The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

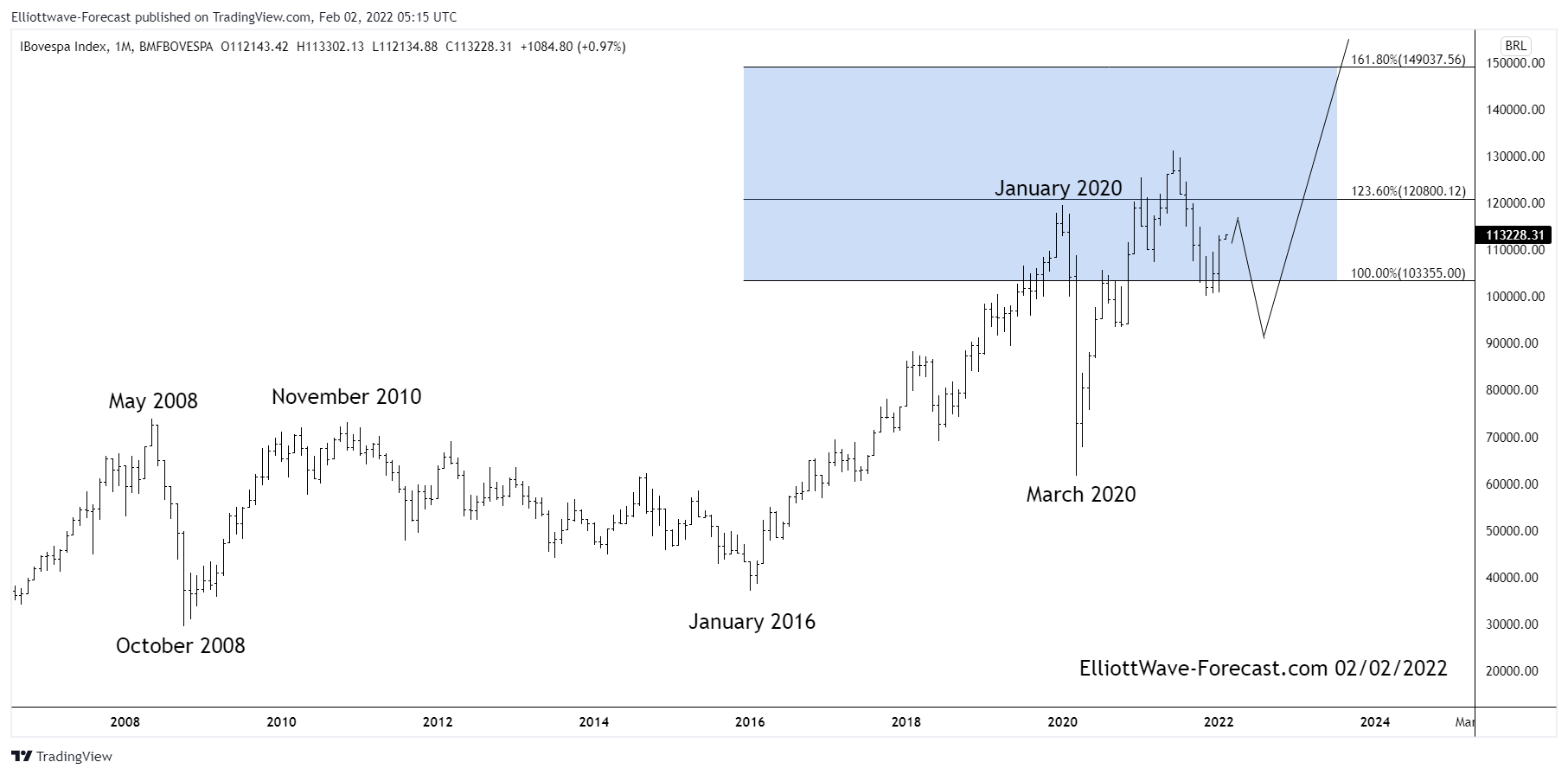

Bovespa Index Long Term Cycles and Bullish Trend

Read MoreBovespa Index Long Term Cycles and Bullish Trend The Bovespa Index has been trending higher with other world indices. Since inception the cycles have shown a bullish trend. In early years not seen on this chart it rallied with other world indices trending higher into the May 2008 highs. It then corrected the whole bullish cycle from […]

-

$CON : Automotive Giant Continental Provides a Buying Opportunity

Read MoreContinental is a German multinational automotive parts manufacturing company. It is specializing in brake systems, interior electronics, tachographs, automotive safety, powertrain and chassis components, tires and other parts for the automotive and transportation industries. Founded in 1871 and headquartered in Hanover, Germany, Continental is a part of DAX40 index. From the all-time lows, the stock […]

-

Elliott Wave View: TX Pulling Back in Wave II

Read MoreTernium S.A. (TX) through its subsidiaries, manufactures & processes various steel products in Mexico, Brazil, US & other countries. It operates through two segments, Steel & Mining. The company founded in 1961 & based in Luxembourg. It comes under Basic materials sector & trades as ‘TX’ ticker at NYSE. Since December-2010 high, TX made low […]

-

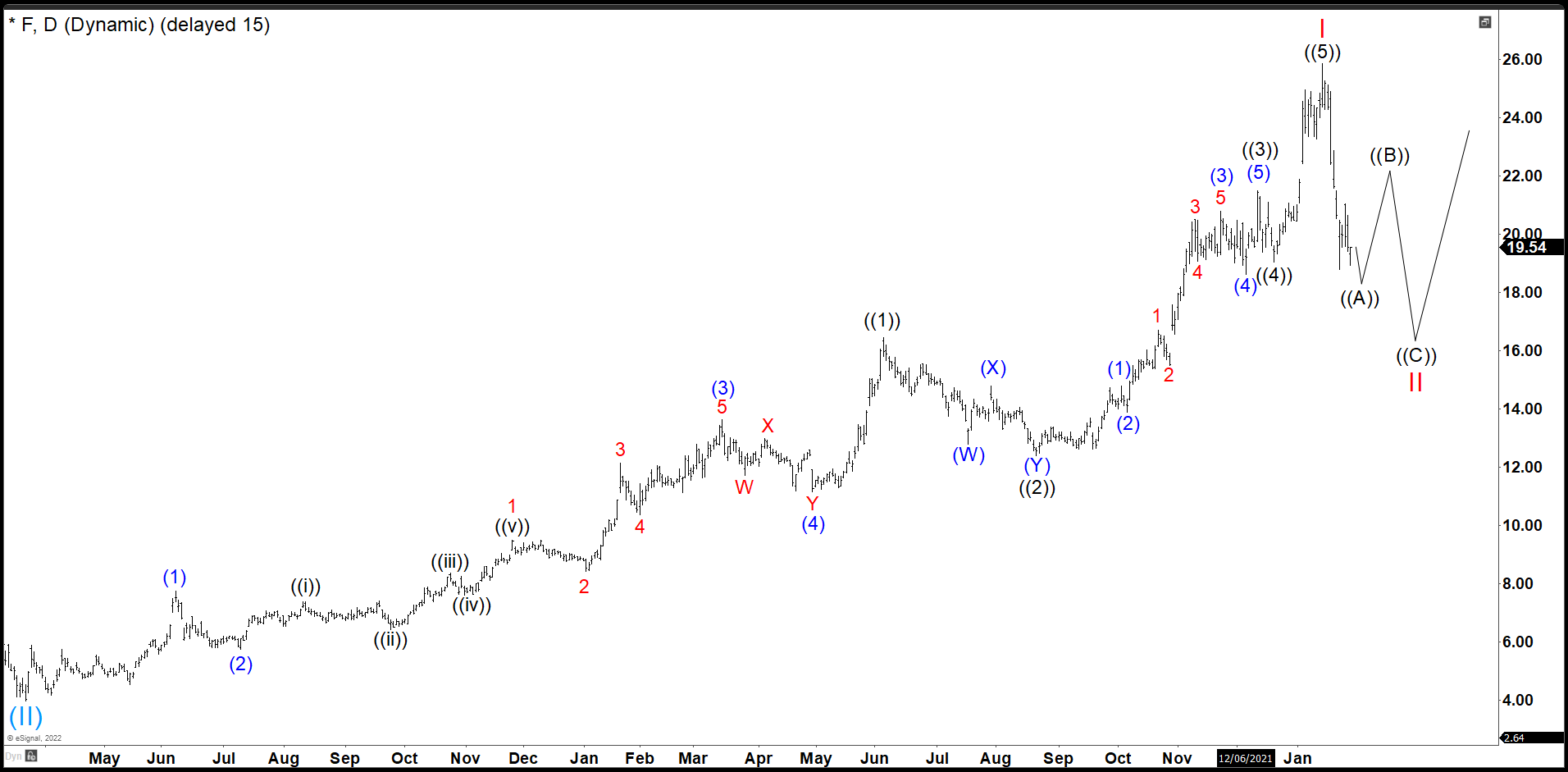

Ford Needs To Ride Further Downside Before Continuing The Rally

Read MoreFord Motor Company (commonly known as Ford) is an American multinational automobile manufacturer headvquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD Daily Chart Ford started a rally from March 2020 low after covid19 crash. From there, we can […]

-

Top Best Gold Mining Stocks to Buy in 2024

Read MoreGold has always been one of the most valuable and profitable commodities, especially for long-term investors. During uncertain times, gold has kept the investors’ money safe and secure. Moreover, the advent of high gold prices in 2020 catapulted the industry to new heights. Strengthened gold prices have led to the gold industry performing well on most […]

-

Can $TLT Bounce Again To Correct The Cycle From the March 2020 Highs?

Read MoreCan $TLT Bounce Again To Correct The Cycle From the March 2020 Highs? Firstly the ETF fund TLT inception date was on July 22, 2002. This instrument seeks to track the investment results of an index composed of or in U.S. Treasury bonds with maturities twenty years or more remaining. There is a lack of data before July […]