The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Forecast: Silver Miners (SIL) Doing Flat Correction

Read MoreSilver Miners (SIL) reached the support area from August 6 peak in 7 swing and reacted higher. However, in the last few trading sessions, the ETF has taken a turn lower. What’s the outlook for the ETF and what alternative should we consider? Let’s take a look at the Elliott Wave update below: SIL Monthly […]

-

Elliott Wave View: Dow Futures (YM) Looking for More Downside

Read MoreDow Futures ended cycle from October 1 low and correcting that cycle. This article and video look at the Elliott Wave path of the Index.

-

Elliott Wave View: Rally in FTSE Expected to Fail

Read MoreShort-term Elliott wave view in FTSE suggests cycle from September 20, 2021 low has ended with wave (1) at 7403.36. The Index is currently correcting that cycle within wave (2). Internal subdivision of wave (2) is unfolding as a zigzag Elliott Wave structure. Down from wave (1), wave ((i)) ended at 7342.61 and rally in […]

-

Elliott Wave View: ASAN Should Extend Lower

Read MoreASANA Inc. (ASAN), operates a work management platform as Software services globally to get work done faster, while enhancing employee engagement by connecting to the mission of organization. It headquartered in San Francisco, California. It trades under the ticker name “ASAN” at NYSE & comes under Technology – Software application sector. ASAN Daily Elliott Wave […]

-

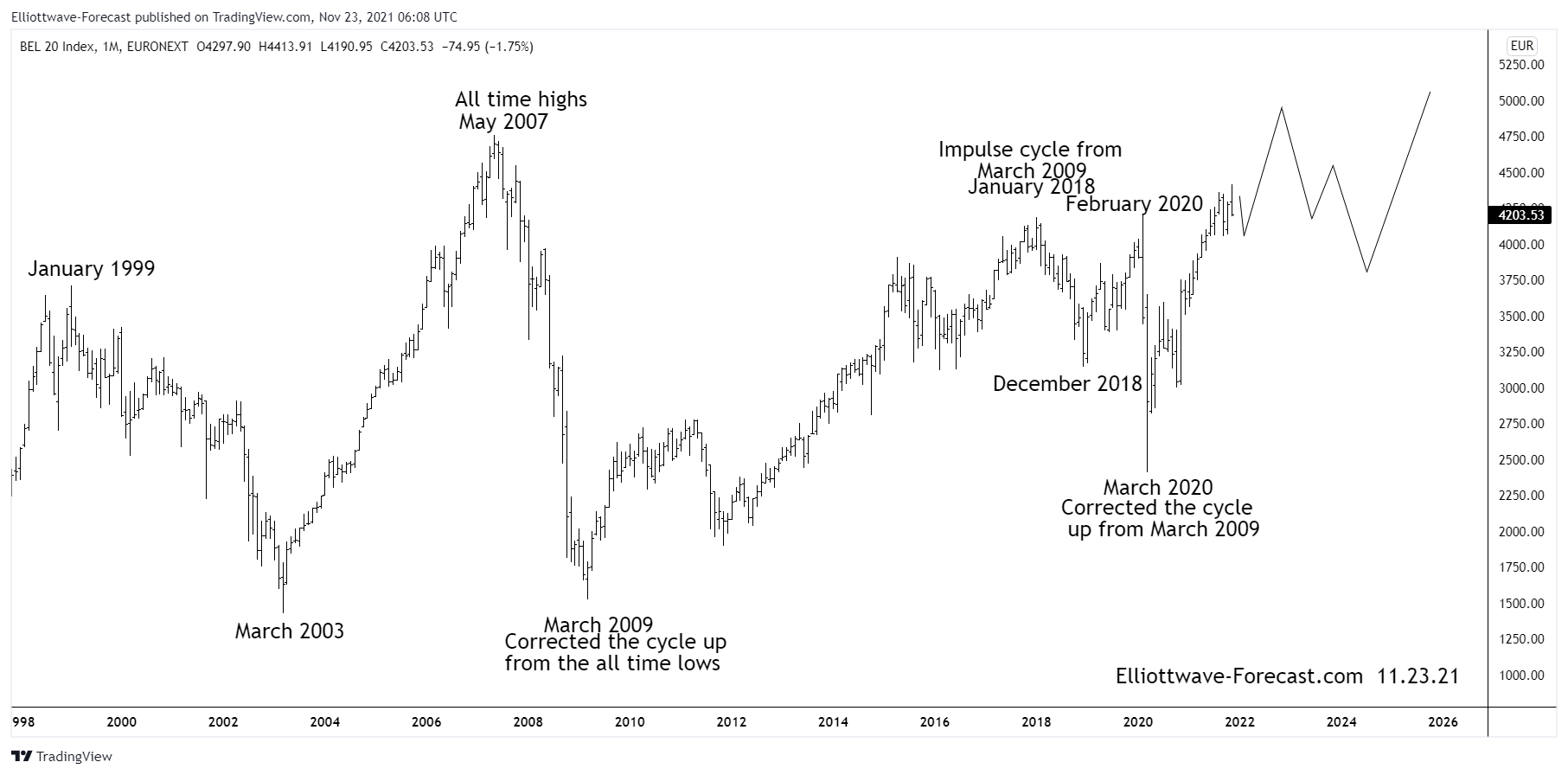

The $BEL20 INDEX Bullish Cycles and Longer Term Swings

Read MoreThe $BEL20 INDEX Bullish Cycles and Longer Term Swings 1st the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other […]

-

Elliott Wave View: DAX Starting Correction

Read MoreDAX ended cycle from October 6 low and looking to correct that cycle. This article and video look at the Elliott Wave path.