The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Best Silver Stocks to Buy in 2024

Read MoreSilver is a valuable and very useful precious metal. It is vital for any industrial applications. Moreover, silver being the best electrical and thermal conductor of all metals, is very high in demand in the industrial sector. Silver is used in: Mobile Phones Electric Vehicles. EV stocks are one of the plenty of investment opportunities to […]

-

SPX Elliott Wave View: More Downside Is Expected To Take Place

Read MoreSPX is showing an incomplete sequence from 04 January 2022 peak favoring more downside. This article and video look at the Elliott Wave path.

-

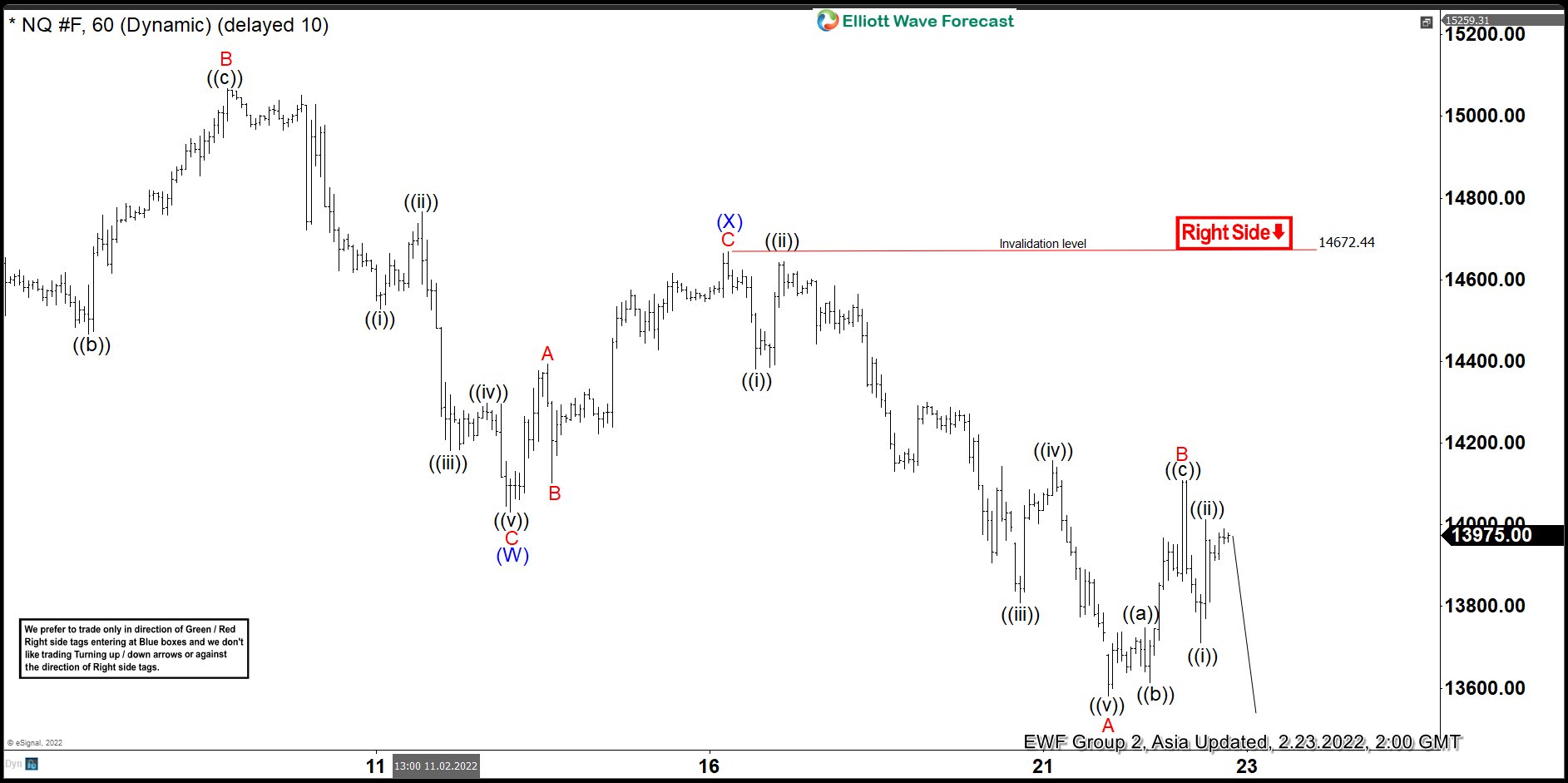

Elliott Wave View: Nasdaq (NQ) Looking to do Bigger Pullback

Read MoreNasdaq (NQ) shows incomplete sequence from November 2021 peak favoring more downside. This article and video look at the Elliott Wave path.

-

Best Stocks for Inflation in 2024

Read MoreInflation is the continuous increase in process of commonly used goods and services. It also indicates devaluing of money which reduces the purchasing power of money. It is a matter of concern for every person living. It affects the present and future, both of every household. Since the 2008 financial crisis, the global economic situation […]

-

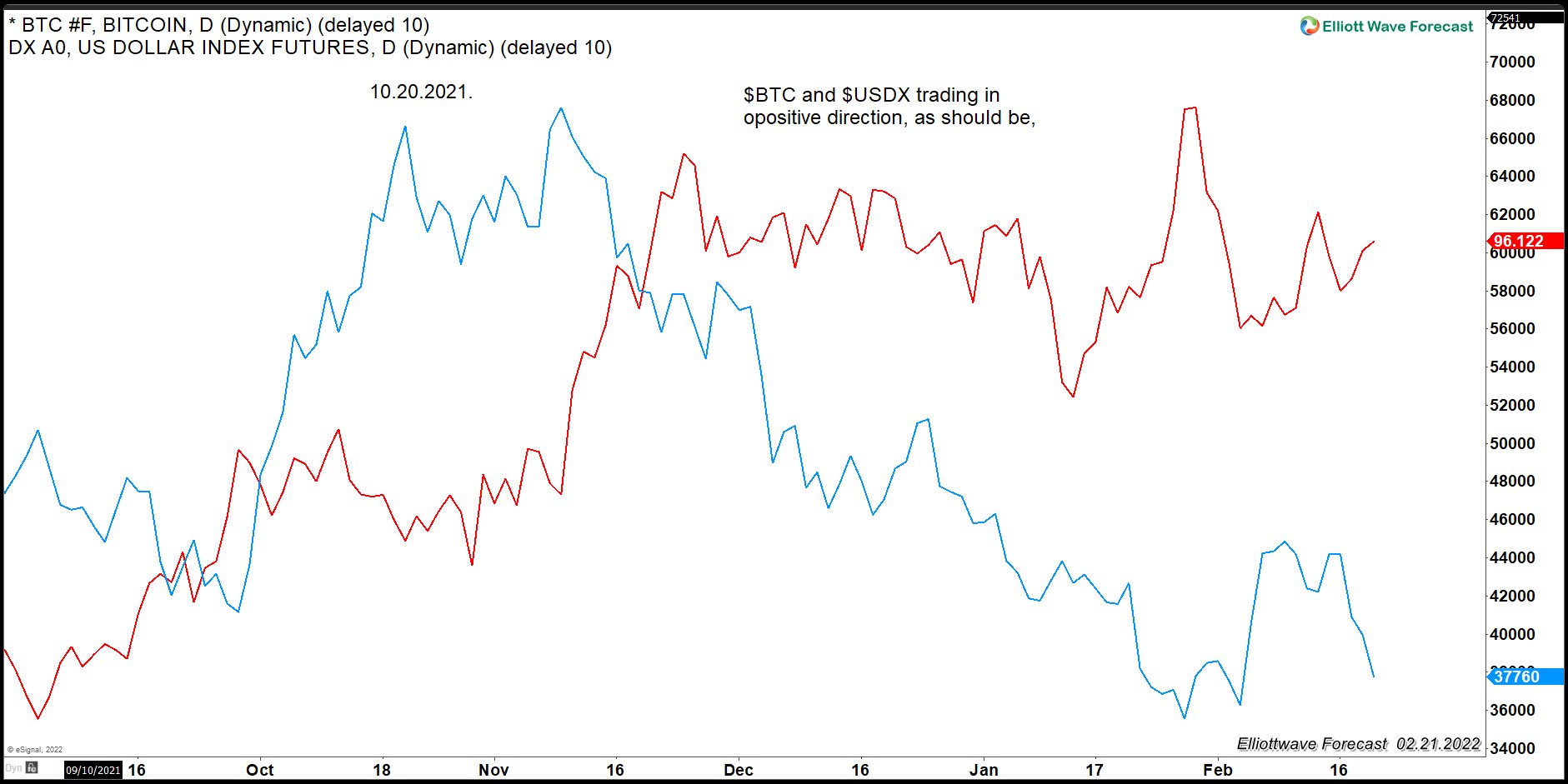

BITO (Proshares Bitcoin Strategy ETF ) Gives Opportunity To Invest Into Bitcoin

Read MoreCryptocurrencies have become very popular worldwide. Many young investors want to chase every move the instrument does daily. The reality is that many traders tend to trade without looking at the higher time frames. Traders also don’t relate instruments that trade within the same group. $BTC (Bitcoin) might have ended the all-time cycle when it […]

-

Elliott Wave View: Nikkei (NKD) Searching for Support

Read MoreNikkei (NKD) near term can see further downside but it’s at the daily support area. This article and video look at the Elliott Wave path.