The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

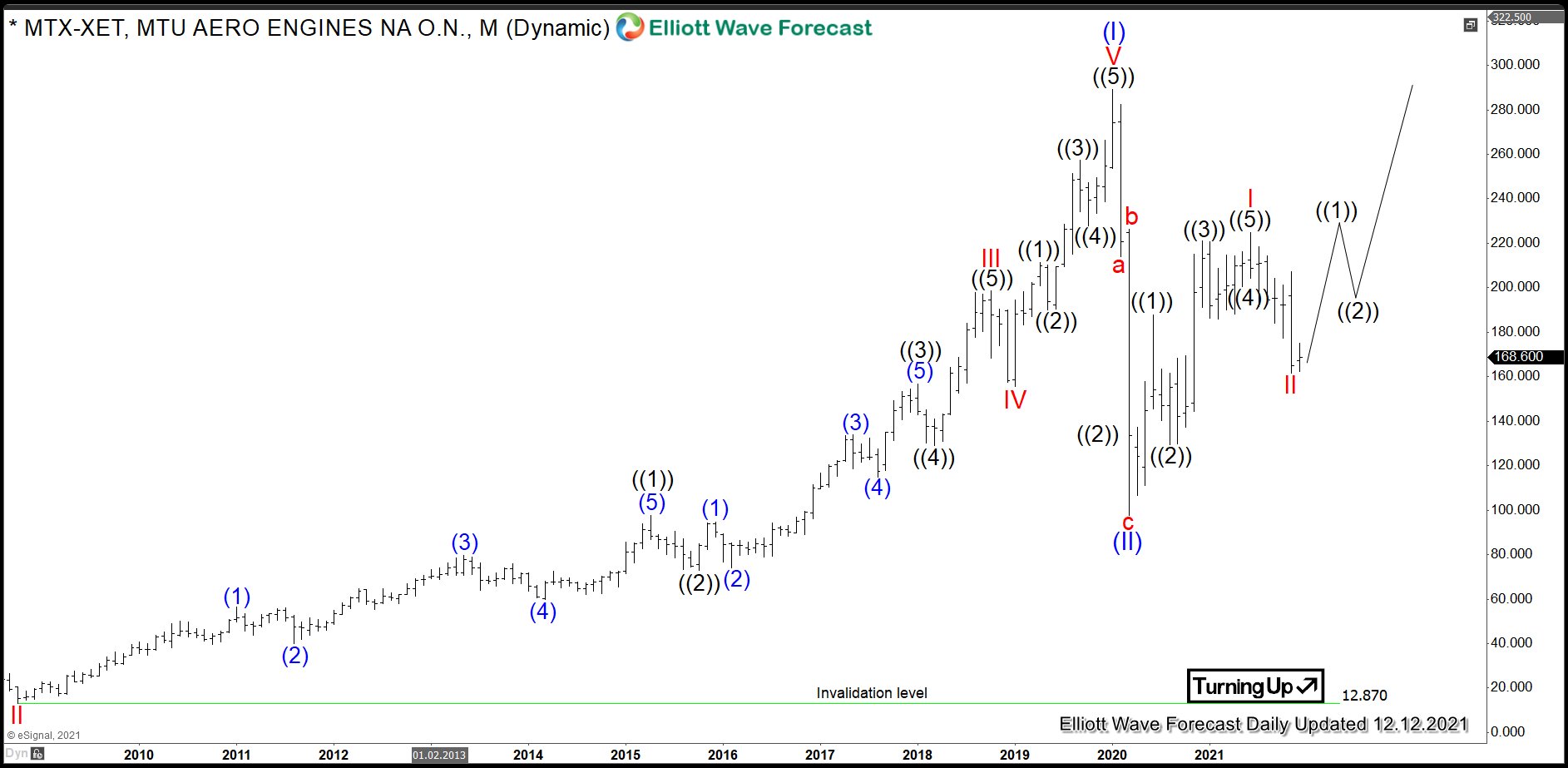

$MTX: MTU Aero Engines Expecting Acceleration Higher

Read MoreMTU Aero Engines AG is a German aircraft engine manufacturer. It develops, manufactures and provides service support for civil and military aircraft engines. Founded in 1934 and headquartered in Munich, Germany, it can be traded under the ticker $MTX at XETRA in Frankfurt. MTU is a part of DAX40 index. In the initial article back in […]

-

Elliott Wave View: Apple (AAPL) looking to correct lower

Read MoreApple (AAPL) ended at least cycle from December 2 low and the stock should correct that cycle. This article and video look at the Elliott Wave path.

-

Elliott Wave View: WIT (WIPRO) Should Expect Short Term Correction

Read MoreWipro Limited (WIT) operates as Information technology, Consulting & Business process services company globally. It operates through three main segments, IT Services, IT Products & India State Run Enterprise Services. The company is based in Bengaluru, India (ADR stock) & trades under $WIT ticker at NYSE. It comes under Technology sector as Information Technology services […]

-

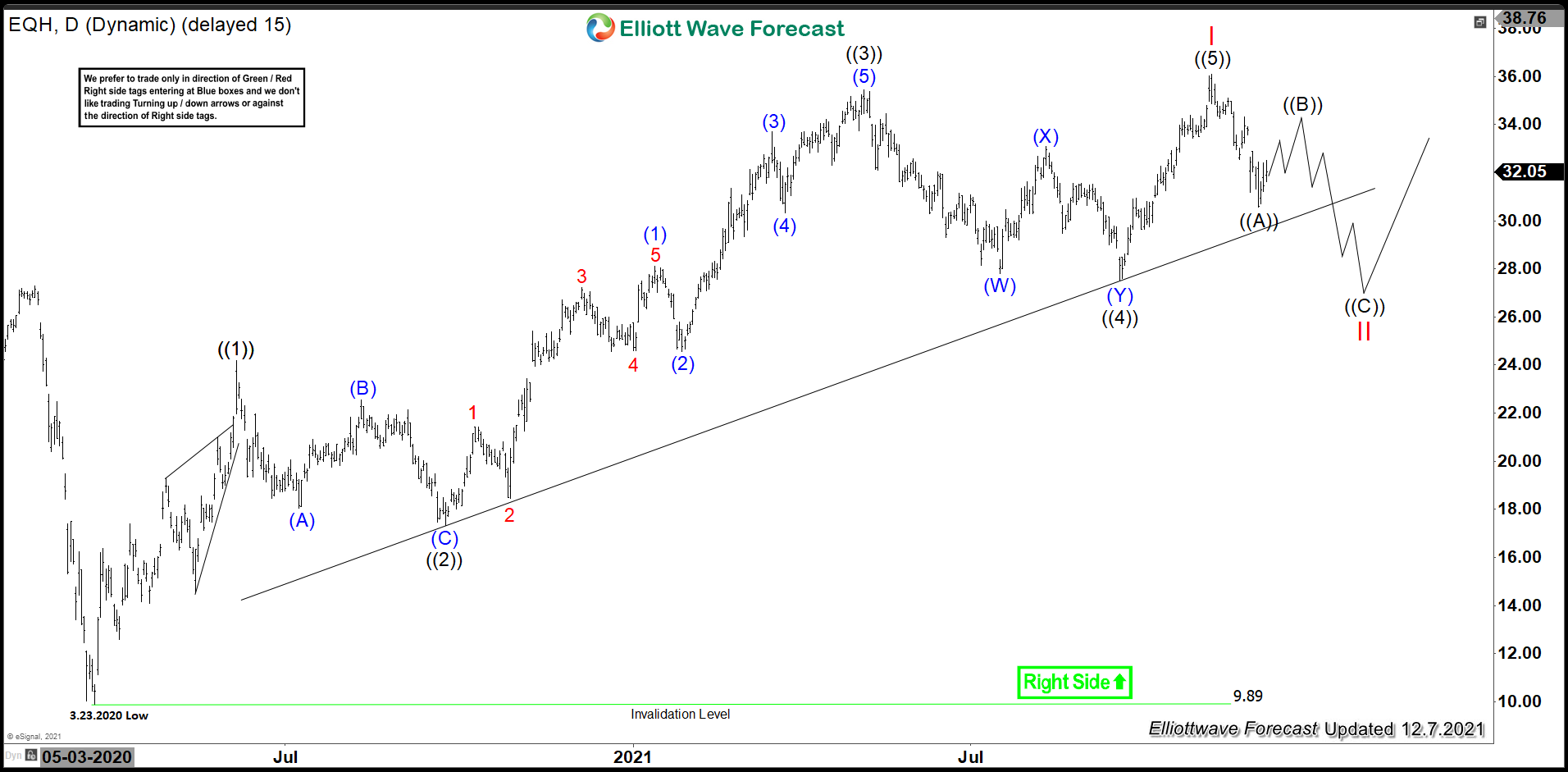

Elliott Wave View: EQH Should Expect Short Term Correction

Read MoreEquitable Holdings Inc (EQH) operates as a diversified financial service through four segments, Individual retirement, Group retirement, Investment management & research & Protection solutions. It based in New York & trades under $EQH ticket at NYSE. It comes under financial services sector as Insurance-diversified industry. EQH – Elliott Wave Daily View: Since March-2020 low at […]

-

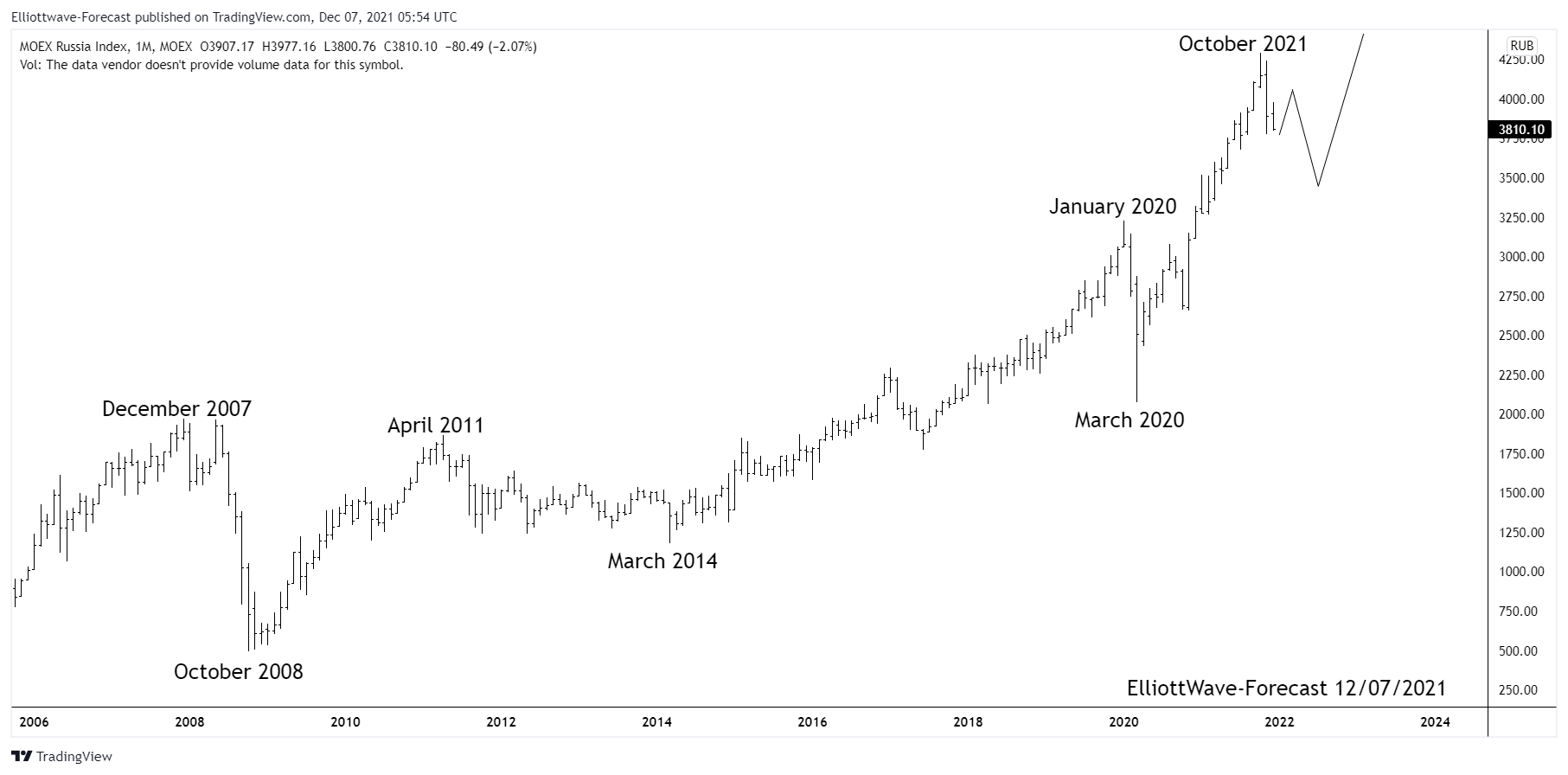

$MICEX Russian Index Longer Term Cycles and Bullish Trend

Read More$MICEX Russian Index Longer Term Cycles and Bullish Trend The Russian index has trended higher with other world indices since inception. The index remained in a long term bullish trend cycle into the December 2007 highs. It made a sharp correction lower in 2008 that lasted until October 2008 similar to other world indices. That is […]

-

Elliott Wave View: Rally in DAX Expected to Fail

Read MoreDAX is correcting cycle from March 2020 low and should see further downside. This article and video look at the Elliott Wave path.