The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

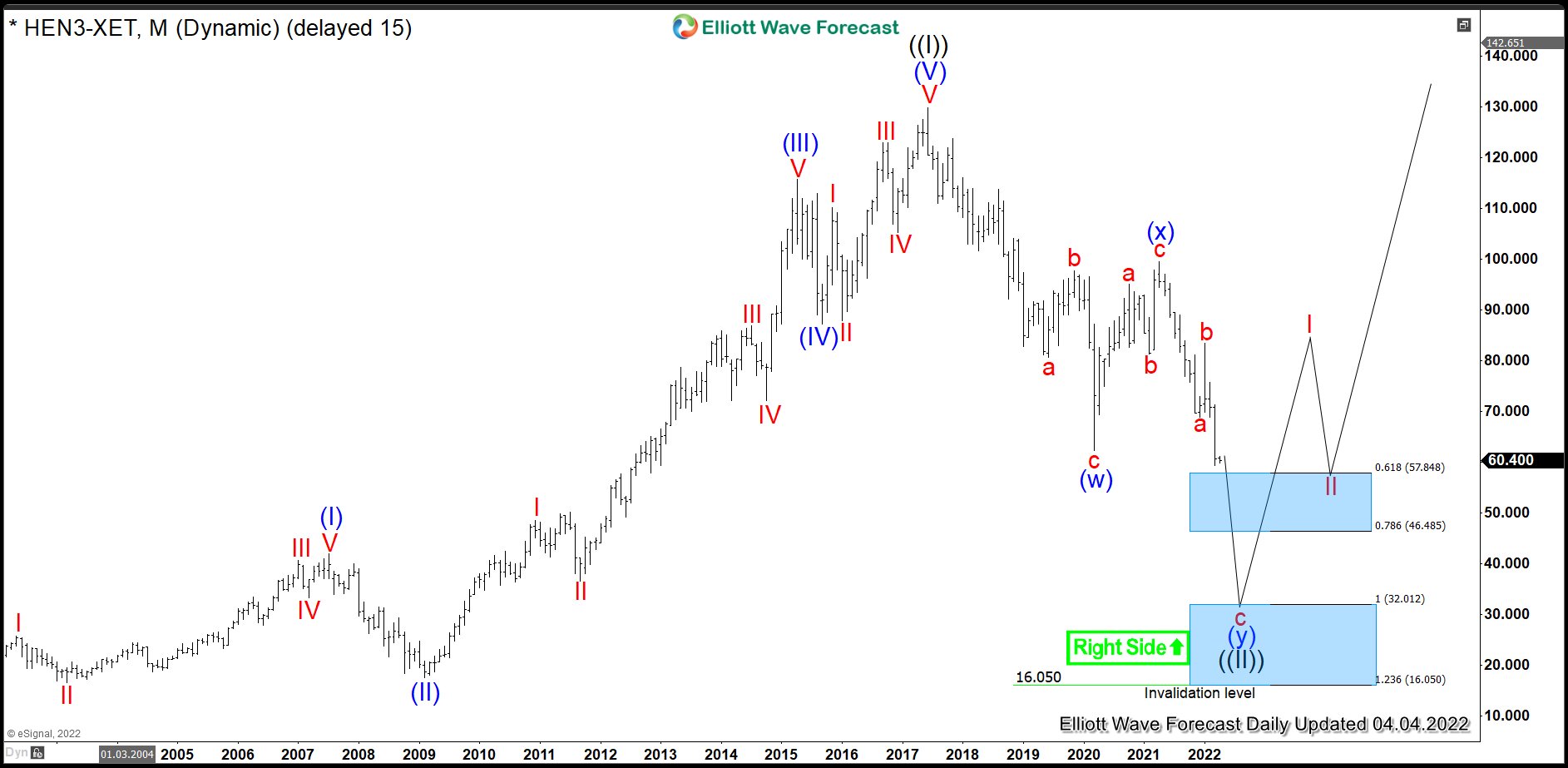

$HEN3: Bearish Sequence in Henkel Provides an Opportunity

Read MoreHenkel AG & Co. KGaA is a German chemical and consumer goods manufacturer known for such brands like Persil, Fa, Pritt, Dial, Purex and Loctite. Founded 1876 and headquartered in Düsseldorf, Germany, the company has three globally operating business units: Laundry & Home Care, Beauty Care, Adhesive Technologies. Investors can trade it under the tickers $HEN […]

-

BAM : Pulling Back Before Next Rally Resumes

Read MoreBrookfield Asset Management (BAM) is an alternative asset manager & REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure & venture capital & private equity assets. It manages a range of public & private investment products & services for institutional & retail clients. It based in Toronto, Canada, comes under Financial services […]

-

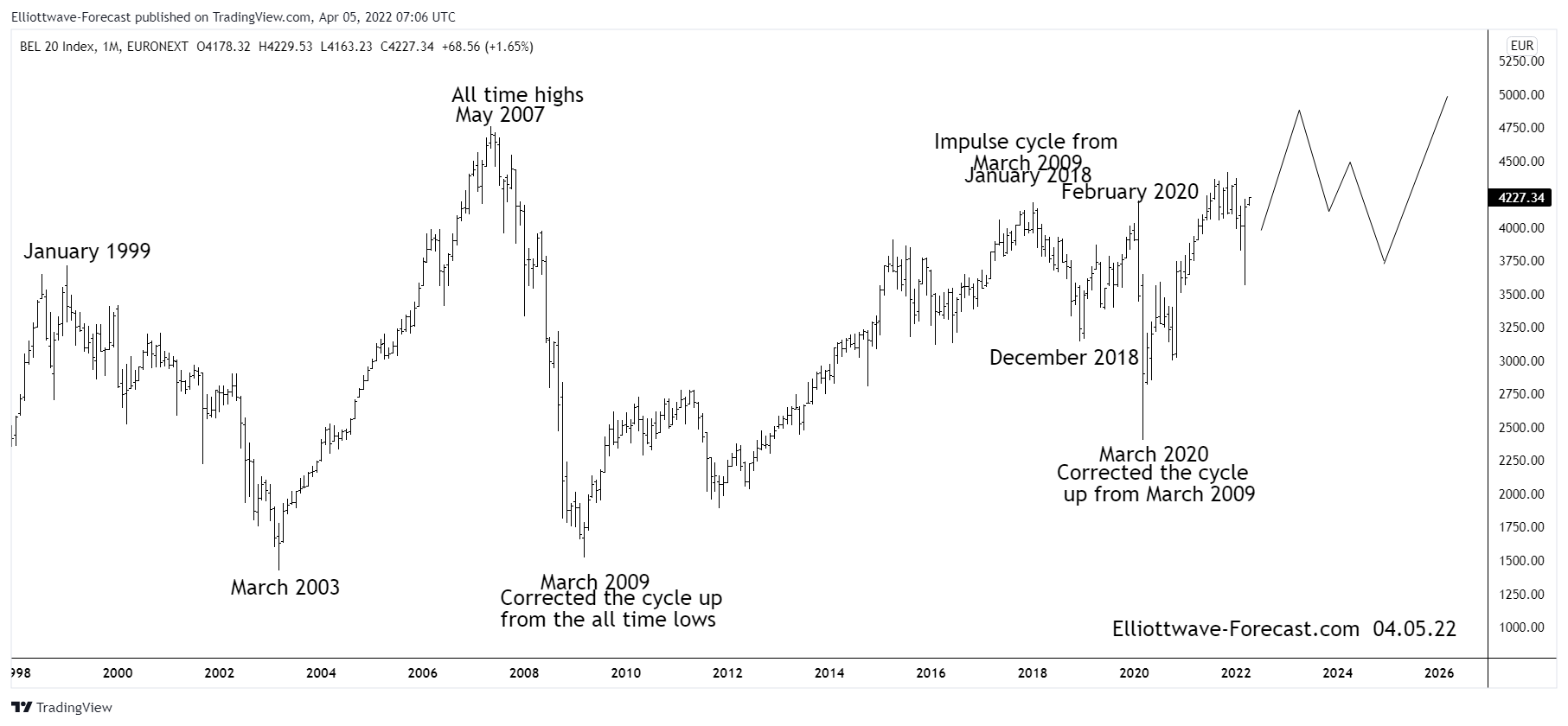

The Longer Term Swings and Bullish Cycles of $BEL20

Read MoreThe Longer Term Swings and Bullish Cycles of $BEL20 1st the BEL20 Index has trended higher with other world indices since the benchmark was established. The index remained in a long term bullish trend cycle into the May 2007 highs. From there it made a sharp correction lower that lasted until March 2009 similar to other […]

-

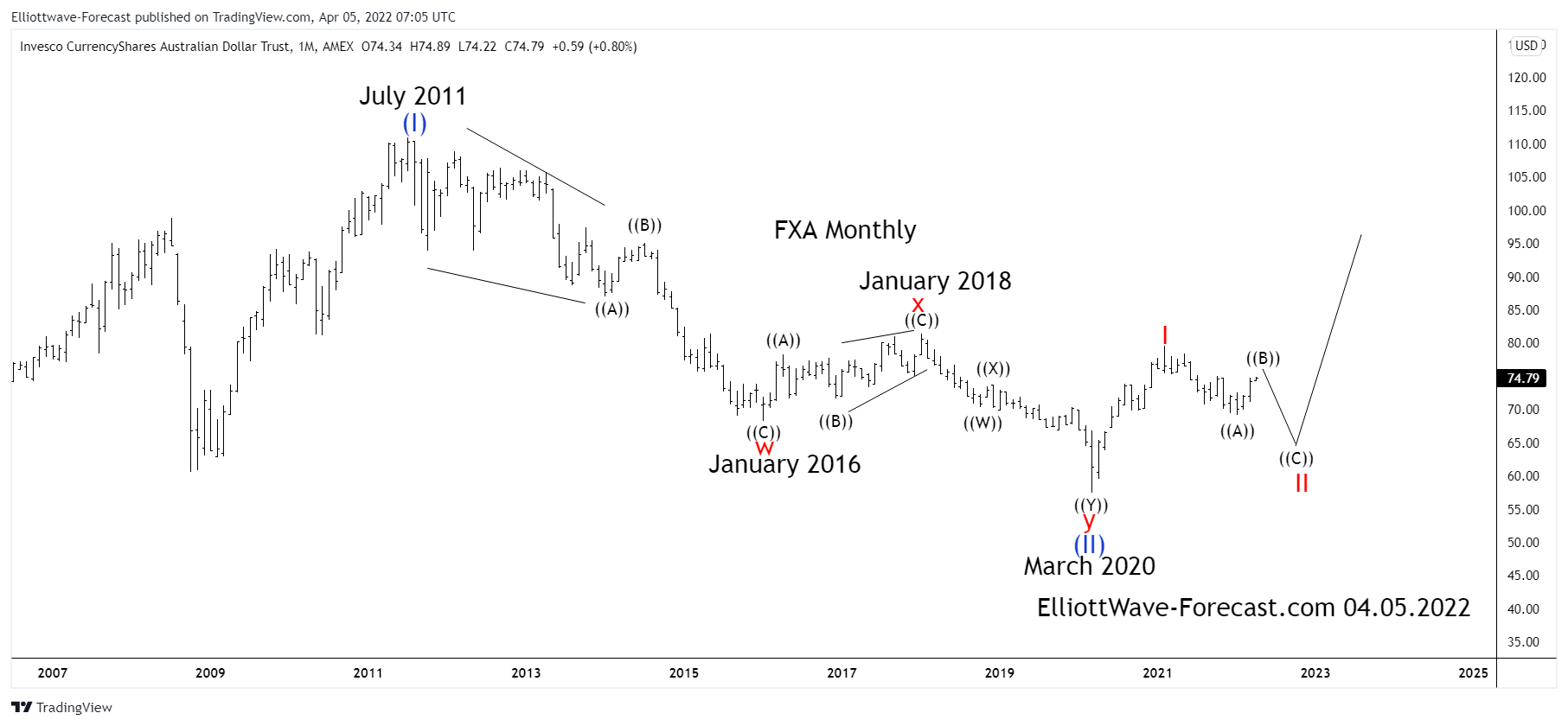

Elliott Wave Analysis and Long Term Cycles of $FXA

Read MoreElliott Wave Analysis and Long Term Cycles of $FXA The FXA ETF fund is the Australian dollar tracking fund that has an inception Date of 06/21/2006. With that said the fund mainly reflects the currency spot price of the AUDUSD pair. The data available from the Reserve Bank of Australia at their website suggests the spot price […]

-

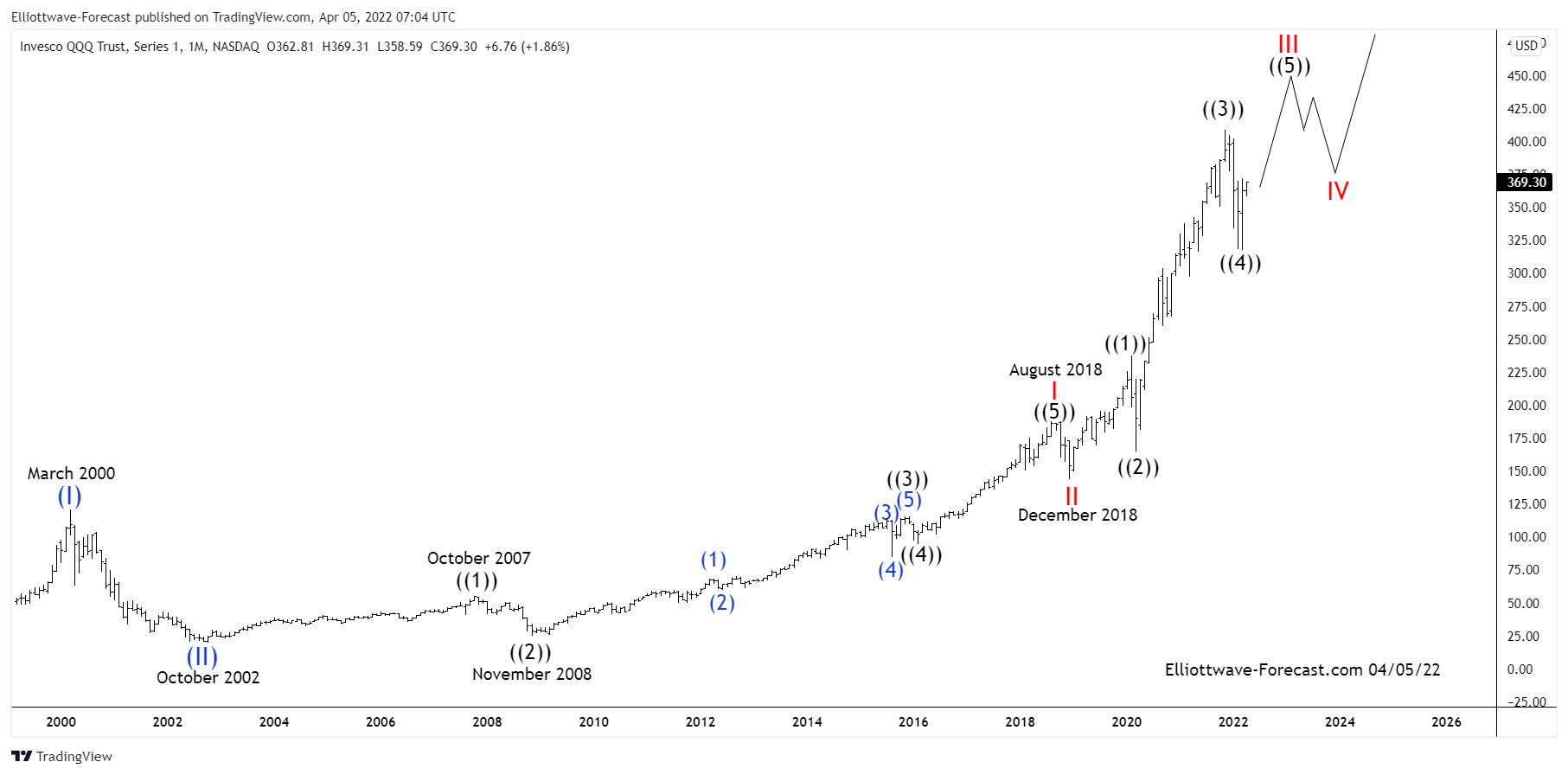

Long Term Cycles & Elliott Wave for $QQQ

Read MoreLong Term Cycles & Elliott Wave for $QQQ Firstly the QQQ instrument inception date was in March 1999. That was before it ended a larger cycle up from the all time lows in March 2000. The ETF instrument mirrors the price movement of the Nasdaq index. As shown below from the March 2000 highs the instrument […]

-

XLF Bounce Allowed Longs To Get Into Risk-Free Position

Read MoreIn this technical blog, we will look at the past performance of the Daily Elliott Wave Charts of XLF. In which, the rally from the 23 March 2020 low unfolded as an impulse and showed a higher high sequence. Therefore, we knew that the structure in XLF is incomplete to the upside & should see […]