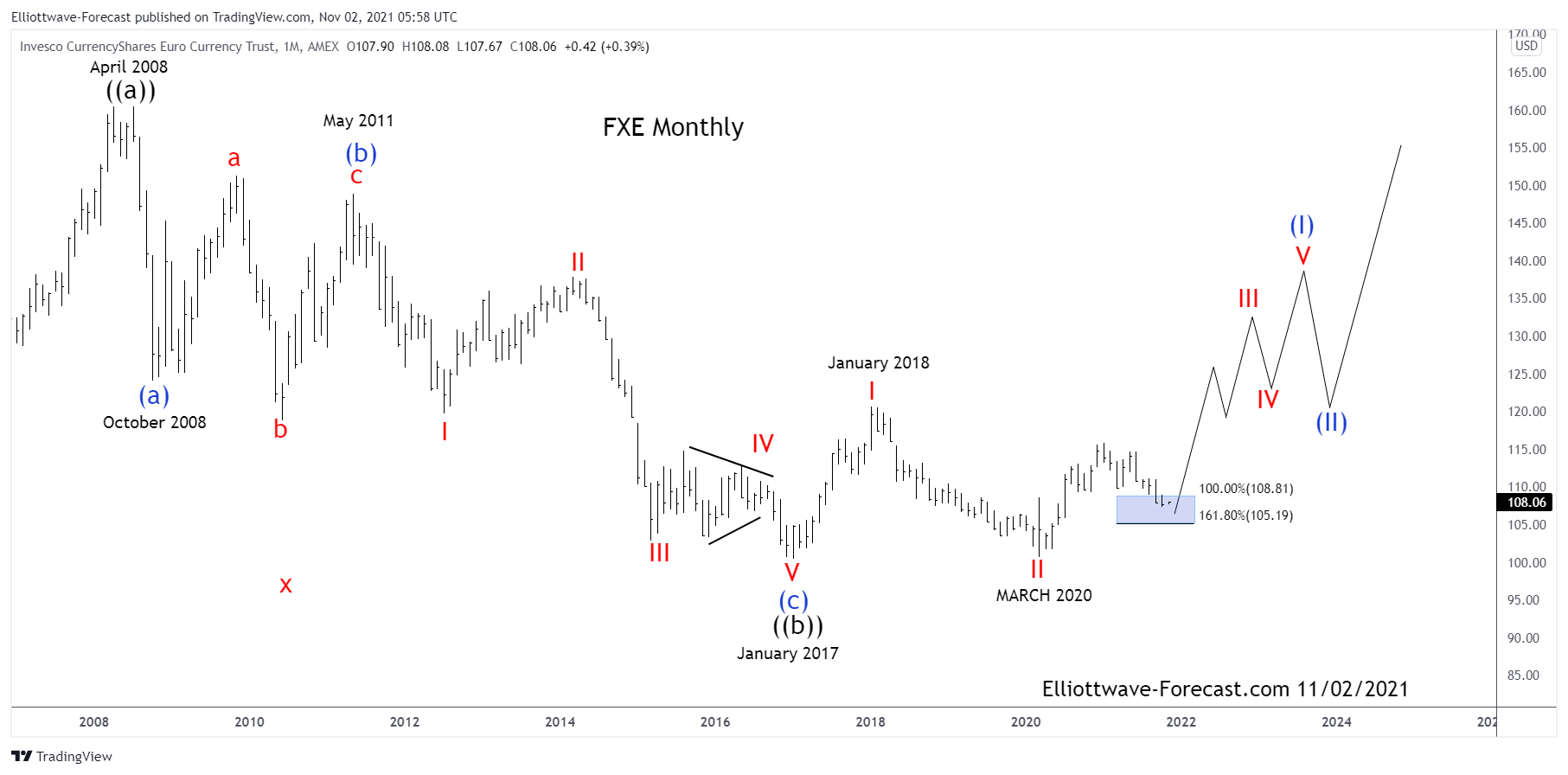

$FXE EURO ETF Elliott Wave & Long Term Cycles

Read More$FXE EURO ETF Elliott Wave & Long Term Cycles Firstly as seen on the monthly chart shown below the instrument made a high in April 2008. There is data back to December 2005 in the ETF fund. Data correlated in the EURUSD foreign exchange pair suggests the high in April 2008 was the end of a […]